Washington state‘s Historic Tax Increases: A Summary of Recent Developments

In a significant political development, Washington State Democrats have passed a new operating budget that introduces the largest tax increases in the state’s history. This monumental decision is poised to impact residents across the state, particularly through substantial property tax hikes and a newly implemented capital gains-style tax. The budget’s passage has sparked considerable debate and concern among various stakeholders, including homeowners, renters, and business owners.

Understanding the New Budget

The budget, approved by the Washington State Democrats, outlines a comprehensive financial strategy for the upcoming fiscal period. However, it is the accompanying tax increases that have drawn the most attention. Lawmakers have emphasized that these measures are necessary to fund essential services and programs, but critics argue that the tax burden will disproportionately affect lower and middle-income families.

Key Features of the Tax Increases

- Massive Property Tax Increases: One of the most significant components of the new budget is the dramatic rise in property taxes. This increase will not only affect homeowners but will also trickle down to renters, as landlords may pass on these costs through higher rent. The implications of this change mean that many families may struggle to keep up with their housing costs amid an already challenging economic landscape.

- Capital Gains-Style Tax: In addition to property taxes, the budget introduces a capital gains-style tax that targets higher earnings from investments. This tax aims to create a more equitable tax system, but it has faced opposition from those who argue that it could deter investment and economic growth.

- Impact on Renters: With property taxes rising, renters are also at risk of experiencing increased housing costs. As property owners seek to maintain their profit margins in light of higher taxes, the rental market may see a significant shift, leading to affordability challenges for many residents.

Political Reactions

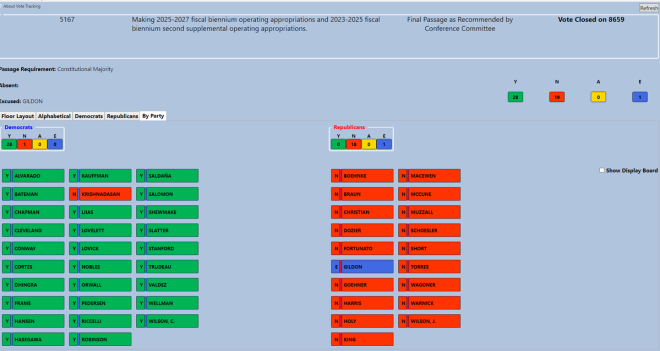

The passage of this budget has ignited a heated debate among lawmakers and the public. The Washington State senate Republicans have voiced strong opposition to the tax increases, arguing that the budget could have been structured differently to avoid placing such a heavy burden on taxpayers. Their statement highlights the sentiment that the situation did not have to escalate to this point, suggesting alternative approaches to budgetary needs.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Supporters of the budget, primarily from the Democratic camp, argue that the tax increases are necessary to fund critical programs, including education, healthcare, and infrastructure improvements. They contend that these investments are vital for the long-term prosperity of Washington State and its residents.

Economic Implications

The economic ramifications of these tax increases are a major point of discussion. Critics warn that the new tax structure could stifle economic growth, deter investment, and lead to an exodus of businesses and individuals seeking more favorable tax environments. Conversely, proponents argue that a well-funded public sector can drive economic growth by improving services and infrastructure, ultimately benefiting residents in the long run.

Summary and Future Outlook

As Washington State moves forward with these historic tax increases, the long-term effects on its economy and residents remain to be seen. The debate surrounding this budget reflects broader discussions on taxation, government spending, and the role of state support in promoting equitable growth.

The recent developments in Washington State serve as a critical case study for other regions grappling with similar budgetary challenges. The balancing act of funding essential services while ensuring a fair tax system is a complex issue that resonates across the nation.

In conclusion, the passage of Washington State’s budget with the largest tax increases in its history is a pivotal moment in the state’s political and economic landscape. As residents brace for the impacts of rising property taxes and new capital gains taxes, the discussions surrounding this budget will likely continue to evolve, shaping the future of governance and fiscal policy in Washington State.

BREAKING, IT DIDN’T HAVE TO BE THIS WAY:

WA Democrats pass the final operating budget which relies on the LARGEST TAX INCREASES IN WASHINGTON STATE HISTORY. Their budget relies on MASSIVE property-tax increases that will also hit renters; a capital gains-style tax on… pic.twitter.com/icWPzxtYhP

— WA Senate Republicans (@WashingtonSRC) April 27, 2025

BREAKING, IT DIDN’T HAVE TO BE THIS WAY:

In a move that has sent shockwaves through Washington State, Democrats have recently passed a final operating budget that hinges on the largest tax increases in the state’s history. This isn’t just a footnote in a political debate; it’s a significant shift that impacts everyone in the state, from homeowners to renters. It’s essential to understand what this means for your wallet and how it could shape the future of Washington.

WA Democrats Pass the Final Operating Budget

When the Washington State Democrats unveiled their latest budget, they touted it as a necessary step for progress and growth. However, many critics, including the Washington Senate Republicans, have labeled it as a fiscal nightmare. The budget not only proposes massive property tax increases but also introduces a capital gains-style tax that many believe will disproportionately affect those who can least afford it. You can check out the official statement from the WA Senate Republicans here.

Largest Tax Increases in Washington State History

Let’s break down what it means to have the largest tax increases in Washington State history. Historically, taxes have always been a contentious issue, but the scale of these increases is unprecedented. The budget aims to raise funds through significant hikes in property taxes, which could see homeowners paying hundreds, if not thousands, more each year. For renters, this could translate into increased housing costs, as landlords may pass on these tax burdens.

Massive Property-Tax Increases

The proposed property tax increases are not just a blip on the radar; they are massive and could significantly change the landscape of housing in Washington. Homeowners are already feeling the pinch with rising costs, and this could push many to the brink. With property taxes set to soar, the affordability crisis could worsen, pushing more people out of their homes.

These tax increases are particularly troubling for renters. If landlords face higher property taxes, they often pass these costs onto tenants. This could mean that even those who don’t own property will feel the financial strain. If you think about it, this creates a vicious cycle where the burden of taxation is shifted onto those who are already struggling to make ends meet.

Capital Gains-Style Tax

Adding fuel to the fire is the introduction of a capital gains-style tax. This type of tax is designed to target wealth generated from investments, but the implications can be far-reaching. While proponents argue that it’s a fair way to tax the wealthy, critics counter that it often ends up impacting middle-class families who may have invested in stocks or property to secure their financial future.

This tax could deter investment in the state and lead to economic stagnation. If businesses and individuals feel that the tax environment is too hostile, they may choose to relocate to friendlier states. This could ultimately hurt job growth and economic development in Washington.

What Does This Mean for Washington Residents?

For the average Washington resident, these developments can feel overwhelming. The prospect of higher taxes can lead to anxiety about the future. Will you be able to afford your home? What will happen if your rent increases? These are legitimate concerns that many are grappling with following the approval of this budget.

Moreover, there’s a broader discussion to be had about how this budget aligns with the needs of the community. Are these tax increases truly necessary for funding essential services, or are they merely a reflection of poor fiscal management? The conversation around this budget is just beginning, and it’s crucial for residents to engage with their local representatives and voice their concerns.

Public Response and Political Fallout

The public response to these tax increases has been mixed. While some support the budget as a necessary evil to fund public services, others see it as a direct attack on working families. The political fallout from this decision is likely to be significant, particularly as we move towards future elections. Voters are likely to remember how their representatives voted on this budget when they head to the polls.

Additionally, grassroots movements are already forming to oppose these tax increases. Activists are rallying to bring attention to the potential negative impacts of this budget, emphasizing the need for more sustainable and equitable fiscal policies. It’s a critical moment for civic engagement, as residents have the chance to make their voices heard.

Looking Ahead: The Future of Taxation in Washington

With these unprecedented tax increases now part of the landscape, what does the future hold for Washington? It’s hard to say definitively, but several possibilities come to mind. If the budget leads to significant public backlash, lawmakers may be forced to reconsider their approach. Conversely, if the tax increases are absorbed without much dissent, we could see a trend towards even higher taxes in the future.

Ultimately, it’s essential for Washington residents to stay informed and engaged. Follow local news sources, attend town hall meetings, and communicate with your elected officials. Your voice matters, and it’s crucial to advocate for policies that promote fairness and sustainability.

In Summary

The passage of the Washington State budget that relies on the largest tax increases in history is a significant development that impacts all residents. With massive property-tax increases and a capital gains-style tax on the horizon, it’s crucial to understand how these changes could affect your financial situation. Whether you’re a homeowner or a renter, the implications are real, and the need for community engagement has never been more critical.

As we move forward, keeping the conversation alive about these tax policies will be essential. Engage, inform yourself, and don’t hesitate to speak up. Washington’s future depends on it.