Death- Obituary news

Welp. Bitcoin is dead Again: An Overview of the Current state of Cryptocurrency

Bitcoin, the leading cryptocurrency, has faced numerous ups and downs since its inception in 2009. With each rise and fall, the sentiment surrounding Bitcoin fluctuates dramatically. Recently, a meme circulating on social media, depicting Bitcoin as "dead," has once again ignited discussions about the cryptocurrency’s future. While the image humorously states, "Welp. Bitcoin is dead again. RIP," the underlying sentiment reflects a broader concern about the volatility and sustainability of digital currencies.

Understanding Bitcoin’s Volatility

Bitcoin’s price volatility is notorious. It has seen meteoric rises, such as reaching nearly $64,000 in April 2021, followed by significant drops that have left investors feeling anxious. This cyclical nature of cryptocurrency markets often leads to declarations of the "death" of Bitcoin, but history shows that such claims are premature. Each time Bitcoin appears to be on the verge of collapse, it often finds a way to recover, leading to a renewed interest in the cryptocurrency.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact of Market Sentiment

Market sentiment plays a crucial role in the performance of Bitcoin and other cryptocurrencies. Social media platforms, such as Twitter, are breeding grounds for discussions that can influence investor behavior. The meme in question, suggesting Bitcoin’s demise, taps into the emotional responses of traders and investors who may be experiencing fear, uncertainty, or doubt (FUD) about the market. Such sentiments can lead to panic selling, further exacerbating price drops.

Key Factors Influencing Bitcoin’s Price

- Regulatory News: Regulatory developments around the world can significantly impact Bitcoin’s price. Governments’ stances on cryptocurrency can either bolster confidence or instill fear. For instance, news of regulatory crackdowns can lead to price drops, while positive regulatory news can prompt price increases.

- Market Adoption: The rate at which businesses and individuals adopt Bitcoin as a means of payment or investment is crucial. Increased adoption often leads to higher demand, which can drive prices up. Conversely, if major companies retract their support or acceptance of Bitcoin, it can lead to declines.

- Technological Developments: Innovations and upgrades to the Bitcoin network, such as improvements in transaction speed and security, can also impact its value. The community’s response to changes, like the implementation of the Lightning Network, can boost confidence in the cryptocurrency’s long-term viability.

- Global Economic Factors: Economic conditions, including inflation rates, interest rates, and overall market conditions, can influence Bitcoin’s attractiveness as an investment. During times of economic uncertainty, some investors turn to Bitcoin as a “digital gold,” seeking a hedge against traditional financial systems.

The Resilience of Bitcoin

Despite the frequent claims of Bitcoin’s death, it has displayed remarkable resilience over the years. The cryptocurrency has survived multiple market crashes, hacks, and regulatory challenges. Each time, it has managed to bounce back and even reach new all-time highs. This resilience is partly due to its decentralized nature, which allows it to operate independently of traditional financial systems.

The Role of Institutional Investors

In recent years, institutional investors have begun to show interest in Bitcoin, viewing it as a legitimate asset class. Companies like MicroStrategy and Tesla have invested heavily in Bitcoin, contributing to its legitimacy as a store of value. This influx of institutional capital has provided a safety net that can help stabilize Bitcoin’s price during turbulent times.

The Future of Bitcoin

While the meme suggesting Bitcoin’s death captures the sentiment of many skeptics, it is essential to consider the broader context. Bitcoin’s future remains uncertain, but its potential for innovation and adoption continues to grow. As technologies evolve and more businesses recognize the benefits of blockchain and cryptocurrencies, Bitcoin may solidify its position as a leading digital asset.

Conclusion

The declaration of Bitcoin’s death is not new; it has been a recurring theme throughout its history. As the cryptocurrency landscape continues to evolve, so too will the narratives surrounding Bitcoin. The combination of market sentiment, regulatory developments, and technological advancements will shape its future. While the meme may have humorously captured the essence of current fears, Bitcoin’s resilience and potential for recovery should not be underestimated.

In summary, Bitcoin remains a complex and dynamic asset that can generate significant returns for investors willing to navigate its volatility. As discussions about its legitimacy persist, the cryptocurrency continues to attract attention and investment from both individuals and institutions. The future may be uncertain, but Bitcoin has proven time and again that it is far from dead.

Welp. Bitcoin is dead again. RIP? Not quite.

For those interested in the cryptocurrency market, staying informed is crucial. Whether you are a long-term investor or a short-term trader, understanding the factors influencing Bitcoin’s price and market sentiment can help you make informed decisions. Remember to conduct thorough research and consider diversifying your investment portfolio to mitigate risks associated with cryptocurrency investments.

Welp. Bitcoin is dead again. RIP. https://t.co/by0w259YkR

Welp. Bitcoin is dead again. RIP.

Ah, the world of cryptocurrency! Just when you think you’ve seen it all, Bitcoin pulls another stunt that leaves us scratching our heads. It’s like a roller coaster ride—you never know when the next drop is coming, and right now, it feels like we’re plummeting into the depths. So, what’s the deal this time? Why are we saying, “Welp. Bitcoin is dead again. RIP”? Let’s dive deep into the chaos and confusion surrounding Bitcoin’s latest “demise.”

Welp. Bitcoin is dead again. RIP.

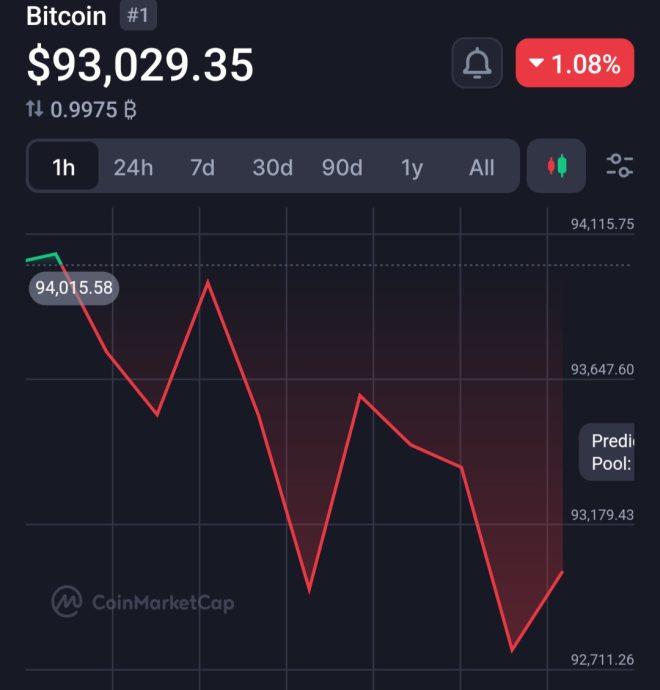

Bitcoin has become synonymous with volatility. Its price swings can leave even seasoned investors feeling a bit queasy. Just a few months ago, we were celebrating new all-time highs, and now, it seems like we’re back to square one. If you’ve been following the news, you’ve likely noticed headlines declaring Bitcoin’s death more times than you can count. What’s the latest? Well, the market has seen a significant downturn, and many are rushing to proclaim that Bitcoin is dead. But is it really?

Let’s take a closer look at what’s happening. The cryptocurrency market is influenced by myriad factors, including regulatory changes, technological updates, and market sentiment. Recently, news about increased regulatory scrutiny has sent shockwaves through the community. High-profile figures in finance have voiced their doubts about Bitcoin’s future, adding fuel to the fire. This leads some to believe that Bitcoin’s glory days are behind it, and we’re left wondering if it’s time to say, “Welp. Bitcoin is dead again. RIP.”

Welp. Bitcoin is dead again. RIP.

One major trigger for the latest dip has been the tightening of monetary policy in various countries. Central banks are raising interest rates to combat inflation, and this can lead to a decrease in risk appetite among investors. When interest rates rise, people tend to pull their money from high-risk assets like cryptocurrencies and invest in more stable options. This shift has been evident in the Bitcoin price charts, where we’ve seen a dramatic decline.

Moreover, social media plays a significant role in shaping public perception. Influencers and analysts often share their opinions, and a single tweet can cause the market to swing wildly. Just look at how quickly things can change! One moment, you’re riding high on optimism, and the next, you’re faced with the harsh reality that Bitcoin is once again facing the death knell.

Welp. Bitcoin is dead again. RIP.

Let’s not forget the impact of mining on Bitcoin’s health. Bitcoin mining consumes a vast amount of energy, and concerns about its environmental impact have been rising. Many people are now questioning whether Bitcoin can survive in a world that is increasingly focused on sustainability. If mining becomes too costly or is banned in certain regions, it could lead to a further decline in Bitcoin’s value. The sustainability debate is very real and continues to loom over Bitcoin like a dark cloud.

Now, you might be wondering, is this the end of Bitcoin? Is it really dead this time? The truth is that while the market is facing significant challenges, Bitcoin has survived downturns before. It’s resilient, and its technology continues to evolve. Whether it’s through the development of the Lightning Network or ongoing discussions about Bitcoin regulation, there are still plenty of reasons to believe that Bitcoin isn’t going anywhere.

Welp. Bitcoin is dead again. RIP.

One of the key factors that differentiate Bitcoin from other assets is its limited supply. With only 21 million coins ever to be mined, Bitcoin has scarcity on its side. This characteristic can create a strong case for its long-term value, regardless of the short-term fluctuations. Investors who recognize the potential of Bitcoin may view the current downturn as an opportunity rather than a death sentence.

Many investors are also taking the “HODL” approach, which stands for “hold on for dear life.” This strategy involves holding onto Bitcoin through thick and thin, believing that the long-term benefits will outweigh the short-term volatility. After all, Bitcoin has experienced several booms and busts since its inception, and those who held on during the darkest days often found themselves rewarded when the market eventually bounced back.

Welp. Bitcoin is dead again. RIP.

The cryptocurrency community is full of passionate individuals who are determined to see Bitcoin succeed. From developers to enthusiasts, there’s a vibrant ecosystem working tirelessly to improve the technology and increase adoption. Major companies are beginning to accept Bitcoin as a form of payment, and institutional interest is growing. This momentum can be a driving force that helps Bitcoin recover from its latest downturn.

However, it’s essential to approach the market with caution. The unpredictability that makes Bitcoin exciting also makes it risky. Just because Bitcoin has bounced back in the past doesn’t guarantee it will do so again. Investors need to stay informed, do their own research, and be prepared for the possibility that Bitcoin may face further challenges ahead.

Welp. Bitcoin is dead again. RIP.

At the end of the day, the phrase “Welp. Bitcoin is dead again. RIP” might be more of a dramatic expression than a factual statement. The cryptocurrency market is notoriously fickle, and while it can feel like the end at times, it’s crucial to remember the bigger picture. Bitcoin has shown resilience, and the passion within the community could ultimately lead to its revival.

So, what’s next? It’s hard to say for sure. The key is to remain engaged and informed. Keep an eye on market trends, stay up-to-date with regulatory changes, and watch how the broader economic landscape evolves. By staying connected to the community and understanding the underlying technology, you might find that Bitcoin is far from dead—it’s just going through another one of its infamous cycles.

Whether you’re a seasoned investor or just dipping your toes into the world of cryptocurrency, the journey is sure to be exciting. Remember, you’re not alone in navigating this wild ride. We’re all in this together, and who knows? Perhaps the next time we hear “Welp. Bitcoin is dead again. RIP,” it’ll be followed by a triumphant comeback that leaves us all cheering.