New York state‘s recent announcement of a bill allowing the government to accept cryptocurrencies as payment signifies a progressive step towards embracing financial innovation. This move aims to enhance operational efficiency, reduce transaction costs, and provide residents with more payment options. By promoting financial inclusion, the state is ensuring that all individuals, including the unbanked and underbanked, have access to government services.

However, the implementation of this bill also raises concerns about regulation and security. New York’s history of strict financial regulations, such as the BitLicense framework, highlights the need for effective integration of digital currencies while ensuring consumer protection and preventing illicit activities. Despite these challenges, the bill has the potential to drive economic growth and attract tech-savvy businesses to the state, creating a vibrant ecosystem of innovation.

As more states consider similar measures, New York’s actions could serve as a blueprint for harnessing the power of digital currencies. This legislation reflects a growing global trend where governments are recognizing the transformative potential of cryptocurrencies in financial transactions. Stay tuned for updates on the impact of this groundbreaking legislation on the financial landscape in New York and beyond.

In a groundbreaking move, New York introduces a bill allowing the state government to accept cryptocurrencies as a legitimate form of payment, reflecting a growing trend towards recognizing digital currencies as practical transaction methods. This legislation allows state agencies to accept cryptocurrencies for taxes, fees, and other services, making transactions more efficient and appealing to crypto enthusiasts. The move signifies New York’s adaptation to technological advancements in finance and encourages a more inclusive economy.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The bill’s significance extends beyond convenience, potentially attracting businesses in the crypto space, leading to economic growth and job creation. As other states observe New York’s initiative, the acceptance of cryptocurrencies may pave the way for more innovative fintech developments. Join the conversation on the implications of this bill and stay informed as New York progresses towards a more modern and tech-friendly economy. the benefits of exercise for mental health

Exercise has long been known to have a multitude of physical benefits, from weight loss and improved cardiovascular health to increased muscle strength and flexibility. However, what many people may not realize is that exercise also has a significant impact on mental health. In fact, regular exercise has been shown to be a powerful tool in managing and even preventing mental health conditions such as depression, anxiety, and stress.

One of the key ways in which exercise benefits mental health is through the release of endorphins, often referred to as the “feel-good” hormones. When we exercise, our bodies release these chemicals, which can help to reduce feelings of pain and stress, as well as improve our overall mood. This is why many people report feeling a sense of euphoria or a “runner’s high” after a particularly intense workout.

In addition to the immediate mood-boosting effects of endorphins, regular exercise has also been shown to have long-term benefits for mental health. Studies have found that individuals who engage in regular physical activity are less likely to experience symptoms of depression and anxiety, and have a lower risk of developing these conditions in the first place. This is thought to be due in part to the fact that exercise can help to regulate levels of neurotransmitters such as serotonin and dopamine, which play a key role in mood regulation.

Exercise can also help to improve self-esteem and self-confidence, which are often negatively impacted by mental health conditions. When we set and achieve fitness goals, we not only improve our physical health but also boost our self-image and sense of accomplishment. This can be particularly beneficial for individuals struggling with conditions such as depression, who may feel a sense of hopelessness or low self-worth.

Furthermore, exercise provides a healthy outlet for stress and anxiety, which are common triggers for mental health conditions. When we engage in physical activity, we are able to release pent-up energy and tension, as well as distract ourselves from negative thoughts and worries. This can help to reduce feelings of overwhelm and promote a sense of calm and relaxation.

Another important benefit of exercise for mental health is its ability to improve sleep quality. Many individuals with mental health conditions such as depression and anxiety struggle with insomnia or disrupted sleep patterns. Regular exercise has been shown to help regulate sleep-wake cycles, promote deeper and more restful sleep, and reduce the incidence of sleep disorders. This can have a significant impact on overall mental well-being, as adequate sleep is essential for mood regulation and cognitive function.

In addition to these benefits, exercise can also help to improve cognitive function and mental clarity. Studies have found that individuals who engage in regular physical activity have better memory, concentration, and problem-solving skills than those who are sedentary. This is thought to be due to the fact that exercise increases blood flow to the brain, which can help to stimulate the growth of new brain cells and improve neural connections.

Overall, the benefits of exercise for mental health are vast and varied. From boosting mood and self-esteem to reducing stress and anxiety, regular physical activity can have a profound impact on our mental well-being. Whether you prefer to go for a run, take a yoga class, or lift weights at the gym, finding a form of exercise that you enjoy and can stick with is key to reaping these benefits. So next time you’re feeling overwhelmed or down, consider lacing up your sneakers and heading outside for a workout – your mind will thank you.

New York Introduces Bill for Cryptocurrency Payments

On April 11, 2025, a significant development emerged in the realm of digital currencies as New York State announced a new bill that would permit the government to accept cryptocurrencies as a form of payment. This initiative, reported by Cointelegraph, showcases New York’s progressive stance on embracing technological advancements and adapting to the evolving financial landscape.

The Implications of Accepting Cryptocurrencies

The introduction of this bill marks a pivotal moment for both the state and the burgeoning cryptocurrency market. By allowing state government entities to accept cryptocurrencies, New York aims to enhance operational efficiency, reduce transaction costs, and provide residents with more versatile payment options. As more businesses and consumers turn to digital currencies, this legislation positions New York as a forward-thinking hub for financial innovation.

Enhancing Financial Inclusion

One of the primary goals behind this initiative is to promote financial inclusion. Cryptocurrencies can offer unbanked or underbanked individuals a means to participate in the financial system. By accepting digital currencies, the state can ensure that all residents have access to government services, fostering a more inclusive economy. This aligns with broader trends in fintech, where digital currencies are increasingly seen as tools for democratizing finance.

Regulatory Framework and Challenges

While the bill opens the door for cryptocurrency payments, it also raises questions about regulation and security. New York has a history of stringent financial regulations, particularly with its BitLicense framework governing cryptocurrency businesses. The successful implementation of this new bill will depend on how effectively the state can integrate digital currencies into its existing regulatory structure while ensuring consumer protection and preventing illicit activities.

Economic Growth and Innovation

Moreover, this legislation has the potential to drive economic growth and attract tech-savvy businesses to the state. As more organizations explore blockchain technology and cryptocurrencies, New York could become a magnet for startups and established companies alike, fostering a vibrant ecosystem of innovation. This could lead to job creation and increased tax revenue, further benefiting the state’s economy.

Conclusion: A Step Towards the Future

In summary, New York’s introduction of a bill to accept cryptocurrencies as payment is a significant step towards modernizing the state’s financial operations. By embracing digital currencies, New York not only enhances its payment systems but also signals its commitment to innovation and financial inclusion. As the bill progresses through the legislative process, it will be crucial for stakeholders to address regulatory concerns and ensure a secure and efficient implementation.

The move resonates with a growing global trend where governments are increasingly recognizing the potential of cryptocurrencies to transform financial transactions. As more states consider similar measures, New York’s actions could serve as a blueprint for others looking to harness the power of digital currencies.

Stay tuned for further updates on this groundbreaking legislation and its potential impact on the financial landscape in New York and beyond. The future of finance is undoubtedly digital, and New York is taking significant strides toward leading the charge.

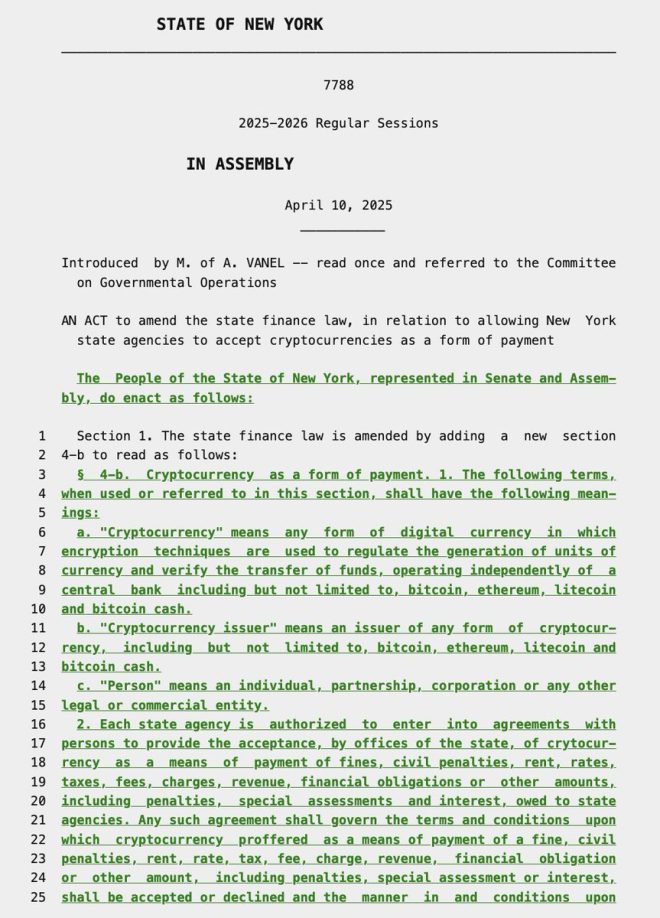

LATEST: New York introduces a new bill to allow the state government to accept cryptocurrencies as a form of payment. pic.twitter.com/W0qTWyT6FI

— Cointelegraph (@Cointelegraph) April 11, 2025

LATEST: New York introduces a new bill to allow the state government to accept cryptocurrencies as a form of payment.

In a groundbreaking move, New York has stepped into the future by introducing a bill that will allow the state government to accept cryptocurrencies as a legitimate form of payment. This exciting development is paving the way for a more digital and tech-savvy economy. The bill reflects a growing trend where states are beginning to recognize the potential of cryptocurrencies, not just as an investment vehicle but as a practical means of transaction.

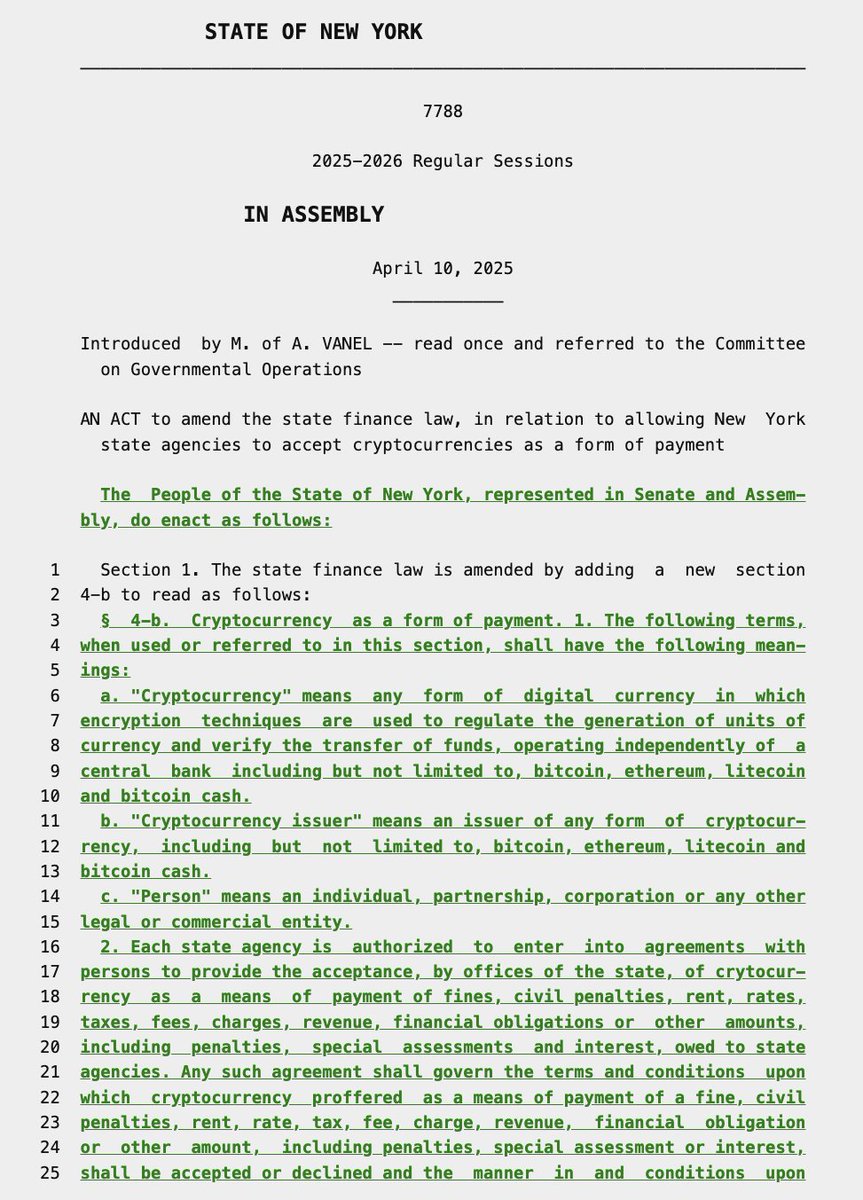

Understanding the Bill

So, what does this bill actually mean for New Yorkers? Essentially, it allows various state agencies to accept digital currencies for payments related to taxes, fees, and other state services. This could mean that you could pay your taxes or even your parking tickets using Bitcoin, Ethereum, or other cryptocurrencies. How cool is that?

The legislation is aimed at making transactions more efficient and appealing to those who are already engaged in the crypto space. With cryptocurrency adoption on the rise, it’s not surprising that New York is taking steps to integrate these digital currencies into its financial ecosystem.

Why Is This Important?

The significance of this bill goes beyond just convenience. It showcases how governments are beginning to embrace technological advancements and adapt to the changing landscape of finance. In recent years, cryptocurrencies have gained a lot of traction, and many people are looking for ways to use their digital assets in everyday life. By allowing cryptocurrencies as a payment method, New York is acknowledging this shift and encouraging a more inclusive economy.

Moreover, this move could attract businesses that operate in the crypto space, potentially leading to economic growth and job creation. Imagine a scenario where startups flourish because they have a supportive regulatory environment. That’s something worth celebrating!

What’s Next for New York and Cryptocurrency?

As the bill progresses through the legislative process, many are watching closely to see how it will unfold. If passed, it could set a precedent for other states to follow suit. States like California and Texas are also eyeing the potential benefits of integrating cryptocurrencies into their payment systems.

The acceptance of cryptocurrencies could also lead to more innovation in fintech, as businesses and consumers seek new ways to engage with digital currencies. It’s an exciting time to be involved in the world of cryptocurrency, and developments like this one make it even more thrilling.

Join the Conversation

What do you think about New York’s decision to introduce this bill? Are you excited about the prospect of using cryptocurrencies for state payments? It’s a hot topic that’s sure to elicit various opinions. As always, staying informed is key, so keep your eyes peeled for updates on this legislation.

In summary, New York’s move to allow cryptocurrencies as a form of payment is a significant step towards a more modern and tech-friendly economy. As we navigate this new frontier, it’s essential to engage and discuss the implications of such changes on our daily lives and the economy as a whole. For more information, you can check out the original announcement from [Cointelegraph](https://twitter.com/Cointelegraph/status/1910566202746823019?ref_src=twsrc%5Etfw).

Cryptocurrencies have been a hot topic in the financial world for quite some time now, with more and more people looking for ways to incorporate these digital assets into their everyday transactions. The recent announcement by New York State to introduce a bill allowing the government to accept cryptocurrencies as a form of payment is a significant step towards embracing this new financial frontier. In this article, we will explore the implications of this groundbreaking legislation, including its potential impact on financial inclusion, economic growth, regulatory challenges, and the future of finance in New York and beyond.

The Implications of Accepting Cryptocurrencies

The decision by New York State to accept cryptocurrencies as a form of payment is a bold move that has far-reaching implications. By allowing state government entities to accept digital currencies, New York is not only enhancing operational efficiency but also providing residents with more versatile payment options. This move reflects the state’s progressive stance on embracing technological advancements and adapting to the evolving financial landscape. As more businesses and consumers turn to digital currencies, this legislation positions New York as a forward-thinking hub for financial innovation.

Enhancing Financial Inclusion

One of the primary goals behind this initiative is to promote financial inclusion. Cryptocurrencies have the potential to offer unbanked or underbanked individuals a means to participate in the financial system. By accepting digital currencies, the state can ensure that all residents have access to government services, fostering a more inclusive economy. This aligns with broader trends in fintech, where digital currencies are increasingly seen as tools for democratizing finance and expanding access to financial services.

Regulatory Framework and Challenges

While the bill opens the door for cryptocurrency payments, it also raises questions about regulation and security. New York has a history of stringent financial regulations, particularly with its BitLicense framework governing cryptocurrency businesses. The successful implementation of this new bill will depend on how effectively the state can integrate digital currencies into its existing regulatory structure while ensuring consumer protection and preventing illicit activities. Addressing these regulatory challenges will be crucial to ensuring a secure and efficient implementation of cryptocurrency payments in New York.

Economic Growth and Innovation

Moreover, this legislation has the potential to drive economic growth and attract tech-savvy businesses to the state. As more organizations explore blockchain technology and cryptocurrencies, New York could become a magnet for startups and established companies alike, fostering a vibrant ecosystem of innovation. This could lead to job creation and increased tax revenue, further benefiting the state’s economy. By embracing digital currencies, New York is signaling its commitment to innovation and positioning itself as a leader in the rapidly evolving world of finance.

Conclusion: A Step Towards the Future

In summary, New York’s introduction of a bill to accept cryptocurrencies as payment is a significant step towards modernizing the state’s financial operations. By embracing digital currencies, New York is not only enhancing its payment systems but also signaling its commitment to innovation and financial inclusion. As the bill progresses through the legislative process, it will be crucial for stakeholders to address regulatory concerns and ensure a secure and efficient implementation. The move resonates with a growing global trend where governments are increasingly recognizing the potential of cryptocurrencies to transform financial transactions. As more states consider similar measures, New York’s actions could serve as a blueprint for others looking to harness the power of digital currencies.

In conclusion, New York’s decision to introduce a bill allowing the government to accept cryptocurrencies as a form of payment is a significant step towards a more modern and tech-friendly economy. This move has the potential to drive economic growth, promote financial inclusion, and position New York as a leader in financial innovation. As we navigate this new frontier of digital currencies, it is essential to engage in discussions and stay informed about the implications of such changes on our daily lives and the economy as a whole. Stay tuned for further updates on this groundbreaking legislation and its potential impact on the financial landscape in New York and beyond. The future of finance is undoubtedly digital, and New York is taking significant strides towards leading the charge. By embracing digital currencies, New York is not only enhancing its financial operations but also signaling its commitment to innovation and financial inclusion. As the bill progresses, stakeholders will need to address regulatory concerns and ensure a secure and efficient implementation to reap the full benefits of this groundbreaking legislation.

As more states consider similar measures, New York’s actions could serve as a blueprint for others looking to harness the power of digital currencies. The future of finance is undoubtedly digital, and New York is taking significant strides toward leading the charge. Stay tuned for further updates on this groundbreaking legislation and its potential impact on the financial landscape in New York and beyond.

In a rapidly evolving financial landscape, the acceptance of cryptocurrencies by governments is a clear indicator of the growing importance and relevance of digital assets. New York’s initiative to introduce a bill allowing the state government to accept cryptocurrencies as a form of payment is a testament to the state’s forward-thinking approach and willingness to embrace technological advancements.

This move not only enhances operational efficiency and reduces transaction costs but also promotes financial inclusion by providing residents with more versatile payment options. By accepting cryptocurrencies, New York is ensuring that all residents have access to government services, thereby fostering a more inclusive economy. This aligns with broader trends in fintech where digital currencies are increasingly seen as tools for democratizing finance.

However, as with any new development, there are challenges and considerations that need to be taken into account. The regulatory framework surrounding cryptocurrencies is still evolving, and ensuring consumer protection and preventing illicit activities will be paramount. New York’s history of stringent financial regulations, particularly with its BitLicense framework, adds an additional layer of complexity to the implementation of this new bill.

Despite these challenges, the economic potential and innovative opportunities that come with embracing cryptocurrencies are significant. By allowing state government entities to accept digital currencies, New York could potentially drive economic growth, attract tech-savvy businesses, and create a vibrant ecosystem of innovation. This could lead to job creation, increased tax revenue, and overall benefits for the state’s economy.

In conclusion, New York’s introduction of a bill to accept cryptocurrencies as payment is a bold and forward-thinking move that has the potential to reshape the state’s financial landscape. By embracing digital currencies, New York is not only keeping pace with technological advancements but also positioning itself as a leader in financial innovation. As the world increasingly moves towards a digital future, New York’s actions serve as a beacon of progress and a model for other states looking to navigate the evolving landscape of finance.

As we navigate this new frontier of digital currencies and blockchain technology, engaging in discussions about the implications of such changes on our daily lives and the economy as a whole is crucial. New York’s decision to introduce a bill allowing cryptocurrency payments is a bold move that signals a shift towards a more digital and inclusive financial system. Let’s delve deeper into the potential impact of this development.

The Implications of Accepting Cryptocurrencies

By opening the door to cryptocurrency payments, New York is not only embracing innovation but also paving the way for increased efficiency and cost savings in government transactions. The adoption of digital currencies can streamline payment processes, reduce reliance on traditional banking systems, and provide residents with more choice in how they transact with the state. This move could also position New York as a leader in financial technology, attracting businesses and investors seeking a progressive regulatory environment.

Enhancing Financial Inclusion

One of the key benefits of accepting cryptocurrencies is the potential to promote financial inclusion. For individuals who may not have access to traditional banking services, digital currencies offer a new avenue for participation in the financial system. By accepting cryptocurrencies for state payments, New York can ensure that all residents have equal access to government services, regardless of their banking status. This inclusive approach aligns with broader efforts to democratize finance and empower underserved communities.

Regulatory Framework and Challenges

While the prospect of cryptocurrency payments presents exciting opportunities, it also raises concerns about regulation and security. New York’s history of robust financial regulations, such as the BitLicense framework, underscores the need for a carefully crafted regulatory approach to digital currencies. Balancing innovation with consumer protection and anti-money laundering measures will be essential to the successful implementation of cryptocurrency payments in government transactions.

Economic Growth and Innovation

Beyond the regulatory challenges, the acceptance of cryptocurrencies by the state government could stimulate economic growth and innovation. By creating a conducive environment for blockchain technology and digital currencies, New York may attract a wave of tech-savvy businesses and entrepreneurs to the state. This influx of talent and investment could spark a new era of innovation, job creation, and economic prosperity, positioning New York as a frontrunner in the digital economy.

Conclusion: Embracing the Future of Finance

New York’s decision to introduce a bill allowing cryptocurrency payments marks a significant step towards embracing the future of finance. By recognizing the potential of digital currencies to transform transactions and promote financial inclusion, the state is setting a precedent for others to follow. As the bill progresses, stakeholders must collaborate to address regulatory challenges, ensure security, and maximize the benefits of this groundbreaking initiative.

As we continue to explore the implications of cryptocurrency acceptance on our daily lives and the economy, it’s essential to engage in thoughtful discussions and stay informed about the evolving landscape of digital currencies. New York’s bold move is just the beginning of a new era in finance, and the possibilities are endless. Stay tuned for further updates on this transformative development and join the conversation on the future of cryptocurrency in New York and beyond.

New York’s bold move to allow cryptocurrencies as a form of payment marks a significant shift towards embracing the digital currency revolution. This decision has far-reaching implications for the state’s economy and sets a precedent for other regions to follow suit. As always, staying informed is key, so keep your eyes peeled for updates on this legislation.

The announcement from New York has sparked conversations about the future of finance and how this move will impact businesses and consumers alike. Cryptocurrencies have been gaining momentum in recent years, with more people recognizing the benefits of decentralized digital currency. By accepting crypto payments, New York is positioning itself as a leader in embracing innovation and adapting to the changing needs of its residents.

For businesses, the ability to accept cryptocurrencies opens up new opportunities for growth and expansion. By tapping into this emerging market, companies can attract tech-savvy customers who prefer to use digital currency for transactions. This move also streamlines the payment process, making it easier and more efficient for both businesses and consumers.

Consumers, on the other hand, stand to benefit from the convenience and security that cryptocurrencies offer. With crypto payments, individuals can make transactions quickly and securely without the need for traditional banking systems. This provides a level of financial freedom and autonomy that is appealing to many in today’s digital age.

As we navigate this new landscape, it’s important to consider the broader implications of integrating cryptocurrencies into our daily lives. While there are clear benefits to using digital currency, there are also challenges and risks to be aware of. It’s essential for both businesses and consumers to educate themselves on the ins and outs of crypto payments to make informed decisions.

One of the key advantages of cryptocurrencies is their ability to facilitate cross-border transactions without the need for expensive and time-consuming intermediaries. This opens up new possibilities for global trade and commerce, making it easier for businesses to reach customers around the world. By embracing crypto payments, New York is positioning itself as a hub for international business and innovation.

It’s also worth noting that cryptocurrencies are still a relatively new and evolving technology, which means there are risks involved. Price volatility, security concerns, and regulatory challenges are all factors that need to be taken into account when using digital currency. By staying informed and being proactive, businesses and consumers can mitigate these risks and make the most of the benefits that cryptocurrencies offer.

In conclusion, New York’s decision to allow cryptocurrencies as a form of payment is a bold and forward-thinking move that signals the state’s commitment to embracing innovation. As we continue to see the rise of digital currency, it’s important for everyone to stay informed and engage in discussions about the impact of these changes on our economy and society. For more information on this topic, you can check out the original announcement from Cointelegraph.

As we look towards the future, it’s clear that cryptocurrencies have the potential to revolutionize the way we think about money and transactions. By embracing this technology, New York is taking a step towards a more modern and tech-friendly economy that has the potential to change everything. Stay tuned for updates on this legislation and the exciting developments that lie ahead.

New York’s Bold Move: Will Crypto Payments Change Everything?