Retail United Advocacy Group Urges SEC to Investigate Naked Short Selling and MMTLP Shareholder Concerns

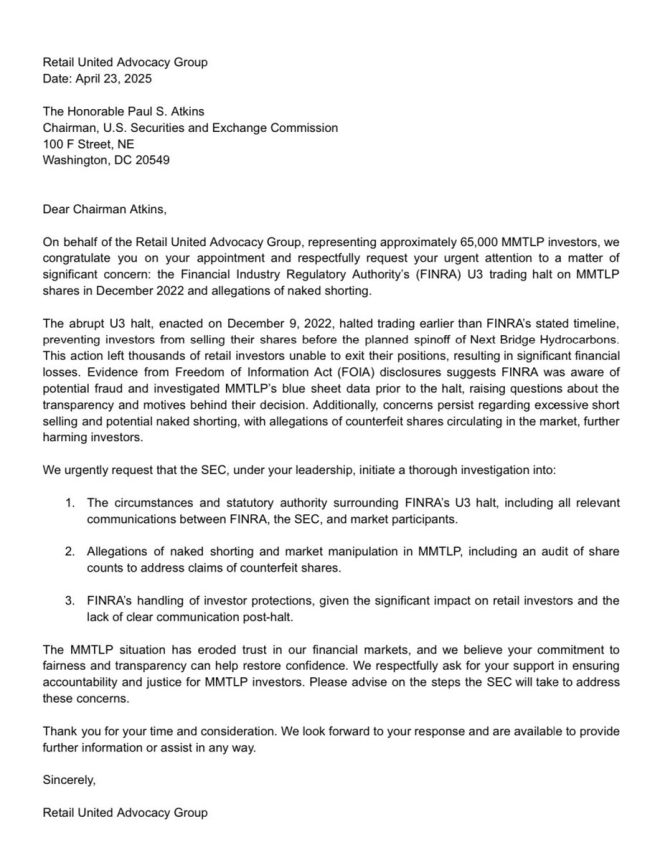

The Retail United Advocacy Group has taken a significant step by sending a detailed letter to SEC Chairman Paul Atkins, addressing critical issues surrounding naked short selling and the implications for shareholders of MMTLP (Meta Materials Inc.). This move underscores the growing concerns among retail investors regarding market practices that may undermine their investments. The letter highlights three main areas of concern: allegations of naked short selling, the U3 trading halt imposed by FINRA, and failures in communication post-halt.

The Urgent Call for investigation

In the communication to SEC Chairman Paul Atkins, the Retail United Advocacy Group has called for an investigation into several troubling points that have surfaced in recent months. The group is particularly focused on allegations related to naked short selling, a practice that has raised eyebrows in the investment community for its potential to distort market dynamics. Naked short selling occurs when a trader sells shares they do not own and have not borrowed, which can lead to an artificial increase in the supply of shares and can negatively impact the stock price.

The group demands a thorough examination of the circumstances surrounding the U3 trading halt implemented by FINRA, which they argue has created additional challenges for MMTLP shareholders. The halt has restricted trading in a manner that some believe is unjustified, leading to financial losses for individual investors who are unable to sell their shares during this period.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Naked Short Selling and Its Consequences

Naked short selling is a contentious issue within the financial markets, often viewed as a violation of fair trading practices. The Retail United Advocacy Group’s letter emphasizes the detrimental effects that naked short selling can have on stock prices and market integrity. When traders engage in naked short selling, they can artificially depress the price of a stock, creating an unfair disadvantage for legitimate investors.

The group is advocating for increased transparency and regulation to prevent such practices from harming retail investors. They argue that the SEC has a responsibility to protect investors and ensure that all market participants play by the same rules. The letter calls for a robust investigation into these allegations to restore confidence in the market and safeguard the interests of retail shareholders.

The FINRA U3 Halt: A Point of Contention

Another critical aspect of the Retail United Advocacy Group’s letter is the request for a comprehensive review of the U3 trading halt imposed by FINRA. This halt has prevented trading in MMTLP shares, significantly impacting shareholders’ ability to manage their investments. The group argues that the U3 halt was not adequately communicated to investors, leading to confusion and frustration among retail shareholders.

The U3 halt is typically implemented when a company fails to meet certain regulatory requirements, but the group contends that the reasons for this halt were not clearly articulated. This lack of clarity has left many investors in the dark about the status of their investments and the future of the stock. The letter emphasizes the need for better communication from regulatory bodies to ensure that investors are kept informed and that they understand the implications of such trading halts.

Post-Halt Communication Failures

The Retail United Advocacy Group is also highlighting the communication failures that have occurred following the U3 halt. Investors have expressed concerns about the lack of timely information regarding the status of MMTLP and the reasons behind the halt. This has led to a sense of uncertainty and distrust among shareholders, who rely on clear communication from regulatory bodies and the companies they invest in.

The group argues that effective communication is essential for maintaining investor confidence and trust in the market. They urge the SEC and FINRA to implement better communication strategies that ensure investors are informed about critical developments affecting their investments. This includes timely updates on trading halts, regulatory actions, and any other relevant information that could impact stock performance.

The Role of Retail Investors in the Market

The actions of the Retail United Advocacy Group reflect a broader trend of retail investors becoming more vocal and organized in advocating for their interests. As the investment landscape continues to evolve, retail investors are increasingly recognizing the importance of their collective voice in shaping market practices and regulatory policies. This growing advocacy is essential for ensuring that the interests of individual investors are represented and protected.

Retail investors have historically faced challenges in navigating the complexities of the financial markets, often feeling sidelined by institutional investors and the regulatory framework. However, the rise of social media and online forums has empowered these investors to unite and advocate for their rights. The letter to SEC Chairman Paul Atkins is a testament to this newfound solidarity among retail investors, as they seek to bring attention to issues that directly impact their financial well-being.

Conclusion: A Call for Action

The Retail United Advocacy Group’s letter to SEC Chairman Paul Atkins serves as a crucial reminder of the ongoing challenges faced by retail investors, particularly concerning naked short selling, trading halts, and communication failures. By urging the SEC to investigate these matters, the group is advocating for greater transparency, accountability, and protection for individual investors.

As the financial landscape continues to evolve, it is essential for regulatory bodies to listen to the concerns of retail investors and take action to address the issues that affect their investments. The call for investigation into naked short selling and the U3 halt reflects a growing demand for fair and transparent market practices. By prioritizing the interests of retail investors, regulatory bodies can help restore confidence in the market and ensure that all participants have a fair opportunity to succeed.

In summary, the Retail United Advocacy Group is making a significant impact in advocating for the rights of MMTLP shareholders and retail investors at large. Their efforts highlight the importance of accountability in the financial markets and the need for regulators to prioritize the interests of individual investors. As this movement continues to gain momentum, it will be essential for regulatory bodies to respond to these concerns and implement measures that promote fair and equitable trading practices.

JUST IN Retail United Advocacy Group Sends Letter to SEC Chairman Paul Atkins Regarding Naked Short Selling and Urging a Resolution for $MMTLP Shareholders

Group Requests Investigation into FINRA’s U3 Halt, Naked Shorting Allegations, and Post-Halt Communication Failures https://t.co/svj3CGo4Un

JUST IN Retail United Advocacy Group Sends Letter to SEC Chairman Paul Atkins Regarding Naked Short Selling and Urging a Resolution for $MMTLP Shareholders

The financial world has been buzzing with news about the Retail United Advocacy Group’s recent actions. This group has taken a significant step by sending a formal letter to SEC Chairman Paul Atkins, addressing the pressing issues surrounding naked short selling and advocating for a fair resolution for $MMTLP shareholders. In this article, we’ll dive into the details of this letter, the allegations of naked short selling, and what this means for investors and the broader market.

Understanding Naked Short Selling

Naked short selling is a practice that has raised eyebrows and caused quite a bit of controversy in the financial markets. Unlike traditional short selling, where an investor borrows shares before selling them, naked short selling occurs when an investor sells shares they do not own and have not borrowed. This can lead to significant market distortions and has been a topic of heated debate among regulators, investors, and financial institutions alike.

The Retail United Advocacy Group is pushing for an investigation into this practice, particularly as it relates to $MMTLP. They believe that naked short selling has played a role in manipulating the stock price and harming legitimate shareholders. As more and more investors become aware of these tactics, the demand for transparency and accountability in the market is growing.

Group Requests Investigation into FINRA’s U3 Halt

The letter also highlights concerns about the U3 halt imposed by FINRA. For those unfamiliar, a U3 halt is a type of trading suspension that occurs when a company is facing significant issues, such as bankruptcy or serious financial distress. The Retail United Advocacy Group believes that this halt has been mishandled and calls for a thorough investigation into the circumstances surrounding it.

Investors who are part of this group feel the U3 halt has not only affected the trading of $MMTLP but has also raised questions about the integrity of the market overall. They argue that the lack of communication from FINRA regarding the halt and subsequent trading activity has left many investors in the dark, unsure of their investment’s future. This uncertainty can be damaging, leading to panic selling and further price declines.

Naked Shorting Allegations and Their Impact on Investors

One of the most alarming aspects of the Retail United Advocacy Group’s letter is the allegations of naked shorting specifically targeting $MMTLP. These allegations suggest that a significant number of shares may have been sold without being properly borrowed, leading to an oversupply of shares on the market. This can create a false sense of liquidity and potentially drive down share prices, impacting everyday investors who have placed their trust in the stock.

The group is urging the SEC to take these allegations seriously and conduct a thorough investigation. They are not just protecting their own interests; they are advocating for all investors who may be affected by similar practices in the future. By shedding light on these activities, the Retail United Advocacy Group hopes to foster a more transparent and equitable market environment.

Post-Halt Communication Failures

Another critical point raised in the letter is the lack of effective communication from FINRA following the U3 halt. The group argues that investors have been left without clear guidance or information regarding the status of their investments or the reasoning behind the halt. This communication breakdown has contributed to frustration and uncertainty among shareholders, many of whom feel abandoned during a crucial time.

Effective communication is vital in the financial world. Investors deserve to be kept informed about the status of their investments, especially during significant market events like trading halts. The Retail United Advocacy Group is calling for improved communication protocols to ensure that investors are not left in the dark in the future.

The Broader Implications for Market Integrity

The issues raised in the letter to SEC Chairman Paul Atkins extend beyond just $MMTLP. They highlight a broader concern regarding market integrity and the practices that can undermine it. Naked short selling, trading halts, and communication failures can erode investor confidence and lead to a less stable market overall.

As retail investors continue to play a more significant role in the market, their voices are becoming increasingly important. The Retail United Advocacy Group is a testament to this trend, representing the collective interests of individual investors who are often overshadowed by institutional players. Their efforts to bring attention to these issues reflect a growing demand for accountability and fairness in the financial system.

What’s Next for $MMTLP Shareholders?

For $MMTLP shareholders, the immediate future may seem uncertain. However, the actions taken by the Retail United Advocacy Group signal a commitment to seeking justice and resolution. By pushing for an investigation and advocating for better communication, they are standing up for the rights of individual investors.

Shareholders should stay informed and actively engage with the ongoing developments surrounding their investments. Joining advocacy groups or participating in discussions can empower investors to make their voices heard. The more investors unite and demand transparency, the more likely it is that positive changes will occur in the market.

Conclusion: The Fight for Fairness in the Market

The Retail United Advocacy Group’s letter to SEC Chairman Paul Atkins is not just a plea for action; it represents a larger movement towards fairness and accountability in the financial markets. By addressing issues like naked short selling, trading halts, and communication failures, this group is standing up for the rights of $MMTLP shareholders and all retail investors.

As the financial landscape continues to evolve, it’s essential for investors to remain vigilant and informed. The call for transparency and integrity in the market is louder than ever, and the actions of groups like the Retail United Advocacy Group can help pave the way for a more equitable future.

For more detailed information, you can read the letter to SEC Chairman Paul Atkins and the full context of the Retail United Advocacy Group’s concerns here.

“`

This HTML-formatted article presents a comprehensive overview of the ongoing situation regarding $MMTLP and the Retail United Advocacy Group’s actions, optimized for search engines and engaging for readers.