New York’s Bold Move: Accepting Cryptocurrencies as Payment

In a significant step towards integrating digital currencies into mainstream finance, New York has introduced a groundbreaking bill that allows the state government to accept cryptocurrencies as a legitimate form of payment. This initiative marks a pivotal moment in the ongoing evolution of financial systems, reflecting a growing recognition of the role that cryptocurrencies play in the modern economy.

Understanding the Bill

The proposed legislation aims to facilitate the acceptance of various cryptocurrencies by state agencies, thereby enabling citizens to pay taxes, fees, and other government-related expenses using digital currencies. This move is not just a nod to the rising popularity of cryptocurrencies but also a strategic effort to modernize the payment systems used by government entities. By embracing digital currencies, New York seeks to enhance efficiency, reduce transaction costs, and attract tech-savvy residents and businesses.

The Implications for Businesses and Residents

For businesses operating in New York, this bill could provide a significant advantage. By allowing cryptocurrency payments, businesses can tap into a new customer base that prefers digital currencies. This is particularly relevant for sectors like e-commerce and tech startups, where customers are increasingly looking for flexible payment options.

Moreover, residents of New York will benefit from this initiative by gaining the ability to conveniently pay taxes and other fees using cryptocurrencies. This could simplify transactions, especially for those who may already hold cryptocurrencies and prefer not to convert them into fiat currency. It also reflects a broader trend of increasing financial inclusivity, as digital currencies offer a viable alternative for individuals who may have limited access to traditional banking services.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

A Part of a Larger Trend

New York’s move to accept cryptocurrencies is part of a larger trend observed across various states and countries. Globally, more governments and financial institutions are beginning to recognize the potential of digital currencies. As blockchain technology continues to evolve, the need for regulatory frameworks has become increasingly crucial. New York, known for its financial innovation, aims to position itself at the forefront of this evolution.

Challenges Ahead

While the bill represents a significant step forward, it also faces challenges. Regulatory concerns about security, fraud, and tax implications surrounding cryptocurrencies remain at the forefront of discussions. The volatility of cryptocurrency values also poses a risk for both the state and its residents. Addressing these challenges will be essential to ensure the successful implementation of the bill and to foster public trust in the use of digital currencies for government transactions.

The Future of Cryptocurrency Payments

Looking ahead, the acceptance of cryptocurrencies as a form of payment by government agencies could set a precedent for other states to follow. If successful, New York may pave the way for a broader acceptance of cryptocurrencies across the United States, encouraging a more comprehensive regulatory approach to digital currencies.

As the landscape of finance continues to change, the integration of cryptocurrencies into everyday transactions could reshape how individuals and businesses interact with government entities. This legislative move highlights the growing recognition of digital currencies as a legitimate and practical payment method, reflecting a future where traditional and digital currencies coexist.

Conclusion

The introduction of a bill allowing the New York state government to accept cryptocurrencies signifies a crucial step in the evolution of digital currencies within the financial ecosystem. By embracing this technology, New York is not only enhancing its payment systems but also positioning itself as a leader in the cryptocurrency space. As the implications of this bill unfold, it will be essential to monitor its impact on residents, businesses, and the broader financial landscape. The future of cryptocurrency payments in government transactions is bright, and New York is setting the stage for a transformative shift in how we approach financial interactions in the digital age.

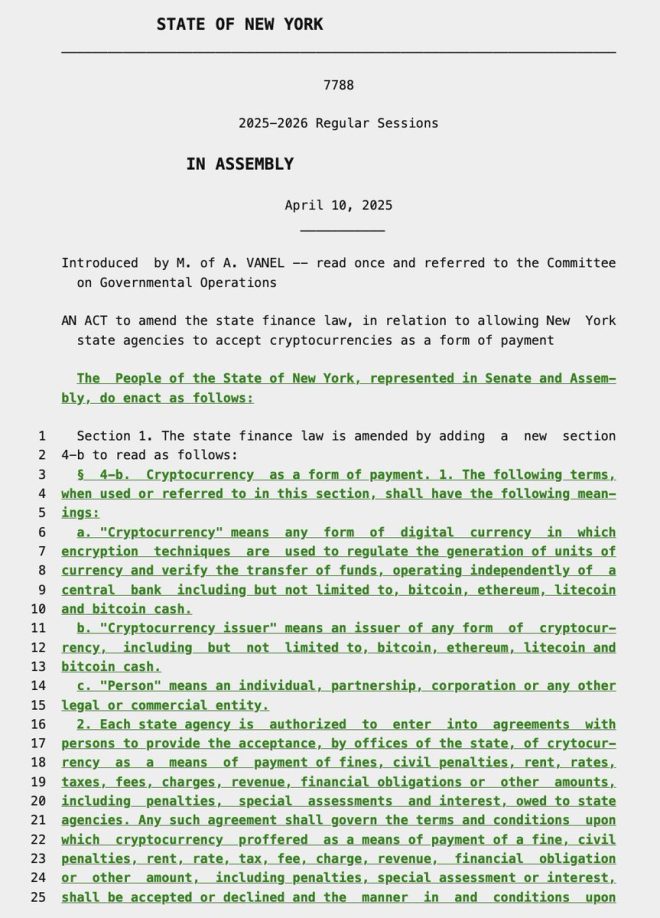

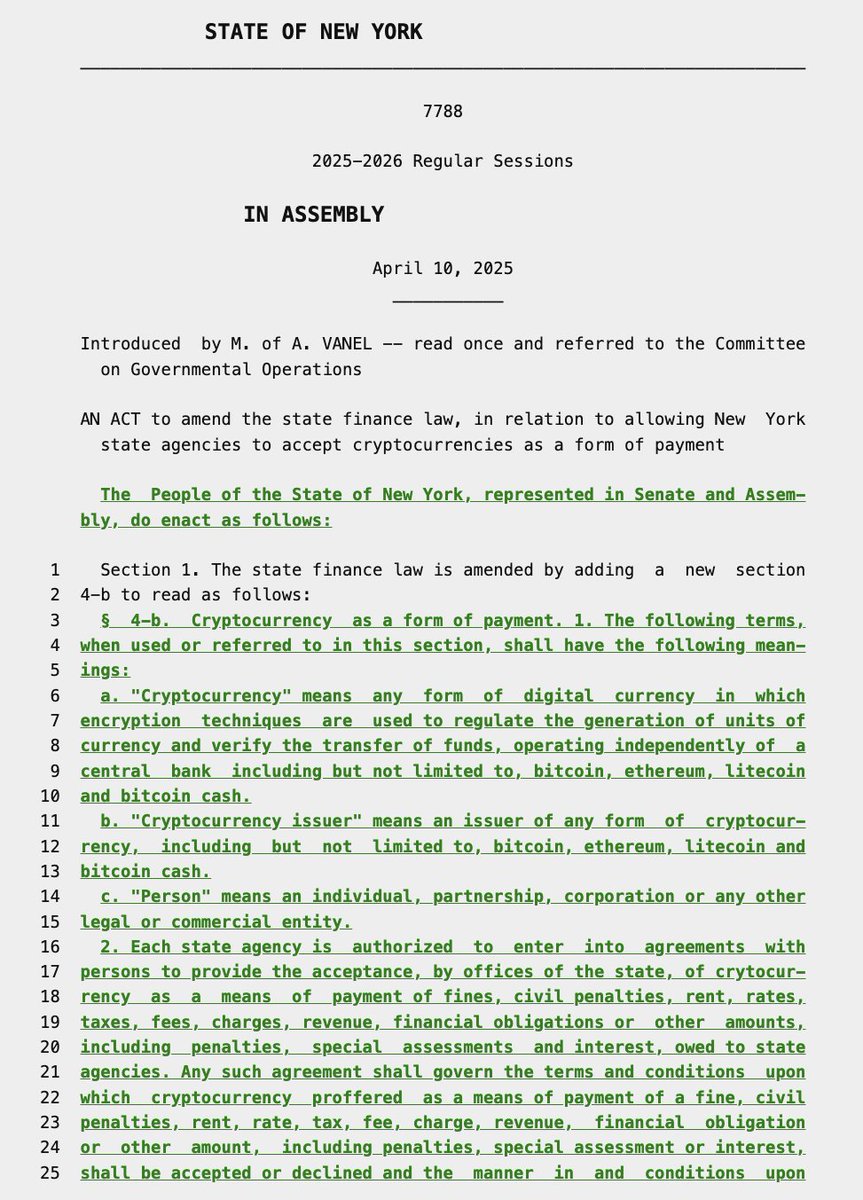

LATEST: New York introduces a new bill to allow the state government to accept cryptocurrencies as a form of payment. pic.twitter.com/W0qTWyT6FI

— Cointelegraph (@Cointelegraph) April 11, 2025

LATEST: New York introduces a new bill to allow the state government to accept cryptocurrencies as a form of payment

In an exciting development for cryptocurrency enthusiasts and businesses alike, New York has recently introduced a groundbreaking bill that paves the way for the state government to accept cryptocurrencies as a legitimate form of payment. This move marks a significant step forward in the integration of digital currencies into everyday transactions and governmental operations. It’s not just a trend; it’s a signal of the changing financial landscape that could impact how we interact with money in the future.

Understanding the Bill and Its Implications

So, what exactly does this bill entail? At its core, the legislation aims to legitimize cryptocurrencies by enabling state departments to accept various digital currencies for services and fees. This could range from taxes to license fees and even fines. Imagine paying your parking ticket or business license fee with Bitcoin or Ethereum! It’s a revolutionary concept that underscores the growing acceptance of cryptocurrencies in mainstream finance.

Moreover, this bill could create a ripple effect across the country. New York, being one of the largest and most influential states, often sets trends that others follow. If successful, other states may look to adopt similar legislation, further integrating cryptocurrencies into the fabric of American commerce.

Why Now? The Timing of the Bill

You might be wondering why this bill is surfacing now. The surge of interest in cryptocurrencies over the past few years has been monumental. More people are investing, using, and even advocating for cryptocurrencies. It’s no longer just a niche market; it’s a movement. With the increasing acceptance of digital currencies by large corporations and the public’s growing interest, New York lawmakers recognize the need to adapt to this new reality.

Additionally, the COVID-19 pandemic accelerated the shift toward digital transactions. As people sought contactless payment options, cryptocurrencies presented themselves as an appealing alternative. This bill could also serve to bolster New York’s economy by attracting tech-savvy businesses and investors who are eager to operate in a more crypto-friendly environment.

Potential Benefits of Accepting Cryptocurrencies

The benefits of accepting cryptocurrencies are numerous. For starters, it could enhance efficiency in government transactions. Blockchain technology, which underpins most cryptocurrencies, offers transparency and security that traditional payment methods often lack. This could reduce fraud and enhance public trust in governmental operations.

Furthermore, allowing cryptocurrency payments could attract a new demographic of users—tech enthusiasts and younger generations who are more inclined to use digital currencies. This could lead to increased engagement with government services and a more robust revenue stream.

Challenges Ahead

However, it’s not all sunshine and rainbows. The implementation of this bill faces several challenges. One of the primary concerns is the volatility of cryptocurrencies. Prices can fluctuate wildly, sometimes within hours. How will the state handle this volatility? Will they convert payments immediately into fiat currency, or will they hold onto the cryptocurrencies? These questions need clear answers to ensure that the state does not face financial losses.

Additionally, there’s the issue of regulatory compliance. The regulatory landscape surrounding cryptocurrencies is still evolving. New York has some of the strictest regulations in the country, and integrating cryptocurrencies into the existing framework will require careful consideration to avoid legal pitfalls.

Public Reception and Future Prospects

Public reception of this bill has been mixed. While many crypto enthusiasts welcome the news, there are skeptics who worry about the implications of using digital currencies in government transactions. Concerns about security, privacy, and the potential for illicit activities are often raised. It’s essential for lawmakers to address these concerns transparently and work towards building a framework that ensures safety and trust.

As this bill moves through the legislative process, it will be fascinating to see how it evolves. Could this be the beginning of a new era of financial transactions in the United States? Many are hopeful that New York’s pioneering move could lead to broader acceptance of cryptocurrencies across the nation.

Conclusion: A Step Towards a Digital Future

The introduction of a bill in New York to allow the state government to accept cryptocurrencies as a form of payment is a significant milestone in the journey toward a digital economy. It signifies a willingness to embrace innovation and adapt to changing financial landscapes. As the world becomes increasingly digital, it’s crucial for governments to keep up with the pace of change.

This bill opens the door to discussions about the future of money, the role of government in financial transactions, and how we can leverage technology to create a more efficient and inclusive economic system. Whether you’re a seasoned cryptocurrency investor or just curious about the digital currency world, this development is worth keeping an eye on. The future of finance is here, and it’s digital!