The current economic situation of the U.S. dollar is a topic of concern as highlighted in a recent tweet by Maine (@TheMaineWonk). The tweet suggests that the dollar is experiencing a crash, which could be attributed to factors such as inflation, changes in monetary policy, and geopolitical tensions. This decline in the dollar’s value has caught the attention of economists, investors, and consumers, as it can have widespread implications for both domestic and global markets.

Several factors are influencing the dollar’s current trajectory, including rising inflation rates, interest rate policies set by the Federal Reserve, geopolitical tensions, and market sentiment. These elements play a significant role in determining the strength of the dollar and its impact on various aspects of the economy.

The implications of a weak dollar are significant, affecting consumers, businesses, international relations, and trade balances. Higher prices on imported goods can strain budgets and reduce disposable income for consumers, while businesses reliant on imports may experience squeezed profit margins and increased costs. Exporters may benefit from a weaker dollar, making U.S. goods cheaper for foreign buyers, but retaliatory measures from trading partners can complicate trade relations.

To navigate the uncertainties surrounding the dollar’s value, individuals are advised to stay informed about economic indicators and potential market shifts. Diversifying investments, monitoring spending habits, and following reliable financial news sources can help in making informed financial decisions during turbulent economic times.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

As the dollar continues to face challenges, staying ahead of the curve by understanding the factors at play and their implications is crucial. Being proactive in managing finances, exploring new investment opportunities, and staying informed about the dollar’s performance can empower individuals to navigate the evolving economic landscape effectively. By staying informed and prepared, individuals can mitigate the impact of a weakening dollar on their personal finances and make sound financial decisions in the face of economic uncertainty.

Summary of Dollar’s Current Economic Situation

In a recent tweet by Maine (@TheMaineWonk), concerns about a significant decline in the value of the U.S. dollar have been highlighted, indicating a potential economic crisis. This alarming trend has captured the attention of economists, investors, and everyday consumers alike, as fluctuations in currency values can have widespread implications for both domestic and global markets.

The Dollar’s Decline

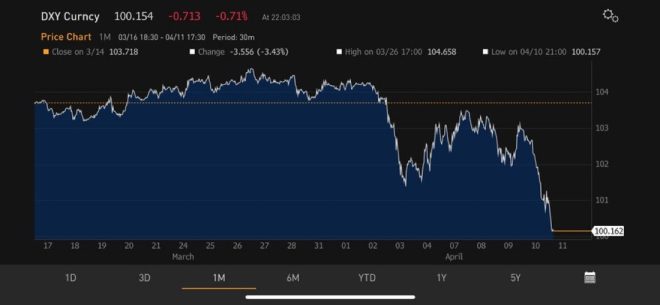

The tweet, accompanied by a striking image, suggests that the U.S. dollar is experiencing a crash, which could be attributed to various factors including inflation, changes in monetary policy, and geopolitical tensions. As the dollar weakens, it can have a cascading effect on international trade, investments, and consumer purchasing power. A depreciating dollar often leads to higher prices for imported goods, which can exacerbate inflationary pressures within the economy.

Factors Influencing the Dollar’s Value

Several key elements could be contributing to the dollar’s current trajectory:

- Inflation Rates: The U.S. is grappling with rising inflation, which can diminish the dollar’s purchasing power. When inflation rates soar, the Federal Reserve may adjust interest rates in an attempt to stabilize the economy, but such measures can also lead to economic uncertainty.

- Interest Rate Policies: The Federal Reserve’s decisions regarding interest rates directly impact the dollar’s strength. If rates are lowered to stimulate growth, it can lead to a weaker currency. Conversely, raising rates might bolster the dollar but could also slow economic growth.

- Geopolitical Tensions: Political instability and international conflicts can lead to market volatility, affecting investor confidence in the dollar. Events such as trade wars, sanctions, or military conflicts can prompt investors to seek safer assets, often leading to a decline in the dollar’s value.

- Market Sentiment: Investor sentiment plays a crucial role in currency valuation. If investors anticipate further declines in the dollar, they may start to sell off dollar-denominated assets, leading to an accelerated depreciation of the currency.

Impacts of a Weak Dollar

The implications of a crashing dollar are significant. For consumers, it means higher prices on imported goods, which can strain budgets and reduce disposable income. For businesses, especially those reliant on imports, the increased costs can squeeze profit margins and lead to higher prices for consumers.

Furthermore, a weak dollar can affect international relations and trade balances. While it may benefit exporters by making U.S. goods cheaper for foreign buyers, it can also lead to retaliatory measures from trading partners, complicating the economic landscape.

Conclusion

In conclusion, the tweet by Maine (@TheMaineWonk) sheds light on a pressing economic issue: the potential crash of the U.S. dollar. With various factors at play, including inflation, interest rates, geopolitical tensions, and market sentiment, the future of the dollar remains uncertain. As the situation evolves, it is crucial for consumers and investors to stay informed about these developments, as they can have far-reaching consequences for the economy and personal finances. Monitoring economic indicators and being prepared for potential shifts in the market can help individuals navigate these turbulent times effectively.

Dollar is crashing. pic.twitter.com/MNXFr4fSzd

— Maine (@TheMaineWonk) April 11, 2025

Dollar is crashing.

The financial world is abuzz with chatter about the alarming state of the dollar. Recently, a tweet by Maine (@TheMaineWonk) highlighted the issue, stating simply, “Dollar is crashing.” This has sparked discussions among economists, investors, and everyday citizens alike. But what does this mean for you? Let’s break it down.

Understanding the Dollar’s Decline

When we say the “Dollar is crashing,” it refers to a significant drop in the value of the U.S. dollar compared to other currencies. This can happen due to various factors, including economic instability, inflation, or changes in interest rates. When the dollar loses value, it impacts everything from the price of goods and services to international trade. For instance, if you’re planning to travel abroad, your dollars may not stretch as far as they used to, making vacations more expensive.

Many people are concerned about how this might affect their purchasing power. If the dollar continues to decline, you might notice that everyday items at the grocery store or the gas station become pricier. This situation can lead to a cycle of inflation, where prices keep rising, and wages don’t necessarily keep pace.

Global Implications of a Weak Dollar

The implications of a crashing dollar extend far beyond U.S. borders. A weaker dollar can make American exports cheaper for foreign buyers, which could potentially boost U.S. manufacturing. However, it can also mean that imports become more expensive, leading to increased costs for businesses that rely on foreign goods. This dynamic can create challenges in the marketplace and affect the overall economy.

Investors are also feeling the heat during these turbulent times. Many are considering shifting their portfolios to hedge against the dollar’s decline. Precious metals like gold and silver often become more appealing during such periods, as they traditionally hold their value better than currency.

What Can You Do?

So, what does this mean for you? If you’re concerned about the dollar crashing, it’s essential to stay informed and consider reviewing your financial strategies. Think about diversifying your investments to include assets that may hold up against inflation. Additionally, you might want to keep an eye on your spending habits and budget accordingly, especially if you notice prices starting to rise.

It’s also a good idea to follow reliable financial news sources and experts to stay updated on the situation. Check out reports from financial institutions or economic analysts who can provide insights into the dollar’s performance and what it might mean for the market.

Staying Ahead of the Curve

As the dollar continues to face challenges, staying informed is your best bet. Understanding the factors at play can help you make better financial decisions. Whether it’s adjusting your budget, exploring new investment opportunities, or simply being aware of how the dollar’s status impacts your day-to-day life, knowledge is power.

In a world where the economy is constantly shifting, keeping a pulse on the dollar’s value is crucial. So, next time you hear someone say, “Dollar is crashing,” you’ll know exactly what they’re talking about and why it matters to you. Keep your eyes peeled and your wallet ready!

In a recent tweet by Maine (@TheMaineWonk), concerns about a significant decline in the value of the U.S. dollar have been highlighted, indicating a potential economic crisis. This alarming trend has captured the attention of economists, investors, and everyday consumers alike, as fluctuations in currency values can have widespread implications for both domestic and global markets.

The tweet, accompanied by a striking image, suggests that the U.S. dollar is experiencing a crash, which could be attributed to various factors including inflation, changes in monetary policy, and geopolitical tensions. As the dollar weakens, it can have a cascading effect on international trade, investments, and consumer purchasing power. A depreciating dollar often leads to higher prices for imported goods, which can exacerbate inflationary pressures within the economy.

Several key elements could be contributing to the dollar’s current trajectory. Inflation rates in the U.S. are on the rise, diminishing the dollar’s purchasing power. When inflation rates soar, the Federal Reserve may adjust interest rates in an attempt to stabilize the economy, but such measures can also lead to economic uncertainty. Additionally, the Federal Reserve’s decisions regarding interest rates directly impact the dollar’s strength. Lowering rates to stimulate growth can result in a weaker currency, while raising rates might bolster the dollar but could also slow economic growth.

Geopolitical tensions, such as political instability and international conflicts, can lead to market volatility, affecting investor confidence in the dollar. Events like trade wars, sanctions, or military conflicts can prompt investors to seek safer assets, often resulting in a decline in the dollar’s value. Market sentiment also plays a crucial role in currency valuation. If investors anticipate further declines in the dollar, they may start to sell off dollar-denominated assets, leading to an accelerated depreciation of the currency.

The implications of a crashing dollar are significant. For consumers, it means higher prices on imported goods, which can strain budgets and reduce disposable income. For businesses, especially those reliant on imports, the increased costs can squeeze profit margins and lead to higher prices for consumers. Furthermore, a weak dollar can affect international relations and trade balances. While it may benefit exporters by making U.S. goods cheaper for foreign buyers, it can also lead to retaliatory measures from trading partners, complicating the economic landscape.

So, what does this mean for you? If you’re concerned about the dollar crashing, it’s essential to stay informed and consider reviewing your financial strategies. Think about diversifying your investments to include assets that may hold up against inflation. Additionally, you might want to keep an eye on your spending habits and budget accordingly, especially if you notice prices starting to rise. It’s also a good idea to follow reliable financial news sources and experts to stay updated on the situation. Reports from financial institutions or economic analysts can provide insights into the dollar’s performance and what it might mean for the market.

As the dollar continues to face challenges, staying informed is your best bet. Understanding the factors at play can help you make better financial decisions. Whether it’s adjusting your budget, exploring new investment opportunities, or simply being aware of how the dollar’s status impacts your day-to-day life, knowledge is power. In a world where the economy is constantly shifting, keeping a pulse on the dollar’s value is crucial. So, next time you hear someone say, “Dollar is crashing,” you’ll know exactly what they’re talking about and why it matters to you. Keep your eyes peeled and your wallet ready!