President trump‘s Proposal to Eliminate Income Taxes for Earners Under $200,000

In a bold move, President Trump has announced a significant economic proposal aimed at American taxpayers. This initiative seeks to completely eliminate income taxes for individuals and households earning under $200,000 annually. Instead, the President plans to implement tariffs as a means of generating revenue for the federal government. This proposal has sparked a lively discussion about its potential impacts on the economy, taxpayers, and the broader socio-economic landscape.

Understanding the Proposal

The core of President Trump’s proposal is to shift the tax burden from income taxes to tariffs. Tariffs are taxes imposed on imported goods, designed to protect domestic industries by making foreign products more expensive. In this case, the administration believes that by increasing tariffs, it can generate sufficient revenue to cover federal expenses, thereby allowing for the elimination of income taxes for a significant portion of the American population.

This strategy could provide a substantial financial relief for low- and middle-income earners, allowing them to retain more of their earnings. According to estimates, millions of American households would benefit from this tax policy shift. The proposal is positioned as a way to stimulate economic growth, increase disposable income, and enhance consumer spending.

Economic Implications

The proposed elimination of income taxes for individuals earning under $200,000 is expected to have several economic implications.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Disposable Income: With the removal of income taxes, families and individuals would have more money to spend or save. This increase in disposable income could lead to higher consumer spending, which is a critical driver of economic growth.

- Impact on Tariffs: While the idea of replacing income tax revenue with tariffs may seem beneficial, there are concerns about the potential negative impacts on international trade. Higher tariffs can lead to increased prices for consumers as import costs rise, potentially leading to inflation. Additionally, retaliatory tariffs from other countries could harm American exporters.

- Job Creation: The administration argues that boosting domestic industries through tariffs could lead to job creation. By making imported goods more expensive, consumers may be encouraged to buy domestically produced products, thereby supporting local businesses and potentially leading to increased employment.

- Shift in Tax Burden: Transitioning to a tariff-based revenue system could disproportionately affect lower-income and middle-income households, particularly if they rely on imported goods. While they may not pay income taxes, they might face higher prices on everyday items due to tariffs, potentially negating the benefits of the tax cut.

Political Reactions

The proposal has garnered mixed reactions from lawmakers, economists, and the public. Supporters argue that it represents a significant step towards tax reform that prioritizes the middle class, while critics raise concerns about the feasibility and potential unintended consequences of relying heavily on tariffs for government revenue.

Opponents of the plan warn that it could lead to increased trade tensions and negatively impact relationships with key trading partners. Additionally, there are fears that the approach could destabilize the economy if not managed carefully, particularly in a global market that is increasingly interconnected.

The Broader Economic Context

The announcement comes at a time when many Americans are feeling the financial strain due to rising costs of living and inflation. The proposal aims to address these concerns directly by putting more money back into the pockets of taxpayers. However, the effectiveness of this strategy will depend on the administration’s ability to successfully implement and manage the proposed tariff system.

Furthermore, the proposal raises questions about the sustainability of funding government operations through tariffs in the long term. Historically, tariffs have fluctuated based on political and economic conditions, which could create instability in government revenue.

Conclusion

President Trump’s proposal to eliminate income taxes for those earning under $200,000 and replace that revenue with tariffs presents a bold vision for economic reform. While it promises to increase disposable income for many Americans, it also raises important questions about the long-term viability of such a tax system and its potential impact on trade and consumer prices.

As the proposal moves forward, it will be crucial for policymakers to consider the myriad effects on different segments of the population and the economy as a whole. The success of this initiative will depend on careful implementation, monitoring, and adjustments to ensure that it achieves its intended goals without causing undue harm to consumers or the overall economy.

In summary, while the elimination of income taxes for middle and lower-income earners could provide significant relief and stimulate economic activity, the reliance on tariffs presents a complex set of challenges that must be navigated thoughtfully. As the debate continues, stakeholders across the spectrum will be watching closely to see how this proposal unfolds and what it means for the future of American tax policy.

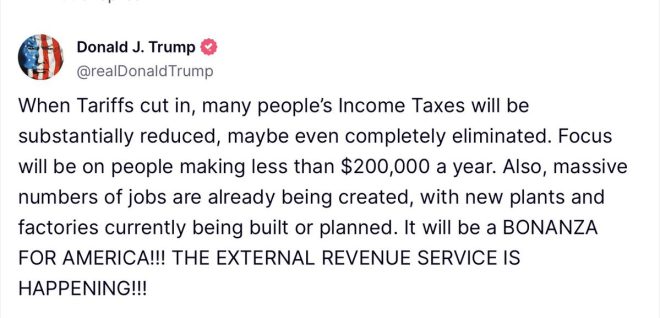

JUST IN: President Trump aims to have tariffs eliminate income taxes for those making under $200k a year pic.twitter.com/GqvP3WulnD

— CryptosRus (@CryptosR_Us) April 27, 2025

JUST IN: President Trump aims to have tariffs eliminate income taxes for those making under $200k a year

In a recent announcement, President Trump has proposed an ambitious plan that aims to reshape the tax landscape for millions of Americans. The idea is straightforward yet bold: using tariffs to eliminate income taxes for individuals and families making under $200k a year. This proposal has generated significant buzz and raised numerous questions about its feasibility and implications. Let’s dive deeper into what this means for everyday Americans and the broader economy.

Understanding Tariffs and Their Role in the Economy

Before we get into the nitty-gritty of this proposal, it’s essential to understand what tariffs are. In simple terms, tariffs are taxes imposed on imported goods. The idea is that by making imported goods more expensive, domestic products become more attractive to consumers, ultimately boosting local businesses. While this can protect local industries, tariffs can also lead to higher prices for consumers, especially if there are no local substitutes for imported products.

So, how do tariffs relate to income taxes? The crux of Trump’s proposal hinges on the idea that the revenue generated from these tariffs could be substantial enough to offset the need for income tax revenue from individuals earning less than $200,000. This means that if successful, low- and middle-income earners could see more money in their pockets, allowing them to spend, save, or invest more freely.

The Potential Benefits for Americans

One of the most significant advantages of this proposal is the potential financial relief it offers to families and individuals struggling to make ends meet. For those earning under $200k, eliminating income taxes could mean a substantial increase in take-home pay. Imagine what that extra cash could do for your family—whether it’s funding education, saving for a home, or simply enjoying a little more financial flexibility.

Additionally, by focusing on tariffs as a revenue source, the administration aims to encourage domestic production. This could lead to job creation in various industries, which is always a plus in a fluctuating economy. A more robust job market often leads to increased consumer confidence, which can further stimulate economic growth.

What Critics Are Saying

While the idea sounds promising, it hasn’t escaped criticism. Opponents of Trump’s proposal argue that relying heavily on tariffs could lead to unintended consequences. For instance, if tariffs raise prices on imported goods, consumers may find themselves paying more at the checkout line, effectively negating any benefits from the eliminated income tax.

Moreover, there’s the question of sustainability. Can tariffs truly generate enough revenue to replace income taxes effectively? Critics argue that this approach may not be a long-term solution to tax reform. They suggest that a more comprehensive tax overhaul could be necessary to create a fair and sustainable system that supports Americans across all income brackets.

The Political Landscape and Its Influence

As with any major policy proposal, the political climate plays a significant role in its potential success. Trump’s administration has a history of advocating for tariffs, particularly in the context of trade wars with countries like China. This approach has garnered support from certain factions of the republican Party, particularly those who prioritize job creation and domestic manufacturing.

However, the Democratic Party has historically leaned towards more progressive tax policies, focusing on higher taxes for the wealthy to fund social programs. This ideological divide could pose challenges for Trump’s proposal as it moves through Congress. Engaging with bipartisan support will be crucial if this plan is to gain traction and ultimately be implemented.

Economic Implications: What to Expect

If Trump’s proposal moves forward, it could have wide-ranging effects on the economy. For one, consumers might initially experience a boost in disposable income, which could lead to increased spending—an essential driver of economic growth. However, as mentioned earlier, rising prices due to tariffs could offset these gains, leading to mixed outcomes for overall consumer welfare.

Additionally, while the goal is to support low- and middle-income earners, it’s essential to consider how this plan might affect higher earners and businesses. If tariffs are increased, businesses reliant on imported goods may face higher costs, which could lead to layoffs or reduced hiring. It’s a delicate balance that the administration will need to navigate carefully.

Public Response and Engagement

Public reaction to Trump’s proposal has been mixed. Many people are intrigued by the idea of eliminating income taxes, especially those in the targeted income bracket. Social media has been buzzing with discussions, memes, and debates about the potential impact of this policy. However, there are also concerns regarding the practicality and fairness of such a system.

Engaging with the public will be crucial for the administration as it attempts to push this proposal forward. Town hall meetings, social media campaigns, and other forms of outreach could help gauge public sentiment and address concerns. By doing so, the administration can refine its approach and build broader support for its initiatives.

What’s Next for the Proposal?

As it stands, President Trump’s proposal is still in the early stages. The next steps involve discussions within Congress, where lawmakers will need to weigh the pros and cons of implementing such a significant change to the tax code. There will likely be hearings, debates, and revisions before any formal legislation is introduced.

For those interested in staying informed, keeping an eye on news outlets and social media platforms is crucial. Engaging in discussions about the proposal can also help raise awareness and contribute to a broader understanding of its implications.

Final Thoughts

The proposal to eliminate income taxes for those making under $200k through tariffs is undoubtedly ambitious. While it offers a compelling vision for financial relief and economic stimulation, it also raises important questions about sustainability and fairness in taxation. As this plan develops, it will be essential for both supporters and critics to engage thoughtfully in discussions about its potential impact on everyday Americans and the economy at large.

Whether you’re a supporter of Trump’s administration or a skeptic, this proposal is worth watching closely. Stay informed, engage in conversations, and consider how such a change could affect your financial future and the nation’s economic landscape.