President trump‘s Proposal on Income Tax Reduction Through Tariffs

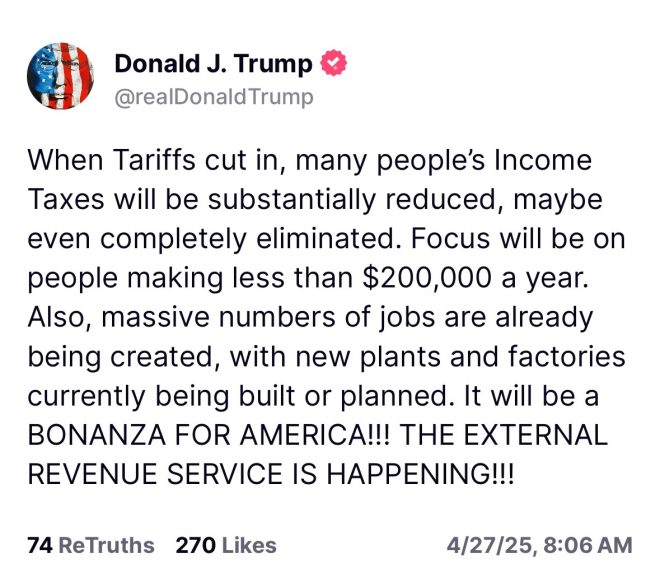

In a significant announcement, former President Donald Trump revealed plans aimed at reducing or even eliminating income tax for individuals earning less than $200,000 annually. The proposed strategy involves utilizing tariffs as a mechanism to achieve this fiscal shift. This proposal, shared via a tweet by journalist Breanna Morello on April 27, 2025, has sparked discussions regarding its potential impact on the economy and the financial well-being of middle-income Americans.

Understanding Tariffs and Their Role

Tariffs are taxes imposed on imported goods, and they play a critical role in a nation’s trade policy. By raising the cost of foreign products, tariffs can encourage consumers to purchase domestically produced items, thereby supporting local industries. Trump’s proposal suggests that revenue generated from these tariffs could be redirected to offset or eliminate income tax obligations for individuals making less than $200,000. This approach aims to relieve financial burdens on middle-class families while promoting American manufacturing.

The Implications of Tax Reduction

Reducing or eliminating income tax for lower-income brackets could provide significant financial relief for many households. For families earning less than $200,000, this move could result in increased disposable income, allowing for greater spending on essentials, savings, and investments. The potential to enhance the quality of life for these families is a focal point of Trump’s proposal.

Moreover, the reduction in income tax obligations could stimulate economic growth. With more money in their pockets, families are likely to spend more, which can drive demand for goods and services. This increased consumer spending could, in turn, lead to job creation and expansion within the domestic market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Considerations

While the proposal sounds promising, it raises several economic considerations. Critics may argue that relying on tariffs for revenue generation can lead to increased consumer prices on imported goods. If tariffs are too high, they might negate the benefits of reduced income taxes by making everyday items more expensive for consumers.

Additionally, there could be concerns about the impact on international trade relations. High tariffs can provoke retaliatory measures from other countries, potentially leading to trade wars that could harm the economy. The long-term sustainability of funding tax cuts through tariffs is another point of contention that economists and policymakers will need to address.

Political Reactions

The proposal has elicited mixed reactions from both sides of the political aisle. Supporters argue that it addresses income inequality by providing tax relief to the middle class, a demographic that has been squeezed by rising living costs. They believe that this initiative could be a game-changer for many families struggling to make ends meet.

On the other hand, opponents express skepticism regarding the feasibility and potential consequences of such a plan. They underscore the importance of a comprehensive tax reform that considers all economic factors, rather than relying on tariffs as a primary source of funding.

The Broader Impact on American Families

For families earning under $200,000, the proposed tax relief could represent a significant financial shift. By alleviating tax burdens, households may find themselves in a better position to invest in education, healthcare, and other critical areas of their lives. Enhanced financial stability could result in improved mental health and overall well-being for families across the nation.

Furthermore, the proposal could pave the way for a broader dialogue about tax reform in the United States. As discussions evolve, it is essential for stakeholders to consider various approaches that balance economic growth with the need for equitable tax policies.

Conclusion

Donald Trump’s proposal to reduce or eliminate income tax for individuals making less than $200,000 through tariffs presents an intriguing approach to tax reform. While the idea of using tariff revenue to support tax relief for middle-income families is appealing, it also raises important questions about economic sustainability and trade relations.

As the proposal garners attention, it is crucial for policymakers, economists, and the public to engage in constructive discussions about the potential benefits and drawbacks. The ultimate goal should be to create a fair and effective tax system that supports economic growth while ensuring that all Americans can thrive.

In summary, Trump’s announcement could significantly impact the financial landscape for many families, and its implications will be closely watched as the political and economic discussions unfold. The balance between tax relief, economic growth, and trade policy will remain a critical topic in the coming months and years.

JUST IN

President Trump is detailing reducing or eliminating income tax for people making less than $200,000 a year through tariffs. pic.twitter.com/Xyl9umxhMs

— Breanna Morello (@BreannaMorello) April 27, 2025

JUST IN

President Trump is detailing reducing or eliminating income tax for people making less than $200,000 a year through tariffs.

So, here’s the scoop: President Trump has just come out with a bold proposal aimed at reshaping the way we think about income tax. In a recent announcement, he suggested that he could potentially reduce or even eliminate income tax for individuals earning less than $200,000 a year. And how does he plan to fund this? Through tariffs. This is a game-changer, and it’s sparking a lot of discussions across the nation.

What Are Tariffs, Anyway?

First off, let’s break down what tariffs really are. Tariffs are essentially taxes imposed on imported goods. When a country wants to protect its own industries or boost local production, it often raises tariffs on foreign products. This makes imported goods more expensive, encouraging consumers to buy domestic products instead. By leveraging tariffs, Trump believes he can create a revenue stream that allows for tax cuts for those who earn less.

The Rationale Behind the Proposal

Now, you might be wondering why this proposal is significant. For one, it aims to relieve financial pressure on millions of Americans who are living paycheck to paycheck. By reducing or eliminating income tax for those under the $200,000 mark, Trump is attempting to put more money back into the pockets of working-class citizens. This could stimulate spending, ultimately boosting the economy. It’s a classic case of trickle-up economics, where the benefits are aimed at the lower and middle classes.

The Impact on Average Americans

Imagine having a little more cash in your wallet each month. Lowering or eliminating income tax for individuals making less than $200,000 a year could mean significant savings. For many families, this extra money could help cover essentials like groceries, healthcare, or even saving for a rainy day. It’s all about giving people a little breathing room and allowing them to prioritize their needs without the burden of hefty tax deductions.

Potential Criticism and Concerns

Of course, not everyone is on board with this idea. Critics argue that relying on tariffs to fund tax cuts could lead to higher prices on imported goods. If companies pass the cost of tariffs onto consumers, we might see an increase in prices at the store, which could offset the benefits of the tax cuts. Additionally, some fear that this strategy might further strain international trade relations. After all, tariffs can lead to retaliatory measures from other countries, potentially sparking trade wars.

How Will This Affect the Economy?

Trump’s proposal could have a ripple effect on the economy. By putting more money in the hands of consumers, there’s a chance that spending will increase, leading to higher demand for goods and services. This could, in turn, stimulate job growth, as businesses may need to hire more employees to meet the demand. However, it’s essential to consider how sustainable this approach is in the long term. If tariffs become a significant revenue source, what happens when the economy shifts, and those tariffs are no longer effective?

Comparing This to Previous Tax Reforms

It’s worth comparing this proposal to previous tax reforms. In the past, we’ve seen tax cuts aimed primarily at corporations and wealthier individuals, with the idea that benefits would eventually trickle down. However, many Americans have felt left out of the benefits of those policies. This new focus on reducing taxes for the lower and middle classes could be seen as a shift in strategy, potentially aiming to address the growing income inequality in the country.

What Experts Are Saying

Financial experts are divided on the efficacy of this plan. Some argue that it could lead to a more equitable tax system, while others caution that it might create more economic instability. For example, a report from the Forbes highlights concerns over the long-term sustainability of funding tax cuts through tariffs. It’s crucial for policymakers to evaluate the potential consequences of such a radical shift in tax strategy.

Public Reaction

Public reaction to Trump’s announcement has been mixed. Supporters are excited about the prospect of keeping more of their hard-earned money, while detractors worry about the implications for international trade and domestic pricing. Social media platforms are buzzing with opinions, showcasing the divide in public sentiment. For example, a tweet from Breanna Morello emphasizes the urgency of the announcement and its potential impact on everyday Americans.

Next Steps: What to Watch For

As this proposal unfolds, it’s essential to keep an eye on how Congress and the public react. Will there be bipartisan support, or will it face significant opposition? The next steps could involve negotiations, revisions, and discussions about the broader implications of such a tax strategy. It’ll be interesting to see how this plays out in the coming months.

In Summary

President Trump’s proposal to reduce or eliminate income tax for individuals making less than $200,000 a year through tariffs presents a unique approach to tax reform. While it has the potential to provide financial relief for many Americans, it also raises questions about sustainability, economic impact, and international trade relations. As the conversation continues, it’s crucial for citizens to stay informed and engage in the dialogue surrounding this significant policy shift.