Unrealized Losses at US Banks Reach $482 Billion: A Deep Dive into the Financial Implications

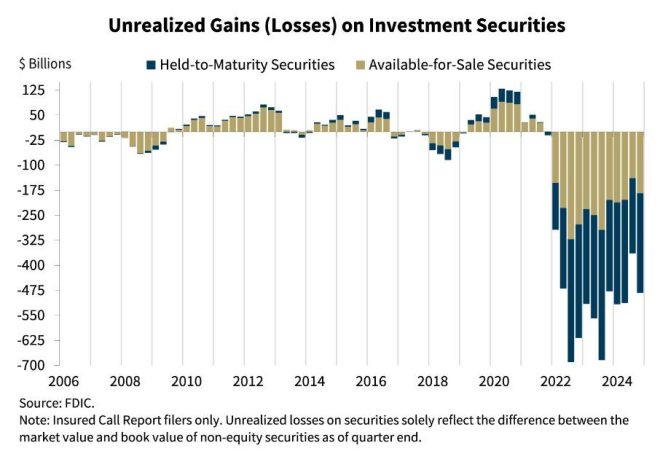

In a striking revelation from April 28, 2025, Cointelegraph reported that unrealized losses at US banks have surged to an alarming $482 billion. This figure represents a staggering 33% increase from the previous quarter, highlighting a significant shift in the financial landscape for American banks. Understanding the implications of these unrealized losses is crucial for investors, policymakers, and the general public alike.

Understanding Unrealized Losses

Unrealized losses refer to declines in the value of assets that have not yet been sold. For banks, this can include various types of securities, loans, and investments. These losses can occur due to market fluctuations, interest rate changes, or shifts in economic conditions. While unrealized losses do not directly impact a bank’s cash flow or immediate financial health, they can have profound implications for overall stability and investor confidence.

The Context of the Surge

The reported increase in unrealized losses is particularly concerning in the aftermath of fluctuating interest rates and economic uncertainty. As the Federal Reserve adjusts interest rates in response to inflationary pressures, the valuation of fixed-income securities can decline, leading to substantial unrealized losses for banks holding these assets.

Factors Contributing to Unrealized Losses

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Rising Interest Rates: The Federal Reserve’s strategy to combat inflation by raising interest rates has made existing bonds less attractive, leading to a decrease in their market value. Banks that hold these bonds are now facing significant unrealized losses.

- Economic Uncertainty: The ongoing volatility in economic conditions, including inflation and geopolitical tensions, has created an unpredictable market environment. This has further exacerbated the situation, leading to increased losses across various financial instruments.

- Regulatory Changes: Recent regulatory changes may also impact how banks report these losses, adding another layer of complexity to their financial statements.

Implications for the Banking Sector

The increase in unrealized losses raises several concerns for the banking sector and the broader economy:

1. Investor Confidence

As unrealized losses grow, investor confidence may wane. Shareholders often look to a bank’s asset valuation when making investment decisions, and significant losses can lead to a decrease in stock prices. This decline can create a negative feedback loop, where falling stock prices lead to further erosion of confidence.

2. Credit Availability

In an environment where unrealized losses are high, banks may become more conservative in their lending practices. This tightening of credit can have broader implications for economic growth, as businesses and consumers may find it more challenging to secure loans.

3. Regulatory Scrutiny

As the Federal Reserve and other regulatory bodies monitor the banking sector’s health, increased unrealized losses may lead to heightened scrutiny and potential regulatory changes. Banks may be required to enhance their capital reserves or adjust their risk management strategies, impacting their operational flexibility.

Strategies for Mitigating Unrealized Losses

To address the challenges posed by rising unrealized losses, banks can adopt several strategies:

1. Diversification of Assets

By diversifying their asset portfolios, banks can mitigate risks associated with specific sectors or financial instruments. A well-diversified portfolio can help buffer against declines in particular asset classes.

2. Active Risk Management

Implementing robust risk management frameworks can enable banks to respond proactively to market changes. This includes regularly assessing portfolio risks and adjusting investment strategies accordingly.

3. Hedging Strategies

Banks may also employ hedging strategies to protect against interest rate fluctuations and other market risks. By utilizing financial derivatives, banks can help stabilize their asset valuations amid volatile market conditions.

The Path Forward

As banks navigate this challenging landscape characterized by unrealized losses, the focus must remain on maintaining stability and restoring investor confidence. Stakeholders, including regulators, investors, and bank management, must work collaboratively to address the underlying factors contributing to these losses while fostering a resilient banking environment.

Conclusion

The increase in unrealized losses at US banks to $482 billion is a significant development that warrants attention from all corners of the financial landscape. Understanding the underlying causes and implications of these losses is crucial for investors and policy-makers alike. As the situation unfolds, proactive measures and strategic adjustments will be essential in managing this growing challenge in the banking sector.

In summary, the recent report by Cointelegraph serves as a wake-up call for banks and investors. It underscores the importance of vigilance in monitoring asset valuations and the potential ripple effects of rising unrealized losses on the broader economy. By adopting effective risk management strategies and fostering a diversified investment approach, banks can better position themselves to weather the storm of financial uncertainty ahead.

—

This summary provides a comprehensive overview of the recent increase in unrealized losses at US banks, emphasizing key factors, implications, and strategies for mitigating risks. By focusing on these elements, it aims to serve as a valuable resource for understanding the current state of the banking sector and its potential trajectory.

JUST IN: Unrealized losses at US banks hit $482 billion, showing a 33% increase from the previous quarter. pic.twitter.com/kiHTxtcwVF

— Cointelegraph (@Cointelegraph) April 28, 2025

JUST IN: Unrealized losses at US banks hit $482 billion, showing a 33% increase from the previous quarter.

Recent reports indicate that unrealized losses at US banks have skyrocketed to an astounding news/unrealized-losses-us-banks-482-billion” target=”_blank”>$482 billion, marking a staggering 33% increase from the previous quarter. This dramatic rise has raised eyebrows across the financial sector and has left many wondering what it means for the economy at large.

Understanding Unrealized Losses

Before diving deeper into the implications, let’s break down what unrealized losses actually are. Simply put, unrealized losses occur when an asset decreases in value but has not yet been sold. For banks, this often applies to investments in securities, which can fluctuate in value based on market conditions. When these assets lose value, banks must account for these losses in their financial statements, even if they haven’t sold the assets yet.

Why is This Increase Significant?

The fact that unrealized losses have surged by 33% is significant for several reasons. First off, it highlights the volatility in the financial markets. Factors such as rising interest rates, inflation, and economic uncertainty can create a challenging environment for banks. When interest rates rise, the value of existing bonds often drops, leading to unrealized losses for banks holding these securities.

Furthermore, a substantial increase in unrealized losses can indicate potential liquidity issues for banks. If these losses become realized—meaning the banks need to sell the assets to cover other liabilities—the financial repercussions could be severe, potentially affecting their ability to lend and operate effectively.

The Impact on the Banking Sector

The banking sector plays a crucial role in the economy, and significant unrealized losses can lead to tighter lending standards. Banks may become more conservative in their lending practices, choosing to hold onto cash rather than extend loans. This could slow economic growth as businesses and consumers find it harder to access the capital they need for investment and spending.

Moreover, if banks start to experience more substantial financial strain, it could lead to a decline in consumer confidence. People might worry about the stability of their bank, leading to increased withdrawals and potentially setting off a ripple effect throughout the financial system.

What’s Driving These Losses?

Several factors are at play behind the surge in unrealized losses. One of the primary drivers is the interest rate environment. The Federal Reserve has been raising interest rates to combat inflation, which can decrease the value of existing bonds. When banks hold a significant amount of these securities, they are directly impacted by any changes in interest rates.

Additionally, broader economic conditions cannot be ignored. Ongoing supply chain issues and geopolitical tensions have contributed to economic instability, making it hard for banks to predict future performance. This uncertainty can lead to volatility in asset values, further contributing to unrealized losses.

Investor Reactions

Investors are keenly watching these developments. A significant increase in unrealized losses might prompt them to re-evaluate their investments in banks and financial institutions. If investors begin to lose confidence, it could lead to declines in stock prices for these banks, worsening their financial situation.

Many investors are likely to ask: “Is my bank safe?” If the answer seems uncertain, they may choose to pull their money out or invest elsewhere. This could exacerbate the issues faced by banks, creating a downward spiral that can be hard to reverse.

Regulatory Responses

In light of these unrealized losses, regulatory bodies may step in to assess the situation. The Federal Reserve and other financial regulators will likely monitor banks’ balance sheets closely. They may implement measures to ensure that banks remain solvent and can withstand economic shocks.

In the past, regulators have taken steps to strengthen capital requirements and improve transparency in the banking sector. As unrealized losses continue to rise, we may see renewed discussions around regulatory reforms aimed at bolstering the financial system’s resilience.

Looking Ahead

As we look forward, it’s essential to keep an eye on how banks are managing these unrealized losses. Will they choose to hold onto their assets, hoping for a market rebound? Or will they take a more aggressive approach, selling off underperforming securities? The decisions they make in the coming months will play a significant role in determining the future health of the banking sector and, by extension, the overall economy.

Conclusion: The Bigger Picture

In summary, the news of unrealized losses at US banks hitting $482 billion is more than just a statistic. It reflects underlying issues in the financial system that could have far-reaching implications for both banks and the wider economy. Understanding these dynamics is crucial for anyone interested in finance, from casual investors to policymakers. Keeping informed and prepared for potential changes will be essential as we navigate this uncertain landscape.

Let’s continue to monitor this situation closely. The financial landscape is continually evolving, and staying informed will be key to understanding how these developments affect you and the economy as a whole.