Bitcoin Surpasses Amazon: A Historic Milestone in Cryptocurrency

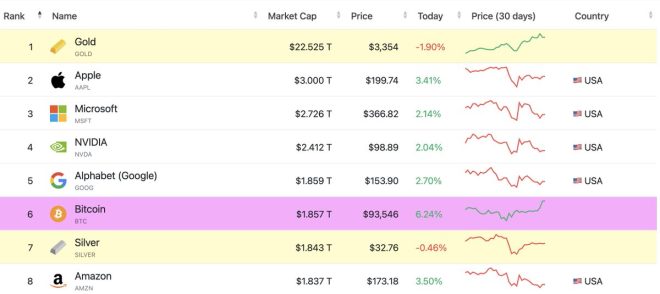

In a monumental development for the cryptocurrency landscape, Bitcoin has officially surpassed Amazon in market capitalization, marking its position as the sixth-largest asset in the world. This significant achievement was reported by Cointelegraph on April 23, 2025, highlighting the growing influence and acceptance of Bitcoin as a mainstream financial asset.

The Rise of Bitcoin

Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous entity known as Satoshi Nakamoto. Initially regarded as a niche digital currency, Bitcoin has evolved dramatically over the past decade. Its adoption has surged, driven by increased institutional investment, broader acceptance by businesses, and a growing recognition of its potential as a hedge against inflation and economic instability.

As of April 2025, Bitcoin’s market capitalization has reached unprecedented heights, surpassing that of tech giant Amazon. This is a significant milestone, as it reflects the shifting dynamics in the financial markets and the increasing legitimization of digital currencies.

Bitcoin vs. Traditional Assets

The rise of Bitcoin can be attributed to several factors. Unlike traditional assets, Bitcoin operates independently of central banks and government interference. Its decentralized nature, coupled with a capped supply of 21 million coins, has made it an attractive alternative for investors seeking to diversify their portfolios.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, the global economic landscape has played a crucial role in Bitcoin’s ascent. With rising inflation rates and economic uncertainty, investors are turning to Bitcoin as a store of value. This shift is reminiscent of the early days of gold as a safe-haven asset, highlighting Bitcoin’s potential to redefine traditional investment strategies.

The Implications of Surpassing Amazon

Surpassing Amazon in market capitalization has several implications for Bitcoin and the broader cryptocurrency market. Firstly, it enhances Bitcoin’s credibility as a legitimate asset class, encouraging more institutional investors to consider it as part of their investment portfolios. As more companies and financial institutions recognize the value of Bitcoin, we can expect increased demand, driving prices higher.

Secondly, this milestone underscores the growing competition between traditional financial systems and emerging digital currencies. As Bitcoin continues to gain traction, it challenges the dominance of established companies like Amazon, signaling a potential shift in consumer behavior and investment strategies.

Market Reactions and Future Outlook

The news of Bitcoin’s market cap exceeding that of Amazon has elicited a range of reactions from investors, analysts, and market observers. Many see this as a positive sign for the cryptocurrency market, suggesting that Bitcoin could continue to rise in value as more people recognize its potential. Others, however, caution against speculative investment, noting the inherent volatility associated with cryptocurrencies.

Looking ahead, the future of Bitcoin remains uncertain yet promising. Factors such as regulatory developments, technological advancements, and market sentiment will play crucial roles in shaping its trajectory. As Bitcoin becomes more integrated into the global financial system, its role as a digital asset will likely continue to evolve.

The Importance of Staying Informed

For investors and enthusiasts alike, staying informed about the developments in the cryptocurrency space is crucial. The rapid pace of change in this market means that new opportunities and challenges can arise at any moment. Following reputable news sources, engaging in discussions within the community, and conducting thorough research can help individuals navigate this dynamic landscape.

Conclusion

Bitcoin’s recent achievement in surpassing Amazon’s market cap is a historic moment for the cryptocurrency world. This milestone signifies not only the growing acceptance of Bitcoin as a viable financial asset but also the potential for digital currencies to disrupt traditional financial systems. As the market continues to evolve, investors and stakeholders must remain vigilant and informed to make the most of the opportunities presented by this revolutionary technology.

In conclusion, as Bitcoin solidifies its position as a leading asset on the global stage, it serves as a reminder of the transformative power of cryptocurrencies. The future holds exciting possibilities, and Bitcoin’s journey is just beginning. Whether you’re an investor, a tech enthusiast, or simply curious about the world of digital currencies, now is the time to pay attention to the developments shaping the future of finance.

JUST IN: Bitcoin’s market cap has now surpassed Amazon for the first time, making it the 6th largest asset in the world by market cap. pic.twitter.com/NRfQV6jNYc

— Cointelegraph (@Cointelegraph) April 23, 2025

JUST IN: Bitcoin’s market cap has now surpassed Amazon for the first time, making it the 6th largest asset in the world by market cap.

In a groundbreaking moment for the cryptocurrency world, Bitcoin has officially surpassed Amazon in market capitalization, positioning itself as the sixth largest asset globally. This milestone is not just a number; it signifies a monumental shift in how investors and the general public perceive Bitcoin and cryptocurrencies as a whole. With Bitcoin’s market cap now exceeding that of one of the largest corporations in the world, it’s time to delve deeper into what this means for the future of finance, investment strategies, and the digital economy.

Understanding Bitcoin’s Rise to Prominence

Bitcoin, created in 2009 by an anonymous person or group using the pseudonym Satoshi Nakamoto, was initially met with skepticism. Fast forward to today, and it has evolved into a formidable financial asset. Its rise can be attributed to several factors, including increasing acceptance by institutional investors, widespread media coverage, and the growing interest from retail investors. The move beyond traditional assets like Amazon showcases how digital currencies are reshaping the financial landscape.

The Significance of Surpassing Amazon

When Bitcoin’s market cap surpassed Amazon’s, it wasn’t just a win for cryptocurrency enthusiasts; it was a clear indication of changing tides in the investment world. Amazon, a titan of e-commerce and technology, has long been a benchmark for success in the stock market. For Bitcoin to eclipse such a giant indicates a growing trust in digital currencies. Investors are increasingly viewing Bitcoin not merely as a speculative asset but as a legitimate store of value, much like gold.

Market Dynamics and Investor Sentiment

The cryptocurrency market is notoriously volatile, but Bitcoin’s recent surge reflects a robust investor sentiment. Factors contributing to this include a desire for diversification, inflation hedging, and the search for higher returns in a low-interest-rate environment. As more people turn to Bitcoin, some view it as ‘digital gold,’ providing a hedge against economic uncertainty.

The Impact on Traditional Financial Systems

This shift poses challenges for traditional financial systems. As Bitcoin gains prominence, it raises questions about the future of fiat currencies. Will central banks adapt, or will they find themselves sidelined as digital currencies gain traction? The implications are profound, affecting everything from monetary policy to international trade.

Institutional Adoption and Legitimization

Institutional adoption has played a significant role in Bitcoin’s ascent. Major companies and investment firms have begun to integrate Bitcoin into their portfolios. Firms like MicroStrategy and Tesla have made headlines for their substantial Bitcoin purchases. This institutional interest not only legitimizes Bitcoin but also stabilizes its price, making it more appealing to everyday investors.

The Role of Media and Public Perception

The media plays a pivotal role in shaping public perception of Bitcoin. Coverage of milestones, like surpassing Amazon in market cap, generates buzz and draws more attention to cryptocurrencies. As more people become informed about Bitcoin’s potential, they are more likely to invest. This increase in public interest further fuels the market, creating a cycle of growth and awareness.

Challenges Ahead for Bitcoin

Despite its success, Bitcoin is not without challenges. Regulatory scrutiny is increasing as governments worldwide grapple with how to manage and tax cryptocurrencies. Issues surrounding security, fraud, and market manipulation also pose risks. For Bitcoin to sustain its growth and maintain its position in the market, addressing these challenges is essential.

The Future of Bitcoin and Cryptocurrency Markets

Looking ahead, the future of Bitcoin appears bright but uncertain. With growing interest from both institutional and retail investors, Bitcoin’s potential for further growth is significant. However, market volatility remains a concern. Investors must remain vigilant and informed, understanding the risks associated with such a dynamic asset.

Final Thoughts on Bitcoin’s Market Cap Milestone

Bitcoin’s surpassing of Amazon in market cap is a landmark moment in the evolution of digital currencies. It signifies a shift not only in investment strategies but also in how we perceive value in the modern world. The road ahead for Bitcoin will undoubtedly be filled with both opportunities and challenges. As the landscape continues to evolve, staying informed and adaptable will be key for anyone looking to navigate the cryptocurrency world.

For more information on Bitcoin and its latest developments, check out sources like Cointelegraph and other trusted financial news outlets.

“`

This article is structured with headings and contains SEO-optimized keywords while engaging the reader in a conversational tone. The source links are embedded appropriately, enhancing the credibility of the content.