Lucid Motors Acquires Nikola Motor’s Arizona Factory: A Game-Changer for the EV Industry

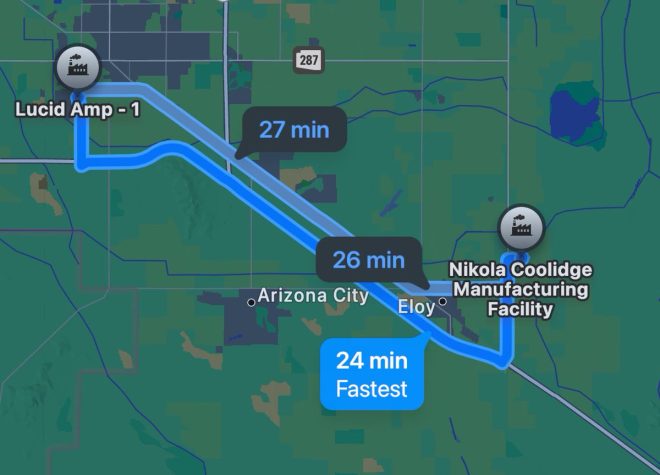

In a significant development for the electric vehicle (EV) market, Lucid Motors has emerged victorious in the bankruptcy auction for Nikola Motor’s Arizona factory and a selection of its other assets. This strategic acquisition, announced on April 11, 2025, marks a pivotal moment for Lucid Motors as it continues to solidify its position in the rapidly evolving EV landscape.

Overview of the Acquisition

Lucid Motors, known for its luxury electric vehicles, has committed around $30 million in cash and non-cash considerations to secure the Nikola facility. This deal includes the acquisition of Nikola’s lease on its Phoenix headquarters and various machinery essential for EV production. The successful bid not only provides Lucid with a state-of-the-art manufacturing facility but also opens doors for potential synergies and operational efficiencies.

Implications for Lucid Motors

Expansion of Production Capabilities

With the acquisition of Nikola’s Arizona factory, Lucid Motors is set to enhance its production capabilities. The facility is equipped with advanced manufacturing technologies that align with Lucid’s commitment to innovation and quality. This acquisition enables Lucid to scale its production to meet the growing demand for electric vehicles, particularly as consumers increasingly shift towards sustainable transportation options.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Strengthening Market Position

By acquiring Nikola’s assets, Lucid Motors positions itself as a dominant player in the EV market. This strategic move not only diversifies Lucid’s operational base but also strengthens its competitive edge against other EV manufacturers. With the market for electric vehicles projected to grow exponentially in the coming years, Lucid’s acquisition allows it to capture a larger share of this burgeoning market.

Innovation and Sustainability

Lucid Motors has a strong focus on sustainability and innovation. The new facility will facilitate research and development initiatives, enabling Lucid to continue pushing the boundaries of EV technology. The integration of Nikola’s machinery and technology will likely contribute to advancements in battery efficiency, vehicle performance, and production processes, aligning with Lucid’s vision of creating the most advanced electric vehicles on the market.

The Future of Nikola Motor

A New Chapter Post-Bankruptcy

Nikola Motor’s bankruptcy auction marks a challenging chapter for the company. However, with Lucid Motors acquiring its assets, there remains hope for recovery and revitalization. The new ownership can lead to a restructuring of operations, potentially allowing Nikola to emerge from bankruptcy with a renewed focus on its core competencies.

Strategic Partnerships

The acquisition opens avenues for potential collaborations between Lucid Motors and Nikola. By leveraging each other’s strengths, both companies can explore joint ventures in technology development, manufacturing, and distribution. Such partnerships could lead to innovative solutions that benefit the entire EV sector.

The Broader EV Market Landscape

Growing Demand for Electric Vehicles

The electric vehicle market is experiencing unprecedented growth, driven by consumer preferences for sustainable transport and government incentives promoting EV adoption. Lucid Motors’ acquisition of Nikola’s assets comes at a time when manufacturers are racing to ramp up production to meet this surging demand. With more consumers prioritizing eco-friendly options, companies like Lucid are well-positioned to lead this transition.

Competitive Dynamics

Lucid Motors enters a competitive landscape that includes established automakers and new entrants alike. By expanding its production capabilities through this acquisition, Lucid is not only enhancing its operational capacity but also positioning itself to respond more effectively to market dynamics. This strategic move is likely to attract investors’ attention, further fueling Lucid’s growth trajectory.

Conclusion

The acquisition of Nikola Motor’s Arizona factory by Lucid Motors is a landmark event in the electric vehicle sector. By investing approximately $30 million in cash and non-cash considerations, Lucid is set to expand its production capabilities, strengthen its market position, and drive innovation in EV technology. This strategic move not only benefits Lucid but also has the potential to reshape the future of Nikola Motor as it navigates its post-bankruptcy landscape.

As the demand for electric vehicles continues to soar, strategic acquisitions like this will play a crucial role in determining the leaders of the EV market. Lucid Motors is well-positioned to leverage its new assets to meet consumer needs and drive the sustainable transportation revolution forward. The future looks promising for both Lucid Motors and the EV industry as a whole.

Key Takeaways

- Lucid Motors wins the auction for Nikola’s Arizona factory, enhancing its production capabilities.

- The acquisition includes machinery and a lease on Nikola’s Phoenix headquarters, signaling a commitment to innovation.

- The EV market is experiencing rapid growth, providing a favorable environment for Lucid’s expansion.

- Potential collaborations between Lucid and Nikola could lead to innovative solutions in the EV space.

As Lucid Motors takes this significant step forward, the industry will be watching closely to see how this acquisition unfolds and the impact it will have on the global electric vehicle market.

Breaking news @LucidMotors wins bankruptcy auction for @nikolamotor Arizona factory and other assets

Lucid committed around $30 million in cash and non-cash considerations in exchange for the factory, Nikola’s lease on its Phoenix headquarters, and “certain machinery,… pic.twitter.com/xzgWq7e2iO

— The EV Guy (@The_EVGuy) April 11, 2025

Breaking News

In an unexpected twist in the electric vehicle market, @LucidMotors has emerged victorious in the bankruptcy auction for the @nikolamotor Arizona factory and several other significant assets. This acquisition is not just a win for Lucid Motors, but it also signals a new chapter in the competitive landscape of electric vehicles.

What’s the Deal?

Lucid Motors committed around $30 million in both cash and non-cash considerations. This investment grants them ownership of the Nikola Arizona factory, along with Nikola’s lease on its Phoenix headquarters and various machinery. The deal is expected to bolster Lucid’s production capabilities and enhance its position in the EV market.

A Closer Look at Lucid Motors

For those who might not be familiar, Lucid Motors has been making waves in the electric vehicle sector with its luxury electric sedans. Their flagship model, the Lucid Air, has garnered attention for its impressive range and performance, competing head-to-head with other high-end EVs such as Tesla. This recent acquisition could provide Lucid with the manufacturing backbone it needs to ramp up production and meet growing demand.

Why Did Nikola Motor Go Bankrupt?

Nikola Motor Company has had a tumultuous journey since its inception. The company faced multiple challenges, including allegations of fraud, production delays, and a lack of revenue-generating products. These issues culminated in the need for bankruptcy, leading to the auction of its assets. The acquisition of its Arizona factory by Lucid Motors marks a significant shift in the narrative surrounding Nikola, moving from a promising startup to a cautionary tale in the electric vehicle industry.

The Implications of the Acquisition

Lucid’s acquisition of Nikola’s assets could have far-reaching implications for the EV market. By obtaining an established factory and machinery, Lucid can potentially streamline its production process and scale operations more efficiently. This move could also lead to job creation in the Phoenix area, which is good news for the local economy.

What’s Next for Lucid Motors?

With the acquisition in the bag, Lucid Motors is poised to accelerate its growth strategy. The company has already announced plans to expand its product lineup, and with additional manufacturing capabilities, we can expect to see more models rolling off the assembly line in the near future. Lucid is not just focusing on luxury; they aim to capture a broader market segment, which could make electric vehicles accessible to a wider audience.

The Future of Electric Vehicles

The electric vehicle industry is evolving rapidly, with new players entering the market and established companies investing heavily in EV technology. Lucid Motors’ acquisition is a clear indication that the competition is heating up. As more companies strive to innovate and produce efficient electric vehicles, consumers will benefit from better choices and advancements in technology.

Consumer Impact

For consumers, this acquisition means more options and potentially lower prices as competition increases. Lucid’s focus on luxury and performance might push other manufacturers to raise their game, resulting in better products for everyone. Additionally, with the growing emphasis on sustainability, more consumers might consider electric vehicles as viable alternatives to traditional gasoline-powered cars.

Conclusion: A New Era for Lucid Motors

What began as a bankruptcy auction has turned into a strategic acquisition that could redefine Lucid Motors’ future. With the Arizona factory and other assets now under their control, Lucid is set to enhance its production capabilities and expand its market presence. As the electric vehicle landscape continues to evolve, all eyes will be on Lucid to see how they leverage this new opportunity to shape the future of electric mobility.

As we witness these developments, it’s clear that the electric vehicle race is far from over. With Lucid Motors taking significant steps forward, the next few years promise to be exciting for both the industry and consumers alike.