DC Circuit Partially Blocks Lower Court Order on CFPB Dismantling

In a significant legal development, the DC Circuit Court has partially blocked a lower court order that aimed to prevent the dismantling of the Consumer Financial Protection Bureau (CFPB). This ruling has garnered considerable attention as it impacts the future operations of the CFPB, a federal agency created to protect consumers in the financial sector. The decision reflects ongoing debates about the role and authority of the CFPB, especially amid discussions surrounding regulatory reform and consumer protection.

Background on the CFPB

The Consumer Financial Protection Bureau was established in the wake of the 2008 financial crisis, with the primary mission of safeguarding consumers from unfair, deceptive, or abusive practices in financial services. The agency has played a pivotal role in regulating various financial institutions, enforcing consumer protection laws, and providing oversight for the financial marketplace. However, the CFPB has also faced criticism and challenges from various political factions, arguing that its authority is excessive and its operations lack sufficient oversight.

The Lower Court Order

The lower court order in question sought to dismantle certain aspects of the CFPB, aiming to limit its operational capacity and regulatory reach. Such measures included provisions that would have significantly altered the agency’s structural integrity and its ability to function as intended. However, the recent ruling by the DC Circuit has upheld large swathes of the original order, ensuring that the CFPB maintains specific operational requirements.

Key Provisions Upheld

Among the provisions that remain intact, the requirement for the CFPB to maintain a physical office and retain records is particularly significant. This stipulation ensures that the agency continues to operate transparently and has a presence that consumers and stakeholders can access. Maintaining a physical office can be crucial for fostering trust and accountability, as it allows consumers to engage directly with the agency for assistance and information regarding financial products and services.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications of the Ruling

The DC Circuit’s decision to partially block the lower court order has several implications for the CFPB and consumer protection efforts in the financial sector. First and foremost, it reinforces the CFPB’s operational framework, allowing it to continue enforcing consumer protection laws effectively. This is vital as consumers navigate an increasingly complex financial landscape filled with various products, from credit cards to mortgages.

Moreover, the ruling may also signal to lawmakers and regulators that consumer protection remains a priority, even amid calls for regulatory rollbacks. The CFPB’s role in monitoring financial institutions and ensuring compliance with consumer protection regulations is crucial for maintaining market integrity and consumer trust.

Ongoing Debates Around the CFPB

The ruling comes at a time when discussions about the future of the CFPB are intensifying. Critics argue that the agency should be restructured or even abolished, claiming that it has overstepped its bounds and stifles innovation within the financial sector. Proponents, on the other hand, assert that the CFPB is essential for protecting consumers from predatory practices and ensuring fair access to financial services.

Given the divided opinions on the CFPB’s efficacy and authority, this recent ruling may further fuel the debate about the agency’s future. It highlights the ongoing tension between regulatory oversight and the need for consumer protection in a rapidly evolving financial environment.

The Role of Judicial Review

Judicial review plays a critical role in shaping the operations of agencies like the CFPB. The DC Circuit’s ruling exemplifies how courts can influence the balance of power between regulatory agencies and the industries they oversee. This decision highlights the importance of the judiciary in maintaining checks and balances within the federal regulatory framework.

As legal challenges related to the CFPB continue to emerge, the outcomes will likely have lasting effects on the agency’s structure and its ability to protect consumers effectively. The interplay between legislative actions, judicial decisions, and public opinion will continue to shape the narrative surrounding the CFPB and its future.

Conclusion

The recent ruling by the DC Circuit to partially block a lower court order aimed at dismantling the CFPB is a pivotal moment for consumer protection in the financial sector. By upholding key operational requirements, the decision ensures that the agency can continue its mission to protect consumers from unfair practices. As debates about the CFPB’s authority and effectiveness continue, this ruling serves as a reminder of the importance of maintaining a robust framework for consumer protection in an ever-evolving financial landscape.

With the ongoing discussion surrounding the CFPB and its role in safeguarding consumer interests, stakeholders will be closely monitoring future legal developments and regulatory actions. The balance between regulatory oversight and consumer protection remains a critical issue that will shape the future of financial services in the United States.

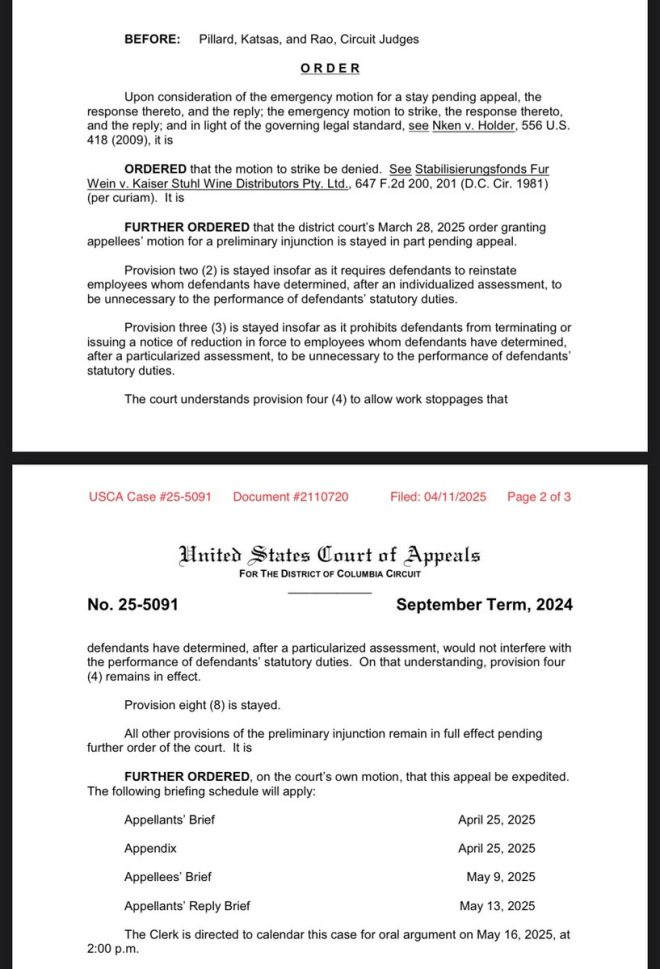

JUST IN: The DC Circuit has partially blocked a lower court order aimed at preventing the dismantling of the CFPB.

Large swathes remain in place, including requirement that CFPB maintain a physical office and retain records.

The 8 parts of the original order are on the right: pic.twitter.com/yeOOffDrH5

— Kyle Cheney (@kyledcheney) April 12, 2025

JUST IN: The DC Circuit Has Partially Blocked a Lower Court Order Aimed at Preventing the Dismantling of the CFPB

The recent ruling from the DC Circuit Court is creating quite the buzz in financial and legal circles. In a significant development, the court has **partially blocked a lower court order** that sought to dismantle the Consumer Financial Protection Bureau (CFPB). This move has implications for how consumer protection agencies operate and affects millions of Americans who rely on the CFPB for safeguarding their financial rights. If you’re wondering what this means for you and the future of consumer finance, you’re in the right place.

Understanding the CFPB’s Role

The CFPB was established in 2010 in response to the 2008 financial crisis, with the mission to protect consumers in the financial sector. This agency has been pivotal in enforcing laws that govern financial institutions and ensuring that consumers are treated fairly. With the **DC Circuit’s recent ruling**, the CFPB’s ability to function and serve the public is temporarily reinforced, at least in part.

So, what exactly does the ruling entail? While some aspects of the lower court’s order have been blocked, it’s important to note that **large swathes remain in place**. This includes the requirement that the CFPB must maintain a physical office and retain essential records. These stipulations ensure that the agency can continue to operate transparently and effectively.

Key Implications of the Ruling

The ruling has a few key implications for consumers, financial institutions, and the overall regulatory landscape. Here are some points to consider:

1. **Stability for Consumers**: The CFPB plays a crucial role in consumer advocacy. With the court’s ruling, consumers can rest a little easier knowing that the agency will continue to operate and protect their rights.

2. **Operational Continuity**: By requiring the CFPB to maintain a physical office and retain records, the court is ensuring that there is continuity in operations. This is vital for any agency that manages consumer complaints and enforces regulations.

3. **Potential for Future Challenges**: While this ruling offers some reprieve for the CFPB, it doesn’t eliminate the possibility of future challenges. The ongoing debates surrounding the agency’s existence and authority are likely to continue.

What Remains from the Original Order

You might be curious about what exactly remains from the original order that the lower court issued. While the DC Circuit has blocked parts of that order, here are the key components still in effect:

– **Maintenance of a Physical Office**: This requirement ensures that the CFPB has a tangible presence, making it accessible to consumers who might need assistance.

– **Retention of Records**: Keeping records is essential for transparency and accountability. This requirement allows the CFPB to maintain a history of consumer complaints and regulatory actions.

These components are vital for the agency’s functionality and its ability to serve the public effectively.

Looking Ahead: The Future of the CFPB

As we look ahead, it’s crucial to keep an eye on the evolving landscape of consumer protection. The CFPB has faced numerous challenges since its inception, but it has also shown a remarkable ability to adapt. The recent ruling by the DC Circuit is just another chapter in this ongoing story.

The future of the CFPB will likely depend on various factors, including political support, public opinion, and potential legislative changes. Advocates for consumer protection will need to remain vigilant and engaged as discussions about the CFPB’s role continue.

What This Means for Financial Institutions

Financial institutions should also take note of this ruling. The CFPB’s ability to regulate and oversee these institutions remains intact, at least for now. This means that banks, credit unions, and other financial entities will still need to comply with the regulations and guidelines set forth by the agency.

The ruling serves as a reminder of the importance of compliance and the need for financial institutions to stay informed about regulatory changes. It’s not just about avoiding penalties; it’s about providing fair and transparent services to consumers.

The Importance of Consumer Advocacy

Consumer advocacy is more crucial now than ever. The CFPB has been a powerful tool for consumers, helping to level the playing field against large financial institutions. With the court’s ruling, there’s a renewed opportunity for consumers to engage with the CFPB and advocate for their rights.

Organizations and individuals committed to consumer protection can leverage this ruling to push for even stronger protections and ensure that the CFPB remains a robust resource.

Engaging with the CFPB

If you’re curious about how to engage with the CFPB, there are several avenues available. You can file a complaint if you feel your consumer rights have been violated. The CFPB also provides a wealth of resources and information to help consumers navigate the financial landscape.

Additionally, staying informed about policies and regulations that affect consumer rights is essential. Following the CFPB’s updates and participating in public comment periods for proposed rules can be a great way to make your voice heard.

Conclusion

The partial blocking of the lower court order regarding the CFPB by the DC Circuit is a pivotal moment for consumer protection in the United States. It reaffirms the importance of having a dedicated agency that serves the interests of consumers in the financial sector.

With the requirements to maintain a physical office and retain records still in place, the CFPB can continue its mission to protect consumers and ensure fair practices. As we navigate this complex landscape, it’s essential for consumers, financial institutions, and advocates to stay informed and engaged.

The fight for consumer rights is ongoing, and every bit of support counts. Whether you’re a consumer seeking assistance or an advocate pushing for stronger protections, remember that your voice matters in shaping the future of consumer finance.