Coinbase Legal Update: SEC and state Lawsuits Withdrawn

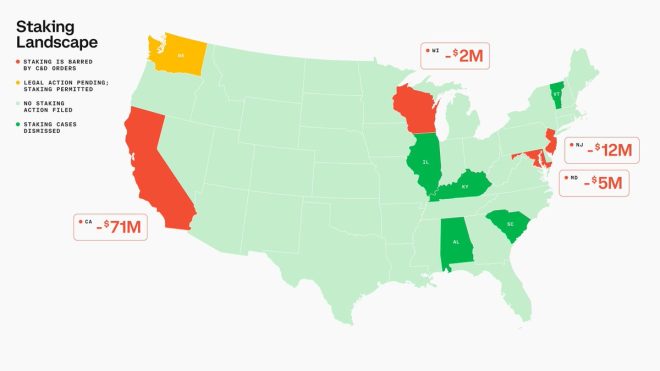

In a significant development for the cryptocurrency landscape, Coinbase’s Chief Legal officer, Paul Grewal, announced that the U.S. Securities and Exchange Commission (SEC) and four states—Illinois, Kentucky, South Carolina, and Vermont, in addition to Alabama—have officially withdrawn their lawsuits targeting Coinbase’s staking services. This decision marks a pivotal moment for Coinbase, a leading cryptocurrency exchange, and its ongoing legal battle with regulatory authorities.

Overview of the Lawsuits

The lawsuits against Coinbase had primarily focused on its staking services, which allow users to earn rewards by participating in the network maintenance of various cryptocurrencies. The SEC argued that these services constituted unregistered securities offerings, thus falling under their jurisdiction. The legal challenges posed significant hurdles for Coinbase, a company that has consistently maintained its commitment to regulatory compliance and transparency.

Implications of the Withdrawn Lawsuits

The withdrawal of these lawsuits is expected to have far-reaching implications for both Coinbase and the broader cryptocurrency market. For Coinbase, it signifies a moment of relief and vindication. The company has faced increasing scrutiny from regulatory bodies as the cryptocurrency sector matures and gains mainstream acceptance. With the lawsuits dropped, Coinbase can continue to develop its staking services without the legal cloud that had previously loomed over them.

For the broader cryptocurrency market, this development may foster a more favorable regulatory environment. The withdrawal of the lawsuits could signal a shift in how regulatory agencies approach the burgeoning crypto sector. It may indicate that regulators are willing to collaborate with industry leaders like Coinbase to establish clearer guidelines and frameworks rather than resorting to litigation as a first response.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Coins and Staking Services

Coinbase’s staking services have gained popularity among users due to their potential for earning passive income. Users can stake various cryptocurrencies, including Ethereum, Tezos, and others, allowing them to earn rewards while contributing to the security and operation of blockchain networks. This model not only benefits users but also enhances the overall ecosystem by promoting network stability and security.

The Role of Regulatory Clarity

This legal update underscores the importance of regulatory clarity in the cryptocurrency industry. As more individuals and institutions enter the space, the need for a clear regulatory framework becomes paramount. Both users and companies benefit from understanding the legal landscape, which can help foster innovation while ensuring consumer protection.

The SEC’s previous stance on cryptocurrency staking services raised concerns among crypto exchanges and their users. The withdrawal of lawsuits may pave the way for more dialogue between regulators and industry stakeholders, ultimately leading to more defined regulations that can help mitigate risks associated with crypto investments.

Future Outlook for Coinbase and the Industry

With the lawsuits withdrawn, Coinbase is now positioned to further solidify its role as a leader in the cryptocurrency space. The company’s commitment to compliance and transparency will likely continue to be a focal point as it navigates the ever-evolving regulatory landscape. This legal victory may also enhance Coinbase’s reputation among investors and users, potentially leading to increased adoption and user engagement.

In the broader context, the cryptocurrency industry is at a crossroads. As regulatory bodies around the world grapple with how best to approach digital assets, developments like the withdrawal of lawsuits against Coinbase can serve as a catalyst for change. The industry is calling for clarity and guidance, and this legal update may signal a step towards a more collaborative approach between regulators and crypto platforms.

Conclusion

The withdrawal of lawsuits against Coinbase regarding its staking services is a significant legal victory for the company and a hopeful sign for the cryptocurrency industry as a whole. With the SEC and four states stepping back, Coinbase can continue to innovate and expand its staking offerings without the burden of litigation. This development not only alleviates immediate legal concerns for Coinbase but also opens up discussions about regulatory clarity in the cryptocurrency sector.

As the industry continues to evolve, the need for clear regulations will only grow. Stakeholders, including exchanges, users, and regulatory bodies, must work together to create a framework that supports innovation while ensuring consumer protection. The recent legal developments surrounding Coinbase may be a crucial step in that direction, promoting a healthier and more sustainable cryptocurrency ecosystem.

In summary, while challenges remain, the legal landscape for cryptocurrency exchanges like Coinbase is becoming more navigable. Stakeholders must remain vigilant and proactive in their efforts to shape a regulatory environment that fosters growth and innovation in the digital asset space.

Breaking:Coinbase Legal Update

Coinbase CLO @iampaulgrewal VanGreck announced that the SEC and four U.S. states — Illinois, Kentucky, South Carolina, and Vermont, plus Alabama — have officially withdrawn their lawsuits against Coinbase’s staking services.

Lawsuits from… pic.twitter.com/amJjwuYIVr

— CoinRank (@CoinRank_io) April 27, 2025

Breaking: Coinbase Legal Update

In the ever-evolving landscape of cryptocurrency, legal battles can sometimes overshadow the core functionalities of platforms. Recently, Coinbase, one of the largest cryptocurrency exchanges in the world, found itself in a significant legal tussle with the U.S. Securities and Exchange Commission (SEC) and several state authorities. However, a recent announcement has changed the narrative surrounding Coinbase’s operations.

What Happened?

On April 27, 2025, Coinbase’s Chief Legal officer, @iampaulgrewal VanGreck, shared some groundbreaking news. The SEC, alongside four U.S. states—Illinois, Kentucky, South Carolina, and Vermont, plus Alabama—has officially withdrawn their lawsuits against Coinbase’s staking services. This development signals a major victory for Coinbase and a potential shift in the regulatory environment surrounding cryptocurrency staking.

Understanding the Lawsuits

To grasp the significance of this legal update, it’s essential to understand what the lawsuits entailed. The SEC and the states accused Coinbase of operating its staking services in a manner that violated securities laws. Staking, for those unfamiliar, involves locking up cryptocurrency in a wallet to support the operations of a blockchain network in exchange for rewards. It’s a popular feature in many cryptocurrencies, allowing users to earn passive income.

Given the complexities of cryptocurrency regulations, these lawsuits placed a cloud over Coinbase’s operations. Investors and users were understandably concerned about the implications for their staked assets and the overall stability of the platform.

The Implications of the Lawsuits Withdrawal

The withdrawal of these lawsuits is significant for several reasons. Firstly, it alleviates the immediate legal pressures on Coinbase, allowing the platform to operate its staking services without the looming threat of litigation. This could lead to a resurgence in user confidence, encouraging more individuals to explore staking as a viable income stream.

Moreover, this move may indicate a broader trend in the regulatory landscape. As the cryptocurrency market matures, regulators might be starting to recognize the importance of fostering innovation while ensuring consumer protection. The decision to withdraw could also reflect a shift in the SEC’s approach to cryptocurrency, signaling a willingness to collaborate with industry leaders rather than pursuing adversarial legal actions.

What Does This Mean for Users?

For Coinbase users, this legal update is a breath of fresh air. With the lawsuits officially withdrawn, user confidence in the platform’s staking services is likely to increase. This could mean more users will feel comfortable engaging with these services, potentially leading to higher staking participation rates. As a result, users could benefit from increased rewards and a more vibrant community around staking activities.

The Future of Staking Services

With the legal hurdles out of the way, what’s next for Coinbase’s staking services? The company can now focus on enhancing the user experience and potentially expanding its offerings. This might include introducing new assets for staking, improving the user interface, or offering better incentives for participants.

Additionally, this legal victory could set a precedent for other cryptocurrency platforms. If Coinbase can successfully navigate the regulatory landscape, it may encourage other companies to innovate without fear of legal repercussions. This could lead to a more dynamic and competitive market.

Industry Reactions

The reaction from the cryptocurrency community has been overwhelmingly positive. Many industry experts view the withdrawal of lawsuits as a pivotal moment, showcasing a potential for greater collaboration between regulators and crypto platforms. It exemplifies a cautious optimism about the future of crypto regulation. You can find some insights on the reactions from various industry leaders on [CoinDesk](https://www.coindesk.com).

Regulatory Environment Moving Forward

As we look ahead, the regulatory environment for cryptocurrency is sure to evolve. The SEC and other regulatory bodies are likely to refine their approaches, balancing the need for oversight with the desire to foster innovation. The fact that they withdrew lawsuits against a major player like Coinbase could signal a willingness to work towards more favorable regulations for the industry.

It’s important for crypto enthusiasts and investors to stay informed about these developments. Engaging with platforms that prioritize compliance and user education can help mitigate risks associated with the frequently changing regulatory landscape.

Conclusion: A Path Forward for Coinbase and Its Users

In summary, the withdrawal of lawsuits against Coinbase’s staking services marks a significant milestone in the company’s journey and the broader cryptocurrency landscape. As the dust settles, it’s clear that this legal update opens the door for innovation and growth within the staking space. For users, this means a more secure and promising environment to engage with staking services, fostering a deeper connection to the crypto ecosystem.

Stay tuned for more updates as Coinbase and the regulatory landscape continue to evolve. The future of crypto may be brighter than ever, and we’re excited to see where this journey takes us!

“`

This article provides a comprehensive overview of the recent legal developments surrounding Coinbase, focusing on the implications for users and the broader cryptocurrency ecosystem. The conversational tone and engaging style aim to inform and resonate with readers interested in cryptocurrency and legal matters.