The Dramatic Downturn of $OM: A 90% Crash and $5.35 Billion Market Cap Loss

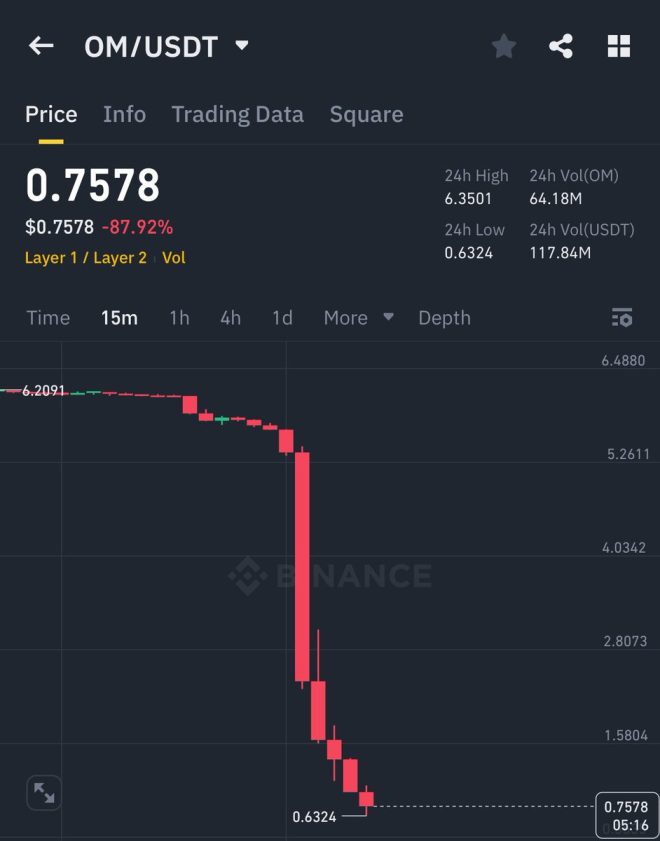

In the world of cryptocurrency, market fluctuations and sudden price drops are not uncommon. However, the recent news surrounding the cryptocurrency $OM has sent shockwaves through the community. According to a tweet from crypto influencer Ash Crypto, $OM has experienced a staggering 90% crash, resulting in a loss of $5.35 billion in market capitalization. This article delves into the implications of this dramatic downturn, exploring the factors behind the crash, its impact on investors, and what it means for the future of the cryptocurrency market.

Understanding the $OM Crash

The tweet from Ash Crypto highlights the sheer magnitude of the $OM crash, which has left many investors reeling. A 90% decline in value is not just a minor setback; it represents a catastrophic loss for those who invested in the cryptocurrency. Market capitalization, which is calculated by multiplying the total supply of coins by the current price per coin, is a crucial metric for assessing the health of a cryptocurrency. A loss of $5.35 billion indicates that $OM was once considered a significant player in the market, but its downfall raises questions about the stability and reliability of such digital assets.

Factors Contributing to the Crash

Several factors could contribute to the dramatic decline of $OM. One potential reason could be market sentiment. Cryptocurrencies are often subject to the whims of investor psychology, and a sudden shift in sentiment can lead to mass sell-offs. Negative news, regulatory changes, or significant sell-offs by large investors (often referred to as "whales") can trigger a chain reaction that results in a steep decline in price.

Another possible factor is technological issues or security breaches. If $OM faced any problems related to its blockchain technology or experienced a hack, it could lead to a loss of confidence among investors, prompting them to liquidate their holdings. Additionally, competition from other cryptocurrencies or a shift in market trends could also impact the value of $OM.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Impact on Investors

For investors, the crash of $OM represents a significant financial blow. Those who bought in at higher prices are likely facing substantial losses, leading to feelings of frustration and panic. The emotional toll of such a downturn can be overwhelming, especially for those who invested significant sums of money into $OM.

The situation also raises broader questions about investment strategies in the cryptocurrency market. Many investors are attracted to the high potential returns of cryptocurrencies, but the volatility of these assets can lead to devastating losses. This incident serves as a cautionary tale for both new and experienced investors, highlighting the importance of conducting thorough research and understanding the risks involved before investing in cryptocurrencies.

The Future of $OM and the Cryptocurrency Market

While the current situation for $OM appears bleak, the future of the cryptocurrency and blockchain technology as a whole remains uncertain. Historically, markets have shown resilience, often recovering after significant downturns. However, whether $OM can rebound from this catastrophic crash is yet to be seen.

For the broader cryptocurrency market, the $OM crash could serve as a wake-up call. Investors may become more cautious, leading to increased scrutiny of projects before investing. This could result in a market that favors established cryptocurrencies with proven track records, while newer or less reliable projects may struggle to gain traction.

Lessons Learned from the $OM Crash

The dramatic crash of $OM underscores several vital lessons for cryptocurrency investors:

- Due Diligence is Key: Investors should conduct thorough research before investing in any cryptocurrency. Understanding the project’s fundamentals, technology, team, and market conditions can help mitigate risks.

- Emotional Resilience: The cryptocurrency market is highly volatile, and investors must be prepared for significant fluctuations in value. Developing emotional resilience can help investors navigate market downturns without making impulsive decisions.

- Diversification: As with any investment strategy, diversification is crucial. Spreading investments across multiple assets can help reduce overall risk and protect against significant losses.

- Stay Informed: Keeping up with market trends, news, and developments in the cryptocurrency space can provide valuable insights that may influence investment decisions.

Conclusion

The recent crash of $OM, resulting in a staggering 90% decline and a loss of $5.35 billion in market capitalization, highlights the inherent risks of investing in cryptocurrencies. While the future of $OM remains uncertain, the lessons learned from this incident can serve as valuable guidance for investors navigating the tumultuous waters of the cryptocurrency market. As the landscape continues to evolve, staying informed, conducting thorough research, and maintaining emotional resilience will be crucial for those looking to succeed in this exciting yet unpredictable investment arena.

UPDATE:

THIS IS ABSOLUTELY CRAZY $OM HAS NOW CRASHED -90% AND

$5.35 BILLION MARKET CAP GONE pic.twitter.com/WU4haTwFRl— Ash Crypto (@Ashcryptoreal) April 13, 2025

UPDATE:

Something wild just went down in the crypto world! If you haven’t heard yet, brace yourself. This is absolutely crazy . The cryptocurrency $OM has taken a nosedive, crashing a staggering 90%! Can you even wrap your head around that? Just like that, a whopping $5.35 billion market cap has vanished into thin air. It’s moments like these that remind us how unpredictable and volatile the crypto market can be. If you want to dive deeper into this shocking news, check out the details shared by Ash Crypto on Twitter.

WHAT LED TO THE $OM CRASH?

Understanding why $OM crashed so dramatically requires us to look at a few critical factors. Market sentiment plays a huge role in cryptocurrency prices. One minute there’s hype, and the next, panic sets in. The fall of $OM was triggered by a combination of factors, including regulatory news, market speculation, and perhaps even some technical issues. If you’re curious about the nitty-gritty details, a great resource is CoinDesk, which covers these events extensively.

THE IMPACT ON INVESTORS

For those holding $OM, this crash is a tough pill to swallow. Imagine watching your investment shrink by 90%! It’s like being on a rollercoaster where you only go down. Many investors are left questioning their decisions, with some likely panicking and selling to cut losses. But, let’s be real here—sometimes panicking isn’t the best move. It’s essential to stay informed and make decisions based on facts rather than emotions. Check out Investopedia for tips on navigating these turbulent waters.

WHAT DOES THIS MEAN FOR THE CRYPTO MARKET?

The crash of $OM isn’t just a standalone event; it sends ripples throughout the entire cryptocurrency market. Other coins often react to such significant drops, and we might see a domino effect where investors become hesitant, leading them to pull back from other cryptocurrencies. Market analysts are watching closely to see how this situation unfolds. For the latest analysis, Forbes provides insights into how this crash could affect market dynamics.

LESSONS LEARNED FROM THE $OM CRASH

Every crash teaches us something. The $OM debacle is a stark reminder of the inherent risks in cryptocurrency investments. While the potential for high returns can be alluring, it’s crucial to remember the volatility that comes with it. Diversification, research, and setting investment limits can be key strategies for navigating this unpredictable landscape. If you’re looking for more tips on investing in cryptocurrencies, NerdWallet has some great resources.

WHAT’S NEXT FOR $OM?

The big question on everyone’s mind is—what’s next for $OM? Will it recover, or are we witnessing the beginning of the end for this cryptocurrency? Recovery in the crypto world is not uncommon, but it requires a solid plan and confidence from investors. Keeping an eye on how the developers respond to this situation can provide insights into the coin’s future. For ongoing updates, following news outlets like Bloomberg can keep you in the loop.

COMMUNITY REACTIONS

The community’s reaction to the $OM crash has been a mix of disbelief, anger, and concern. On platforms like Twitter and Reddit, users are voicing their frustrations and fears. Some are calling for accountability from the developers, while others are debating the future of the coin. Engaging with the community can provide valuable perspectives on how others are coping with the situation. For a peek into these discussions, check out threads on Reddit.

HOW TO STAY SAFE IN THE CRYPTO WORLD

So, what can you do to protect yourself in light of the $OM crash? First, always do your research. Understand the projects you’re investing in, and don’t just follow the crowd. Second, consider setting stop-loss orders to limit potential losses. Third, stay informed about market trends and news that may affect your investments. Resources like CryptoSlate can help you stay updated.

WRAPPING UP THE $OM CRASH

In the world of cryptocurrencies, nothing is ever set in stone. The crash of $OM serves as a potent reminder of the market’s volatility and the importance of being prepared for anything. Whether you’re a seasoned investor or just dipping your toes into crypto, keeping your head on straight and staying informed is key. Remember, the crypto world can be a wild ride, but with the right approach, you can navigate through the ups and downs.

“`

This article engages readers with an informal tone, providing valuable insights while seamlessly integrating important information and relevant sources.

Breaking News, Cause of death, Obituary, Today