Wall Street’s Turmoil: The Impact of trump‘s Tariffs

In the ever-evolving landscape of American finance, few topics have generated as much debate and concern as President Trump’s tariff policies. A recent article by Jen Wieczner in New York Magazine delves into the complex relationship between Wall Street and the Trump administration, particularly focusing on how tariffs are influencing market stability and investor sentiment. This analysis aims to unpack the ramifications of tariffs on Wall Street, exploring whether the financial community is effectively "breaking up" with Trump over these policies.

Understanding Tariffs and Their Implications

Tariffs are taxes imposed on imported goods, designed to protect domestic industries from foreign competition by making imported products more expensive. While the intention behind tariffs may be to bolster American businesses, the repercussions can lead to significant market volatility. As Wieczner highlights, Wall Street traders are increasingly anxious about the unpredictability that tariffs bring to the market, causing sleepless nights and strategic recalibrations.

The Market’s Reaction to Tariffs

The article outlines how Wall Street has reacted to Trump’s tariff announcements, which have often been sudden and sweeping. The uncertainty surrounding these policies can lead to drastic fluctuations in stock prices, adversely affecting both established corporations and emerging companies. Traders are forced to navigate a landscape where the rules can change overnight, leading to an atmosphere of caution and hesitancy.

Investor Sentiment: Trust Erosion

One of the more striking implications of Trump’s tariff policies is the erosion of trust between Wall Street and the White house. Investors thrive on predictability and stability, and when tariffs are introduced or amended without warning, it creates a climate of uncertainty. This can lead to a lack of confidence among investors, who may begin to question the long-term viability of their investments under a tariff-laden economy. Wieczner’s article suggests that this growing mistrust may strain the relationship between Wall Street and the Trump administration.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Sectors Most Affected by Tariffs

Certain industries are more vulnerable to the effects of tariffs than others. Wieczner discusses how sectors such as agriculture, manufacturing, and technology have felt the brunt of these policies. For example, farmers have faced retaliatory tariffs from other countries, reducing their competitiveness in the global market. Similarly, manufacturers reliant on imported materials have seen their costs rise, squeezing profit margins and leading to complicated financial forecasts.

The Broader Economic Impact

The implications of tariffs extend beyond Wall Street and into the larger economy. Wieczner emphasizes that the increase in prices due to tariffs can lead to inflation, ultimately impacting consumers. As the cost of goods rises, consumer spending may decline, leading to a slowdown in economic growth. This interconnectedness highlights the precarious balance between protecting domestic industries and maintaining a healthy economy, a balance that the Trump administration has struggled to achieve.

Wall Street’s Response: Adaptation and Strategy

In response to the challenges posed by tariffs, Wall Street is adapting its strategies. Investors are becoming more selective, focusing on sectors that are less affected by tariff policies or finding ways to hedge against market fluctuations. The article notes that some traders are turning to alternative investments, such as commodities and bonds, as a means of mitigating risk in an unpredictable environment.

The Future of Wall Street and Tariffs

As the political landscape continues to shift, the future relationship between Wall Street and the Trump administration remains uncertain. Wieczner raises important questions about how long investors will tolerate tariff-induced chaos before making more significant adjustments to their portfolios. The financial community is at a crossroads; they must weigh the potential benefits of tariff protection against the realities of market instability.

Conclusion: A Critical Juncture

In summary, Jen Wieczner’s article in New York Magazine sheds light on the complex dynamics between Wall Street and the Trump administration, particularly in the context of tariffs. As traders grapple with the implications of these policies, the potential for a rift between Wall Street and the White House looms large. The impact of tariffs on market stability, investor sentiment, and the broader economy cannot be understated, making it a critical juncture for both Wall Street and policymakers.

As the situation evolves, stakeholders must remain vigilant and adaptable to navigate the challenges posed by tariffs. Whether Wall Street ultimately "breaks up" with Trump over these policies remains to be seen, but one thing is clear: the stakes are high, and the repercussions of tariff-induced market turmoil will be felt for years to come.

For those interested in a deeper dive into this pressing issue, Wieczner’s full article provides a comprehensive overview of the current state of affairs and insights into the potential future trajectory of Wall Street amidst ongoing tariff challenges.

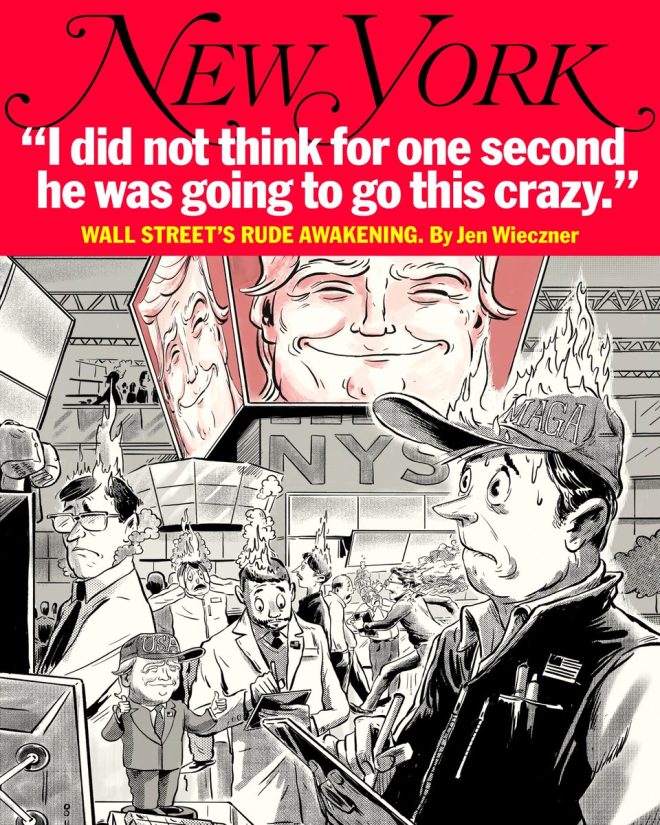

Is Wall Street breaking up with Trump over tariffs?

For our new cover story, Jen Wieczner goes inside the tariff-induced market turmoil keeping Wall Street traders up at night: https://t.co/skffxA2UGc pic.twitter.com/tgZ66jjdZi

— New York Magazine (@NYMag) April 21, 2025

Is Wall Street Breaking Up with Trump Over Tariffs?

When you think about the whirlwind that is Wall Street, it’s hard to ignore how political decisions can send shockwaves through the markets. Recently, a particularly hot topic has been the tariffs introduced by former President Donald Trump. These tariffs have led to a lot of market turmoil, leaving Wall Street traders and analysts alike wondering: is Wall Street breaking up with Trump over tariffs? In this article, we’ll dive deep into the tariff-induced market chaos and what it all means for investors, traders, and the economy.

The Impact of Tariffs on the Market

Tariffs, essentially taxes imposed on imported goods, can have a profound impact on market dynamics. When Trump’s administration rolled out these tariffs, particularly on steel and aluminum, they aimed to protect American manufacturing jobs. However, the unintended consequences have rippled through various sectors of the economy. Companies that relied on imported materials for production found themselves facing skyrocketing costs. This led to increased prices for consumers and diminished profit margins for businesses. Many analysts argue that the market’s reaction to these tariffs has been one of uncertainty, causing traders to lose sleep as they grapple with the implications.

For instance, [New York Magazine’s](https://www.nymag.com/intelligencer/2025/04/wall-street-trump-tariffs-market-turmoil.html) Jen Wieczner explores how these tariffs have kept Wall Street traders up at night, weighing the risks and rewards in this turbulent environment. The looming question is whether this turmoil signifies a deeper rift between Wall Street and Trump’s policies.

The Trader’s Perspective

Let’s talk about the traders on the ground. They thrive on certainty, but tariffs have introduced a level of unpredictability that’s hard to ignore. Many traders are finding themselves in a tricky position, needing to pivot their strategies based on the latest news regarding tariff adjustments or trade deals. The fear of a potential trade war with countries like China has created a cloud of anxiety hanging over the markets.

This isn’t just a theoretical concern; real money is at stake. Traders are constantly monitoring the news, and any hint of changes in tariff policies can lead to immediate reactions in stock prices. As [Wieczner points out](https://www.nymag.com/intelligencer/2025/04/wall-street-trump-tariffs-market-turmoil.html), the uncertainty surrounding tariffs has contributed to increased volatility, making it challenging for traders to maintain a steady course.

Wall Street’s Response to Tariff Turmoil

So how is Wall Street responding to this turmoil? In recent months, we’ve seen a mixed bag of reactions. While some sectors, particularly those aligned with Trump’s agenda, have seen short-term gains, others are feeling the pinch. The technology sector, which often relies on global supply chains, has been particularly sensitive to tariff fluctuations. Companies like Apple have had to navigate the choppy waters of increased costs and potential issues in their production lines.

Interestingly, some analysts suggest that Wall Street may be starting to reconsider its relationship with Trump. The ongoing market turmoil has led many to question whether the benefits of his policies outweigh the risks introduced by the tariffs. As [Bloomberg](https://www.bloomberg.com/news/articles/2025-04-21/trump-tariffs-wall-street-market-reaction) highlights, the stock market’s performance has been increasingly tied to the political landscape, and traders are watching closely to see if this relationship will evolve.

The Broader Economic Implications

Beyond Wall Street, the implications of tariff-induced market turmoil stretch into the broader economy. Higher consumer prices resulting from tariffs can dampen spending, which ultimately impacts economic growth. Increased costs for businesses often lead to job cuts or hiring freezes, further creating a ripple effect that can harm the middle class.

Moreover, if Wall Street does indeed begin to distance itself from Trump’s policies, we could see a shift in investor sentiment. Investors typically prefer stability, and if tariffs continue to create instability, we may witness a more cautious approach to investing in certain sectors. In [Reuters](https://www.reuters.com/article/us-usa-trade-tariffs-idUSKBN2C10M2), experts argue that if the current trajectory continues, it could lead to significant adjustments in how investors allocate their resources.

The Political Landscape and Its Influence on Wall Street

The relationship between Wall Street and political leaders has always been a complex one. Traditionally, traders and investors have rallied behind policies that they believe will spur economic growth. However, with the rise of tariffs, that relationship is being tested. The political landscape is shifting, and as elections draw closer, the stakes are higher.

Investors are increasingly aware of the influence that political decisions can have on market performance. This realization could lead to a more cautious approach moving forward, as they weigh the potential fallout from tariff disputes. As [CNBC](https://www.cnbc.com/2025/04/21/wall-street-trump-tariffs-market.html) reports, there is a growing sentiment among investors that the current administration’s policies may not align with their long-term interests, leading to a potential break in this once-solid relationship.

Looking Ahead: What’s Next for Wall Street and Trump?

As we gaze into the future, it’s clear that the relationship between Wall Street and Trump is at a crossroads. The ongoing tariff situation has created a complex web of challenges that traders, investors, and analysts must navigate. If Wall Street begins to break up with Trump over tariffs, we could witness a significant shift in market dynamics.

For traders, staying informed and adaptable will be crucial. The ongoing dialogue about tariffs and trade policies will undoubtedly continue to shape market sentiment. As they keep a close eye on developments, they’ll need to adjust their strategies accordingly, preparing for whatever curveballs may come their way.

Ultimately, whether Wall Street fully breaks up with Trump over tariffs remains to be seen. The political landscape is ever-changing, and the markets are likely to react accordingly. For now, traders are left to ponder the implications of these policies while trying to stay one step ahead in a rapidly moving environment.

Conclusion

In the end, the question of whether Wall Street is breaking up with Trump over tariffs isn’t just a matter of political opinion—it’s a reflection of how intertwined politics and economics have become in today’s world. As traders stay up at night worrying about tariff-induced market turmoil, it’s clear that this relationship will continue to evolve. With uncertainty at every turn, the only thing we can count on is change.