President trump Proposes Tax Cuts for Middle-Class Americans

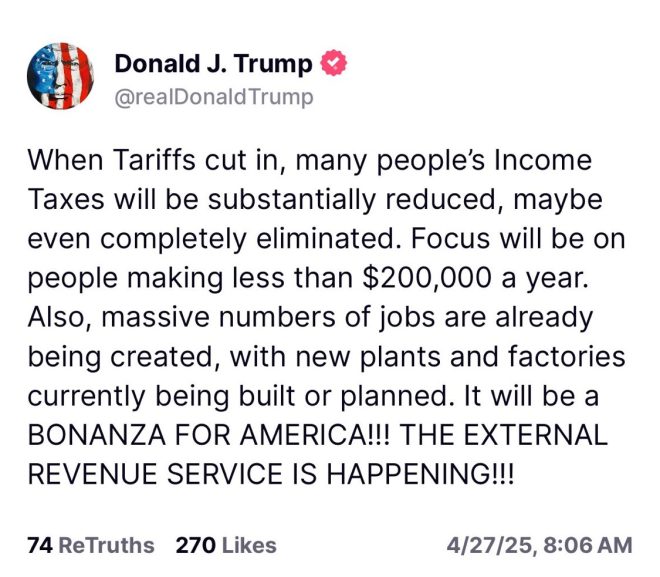

In a bold move aimed at bolstering the financial well-being of the middle class, former President Donald Trump has announced plans to potentially reduce or eliminate income tax for individuals making less than $200,000 annually. This proposal, referred to as his "External Revenue Plan," is designed to alleviate the financial burden on middle-income earners and stimulate economic growth.

Understanding Trump’s External Revenue Plan

The External Revenue Plan is a strategic initiative that seeks to create a favorable financial environment for middle-class Americans. By proposing to reduce or eliminate income taxes for those earning below $200,000, Trump aims to provide immediate financial relief to a significant segment of the population. This tax policy is expected to increase disposable income, allowing families to invest in their needs, save for the future, or contribute to local economies.

The Impact on Middle-Class Americans

Middle-class families often face financial challenges, including rising living costs, healthcare expenses, and education fees. By reducing or eliminating income tax for those earning less than $200,000, Trump’s plan seeks to address these concerns directly. The potential benefits of this tax reduction include:

- Increased Disposable Income: Families will have more money in their pockets, allowing them to manage essential expenses more effectively.

- Stimulated Economic Growth: With additional disposable income, families are likely to increase their spending, which can lead to greater demand for goods and services.

- Encouragement of Savings and Investments: The financial relief from lowered taxes may encourage families to save or invest, fostering long-term economic stability.

The Broader Economic Context

Trump’s proposal comes at a time when many Americans are feeling the strain of economic pressures, including inflation and stagnant wage growth. By targeting tax relief at the middle class, Trump’s plan seeks to address these broader economic issues head-on. It reflects a growing recognition that supporting the middle class is vital for achieving sustainable economic growth.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Analyzing the Political Ramifications

The proposal is not just an economic strategy; it is also a political maneuver. By positioning himself as a champion of the middle class, Trump aims to solidify his support base and appeal to undecided voters. This tax cut plan could resonate well with constituents feeling the pinch of financial insecurity and looking for tangible solutions.

Potential Opposition and Challenges

While the proposal may garner support from middle-class voters, it could also face significant opposition. Critics may argue that reducing income tax for this demographic could lead to decreased government revenue, impacting public services and programs that many Americans rely on. Additionally, there may be concerns about how such a tax reduction will be funded and its long-term implications for the federal budget.

The Future of Tax Reform

Trump’s initiative is likely to reignite discussions surrounding tax reform in America. The proposal could influence future legislative agendas and set the tone for how politicians approach taxation and economic policy in the coming years. As discussions around tax reform evolve, it is essential for policymakers to consider the broader implications of such changes on government funding and social programs.

Conclusion: A Tax Plan for the People?

Trump’s proposed tax cuts for individuals earning less than $200,000 represent a significant shift in his approach to economic policy. By focusing on the middle class, he aims to create a more favorable financial landscape for everyday Americans. As with any major policy proposal, the effectiveness and feasibility of this plan will depend on a range of factors, including political support, economic conditions, and public response.

In a political climate where economic issues dominate the conversation, Trump’s External Revenue Plan could be a pivotal element in shaping the economic discourse leading up to future elections. As Americans await further details on this proposal, the potential for tax reform targeting the middle class remains a critical topic of discussion.

This initiative serves as a reminder of the ongoing challenges facing middle-class families and the importance of policies that prioritize their financial stability. As the political landscape continues to evolve, the impact of Trump’s tax proposal on the middle class will be closely monitored by economists, politicians, and citizens alike.

In summary, Trump’s plan to eliminate or reduce income tax for individuals earning less than $200,000 could be a significant step towards providing financial relief for the middle class. With the potential for increased disposable income and stimulated economic growth, this proposal may redefine the economic landscape in the United States, making it a topic worth following closely in the months and years to come.

Breaking

President Trump is planning on reducing/ eliminating income tax for people making less than $200k. This was his External revenue plan . Trumps saving the middle class! pic.twitter.com/cKkjHbtMoD

— JayPatriot (@Jaypatriot90) April 27, 2025

Breaking

So, here we are in a political landscape that just keeps getting more interesting. President Trump has recently announced plans to reduce or eliminate income tax for individuals making less than $200,000 per year. This news has stirred quite a bit of conversation, with many people wondering what this means for the economy and for the middle class. Is Trump really saving the middle class, or is this just another campaign promise? Let’s dive into the details.

President Trump’s External Revenue Plan

Now, when we talk about Trump’s External Revenue Plan, it’s essential to understand what he’s aiming to achieve. The idea behind this plan is to relieve financial pressure on the middle class, which is often seen as the backbone of the American economy. By eliminating or significantly reducing income tax for those earning under $200,000, the Trump administration hopes to boost disposable income, which could, in turn, stimulate spending and economic growth. But how feasible is this plan, and what are the implications?

Understanding the Impact on the Middle Class

The middle class has long felt squeezed by rising costs and stagnant wages, and many are looking for relief. Trump’s proposal may sound like music to their ears. Imagine having more money in your pocket each month! This could mean more spending on essentials, such as groceries, healthcare, and education, which would directly benefit local businesses and the economy at large.

However, the big question remains: will this tax reduction actually help? Critics argue that such tax cuts could lead to a significant loss in federal revenue, which might affect funding for essential services. Programs like Social Security, Medicare, and public education could be at risk if the government doesn’t find ways to make up for that lost income.

Reactions from Various Sectors

Reactions to this announcement have been mixed. Supporters of Trump’s plan argue that it’s a much-needed breath of fresh air for families struggling to make ends meet. They point out that by allowing people to keep more of their earnings, it empowers them to invest in their futures. On the other hand, critics have raised concerns about the long-term sustainability of such a plan. Forbes has outlined some of these concerns, shedding light on potential risks involved.

The Economic Ripple Effect

Now, let’s talk about the broader economic implications. If this tax cut takes effect, it could lead to an increase in consumer spending. More money in the hands of the middle class generally means more spending at local shops, restaurants, and entertainment venues. This influx of cash could help to invigorate local economies, creating jobs and driving growth. But there’s also the flip side to consider. With potential cuts to government services, how will that balance out?

Long-term Sustainability of the Tax Plan

It’s crucial to think about the long-term sustainability of Trump’s proposal. While short-term benefits might be appealing, what happens when the government has less revenue coming in? Will they cut essential services that many Americans rely on? Will they increase other forms of taxation to compensate? These are valid concerns that need to be addressed.

Moreover, some economists warn that such tax cuts could lead to increased national debt if not paired with spending cuts. The balance between tax cuts and government spending is delicate, and any significant shift could have lasting consequences on the economy.

What This Means for Future Generations

When discussing tax cuts like these, it’s essential to consider the implications for future generations. If the government faces a budget shortfall due to reduced tax revenues, the burden may eventually fall on younger Americans. They could face higher taxes down the line to make up for today’s cuts. It’s a complex situation that requires careful consideration.

The Role of Tax Policy in Economic Growth

Tax policy plays a significant role in shaping economic growth. In theory, reducing income tax for individuals earning less than $200,000 should stimulate demand, which is essential for economic growth. However, the actual outcomes depend on various factors, including consumer confidence, job growth, and overall economic conditions.

Public Opinion and Political Landscape

Public opinion on Trump’s tax plan is likely to vary widely. Supporters view it as a necessary step to empower the middle class, while opponents may see it as a risky gamble with the nation’s financial health. As we approach upcoming elections, these opinions will undoubtedly influence political campaigns and discussions around economic policy.

What’s Next for Trump’s Proposal?

As the details of this plan unfold, it will be interesting to see how it’s received by Congress and whether it gains traction among lawmakers. The political landscape is always shifting, and tax reform is often a contentious topic. Will Trump’s proposal pass smoothly, or will it face significant roadblocks? Time will tell.

Engaging with the Community

For those who feel strongly about this issue, engaging with your community and representatives can make a difference. Whether you’re in favor of the tax cuts or believe they pose a risk, expressing your opinion can help shape the conversation. Attend town halls, write to your local representatives, or participate in community forums to voice your thoughts.

Staying Informed

In a fast-paced political climate, it’s crucial to stay informed about developments related to tax policies and economic initiatives. Follow reliable news sources and engage in discussions about the implications of these policies. Knowledge is power, and being informed will help you make educated decisions that affect you and your family.

Conclusion

President Trump’s plan to potentially reduce or eliminate income tax for individuals making less than $200,000 has sparked a significant conversation about the future of the middle class and the economy as a whole. While the idea holds promise for those struggling financially, it raises numerous questions regarding sustainability and long-term ramifications. As with any major policy change, staying informed and engaged will be crucial for navigating the implications of such decisions.

With that said, the next few months will be critical in determining the fate of this proposal and its potential impact on the American people. Stay tuned!

Breaking News, Cause of death, Obituary, Today