Lagos High Court Sentences Jeweller to Four Years for Currency Violations

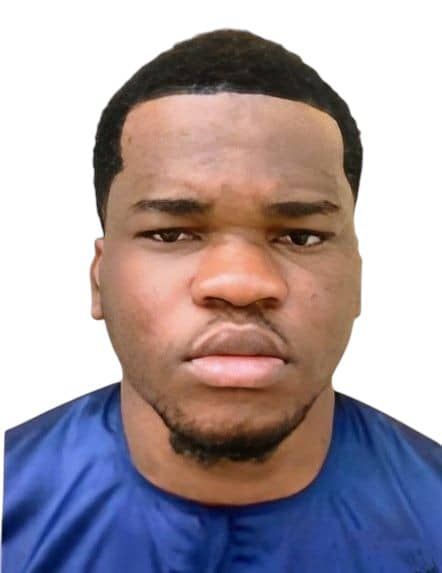

In a landmark ruling, the Lagos High Court in Ikoyi has sentenced jeweller Uzondu Precious Chimaobi to four years in prison for selling a Cartier bracelet in U.S. dollars while refusing to accept the equivalent in Nigerian Naira. This case has sparked significant discussion surrounding currency regulations and business practices in Nigeria, reflecting the ongoing challenges faced by local businesses in complying with financial laws.

Context of the Case

The case arose amidst a backdrop of economic challenges in Nigeria, where the Naira has faced considerable devaluation against foreign currencies, particularly the U.S. dollar. This economic climate has led many businesses, especially in high-end retail and luxury goods, to navigate complex regulations regarding pricing and currency acceptance. Uzondu Precious Chimaobi’s actions of selling luxury items in dollars not only defied local currency regulations but also highlighted a growing trend among businesses to prefer foreign currency transactions.

Legal Implications

The court’s decision underscores the importance of adhering to the Central Bank of Nigeria’s regulations, which mandate that all transactions within the country should be conducted in Naira. By opting to transact in U.S. dollars, Chimaobi violated these regulations, leading to his prosecution. The ruling serves as a warning to other businesses that similar actions could result in severe legal consequences.

Public Reaction

The verdict has generated a mixed response from the public and business community. Many have expressed concern over the implications for the luxury retail sector, which may struggle to attract customers if they cannot accept foreign currency. Others argue that the ruling is a necessary step towards stabilizing the economy and promoting the use of the national currency.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Considerations

Nigeria’s economy has been grappling with high inflation rates, currency devaluation, and a challenging business environment. The decision to prosecute Chimaobi reflects broader economic policies aimed at strengthening the Naira and ensuring that local businesses play by the rules set forth by the government. Understanding the implications of such legal rulings is crucial for both consumers and business owners navigating the complexities of Nigeria’s economic landscape.

Future of Currency Transactions in Nigeria

As the case of Uzondu Precious Chimaobi unfolds, it raises critical questions about the future of currency transactions in Nigeria. Will more businesses be prosecuted for similar violations? How will this impact consumer behavior in high-end markets? Such inquiries are vital for stakeholders in the Nigerian economy, as they will need to adapt to the evolving regulatory environment.

Conclusion

The sentencing of Uzondu Precious Chimaobi serves as a pivotal moment in Nigeria’s legal and economic landscape. It emphasizes the necessity for businesses to comply with currency regulations while navigating the complexities of the market. As discussions continue around this case, it will be essential for businesses and consumers to remain informed about the legal framework governing currency transactions in Nigeria.

Related Topics

- Currency Regulations in Nigeria: Understanding the laws governing currency transactions can help businesses avoid legal pitfalls.

- Impact of Currency Devaluation on Businesses: Examining how the devaluation of the Naira affects pricing strategies and consumer behavior.

- The Luxury Goods Market in Nigeria: Insights into how economic conditions shape the luxury market and consumer preferences.

This summary provides an overview of the recent legal developments regarding currency transactions in Nigeria and highlights the implications for businesses and consumers alike. As the situation evolves, it will be crucial for all stakeholders to stay informed and adapt to the changing landscape.

JUST IN: Lagos High court sitting in Ikoyi had sentenced jeweller Uzondu Precious Chimaobi to four years imprisonment for selling Cartier bracelet in dollars and refusing to collect the Naira equivalent. pic.twitter.com/PUxzlW3wuf

— Nigeria Stories (@NigeriaStories) April 16, 2025

JUST IN: Lagos High Court Sits in Ikoyi

When we think about the legal system, especially in places like Lagos, Nigeria, it often feels distant and complicated. But recent news from the Lagos High Court sitting in Ikoyi brings a very real and pressing issue to the forefront of our minds. The case involves jeweller Uzondu Precious Chimaobi, who was sentenced to four years in prison for selling a Cartier bracelet in US dollars while refusing to accept the Naira equivalent. This incident has sparked widespread discussions about currency regulations, the value of goods, and the implications for businesses operating in Nigeria.

The Case of Uzondu Precious Chimaobi

Uzondu Precious Chimaobi, a jeweller known for dealing in luxury items such as Cartier bracelets, found himself in a legal quagmire that many small business owners fear. According to reports, Chimaobi’s decision to sell his products in US dollars was viewed as an attempt to undermine the local currency, the Naira. The Lagos High Court’s ruling has raised eyebrows, not just for the sentence itself but for the broader implications it has on the business environment in Nigeria.

The court’s decision has sent a clear message about compliance with Nigeria’s currency laws. In a country where the economy is fluctuating, the value of the Naira is often a hot topic. Many businesses struggle with pricing their goods in a way that is both competitive and compliant with local laws. Selling luxury items in foreign currency, particularly in a country where economic instability is prevalent, raises questions about accessibility and fairness.

Understanding Currency Regulations in Nigeria

Currency regulations in Nigeria are designed to stabilize the economy and protect consumers. The Central Bank of Nigeria (CBN) has issued guidelines that mandate the use of the Naira for all transactions conducted within the country. Engaging in transactions in foreign currencies can lead to significant legal repercussions, as seen in Chimaobi’s case. This is particularly relevant for businesses that cater to affluent customers who may prefer to transact in more stable currencies like the dollar or euro.

What does this mean for business owners? It highlights the necessity of understanding the laws governing currency exchange and the importance of adhering to them. For entrepreneurs, especially those in the luxury goods sector, this ruling serves as a reminder to stay informed and compliant with the ever-evolving economic landscape in Nigeria.

The Impact on Small Businesses

For small business owners, Uzondu Precious Chimaobi’s sentencing poses serious questions about the sustainability of their practices. Many small businesses rely on foreign currency transactions to maintain profit margins, especially when their products are sourced internationally. The fear of legal repercussions can create a chilling effect, making entrepreneurs hesitant to operate freely.

Additionally, the ruling could lead to a ripple effect in the market. Business owners might start to think twice about pricing their goods in foreign currencies or may even reconsider their entire business model. This could stifle innovation and lead to a lack of competitiveness in the luxury goods market within Nigeria, as businesses adapt to avoid similar legal issues.

The Broader Conversation on Currency and Trade

Chimaobi’s case has opened the doors to a broader discussion about currency and trade in Nigeria. The legal framework surrounding currency transactions is critical, but it also begs the question of whether such strict regulations stifle the growth of businesses. As Nigeria continues to develop and integrate into the global economy, the balance between protecting the local currency and encouraging international trade becomes increasingly complex.

Moreover, as many luxury goods are imported, the reliance on foreign currencies for pricing is likely to persist. Consumers may be willing to pay in dollars for high-end items, which places businesses in a difficult position. The challenge lies in navigating these regulations while catering to the preferences of a clientele that may prefer transactions in a more stable currency.

Consumer Reactions and Market Sentiment

The public’s reaction to Chimaobi’s sentencing has been mixed. Some see it as a necessary step to uphold the integrity of the Naira and maintain economic stability, while others view it as an overreach that could harm the luxury market and discourage investment. This polarization reflects the broader sentiment within Nigeria, where the economy is often viewed through the lens of both opportunity and challenge.

Consumers who frequent high-end stores expect a certain level of service, which includes flexible payment options. The ruling may lead to frustration among consumers who prefer to transact in dollars, potentially impacting their shopping experience. As the conversation unfolds, it will be essential for businesses to adapt while remaining compliant with the law.

The Future of Luxury Goods in Nigeria

Looking ahead, the implications of Chimaobi’s case could lead to significant changes in how luxury goods are marketed and sold in Nigeria. Businesses may need to reconsider their pricing strategies and payment methods to align with legal requirements while still appealing to their target market. This balancing act will require creativity and adaptability.

Moreover, the government may want to reassess its approach to currency regulations, particularly as Nigeria continues to navigate its place within the global economy. Encouraging a thriving luxury market while ensuring compliance with currency laws could foster a more robust economic environment.

Conclusion: A Call for Dialogue and Adaptation

The situation surrounding Uzondu Precious Chimaobi is more than just a legal matter; it highlights the complexities of running a business in Nigeria’s challenging economic landscape. As consumers, business owners, and policymakers engage in this dialogue, it is crucial to consider how regulations can evolve to support both the economy and the entrepreneurs who drive it. The case serves as a reminder of the importance of understanding local laws and the potential consequences of non-compliance.

By fostering an open conversation about currency regulations and business practices, Nigeria can work towards creating an environment that encourages growth, innovation, and compliance. As the luxury market continues to evolve, staying informed and adaptable will be key for all stakeholders involved.