Strategy’s Rapid Accumulation of Bitcoin

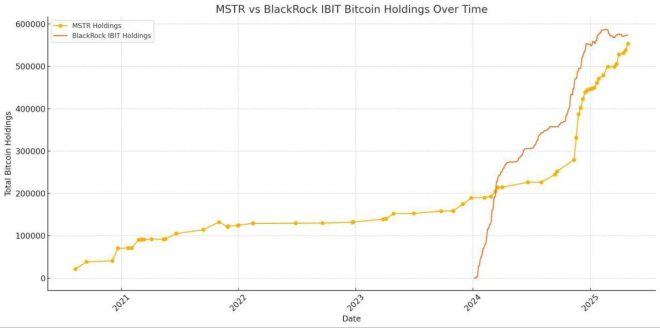

In recent developments within the cryptocurrency market, a significant acquisition has taken place, positioning Strategy as a formidable player in the Bitcoin (BTC) landscape. As of April 29, 2025, Strategy has increased its holdings to 553,555 BTC, now only 20,000 BTC behind the industry giant, BlackRock, which holds 573,869 BTC. This strategic move has garnered attention from investors and analysts alike, highlighting the increasing competition in the cryptocurrency space.

The Growing Importance of Bitcoin Holdings for Institutions

Bitcoin has emerged as a digital asset that is not only popular among individual investors but also increasingly attractive to institutional players. The shift towards institutional adoption of Bitcoin is reshaping the market dynamics and presenting new investment opportunities. Strategy’s recent accumulation of BTC underscores this trend, as institutions recognize the potential of Bitcoin as a hedge against inflation and a store of value.

Analyzing Strategy’s Position in the Market

With the recent purchase of Bitcoin, Strategy has positioned itself as a significant holder within the cryptocurrency ecosystem. This substantial accumulation is indicative of a broader trend where institutional investors are looking to diversify their portfolios with digital assets. Holding over half a million BTC places Strategy in a competitive stance against BlackRock, which has long been perceived as a leader in asset management.

The Competitive Landscape: Strategy vs. BlackRock

As of now, Strategy trails BlackRock by a mere 20,000 BTC, a gap that can be bridged with further strategic acquisitions. This competition is not just about the quantity of holdings but also about the influence and credibility that come with being a major Bitcoin holder. BlackRock’s established reputation in the traditional finance sector gives it a distinct advantage, yet Strategy’s rapid growth demonstrates its ambition to challenge established norms and potentially reshape the landscape of institutional investment in cryptocurrencies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of Bitcoin Accumulation

The implications of Strategy’s accumulation of Bitcoin extend beyond mere numbers. As more institutions enter the Bitcoin market, the overall demand for BTC increases, which can lead to price appreciation. The fact that both Strategy and BlackRock are significantly increasing their Bitcoin holdings suggests a bullish outlook on the future value of Bitcoin. This trend could drive more institutional investors to consider Bitcoin as a viable asset class, further legitimizing its position in the financial world.

The Role of Media in Shaping Perceptions

Media outlets like Cointelegraph play a crucial role in disseminating information about major events in the cryptocurrency market. The tweet highlighting Strategy’s recent Bitcoin acquisition not only informs the public but also influences market sentiment. Positive news regarding institutional investment can lead to increased interest from retail investors, thereby creating a feedback loop that drives demand and prices higher.

The Future of Bitcoin and Institutional Investment

Looking ahead, the future of Bitcoin and its role in institutional investment appears promising. With entities like Strategy actively accumulating Bitcoin, the narrative around Bitcoin as a mainstream asset continues to strengthen. This may lead to the introduction of more Bitcoin-based financial products, which could further engage institutional investors and diversify the market.

Conclusion: A New Era for Bitcoin Investment

In summary, Strategy’s recent acquisition of Bitcoin, positioning it just 20,000 BTC behind BlackRock, signifies a pivotal moment in the cryptocurrency market. As institutional interest grows and competition intensifies, Bitcoin is likely to solidify its status as a cornerstone of digital asset investment. Investors and analysts will be closely monitoring how these developments unfold, as they could have far-reaching implications for the entire cryptocurrency market. The dynamics of institutional investment in Bitcoin are evolving, and Strategy’s aggressive stance may herald a new era of competition and innovation in this space.

This significant accumulation by Strategy not only positions them as a key player alongside BlackRock but also reflects the broader acceptance and institutional embrace of Bitcoin. As the cryptocurrency landscape continues to evolve, the rivalry between these two entities could reshape the future of Bitcoin and its perceived value among investors.

JUST IN: After yesterday’s purchase, Strategy is now just 20,000 $BTC behind BlackRock, holding 553,555 $BTC compared to BlackRock’s 573,869 $BTC. pic.twitter.com/znyinfdhrh

— Cointelegraph (@Cointelegraph) April 29, 2025

JUST IN: After yesterday’s purchase, Strategy is now just 20,000 $BTC behind BlackRock, holding 553,555 $BTC compared to BlackRock’s 573,869 $BTC.

In the ever-evolving landscape of cryptocurrency, the recent acquisition by an entity known as Strategy has caught the attention of many in the finance and crypto communities. Just yesterday, this entity bought enough Bitcoin to bring its total holdings to an impressive $BTC 553,555. That’s only 20,000 $BTC shy of BlackRock, which currently holds 573,869 $BTC. This news is significant for several reasons, and we’ll unpack them in this article.

What Does This Mean for Strategy?

The fact that Strategy is now so close to BlackRock’s Bitcoin holdings indicates a strategic move that could reshape the dynamics in the cryptocurrency market. For a while, BlackRock has been a giant in the investment space, and seeing another major player like Strategy emerge with such substantial holdings could suggest a shift in market influence. But what does this mean for the average investor or crypto enthusiast? Well, it could lead to increased competition, innovation, and potentially more investment in Bitcoin as these large players vie for dominance.

The Significance of $BTC Holdings

Bitcoin, often referred to as digital gold, has been a hot topic for years. With its limited supply and growing acceptance, the value of Bitcoin has skyrocketed, making it a coveted asset for both retail and institutional investors. Holding a significant amount of $BTC not only signals confidence in its future value but also places Strategy in a position of power. By accumulating over half a million Bitcoins, they have the potential to influence market prices significantly.

BlackRock: The Titan of Traditional Finance

BlackRock is known for its substantial influence in traditional finance. As the world’s largest asset manager, it oversees trillions of dollars. The fact that they hold 573,869 $BTC demonstrates their commitment to diversifying their portfolio. This interest in Bitcoin reflects a growing trend among institutional investors who are beginning to see the value of cryptocurrencies as part of a balanced investment strategy.

How Does This Impact Investors?

For individual investors, the news of Strategy nearing BlackRock’s Bitcoin holdings could present both risks and opportunities. On one hand, the influx of institutional investments often leads to increased volatility. On the other hand, it could also result in a more stable market as these large players bring liquidity and credibility to the crypto space. If you’re considering investing in Bitcoin now, it’s essential to stay informed about these developments. They could impact your investment strategy significantly.

Market Reactions and Future Predictions

The immediate reaction to Strategy’s announcement has been one of excitement. Many in the crypto community see this as a bullish sign, indicating that institutional interest in Bitcoin is not just a fad but a continuing trend. As more entities begin to allocate a portion of their portfolios to Bitcoin, we might see a gradual increase in the overall market cap of cryptocurrencies.

Looking ahead, one question remains: what’s next for both Strategy and BlackRock? Will Strategy surpass BlackRock in Bitcoin holdings, or will BlackRock continue to dominate the space? Time will tell, but one thing is sure; the competition between these two giants will be fascinating to watch.

Understanding the Broader Context of Crypto Investments

Investing in cryptocurrency isn’t just about Bitcoin. The emergence of various altcoins has diversified the landscape. However, Bitcoin remains the front-runner, often serving as a gateway for new investors. Strategy’s move reinforces the idea that Bitcoin is a significant player in the crypto market.

Moreover, the traditional financial world is increasingly integrating with digital assets. This blend of traditional finance and cryptocurrencies opens up new avenues for investment and innovation that could reshape the financial landscape as we know it.

Risks of Investing in Bitcoin

While the potential for high returns exists, investing in Bitcoin and other cryptocurrencies comes with its share of risks. Market volatility can swing prices dramatically in short periods, and the regulatory environment surrounding cryptocurrencies is still developing. Investors should conduct thorough research and consider their risk tolerance before diving into this exciting yet unpredictable market.

The Role of Media and Information in Crypto Investments

In the age of information, keeping up with trends and news is vital for any investor. Social media platforms, such as Twitter, play a critical role in disseminating information rapidly. The announcement by Cointelegraph, for example, has sparked discussions and analyses across various platforms. Engaging with reliable sources can provide insights that can help you make informed investment decisions.

Community Sentiment and the Future of Bitcoin

The sentiment within the cryptocurrency community also plays a crucial role in influencing prices. With news like Strategy’s recent acquisition, many are optimistic about the future of Bitcoin. Engaging with community forums and discussions can give you a better understanding of the general sentiment and expectations surrounding Bitcoin and the broader cryptocurrency market.

Conclusion: What’s Next?

As we look to the future, it’s clear that the competition between Strategy and BlackRock will be a significant narrative in the cryptocurrency space. With Strategy now just 20,000 $BTC behind BlackRock, the dynamics of the market are bound to shift. This could lead to increased interest and investment in Bitcoin and possibly other cryptocurrencies.

For individual investors, staying informed and aligned with market trends is crucial for navigating this fast-paced environment. Whether you’re a seasoned investor or just starting, the landscape is shifting, and it’s an exciting time to be involved in the world of cryptocurrencies.