Death- Obituary news

Summary of the Recent Developments in the $GME Case Involving Ryan Cohen

In a significant turn of events within the financial and trading community, the case against Ryan Cohen, the influential chairman of GameStop Corp. (GME), has been dismissed. This development has stirred up considerable interest, particularly among investors and traders who have been closely following the dynamics of the GameStop saga.

Background on Ryan Cohen and GameStop

Ryan Cohen is a well-known figure in the world of retail investment, especially in connection with GameStop, a video game retailer that gained notoriety in early 2021 due to its unprecedented stock price surge fueled by retail investor enthusiasm. Cohen’s role as chairman of GameStop has been pivotal, as he has spearheaded initiatives to revitalize the company amid a shifting retail landscape. His vision includes transforming GameStop into a more digital-centric business, which has attracted both admiration and skepticism from various quarters.

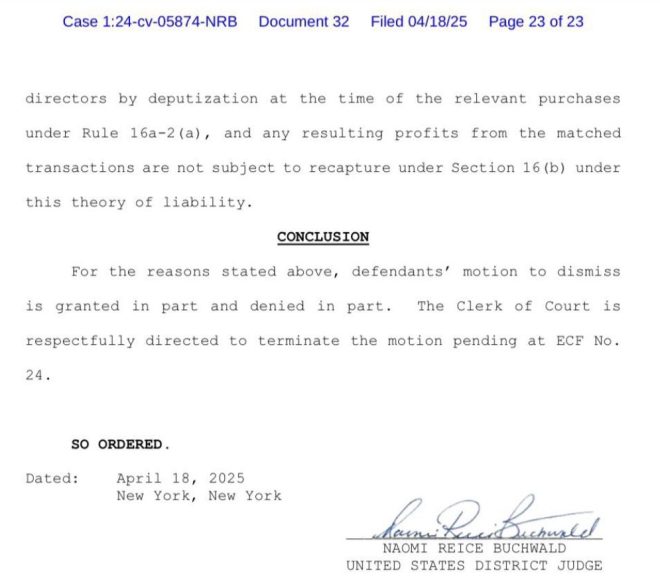

The Dismissal of the Case

The case against Cohen, which had been a topic of speculation and discussion, has been dismissed, leading to a wave of reactions across social media platforms. Many investors viewed the dismissal as a positive sign, reflecting confidence in Cohen’s leadership and vision for GameStop. This decision has prompted many to reassess their positions regarding the stock and the future of the company.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Significance of the Dismissal

The dismissal of the case is significant for several reasons. Firstly, it alleviates uncertainty surrounding Cohen’s role and the potential impact on GameStop’s stock performance. Investors are likely to have renewed confidence, seeing this as a validation of Cohen’s strategies. Additionally, the dismissal may encourage more retail investors to engage with the stock, potentially leading to increased trading volume and price movements.

Ryan Cohen’s Social Media Activity

Adding to the intrigue, Ryan Cohen deleted a tweet that many speculated was a direct response to past controversies surrounding the stock and the broader market dynamics. The tweet, which referenced "RIP D*mpass," was seen as provocative and has since been removed. The decision to delete the tweet could suggest a desire for a more measured and strategic approach to communication, especially in light of the recent legal developments. The phrase "Ryan came back from the dead" used in the tweet captures the sentiment among investors that Cohen’s leadership and the company’s prospects have been revitalized.

Community Reactions

The reaction from the online trading community, particularly on platforms like Twitter, has been overwhelmingly positive. Many users expressed their excitement and optimism about GameStop’s future, with some users even suggesting that the dismissal is a crucial turning point for the company. The hashtag $GME continues to trend as traders and investors share their thoughts and strategies regarding the stock.

The Broader Implications for Retail Investors

The dismissal of the case against Cohen serves as a reminder of the intricate relationship between legal matters, stock performance, and public perception in the realm of retail investing. It highlights the potential for rapid changes in sentiment based on news developments, underscoring the importance of staying informed.

Retail investors are often influenced not only by financial metrics but also by the narratives surrounding key figures like Ryan Cohen. The evolution of GameStop, driven in part by community engagement and social media dynamics, exemplifies how retail investors can shape market movements. This case serves as a pivotal moment that could either bolster or hinder the growing trend of retail trading.

Conclusion

The dismissal of the case against Ryan Cohen marks a pivotal moment for GameStop, reaffirming the faith of many investors in the company’s leadership and future. As Ryan Cohen steps back into the limelight, the excitement surrounding GameStop is palpable. The removal of controversial social media content also suggests a more strategic approach to communication from Cohen, aiming to foster confidence among investors.

As the situation unfolds, retail investors will be keenly observing the developments surrounding GameStop and its chairman. With the stock still representing a beacon for many in the retail trading community, the aftermath of this case could have lasting implications for both GameStop and the broader market. Investors and traders are encouraged to keep a close eye on the developments, as the landscape continues to evolve. The dynamics of the $GME saga are far from over, and each twist and turn only adds to the narrative that has captivated a generation of retail investors.

$GME Case against Ryan Cohen is dismissed, and now he deleted his RIP D*mpass tweet too.

Ryan came back from the dead. https://t.co/xIVd0KAdjT pic.twitter.com/xTE6lM9Mhu

— Han Akamatsu 赤松 (@Han_Akamatsu) April 19, 2025

$GME Case against Ryan Cohen is dismissed, and now he deleted his RIP D*mpass tweet too.

The world of finance and stock trading is filled with its fair share of drama, and nothing exemplifies this better than the recent news surrounding GameStop ($GME) and its co-founder, Ryan Cohen. The case against Cohen has been dismissed, marking a significant moment not just for him but for the entire GameStop saga. This dismissal has sparked excitement and debate among investors and fans alike, especially since Cohen also deleted a tweet that seemed to signal a dramatic farewell. The phrase “Ryan came back from the dead” perfectly encapsulates the sentiment swirling around this latest twist in the GameStop story.

What Happened with the $GME Case?

So, let’s break this down. The case against Ryan Cohen was centered around allegations that he had misled investors regarding GameStop’s future. As the co-founder and significant figure in the company, his words carry substantial weight. When the news broke that the case was dismissed, it sent ripples through the stock market, leading to a surge in GameStop’s stock value. Investors who had been on the edge of their seats could finally breathe a sigh of relief.

Twitter Drama: Deleted Tweets and Reactions

Now, let’s talk about the tweet that has everyone buzzing. Ryan Cohen had previously tweeted a rather cryptic message that seemed to hint at the end of his involvement with GameStop, which many interpreted as a “RIP D*mpass” farewell. This tweet didn’t just vanish into thin air; it left behind a trail of speculation and concern among fans and investors. However, with the dismissal of the case, Cohen deleted this ominous tweet, leading many to speculate about his future plans for GameStop. Did he really come back from the dead? Or is this just a strategic move to regain control of the narrative?

The Significance of Cohen’s Return

Ryan Cohen is not just any investor; he is a symbol of hope for many GameStop enthusiasts. His involvement has been seen as a lifeline in a company that has faced significant challenges over the years. When he initially joined the board, many believed he could steer the company in a new direction—a direction that would defy the odds and breathe new life into the struggling retailer. The dismissal of the case against him not only clears his name but also reaffirms his position as a key player in the GameStop narrative. The phrase “Ryan came back from the dead” isn’t just a catchy line; it reflects a resurgence of optimism among investors who believe in the potential of GameStop.

What This Means for GameStop’s Future

With the legal hurdles behind him, what’s next for Ryan Cohen and GameStop? Many analysts are watching closely to see how Cohen will leverage this newfound freedom. Will he implement bold strategies to enhance the company’s growth? Will he be more vocal about his plans moving forward? Investors are hungry for insight, and the next few weeks will be crucial in determining the trajectory of not just GameStop, but also the broader market sentiment regarding meme stocks and retail trading.

Investor Sentiment: A Roller Coaster Ride

Investor sentiment surrounding GameStop has always been a wild ride, fueled by social media buzz and the collective enthusiasm of retail traders. The dismissal of the case against Cohen has reignited that enthusiasm. Many are flocking to platforms like Reddit and Twitter to share their excitement and theories about what lies ahead. The hashtag #GME has become a battleground for discussions, memes, and speculation. The GameStop community is as passionate as ever, and this latest news has only amplified their voices.

Implications for the Stock Market

The implications of Cohen’s case dismissal extend beyond GameStop itself. It raises questions about the regulatory environment for stocks and the increasing influence of social media on trading behaviors. The GameStop saga has already challenged traditional notions of market dynamics, and Cohen’s return could further shake things up. For investors who have been following this closely, it’s a reminder of how rapidly things can change in the financial world.

The Role of Social Media in Stock Trading

Social media has transformed the landscape of stock trading, allowing everyday investors to band together and influence stock prices effectively. The GameStop phenomenon highlighted this shift, demonstrating how collective action can disrupt conventional trading patterns. As Ryan Cohen continues to navigate his role in this environment, his every move will be scrutinized, discussed, and debated across platforms. The fusion of finance and social media is here to stay, and it will be fascinating to see how this plays out.

Looking Ahead: The Future of GameStop

As we look to the future, the question remains: what will Ryan Cohen do next? With the legal clouds cleared, he has an opportunity to reshape GameStop’s identity and strategy. Whether it’s through innovative business models, partnerships, or new product lines, the possibilities are endless. Investors are eager to see how he will steer the ship moving forward, especially in a market that’s still reeling from the effects of economic uncertainty.

Your Take on the Situation

What do you think about the recent developments in the GameStop saga? Are you excited about Ryan Cohen’s return and what it means for the future of $GME? The community is buzzing, and everyone has an opinion. Whether you’re an avid investor or just someone intrigued by the stock market’s latest drama, there’s plenty to discuss. Share your thoughts in the comments below, and let’s keep the conversation going!

Final Thoughts

The GameStop saga is far from over, and with Ryan Cohen back in the spotlight, there’s no telling what will happen next. As we monitor this unfolding story, one thing is clear: the intersection of social media and finance is a space to watch. For now, let’s enjoy the ride and see where this journey takes us. After all, in the world of stocks, anything can happen!

“`

This article should provide an engaging overview of the recent $GME developments while optimizing for SEO and maintaining a conversational tone.