Unusual Market Movements: Analyzing the Dramatic Rise in QQQ Options

In the fast-paced world of stock trading, certain movements can indicate significant shifts in market sentiment or investor behavior. A recent tweet from the account @unusual_whales highlighted an extraordinary event involving QQQ options that warrants in-depth analysis to understand its implications for traders and investors alike. This summary will break down the unusual trading activity, the context surrounding it, and the potential implications for future market behavior.

Understanding QQQ Options

Before diving into the specifics of the tweet, it’s essential to understand what QQQ options are. The QQQ is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index, which comprises 100 of the largest non-financial companies listed on the Nasdaq stock market. Options are financial derivatives that give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specified expiration date. In this case, the focus is on a call option with a specific expiration date, which allows traders to bet on the future price increase of the QQQ.

The Unusual Trading Activity

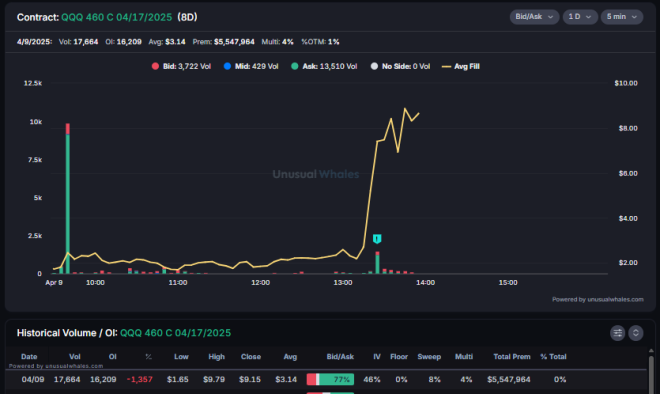

According to the tweet, there was a significant surge in volume for QQQ call options, specifically a 460C expiring on April 17. Traders acquired these options at a price of $0.85 per contract. Remarkably, the price of these contracts skyrocketed to as high as $31 during the trading day. This represents an astronomical increase of over 2000%, indicating a massive profit opportunity for traders who entered the position early.

The activity occurred before any notable news was released, suggesting that traders may have been anticipating a favorable market movement or acting on insider information. The sheer volume of trades indicates strong investor sentiment and confidence in the future performance of the Nasdaq-100.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact of trump’s Announcement

The tweet mentions that these trades occurred before former President Donald Trump announced a pause, which could have influenced market sentiment. While the specifics of the announcement were not detailed in the tweet, any political news, especially from influential figures, can dramatically impact market performance. Traders often react quickly to political events, which can lead to volatility in the stock market.

In this instance, the timing of the option trades and the subsequent announcement suggests that some traders were positioned to benefit from anticipated market shifts. This behavior is not uncommon; savvy investors often look for patterns or potential catalysts that could lead to significant price movements.

The Broader Implications

The trading activity surrounding the QQQ options raises several questions about market behavior and investor psychology. The fact that such a significant increase in contract value occurred without any immediate news indicates a speculative nature among traders. It reflects a broader trend in which investors are increasingly willing to take risks based on their analysis or intuition.

This situation also highlights the importance of volume analysis in trading. High volume can indicate strong interest in a particular asset, and sudden spikes in volume are often precursors to price movements. Traders should be aware of these indicators and consider them when making investment decisions.

Lessons for Traders and Investors

The unusual moves seen in the QQQ options serve as a case study for traders and investors looking to navigate the complexities of the stock market. Here are some key takeaways:

- Watch for Volume Spikes: Significant changes in trading volume can signal potential price movements. Traders should keep an eye on volume trends when analyzing stocks and options.

- Stay Informed: While the trades in question occurred before any major news, staying informed about market events and economic indicators is crucial. Events like political announcements can sway market sentiment rapidly.

- Risk Management: With the potential for rapid gains comes the risk of substantial losses. Traders should implement strong risk management strategies to protect their capital.

- Be Cautious of Speculation: While speculative trading can lead to high rewards, it also involves significant risk. Traders should balance their portfolios with a mix of speculative and stable investments.

- Understand Market Sentiment: Investor psychology plays a critical role in market movements. Understanding how broader market sentiment can influence trading behavior is essential for making informed decisions.

Conclusion

The extraordinary trading activity surrounding QQQ options, as highlighted by @unusual_whales, illustrates the dynamic nature of the stock market and the factors that can influence trading behavior. By analyzing the context of these trades, including the timing of political announcements and the implications of volume spikes, traders can glean valuable insights to inform their investment strategies.

As the market continues to evolve, staying informed and adaptable will be crucial for success in the ever-changing landscape of stock trading. Whether you are an experienced trader or just starting, understanding these dynamics can enhance your ability to navigate the complexities of the financial markets effectively.

I want you to understand how unusual the moves were today.

Before Trump announced a pause, there was HUGE $QQQ volume on a 460C expiring 04/17.

They were bought for $0.85 and ran to as high as $31 per contract!!!

This was before any news.

Later in the day, it rallied 2000% in… pic.twitter.com/vXKmKi0whh

— unusual_whales (@unusual_whales) April 10, 2025

I Want You to Understand How Unusual the Moves Were Today

If you’ve been keeping an eye on the stock market, you probably noticed some eyebrow-raising movements recently. It’s not every day that you see such dramatic shifts, especially in a single trading day. One of the standout moments came when a significant volume of $QQQ contracts were traded, marking a unique point in the market. This article dives into what happened, the implications of these moves, and why they matter.

Before Trump Announced a Pause

Just before former President Trump announced a pause, something extraordinary happened in the trading world. There was a massive surge in volume for the $QQQ options, specifically a 460C expiring on April 17. Traders weren’t just casually buying these contracts; they were making significant investments. The contracts were initially bought for just $0.85 but skyrocketed to a jaw-dropping $31 per contract! This kind of movement is rare and definitely worth discussing.

What Caused Such Huge Volume?

You might be wondering, what led to such unusual trading activities? The truth is, significant options trading often hints at underlying sentiment. Traders typically react to news or anticipated events. In this case, the unusual volume was recorded before any announcement. It suggests that traders were either anticipating something big or acting on insider information. This kind of speculation can create ripples in the market, leading to further volatility.

Understanding Options Trading

If options trading is new to you, don’t worry! Let’s break it down. When you buy an option, you’re essentially purchasing the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific timeframe. In this instance, the 460C option gives the holder the right to buy shares of the Invesco QQQ Trust, which tracks the performance of the Nasdaq-100 Index. The significant price jump from $0.85 to $31 illustrates the tremendous potential for profit (or loss) associated with options trading.

The Aftermath: A 2000% Rally

As if the initial surge wasn’t enough, later in the day, the price rallied an astonishing 2000%! Just imagine the thrill and surprise among traders who capitalized on this opportunity. Such a rally can only be described as a roller coaster ride, where fortunes can change in the blink of an eye. This is precisely why many traders are drawn to options, despite the inherent risks.

Why Do These Movements Matter?

Now, you might be thinking, “Why should I care about a few trades?” Well, these movements are crucial for a few reasons. First, they reflect market sentiment. When traders are confident enough to make large bets, it often indicates bullish sentiment. Conversely, a sudden drop in trading volume can signal fear or uncertainty. Keeping an eye on these metrics can provide valuable insights into market trends.

The Bigger Picture: Market Dynamics

The stock market is a complex web of interconnected elements. Events like Trump’s announcements can have cascading effects that ripple through various sectors. The unusual trading volumes and subsequent price movements can lead to increased volatility, which affects not just individual traders but the broader market. Understanding these dynamics can help you navigate the trading landscape more effectively.

Lessons for Retail Investors

For retail investors, there’s a lot to learn from these unusual moves. First, it’s essential to stay informed about current events and market sentiment. Knowledge is power, especially in trading. Secondly, consider the benefits of diversifying your portfolio. Relying solely on one stock or sector can expose you to more risk. By spreading your investments, you can mitigate potential losses and capitalize on different opportunities.

Risks Involved in Options Trading

While the potential for high returns in options trading is appealing, it’s crucial to acknowledge the risks. The market can be unpredictable, and factors like sudden news announcements or market changes can lead to significant losses. Always assess your risk tolerance and consider consulting with a financial advisor if you’re new to options trading. It’s better to be safe than sorry!

Staying Updated: Tools and Resources

To stay on top of market movements and trading volumes, consider utilizing various tools and resources. Websites like Bloomberg and MarketWatch provide real-time data and insights. Additionally, following experts on platforms like Twitter can give you a sense of the market buzz and trends. Just remember, not all information is reliable, so always verify facts before making trading decisions.

Conclusion: The Thrill of the Market

As we wrap up, it’s clear that unusual market moves like the ones we’ve discussed can be thrilling and informative. They offer a glimpse into the psychology of traders and the market itself. By understanding these dynamics, you can position yourself better in the trading world. Whether you’re a seasoned trader or just getting started, keeping an eye on unusual trading volumes can provide you with valuable insights and opportunities. So, stay curious, stay informed, and happy trading!

“`

This article has been crafted to engage readers using a conversational tone while providing valuable insights into unusual trading moves, specifically in relation to $QQQ options. The structure and headings are designed to enhance SEO optimization, making it easier for readers to find and understand the content.

Breaking News, Cause of death, Obituary, Today