Summary of trump‘s Comments on GDP news and Tariffs

On April 30, 2025, former President Donald Trump shared his insights on the current economic situation following the latest Gross Domestic Product (GDP) news. His remarks were highlighted in a tweet by Eric Daugherty, emphasizing Trump’s perspective on economic growth, tariffs, and the stock market under President Joe Biden’s administration. In this summary, we’ll explore Trump’s statements and their implications for the U.S. economy.

Trump’s Optimism on Economic Growth

Trump began his commentary with a note of optimism regarding the U.S. economy, stating that "tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers." This assertion suggests that Trump believes the impact of tariffs will encourage domestic production and attract foreign companies to establish operations in the United States. This shift could potentially lead to job creation and increased economic activity, aligning with his long-standing views on the importance of manufacturing and job growth.

Critique of Biden’s Economic Policies

A significant portion of Trump’s statement was dedicated to criticizing President Biden’s handling of the economy. He referred to the current stock market conditions as "Biden’s stock market," distancing himself from the current economic climate and implying that any negative trends should be attributed to the incumbent administration. This rhetorical strategy is common in political discourse, where leaders seek to highlight the failures of their predecessors or opponents to bolster their own reputations.

The Call for Patience

Trump’s remarks also included a call for patience, as he stated, "Our country will boom, but we have to get rid of the Biden ‘overhang.’" This phrase likely refers to what Trump perceives as the burdensome policies and regulations put in place by the Biden administration that he believes are hindering economic growth. By urging patience, Trump seems to be suggesting that the economic recovery will take time and may require a shift in policies to achieve the growth he envisions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Context and Implications

To understand the context of Trump’s comments, it’s essential to consider the broader economic environment in 2025. The U.S. economy had been recovering from the impacts of the COVID-19 pandemic, with fluctuations in GDP growth and employment rates. The role of tariffs, particularly in the context of trade relations with countries like China, has been a contentious issue. Trump’s administration implemented significant tariffs aimed at protecting American industries, a policy he continues to advocate.

The idea of companies relocating to the U.S. aligns with Trump’s focus on "American First" policies, which prioritize domestic manufacturing and job creation. In recent years, there has been a trend of companies reevaluating their supply chains and considering reshoring as they adapt to global economic changes, supply chain disruptions, and geopolitical tensions.

Conclusion

In summary, Trump’s statements following the GDP news reflect his characteristic optimism about the U.S. economy, coupled with a critical stance on Biden’s policies. He emphasizes the potential for economic growth driven by tariffs and domestic investment, while simultaneously calling for patience from his supporters. As the political landscape evolves, Trump’s remarks highlight the ongoing debate over economic strategies and the impact of leadership on the nation’s financial health.

By analyzing Trump’s commentary, we gain insights into the current economic discourse and the potential directions for U.S. economic policy in the coming years. Whether his predictions about tariffs and corporate relocation will materialize remains to be seen, but his influence on the conversation around economic growth is undeniable.

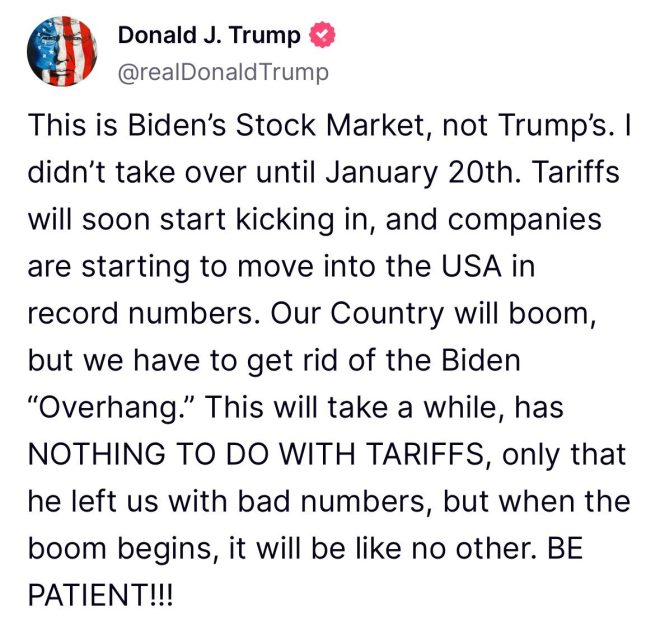

TRUMP AFTER GDP NEWS: “Tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers.”

“This is Biden’s stock market, not Trump’s.”

“Our country will boom, but we have to get rid of the Biden ‘overhang.'”

“BE PATIENT!” pic.twitter.com/WX5r2cWwpj

— Eric Daugherty (@EricLDaugh) April 30, 2025

TRUMP AFTER GDP NEWS: “Tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers.”

You might have come across the recent comments made by former President Donald Trump regarding the state of the economy, particularly after new GDP data was released. In a statement that has sparked discussions across social media platforms, Trump emphasized that tariffs will soon begin to impact the market positively, and he highlighted a significant trend: companies relocating to the USA at unprecedented rates.

This assertion raises a critical question: what does this mean for the American economy? Let’s dive deeper into the implications of these remarks and explore the broader context of tariffs, GDP, and corporate movement within the United States.

“This is Biden’s stock market, not Trump’s.”

When Trump stated, “This is Biden’s stock market, not Trump’s,” he pointed toward a narrative that many of his supporters have echoed. They believe that the current economic performance reflects the policies of the Biden administration rather than the previous Trump administration’s strategies. The notion of assigning blame or credit for economic conditions is not new in politics, but it becomes particularly pronounced during times of economic fluctuations.

So, what’s the reality here? It’s important to recognize that stock markets can be influenced by a myriad of factors, including global events, interest rates, and consumer confidence. The dynamics of the stock market are complex and multi-faceted. For instance, the pandemic has drastically altered consumer behavior, leading to unique market conditions that may not solely reflect the effectiveness of any single administration’s economic policies.

Additionally, the economic recovery post-COVID-19 has seen various sectors performing differently. Some industries have thrived, while others continue to struggle. This uneven recovery could lead to contrasting opinions on which party should take credit or blame for the current economic climate.

“Our country will boom, but we have to get rid of the Biden ‘overhang.’

Trump’s statement that “our country will boom, but we have to get rid of the Biden ‘overhang'” suggests a sense of urgency for economic change. The term “Biden overhang” can be interpreted as the burdens or challenges that the current administration presents to economic growth. This includes policies that some believe hinder business investment and job creation.

Critics of current policies argue that higher taxes and increased regulations could stifle economic growth. Supporters, however, argue that these measures are necessary for sustainable growth and addressing income inequality. The debate continues to rage on, with both sides presenting compelling arguments.

What is essential for the economy is a balanced approach. Finding ways to stimulate growth while also addressing the needs of the workforce and ensuring equitable opportunities can lead to a more robust economic environment.

“BE PATIENT!”

One of the more intriguing aspects of Trump’s remarks is his call to “BE PATIENT!” This phrase resonates with many Americans who are experiencing the ups and downs of economic life. Patience in economic recovery can be challenging, especially for those directly affected by job losses or inflation.

Trump’s insistence on patience suggests that he believes positive changes are on the horizon, particularly regarding the impact of tariffs and the return of companies to American soil. The theory is that as tariffs take effect, they will create an environment that encourages domestic manufacturing and investment, leading to job growth.

The reality is that economic recovery often takes time. Policies may take months or even years to fully materialize and show their effects on the economy. For instance, tariffs can lead to short-term gains for some sectors but may also raise prices for consumers. This duality can create significant tension within the marketplace.

The Impact of Tariffs on the Economy

Tariffs are a significant point of discussion in Trump’s economic narrative. By imposing tariffs, the government can make imported goods more expensive, which can encourage consumers to buy domestically produced products. This, in theory, could lead to job creation and boost the local economy.

However, it’s essential to consider the broader implications of tariffs. While they might protect certain industries, they can also provoke retaliatory actions from other countries, leading to trade wars. The consequences of such measures can ripple through the economy, affecting prices, consumer behavior, and international relations.

For a deeper understanding of tariffs and their effects, you might want to check out sources like the [Council on Foreign Relations](https://www.cfr.org/) or the [U.S. Trade Representative](https://ustr.gov/) for insights into how tariffs shape not only the U.S. economy but also global trade dynamics.

The Corporate Shift to the USA

The claim that companies are relocating to the USA in record numbers is an intriguing one. Various factors could be driving this trend, from the desire to simplify supply chains to the benefits of being closer to consumers.

In recent years, many companies have considered reshoring as a strategy to mitigate risks associated with overseas manufacturing, such as shipping delays and geopolitical tensions. The COVID-19 pandemic highlighted vulnerabilities in global supply chains, prompting businesses to rethink their strategies.

Furthermore, government incentives for domestic production can also play a critical role. The current administration’s policies may encourage businesses to consider relocating to the U.S., which could lead to job creation and economic growth—provided that the right conditions are in place.

Public Sentiment and Economic Outlook

Public sentiment plays a crucial role in shaping the economy. Consumer confidence can drive spending, which in turn fuels growth. Trump’s remarks, while politically charged, tap into a collective desire for a thriving economy.

The challenge lies in navigating public perception amidst economic recovery. Individuals may feel anxious about inflation or job stability, leading to cautious spending behavior. This is where communication from leaders becomes vital. Clear and reassuring messages regarding economic strategies can help bolster confidence and encourage spending.

Engaging with the public on these topics is essential. Leaders must articulate their plans and how they intend to address the concerns of everyday Americans. Transparency can foster trust, which is a crucial component of a healthy economy.

Conclusion

Trump’s recent comments after the GDP news reflect a broader narrative regarding the state of the American economy. From tariffs to corporate relocations, the conversation is rich with implications for the future. Whether one agrees or disagrees with his assessments, it’s clear that the economic landscape is ever-evolving.

As we navigate these complex issues, it becomes evident that the path to economic growth requires collaboration, understanding, and a willingness to adapt to changing circumstances. The interplay of policies, public sentiment, and market dynamics will shape the future of the American economy in ways we are only beginning to understand.

By staying informed and engaged, we can all contribute to a dialogue that fosters economic resilience and growth. Remember, the economy is not just numbers and charts; it’s about people, jobs, and the communities we build together.

Breaking News, Cause of death, Obituary, Today