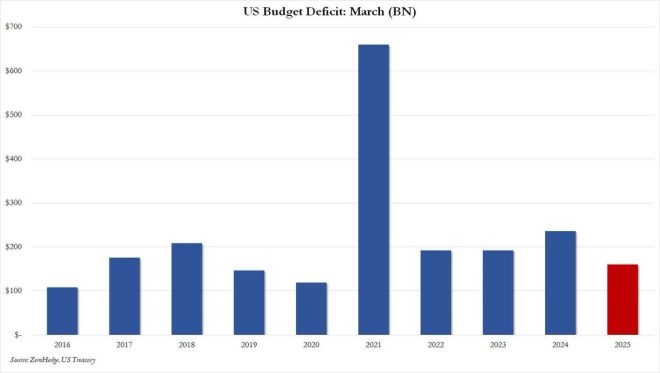

March Deficit Drops to 5-Year Low Amid DOGE’s Financial Impact

In a striking economic development, the U.S. Treasury Department has reported that the budget deficit for March has plummeted to its lowest point in five years. The deficit now stands at just $161 billion, representing an astonishing 32% reduction compared to the previous year. This significant decrease is largely attributed to the financial maneuvers surrounding Dogecoin (DOGE), which has reportedly played a role in slashing wasteful spending and reallocating funds.

The Role of DOGE in Financial Reform

Dogecoin, initially created as a meme cryptocurrency, has gained traction not only among investors but also as a potential tool for financial reform. As reported by Mario Nawfal on Twitter, the March deficit reduction aligns with a notable $45 billion cut in "Income Security" programs. This shift indicates a concerted effort to curb unnecessary expenditures and redirect resources more effectively.

The implications of this budgetary change are profound. By focusing on reducing the deficit, the government may be able to stabilize the economy, encourage growth, and foster an environment conducive to innovation and investment. Furthermore, it highlights the growing influence of cryptocurrencies in the financial landscape, as DOGE’s popularity continues to rise.

Analyzing the Deficit Reduction

The decrease in the budget deficit can be attributed to several factors, including increased tax revenues and decreased expenditure. The government’s ability to tighten its fiscal belt while promoting economic stability is crucial, especially in a post-pandemic era. The reduction of the deficit to $161 billion suggests that the government is making strides toward fiscal responsibility.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In addition to the cut in "Income Security," other areas of spending have also been scrutinized. The focus on eliminating wasteful spending practices aligns with broader economic strategies aimed at ensuring that taxpayer dollars are utilized efficiently. The Treasury’s ability to manage its finances effectively will be vital in the coming years as the nation tackles various economic challenges.

The Impact of Cryptocurrency on Government Spending

The integration of cryptocurrencies like Dogecoin into the financial system raises questions about the future of traditional finance. As digital currencies become more mainstream, their potential to influence government spending and budgetary policies cannot be ignored. The rise of DOGE and similar cryptocurrencies indicates a shift in how financial resources are viewed and managed.

Moreover, the enthusiasm surrounding cryptocurrencies has the potential to drive innovation in payment systems, taxation, and even social welfare programs. As governments explore the possibility of integrating blockchain technology into their financial frameworks, there may be a profound transformation in how funds are allocated and monitored.

Public Reaction and Future Implications

The announcement of the reduced deficit has elicited various reactions from the public, ranging from optimism to skepticism. Proponents of fiscal responsibility are celebrating the government’s efforts to reduce wasteful spending, while critics may question the sustainability of such cuts. The role of Dogecoin in this financial landscape is also a topic of debate, with some arguing that its influence may be fleeting.

As the government continues to navigate the complexities of its budget, it will need to strike a balance between necessary spending and innovative approaches to financial management. The challenge lies in maintaining a robust economy while ensuring that social safety nets remain intact. The recent developments surrounding the March deficit serve as a reminder of the ongoing struggle between fiscal responsibility and social welfare.

Conclusion: A New Era of Financial Management

The plunge in the March deficit to a five-year low, coupled with the impact of Dogecoin on government spending, signals a potential shift in how fiscal policies are crafted and implemented. As cryptocurrencies gain prominence, traditional financial systems may need to adapt to this new reality.

The U.S. Treasury’s ability to navigate these changes will be crucial in shaping the future of the economy. As we move forward, monitoring the interplay between cryptocurrencies and government fiscal policies will be essential for understanding the broader economic landscape.

In summary, the significant reduction of the budget deficit to $161 billion and the subsequent cuts in spending highlight a pivotal moment in U.S. economic history. The influence of Dogecoin in this process raises important questions about the role of digital currencies in shaping government policies and financial strategies. As we explore the implications of these changes, it becomes increasingly clear that we are entering a new era of financial management, one that may redefine the relationship between government spending and emerging technologies.

MARCH DEFICIT PLUNGES TO 5-YEAR LOW AS DOGE SLASHES democrat SLUSH FUNDS

Treasury reports show March deficit dropped to just $161B – a shocking 32% lower than last year as DOGE begins chopping wasteful spending.

The smoking gun: a massive $45B cut in “Income Security”… https://t.co/3s0ynPxGnt pic.twitter.com/SN4XfvIO3L

— Mario Nawfal (@MarioNawfal) April 11, 2025

MARCH DEFICIT PLUNGES TO 5-YEAR LOW AS DOGE SLASHES DEMOCRAT SLUSH FUNDS

March has brought some surprising news in the world of economics, as the Treasury reports indicate that the deficit has dropped to a remarkable five-year low. At just $161 billion, this figure represents a staggering 32% decrease compared to last year’s deficit. This shift raises eyebrows and prompts discussions about what exactly is driving this change. Could it be the influence of cryptocurrencies like Dogecoin (DOGE) making waves in government spending?

Treasury Reports Unveiling the Deficit Shift

The Treasury reports are crucial for understanding the financial health of the nation. These documents detail the government’s income and expenditures, allowing us to gauge how well it’s managing its finances. The recent report shows that March’s deficit has fallen significantly, which is quite unexpected given the usual trends in governmental spending. With the deficit now at $161 billion, this marks the lowest point in five years, sparking conversations about fiscal responsibility and spending cuts.

But what does this all mean for the average American? For one, it suggests that perhaps the government is becoming more mindful of how it allocates taxpayer dollars. This is especially relevant in times when many are calling for greater accountability in government spending. The shift could indicate a new approach to budgeting that prioritizes essential services over wasteful expenditures.

How DOGE is Influencing Government Spending

The mention of Dogecoin in the context of government spending may seem unusual at first. However, the rise of cryptocurrencies has prompted some intriguing shifts in financial landscapes. Dogecoin, once seen as a meme currency, has garnered a loyal following and is now being discussed in serious economic circles. As per reports, it appears that DOGE is not just a digital currency but has also become a symbol of grassroots financial activism.

The idea that DOGE could be “chopping wasteful spending” is particularly compelling. It suggests that the popularity of cryptocurrencies may be pushing officials to reconsider where and how they spend money. In an age where citizens are more informed and engaged, there’s a growing demand for transparency and efficiency in government expenditures.

The Smoking Gun: A Massive $45B Cut in “Income Security”

One of the standout figures in the recent Treasury reports is the staggering $45 billion cut in what’s termed “Income Security.” This category includes various social safety nets, such as unemployment benefits and welfare programs. The significant reduction raises questions about the implications for those who rely on these programs. While cutting wasteful spending is important, it also necessitates a careful balance to ensure that vulnerable populations aren’t adversely affected.

The budget cuts might reflect a shift in governmental priorities, signaling a move away from broad safety nets to more targeted assistance. It’s essential to analyze what these cuts mean for those who depend on these programs. Will this be a permanent change, or will we see a reversal if economic conditions shift?

Understanding the Bigger Picture

It’s easy to get caught up in the numbers and forget the human element behind them. The cuts in “Income Security” can have real-life impacts on families and individuals who are struggling to make ends meet. While the government may be applauded for reducing the deficit, it’s crucial to maintain a dialogue about the implications of these budgetary choices.

Moreover, this economic landscape is complex. The interplay between digital currencies like DOGE and government spending is still being studied, but the potential for cryptocurrencies to influence fiscal policy is becoming more evident. As more people invest in and use cryptocurrencies, their impact on traditional finance will likely grow.

The Role of Citizen Engagement

A notable aspect of this financial shift is the role that citizen engagement plays in the discussion around government spending. As more people become aware of how their tax dollars are spent, there’s a push for transparency and accountability. The rise of social media has amplified voices advocating for fiscal responsibility, and it’s clear that citizens are no longer passive observers in the financial realm.

This increased scrutiny can have a profound effect on governmental decision-making. Lawmakers may find themselves more inclined to justify spending decisions when they know that constituents are paying attention. The combination of cryptocurrency enthusiasm and a more informed citizenry could lead to significant changes in how budgets are crafted and executed.

The Future of Fiscal Responsibility

Looking ahead, it’s essential to consider what this new landscape means for fiscal responsibility. Will we see more budget cuts, or will there be a push to reinvest in critical social programs? As the economic situation continues to evolve, so too will the discussions surrounding government spending.

The relationship between cryptocurrencies and government finances is still in its infancy, but it’s worth monitoring closely. The potential for digital currencies to reshape economic policies and priorities is significant, and we might be witnessing the early stages of a broader transformation in how we think about money and government spending.

In summary, the March deficit drop to a five-year low, combined with the influence of DOGE and significant cuts in “Income Security,” paints a complex picture of our current economic landscape. These developments underscore the importance of ongoing dialogue about fiscal responsibility, transparency, and the role that citizens play in shaping financial policies. The future of government spending may be more intertwined with grassroots movements and digital currencies than ever before, making it an exciting time to be engaged in these discussions.

Breaking News, Cause of death, Obituary, Today