Understanding the U.S. Debt Burden: A Growing Concern

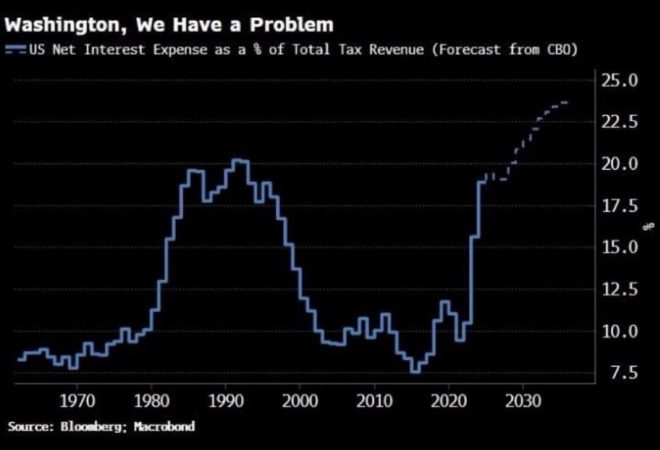

In recent discussions surrounding the U.S. economy, a critical issue has come to light: the substantial burden of national debt and its implications on government finances and taxpayer contributions. A tweet from financial analyst Carl Menger highlights a pressing concern: interest payments on the national debt are currently consuming approximately 20% of tax revenue, with projections indicating this figure could rise to around 25% in the near future.

The Current state of U.S. Debt

The U.S. national debt has reached staggering levels, and the implications of this financial burden are far-reaching. As of April 2025, interest payments on this debt are significantly impacting the federal budget, leading to a situation where more taxpayer money is directed toward servicing debt rather than funding essential public services and infrastructure. This trend raises critical questions about the sustainability of U.S. fiscal policies and the long-term economic outlook.

The Mechanics of Interest Payments

Interest payments on government debt represent the cost of borrowing money. When the government issues bonds, it effectively takes out loans from investors, promising to pay back the principal amount with interest. As the national debt grows, so do these interest payments. This scenario creates a vicious cycle: increasing debt leads to higher interest payments, which can lead to further borrowing, compounding the problem.

Impact on Tax Revenue

The increasing percentage of tax revenue consumed by interest payments has serious implications for government operations. With 20% of tax revenue currently allocated to these payments, and projections indicating a rise to 25%, the government may face significant challenges in funding essential services such as healthcare, education, and infrastructure development. The diversion of funds to interest payments limits the federal government’s ability to invest in programs that stimulate economic growth and improve the quality of life for citizens.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Economic Consequences

The rising debt burden can lead to detrimental economic consequences. As the government allocates more of its budget to interest payments, it may be forced to make difficult choices regarding spending cuts or tax increases. Such measures can stifle economic growth, reduce public investment, and ultimately harm the economy. Additionally, a high debt-to-GDP ratio can lead to reduced investor confidence, which can further complicate the government’s ability to finance its obligations.

Long-Term Projections

The projection that interest payments could reach 25% of tax revenue raises alarms among economists and policymakers alike. If this trend continues, it could lead to a significant reshaping of government priorities and spending. Analysts warn that if the government does not take proactive steps to address the growing debt burden, the long-term consequences could be severe. This situation could hinder economic growth and lead to potential financial instability.

Solutions and Recommendations

Addressing the U.S. debt burden requires a multi-faceted approach. Policymakers must consider a combination of strategies to manage the national debt effectively. Some potential solutions include:

- Fiscal Responsibility: Implementing policies that promote fiscal responsibility can help ensure that government spending aligns with revenue. This may involve reevaluating spending priorities and identifying areas where cuts can be made without compromising essential services.

- Tax Reform: Revising the tax code to enhance revenue generation could provide the government with additional funds to service its debt. This might involve closing tax loopholes, increasing tax rates for high earners, or introducing new revenue streams.

- Economic Growth Initiatives: Fostering economic growth through investments in infrastructure, education, and technology can help increase tax revenue over time. A growing economy typically generates higher tax revenues, which can be used to address the debt burden.

- Debt Management Strategies: The government could explore options for refinancing existing debt at lower interest rates or restructuring payment timelines to reduce the immediate financial burden.

- Public Awareness and Engagement: Engaging the public in discussions about the implications of the national debt can foster a more informed citizenry. Increased awareness can lead to greater demand for accountability and responsible fiscal policies from elected officials.

Conclusion

The U.S. debt burden is a growing concern that requires immediate attention from policymakers and citizens alike. With interest payments currently consuming a significant portion of tax revenue and projections indicating an upward trend, the implications for government services and economic stability are profound. By implementing strategic fiscal policies, promoting economic growth, and engaging the public in discussions about debt management, the U.S. can work toward a more sustainable financial future.

In summary, the call to action is clear: the time to address the national debt is now. As taxpayers, citizens must remain vigilant and engaged, advocating for policies that prioritize fiscal responsibility and long-term economic health. The future of the U.S. economy depends on our collective ability to navigate the challenges posed by an escalating debt burden.

BREAKING: U.S. Debt Burden Deepens. Interest Payments Eat ~20% of Tax Revenue Today, Set to Reach ~25% and Climbing.

Washington, we have a problem. pic.twitter.com/v3D4fbE4NY

— Carl ₿ MENGER (@CarlBMenger) April 26, 2025

BREAKING: U.S. Debt Burden Deepens

The financial landscape of the United States is undergoing a dramatic shift, and it’s one that every American should pay attention to. Recently, the alarm bells have been ringing louder than ever about the escalating debt burden that the country is facing. According to recent reports, interest payments on this debt are consuming approximately 20% of tax revenue today, and that figure is projected to reach an alarming 25% and climbing. This situation is not just a statistic; it’s a wake-up call for policymakers and taxpayers alike. Source.

Interest Payments: A Growing Concern

Interest payments are often seen as a necessary evil in government finance, but when they begin to eat away at a significant portion of tax revenue, it raises serious questions about fiscal sustainability. In simple terms, when the government spends a quarter of its income just on interest, there’s less money for crucial services like education, healthcare, and infrastructure. Think about it: if you were paying a quarter of your paycheck just to cover interest on your credit card, how would that affect your lifestyle? This is the reality many Americans may soon face on a national scale.

The Implications for Taxpayers

As interest payments continue to grow, taxpayers may find themselves on the hook for additional taxes or cuts to vital services. The more money that goes toward interest, the less there is for things that directly impact our lives. Education budgets might shrink, roads could go unpaved, and social services may face deep cuts. If this trend continues, everyday Americans will inevitably feel the pinch. It’s not just a numbers game; it’s about the quality of life and the services we rely on.

Why Is the Debt Burden Increasing?

So, what’s driving this escalating debt burden? Various factors contribute to this worrying trend. First off, government spending has surged, especially in response to crises like the COVID-19 pandemic. While emergency spending is often necessary, it leads to a ballooning national debt that has to be repaid. Furthermore, the rising cost of servicing existing debt, due to higher interest rates, only adds fuel to the fire. To manage this debt sustainably, we need to look at both how much we’re spending and how we can generate more revenue.

The Role of Interest Rates

Interest rates play a crucial role in determining how manageable national debt is. When interest rates are low, the government can borrow money at a cheaper rate, which is more sustainable in the long run. However, with the Federal Reserve gradually raising interest rates to combat inflation, the cost of servicing the debt increases. This means the government will pay more in interest payments, further straining the budget and leading to the current crisis we find ourselves in. It’s a vicious cycle that needs urgent attention.

Options for Addressing the Debt Crisis

Addressing the growing debt burden isn’t easy, but it’s necessary. Policymakers have several options, from increasing taxes to cutting spending. Each option comes with its own set of pros and cons, and the best approach is often a combination of both. For instance, investing in economic growth can help increase tax revenue without raising rates. If the economy grows, there will be more taxpayers contributing to the revenue pool, potentially easing the burden of interest payments.

The Impact on Future Generations

One of the most concerning aspects of the U.S. debt crisis is its impact on future generations. The longer we allow this problem to fester, the more it will affect our children and grandchildren. They will inherit a mountain of debt and potentially higher taxes that could limit their opportunities. Imagine a world where your children have to pay significantly more in taxes just to cover the interest on the national debt. It’s a sobering thought and one that should motivate us to take action now.

The Importance of Fiscal Responsibility

Fiscal responsibility is crucial now more than ever. The government must make difficult choices to rein in spending and ensure that tax dollars are used efficiently. This means prioritizing essential services and cutting waste wherever possible. It also means being transparent with taxpayers about where their money is going and how it’s being used. Openness can lead to greater public trust and support for necessary reforms.

The Role of Citizens in the Discussion

As citizens, we have a role to play in this conversation. Staying informed about the financial health of our nation and advocating for policies that promote fiscal responsibility is essential. Engaging in discussions with friends, family, and local leaders can help raise awareness about the implications of the national debt. We need to demand accountability from our elected officials and ensure that they prioritize sustainable fiscal policies.

Looking Ahead: The Path Forward

It’s clear that we have a problem on our hands. The U.S. debt burden is deepening, and the consequences of inaction could be dire. However, it’s not too late to make changes that can help mitigate this crisis. By focusing on fiscal responsibility, engaging citizens in the discussion, and advocating for thoughtful policy solutions, we can work towards a more sustainable financial future. It’s time to face the facts and act decisively to protect our economic well-being.

Conclusion: Washington, We Have a Problem

The message is clear: Washington, we have a problem. The growing debt burden and rising interest payments are issues that demand immediate attention. It’s time for all of us—policymakers and citizens alike—to come together and find solutions that ensure a stable and prosperous future for all. As we navigate these turbulent waters, let’s remember that the choices we make today will shape our nation for generations to come. Source.

“`

This article provides a comprehensive view of the U.S. debt burden, engaging with readers in a friendly and informative tone while ensuring SEO optimization through the use of relevant keywords and structured headings.