New York Introduces a Bill for Cryptocurrency Payments

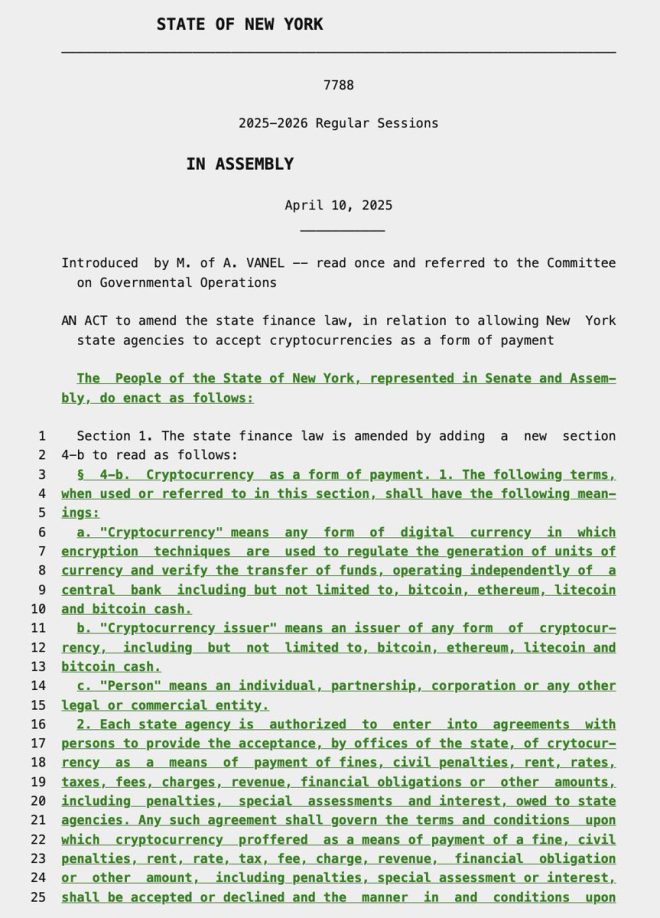

In a groundbreaking move, the state of New York has introduced a new bill that allows the state government to accept cryptocurrencies as a form of payment. This development is crucial in the ongoing evolution of digital currencies and their integration into mainstream financial systems. As cryptocurrencies gain traction globally, this legislative change positions New York as a potential leader in the adoption of decentralized finance.

The Significance of the Bill

The introduction of this bill marks a significant step towards legitimizing cryptocurrencies in the public sector. By allowing state transactions to be conducted in digital currencies, New York is acknowledging the growing relevance of cryptocurrencies such as Bitcoin, Ethereum, and particularly XRP, which has garnered attention for its rapid transaction speeds and efficiency.

Cryptocurrencies have been gaining popularity not just among individual investors but also among businesses and institutions. Accepting crypto payments could streamline transactions, reduce fees associated with traditional payment methods, and enhance transparency in government financial dealings.

The Potential Impact on Businesses

With the state government now able to accept cryptocurrencies, businesses operating in New York may find new opportunities for growth. Companies that already accept digital currencies can enhance their customer base by attracting crypto enthusiasts. Furthermore, businesses that are hesitant to adopt cryptocurrencies may feel encouraged to explore this option, knowing that government transactions are becoming crypto-friendly.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The bill could also lead to increased investment in the cryptocurrency sector within New York. As the state embraces this digital revolution, it could attract startups and established companies in fintech and blockchain technology. This influx could result in job creation and economic growth, positioning New York as a hub for innovation.

XRP and Its Role

Among the various cryptocurrencies, XRP stands out as a significant player in this emerging landscape. Its ability to facilitate quick and cost-effective transactions makes it an attractive option for both consumers and businesses. The announcement regarding New York’s acceptance of crypto payments has sparked excitement within the XRP community, as many believe that this could lead to increased adoption of XRP for everyday transactions.

XRP’s underlying technology, the Ripple network, is designed for secure and instantaneous cross-border payments, making it particularly useful in a state that is looking to modernize its financial operations. The integration of XRP into government transactions could set a precedent for other states and countries considering similar measures.

Legal and Regulatory Considerations

While the bill’s introduction is a step forward, it also raises important legal and regulatory questions. The state government will need to establish clear guidelines for how cryptocurrencies can be used for payments, including tax implications, accounting practices, and consumer protections. Ensuring that the use of digital currencies complies with existing financial regulations will be crucial to the bill’s success.

Furthermore, there may be concerns regarding the volatility of cryptocurrencies. Prices can fluctuate dramatically in a short period, which could pose challenges for budgeting and financial planning within state government. Addressing these issues will require careful consideration and potentially additional legislation.

The Future of Cryptocurrency in New York

The passage of this bill could signify a broader trend towards the adoption of cryptocurrencies in government transactions across the United States. As more states explore the potential benefits of digital currencies, New York’s decision may serve as a model for others to follow.

The incorporation of cryptocurrencies into governmental payment systems could lead to a more agile and responsive financial infrastructure. It could also encourage further innovation in blockchain technology, as developers work to create solutions that address the unique challenges associated with government use of digital currencies.

Conclusion

The recent introduction of a bill in New York allowing the state government to accept cryptocurrencies as payment is a significant milestone in the evolution of digital currency adoption. This development not only enhances the legitimacy of cryptocurrencies but also opens the door for businesses and consumers to engage more fully with this emerging financial landscape.

As New York positions itself as a leader in cryptocurrency acceptance, the implications for the economy, regulatory landscape, and technological innovation could be profound. The excitement surrounding XRP and similar cryptocurrencies indicates a growing acceptance of digital assets in everyday transactions.

The road ahead will undoubtedly involve navigating legal complexities and addressing concerns about volatility and consumer protection. However, the potential benefits of embracing cryptocurrencies are significant, and New York’s bold legislative step may inspire other states to follow suit in the quest for financial modernization.

In summary, New York’s acceptance of cryptocurrency payments is a forward-thinking initiative that could reshape the financial landscape, foster innovation, and pave the way for a more inclusive economic future. As the crypto community rallies around this news, the focus will be on how quickly and effectively the state can implement this new payment system, setting a precedent for others to explore the exciting possibilities of digital currency integration.

BREAKING:

NEW YORK HAS INTRODUCED A NEW BILL THAT ALLOWS THE STATE GOVERNMENT TO ACCEPT CRYPTOCURRENCIES AS PAYMENT! #XRP IS READY! pic.twitter.com/vL71svlnFn

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) April 11, 2025

BREAKING:

NEW YORK HAS INTRODUCED A NEW BILL THAT ALLOWS THE STATE GOVERNMENT TO ACCEPT CRYPTOCURRENCIES AS PAYMENT!

Crypto enthusiasts, the moment we’ve all been waiting for is finally here! New York has taken a monumental step by introducing legislation that permits its state government to accept cryptocurrencies as payment. This move is a significant endorsement of digital currencies, paving the way for a future where crypto could become a mainstream payment option. But what does this really mean for you, and how can you get involved? Let’s dive in!

What Does the New Bill Entail?

The newly introduced bill marks a pivotal shift in how governmental transactions can be conducted. Under this legislation, residents of New York will be able to pay various state fees and taxes using cryptocurrencies. This includes everything from motor vehicle registrations to business licenses. Essentially, New York is embracing the digital currency revolution, and it’s not just a passing trend!

This bill not only legitimizes cryptocurrencies but also encourages businesses and individuals to start using them more frequently. The government’s acceptance of crypto payments could help legitimize these currencies even further in the eyes of the general public, fostering a greater acceptance of digital currencies.

#XRP IS READY!

Among the cryptocurrencies that could potentially be accepted, XRP stands out as a frontrunner. XRP is known for its speed and low transaction fees, making it an attractive option for everyday payments. If you’re unfamiliar with XRP, it’s the native cryptocurrency of the Ripple network, which aims to facilitate fast and cost-effective cross-border transactions.

With New York’s new bill, XRP could see increased use not just for investments but also for practical, everyday transactions. This could potentially elevate its status in the market, leading to more widespread adoption. If you’re an XRP holder or considering investing, this news is certainly something to get excited about!

Why Is This Important for New Yorkers?

For everyday New Yorkers, this new bill could change the way you conduct business with the state. Imagine being able to pay your taxes or renew your driver’s license with just a few clicks using your favorite cryptocurrency. It’s not only convenient but also offers an additional layer of financial freedom.

Furthermore, this bill could encourage local businesses to start accepting cryptocurrencies as well. If the state is willing to take this step, it might inspire local merchants to follow suit, creating an ecosystem where digital currencies are a viable option for transactions. This could lead to an increase in tech-savvy businesses and a boost in the local economy.

The Potential Impact on Businesses

Businesses in New York, both large and small, should take note of this new legislation. Accepting cryptocurrencies can open up new revenue streams by attracting a tech-savvy clientele eager to pay with digital currencies. Additionally, accepting crypto could reduce transaction fees associated with traditional payment methods, benefiting businesses in the long run.

Moreover, this move could enhance customer loyalty. Offering crypto payment options can make your business stand out, particularly among younger consumers who are more inclined to use digital currencies. By embracing this trend, businesses can position themselves as forward-thinking and innovative.

Challenges Ahead

While this new legislation is exciting, it’s not without its challenges. Regulatory uncertainty still looms over the cryptocurrency industry. Businesses and individuals will need to navigate these waters carefully. Furthermore, the volatility of cryptocurrencies poses a risk; a payment made today could be worth significantly less or more tomorrow. This aspect could deter some from fully embracing crypto payments.

Security is another concern. As cryptocurrencies become more mainstream, they also become more attractive targets for hackers. Both businesses and consumers must ensure they have robust security measures in place to protect their digital assets.

What’s Next for Cryptocurrency in New York?

With the introduction of this bill, New York is setting a precedent that could influence other states to follow suit. If this trend continues, we could see a wave of legislation nationwide that allows for the acceptance of cryptocurrencies in various capacities.

As we move forward, it will be essential to monitor how this bill is implemented and how it affects the local economy. Will it lead to more businesses accepting cryptocurrencies? Will it foster a new generation of crypto enthusiasts? Time will tell, but one thing is for sure: the landscape of digital currencies is evolving, and New York is at the forefront of this change.

How to Get Involved

If you’re excited about the developments in New York and want to get involved, there are several ways to do so. First, stay informed about the legislation and any updates regarding its implementation. Joining local crypto communities, both online and offline, can provide valuable insights and networking opportunities.

Additionally, consider investing in cryptocurrencies like XRP, especially if you believe in their potential for everyday transactions. However, make sure you do your own research and understand the risks involved in cryptocurrency investments.

Conclusion

The introduction of this new bill in New York is a landmark moment for the cryptocurrency community. It signals a shift toward broader acceptance of digital currencies and could set the stage for a new era in how we conduct financial transactions. As the landscape continues to evolve, staying informed and adapting to these changes can help you make the most of this exciting opportunity!