GameStop Stock Update: First National Corp’s Recent Acquisition

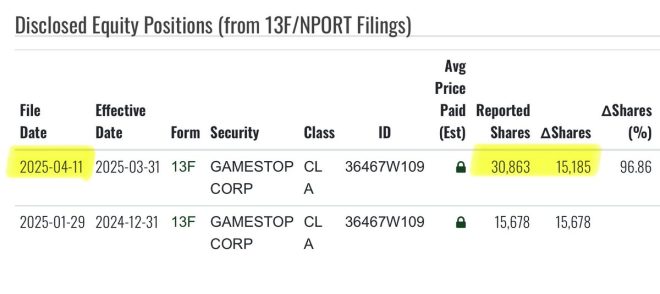

In a significant development for the gaming and investment community, First National Corp filed a 13F-HR form on April 11, 2025, revealing its ownership of 30,863 shares of GameStop Corp. (GME), valued at approximately $688,862 as of March 31, 2025. This news comes amid ongoing interest in GameStop’s stock, which has remained a focal point for both retail and institutional investors.

Understanding the 13F-HR Filing

A 13F-HR filing is a quarterly report that institutional investment managers are required to submit to the U.S. Securities and Exchange Commission (SEC). This report provides transparency into the holdings of large investment firms, allowing the public to see how much of a particular stock they own. For GameStop investors, the details of First National Corp’s recent filing provide valuable insights into the institutional interest surrounding this stock.

First National Corp’s Investment in GameStop

According to the filing, First National Corp not only holds 30,863 shares of GameStop but has also increased its holdings by 15.185 shares, which marks a staggering 96.86% change in its share count during the reported quarter. This substantial increase in ownership indicates a strong belief in GameStop’s future prospects, particularly given the company’s ongoing pivot toward e-commerce and digital sales in the gaming industry.

Implications for GameStop and its Investors

The uptick in institutional investment is significant for GameStop, especially as the company navigates the competitive gaming landscape. Institutional investors like First National Corp often conduct extensive research before making investment decisions, and their increased stake could signal confidence in GameStop’s strategic direction and recovery initiatives.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

For retail investors, this news may serve as a catalyst for renewed interest in GME stock. Many retail investors closely monitor institutional moves, as large players can significantly influence stock prices. The fact that First National Corp has increased its position may encourage others to consider investing in GameStop, potentially driving demand and impacting the stock’s performance in the near term.

GameStop’s Business Transformation

GameStop has been undergoing a transformation aimed at moving from a primarily brick-and-mortar retail model to a more dynamic digital presence. This shift has been crucial as the gaming industry increasingly embraces online sales and digital distribution. The company’s leadership, under CEO Matt Furlong, has been implementing strategies to revitalize the brand and enhance customer engagement through various digital initiatives, including a focus on e-commerce and partnerships with gaming developers.

The Broader Market Context

GameStop’s stock has been a subject of intense speculation and volatility, especially following the infamous short squeeze in early 2021. This event captured the attention of retail investors and highlighted the power of social media in influencing stock trends. The current investment by First National Corp reflects a broader trend of institutional investors revisiting GameStop as it stabilizes and evolves in a rapidly changing market.

What This Means for Future Investors

For potential investors, the filing from First National Corp could be seen as a reason to reevaluate GameStop as an investment opportunity. With institutional interest on the rise, investors may want to consider the underlying fundamentals of the company, including its financial health, market position, and growth strategies.

Investors should also remain aware of the inherent risks associated with investing in volatile stocks like GameStop. Though institutional backing can lend credibility, it does not guarantee future performance. As with any investment, it is critical to perform thorough research and consider market conditions before making financial decisions.

Conclusion

In summary, First National Corp’s recent acquisition of shares in GameStop highlights a renewed interest in the company from institutional investors. The 13F-HR filing reveals a significant increase in their holdings, suggesting confidence in GameStop’s future potential. As the company continues to adapt its business model to meet the demands of the evolving gaming landscape, investors will be watching closely to see how these changes translate into performance on the stock market.

With GameStop’s ongoing transformation, combined with the backing of institutional investors, the coming months may provide critical insights into the company’s trajectory and its ability to capture market share in the digital era. For both retail and institutional investors, this represents a pivotal moment to reassess GameStop’s position in the gaming industry and consider the opportunities that lie ahead.

$GME JUST IN: First National Corp , filed a 13F-HR form, on April 11, 2025 disclosing ownership of 30,863 shares of GameStop, valued at $688,862 USD as of March 31, 2025.

They bought an extra 15.185 shares which represents a change in shares of 96.86% during the quarter.

The… pic.twitter.com/00cXMhck7Q

— Han Akamatsu 赤松 (@Han_Akamatsu) April 14, 2025

$GME JUST IN: First National Corp Files 13F-HR Form

In an exciting development for investors and fans of the gaming retail giant, GameStop, $GME has been making waves in the financial world. On April 11, 2025, First National Corp filed a 13F-HR form that disclosed their ownership of 30,863 shares of GameStop, valued at a whopping $688,862 USD as of March 31, 2025. This news has investors buzzing, and it’s easy to see why!

What Does This 13F-HR Filing Mean?

For those who might not be familiar, a 13F-HR filing is a quarterly report that institutional investment managers are required to file with the SEC if they manage over $100 million. This form provides a snapshot of the manager’s investment portfolio, allowing the public to see what stocks they are holding. First National Corp’s recent filing indicates a strong commitment to GameStop, particularly given that they purchased an additional 15.185 shares during the quarter. This significant increase represents a change in shares of 96.86%, which is quite substantial!

Why GameStop is Still Making Headlines

GameStop has been in the spotlight for quite some time now, especially after the infamous short squeeze in early 2021. The stock has become a symbol for retail investors who banded together to challenge Wall Street. Even as the market has fluctuated, GameStop continues to attract attention. With First National Corp upping their stakes, it suggests that there is still confidence in the company’s future potential.

Understanding the Impact of Institutional Investment

Institutional investors like First National Corp play a crucial role in the stock market. Their decisions can significantly influence stock prices and market trends. When a firm like First National Corp increases its holdings in a company like GameStop, it can signal to other investors that the stock is worth considering. This could lead to increased buying pressure, which might drive up the stock price.

The Numbers Behind the Investment

Let’s dive deeper into the numbers. First National Corp now holds 30,863 shares of GameStop, which translates to a market value of $688,862 USD. This valuation is based on the stock price as of March 31, 2025. The additional purchase of 15.185 shares indicates a strong bullish sentiment towards the company’s future. For context, a 96.86% increase in holdings within just one quarter is not something you see every day!

GameStop’s Business Strategy and Future Outlook

As GameStop continues to pivot its business strategy, investors are keenly watching how the company adapts to the changing retail landscape. The shift towards e-commerce and digital sales has been a focal point, especially as the gaming industry evolves. GameStop has made strides in enhancing its online presence and diversifying its product offerings, which could bode well for its long-term growth.

The Role of Retail Investors

The enthusiasm from retail investors can’t be overlooked. The community that rallied around GameStop has remained passionate about the stock, often using social media platforms like Twitter to share insights and predictions. This grassroots support has been a significant factor in the company’s resilience, and it’s worth noting how this sentiment contributes to market fluctuations.

Market Reactions and Investor Sentiment

Following the news of First National Corp’s increased investment in GameStop, market reactions have been mixed. Some analysts believe this could be a bullish indicator, while others remain cautious due to the stock’s volatility. It’s essential for potential investors to do their research and consider both the potential risks and rewards before diving into the stock.

Conclusion: What’s Next for GameStop?

As GameStop continues to navigate its path forward, the involvement of institutional investors like First National Corp signals a level of confidence that could attract further interest in the stock. The recent 13F-HR filing has reminded everyone that GameStop is still a player in the market, and its future remains a hot topic. For those interested in following the stock’s journey, keeping an eye on upcoming earnings reports and strategic announcements will be crucial.

Whether you’re a seasoned investor or just getting started, the GameStop saga is an exciting one to watch. With the ongoing support from retail investors and significant moves from institutional players, the story of $GME is far from over!