Economic Uncertainty Update: Navigating the Chaos

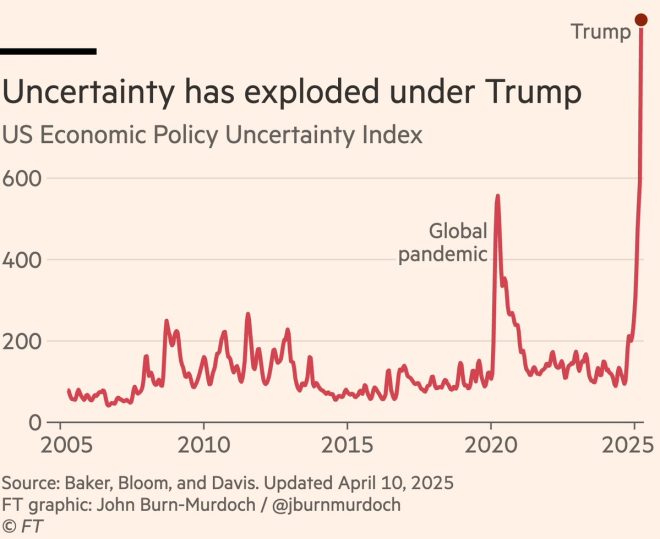

In today’s volatile economic landscape, the constant shifts in policy positions can create a sense of chaos for businesses, investors, and consumers alike. The recent update on economic uncertainty highlights how the frequent changes in direction—often influenced by new, maverick advisors—can result in a lack of clarity and stability. This summary will delve into the implications of these shifts and the broader context surrounding economic uncertainty, emphasizing the need for consistent and coherent policies.

The Impact of Policy Volatility

Economic policies are critical in shaping the environment for growth and stability. When governments and organizations oscillate between varying policy positions, it not only breeds confusion but also undermines trust. Stakeholders, including investors and consumers, rely on predictable frameworks to make informed decisions. However, as noted in the recent update, the trend of adopting contradictory justifications further complicates the landscape.

For instance, one week a government may advocate for austerity measures, while the next may promote expansive fiscal policies. This erratic behavior can lead to hesitation among investors, who may delay committing capital due to uncertainty about future returns. Similarly, consumers might curtail spending in anticipation of potential economic downturns, further exacerbating the situation.

The Role of Advisors in Shaping Economic Policy

The choice of advisors plays a significant role in determining economic policy. The tendency to favor new, often unconventional advisors each week may lead to a lack of continuity in policy direction. While fresh perspectives can bring innovative ideas, the constant rotation of advisors can result in fragmented strategies that fail to address underlying economic issues.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In an environment where advisors are frequently changed, the core challenges—such as inflation, unemployment, and economic growth—may not receive the sustained attention they require. This inconsistency can hinder long-term planning and create an atmosphere of unpredictability that affects all sectors of the economy.

The Search for Sanity Amidst Chaos

Despite the chaos, there are moments when policy pivots lean towards rationality. However, the overarching theme remains one of disorder. Even when a particular policy direction appears sane, the surrounding instability can overshadow its potential benefits. For example, temporary relief measures may provide short-term assistance, but without a coherent long-term strategy, their effectiveness can be severely limited.

Investors and businesses are thus left to navigate through a maze of ever-changing regulations and policies, making it increasingly challenging to forecast economic trends. This unpredictability can lead to inefficiencies in the market and may deter foreign investment, further complicating the recovery process.

The Broader Economic Context

The current economic uncertainty is not just a domestic issue; it has global implications. The interconnectedness of economies means that instability in one region can have ripple effects worldwide. For example, changes in U.S. economic policy can influence market conditions in Europe and Asia, affecting international trade and investment.

Furthermore, global events—such as pandemics, geopolitical tensions, and climate change—add additional layers of complexity to the economic landscape. Policymakers must consider these factors while also managing domestic issues. However, the prevailing chaos can hinder effective responses to these multifaceted challenges.

Strategies for Navigating Economic Uncertainty

In light of the current environment, businesses and investors can adopt several strategies to navigate economic uncertainty effectively:

- Diversification: By diversifying investments across various sectors and geographies, stakeholders can mitigate risks associated with economic volatility.

- Scenario Planning: Businesses should engage in scenario planning to anticipate potential shifts in policy and their implications. This proactive approach can help organizations remain agile and adaptable.

- Building Resilience: Developing resilient business models that can withstand economic shocks is crucial. This may involve investing in technology, enhancing supply chain management, and fostering a culture of innovation.

- Staying Informed: Keeping abreast of economic trends, policy changes, and market conditions is essential for making informed decisions. Engaging with economic analysts and industry experts can provide valuable insights.

- Advocacy for Stability: Stakeholders should advocate for coherent and stable economic policies. Engaging with policymakers and contributing to public discourse can help promote a more predictable economic environment.

Conclusion

The recent economic uncertainty update serves as a reminder of the complexities inherent in navigating a chaotic policy landscape. While occasional pivots towards sanity may occur, the overarching volatility can overshadow potential benefits. It is crucial for businesses, investors, and consumers to adopt strategies that allow them to thrive amidst uncertainty.

As we move forward, the need for clear and consistent economic policies has never been more pressing. By fostering stability and coherence, policymakers can help restore confidence in the economy, paving the way for sustainable growth and prosperity. In an age where chaos seems to reign, a collective commitment to sound economic governance is essential for charting a stable course ahead.

Economic uncertainty update:

The thing about veering wildly between policy positions, favouring a new maverick advisor each week, and using contradictory justifications at every turn, is that even if one particular pivot is in the direction of sanity, chaos is the constant. https://t.co/ayRuXZfd8i

Economic Uncertainty Update:

Let’s dive into the current economic landscape. If you’ve been keeping an eye on the news, you might have noticed that things are feeling a bit rocky. You know the drill: one day we hear about promising job growth, and the next, the stock market takes a nosedive. This sort of volatility isn’t just annoying; it’s downright unsettling. As we navigate these uncertain waters, it’s critical to unpack what’s happening and how it might affect us all.

The Thing About Veering Wildly Between Policy Positions

When we look at economic policy, it’s as if we’re on a rollercoaster. The government seems to be shifting its stance on major issues almost weekly. One week, we’re all about fiscal stimulus, and the next, the narrative changes, focusing on austerity measures. This constant back-and-forth can make it tough for businesses and consumers to plan for the future. Forbes highlights how such erratic policies create chaos, making it hard for anyone to feel secure.

Favouring a New Maverick Advisor Each Week

It seems like every week there’s a new economic advisor stepping into the limelight with bold ideas and unconventional approaches. While fresh perspectives can sometimes breathe life into stagnant policies, the frequency of these changes can lead to confusion. One week it’s a focus on innovation, and the next, it’s all about regulation. This inconsistency leaves many scratching their heads, wondering which direction we’re really heading in. The Guardian points out that this kind of unpredictability can have real consequences for investment and consumer confidence.

Using Contradictory Justifications at Every Turn

Have you ever had a friend who changes their story every time you ask them about something? That’s how it feels with the current economic justifications. One moment, the reasoning is rooted in the need for immediate growth, and the next, it flips to long-term stability. This kind of contradictory justification can make it challenging to trust the information we receive. When the government continually shifts its narrative, it raises questions about their overall strategy and intentions.

Even if One Particular Pivot is in the Direction of Sanity

Occasionally, a policy shift does seem to make sense—like when they prioritize job creation or investment in infrastructure. But even in these moments of clarity, the chaos surrounding them can overshadow potential benefits. The constant turmoil means that even well-intentioned policies can fall flat because they lack consistent support and coherent messaging. The Brookings Institution discusses how stability in policies is essential for fostering a thriving economy.

Chaos is the Constant

As we navigate through this economic uncertainty, one theme emerges: chaos is the constant. Whether it’s erratic policies or shifting narratives, the unpredictability is palpable. Businesses are having a tough time making decisions, consumers are holding off on spending, and investors are skittish. This environment is like trying to walk through a fog—everything feels unclear and shaky. The Economist emphasizes that without a clear path forward, everyone feels the heat of uncertainty, leading to a cycle of hesitation and doubt.

The Impact on Daily Life

So, what does all this chaos mean for you and me? Well, it trickles down into our daily lives in various ways. From fluctuating prices at the grocery store to rising interest rates on loans, the ripple effects are hard to ignore. It’s not just about numbers on a chart; it’s about how these economic shifts affect our wallets and our peace of mind. When you hear about inflation rising, it’s not just a statistic; it’s the price of your favorite cereal going up. The CNBC article explains how inflation can affect the average consumer, making budgeting a challenge.

Staying Informed

In such a chaotic environment, staying informed is crucial. While it’s easy to get overwhelmed by the constant barrage of news, focusing on reputable sources can help. Whether it’s reading articles from trusted financial news outlets or following expert opinions, being educated about the current economic situation can empower you to make better decisions. Knowledge is power, after all. Websites like Reuters provide valuable insights into the latest economic trends and forecasts.

Looking Ahead

While the current economic landscape is filled with uncertainty, it’s essential to remember that these cycles are often temporary. History shows us that economies can rebound and that stability can return. The key is to remain adaptable and keep a close eye on economic indicators that might hint at future trends. Whether it’s unemployment rates, consumer confidence, or inflation data, keeping tabs on these metrics can help you navigate the choppy waters ahead.

Building Resilience

In the face of chaos, building personal and financial resilience is vital. This might mean diversifying investments, creating an emergency fund, or simply being more mindful of spending habits. By taking proactive steps, you can better prepare for whatever economic twists and turns may come your way. Resources from organizations like the National Foundation for Credit Counseling can provide valuable tips on managing your finances during uncertain times.

The Takeaway

It’s clear that we’re living in a time of significant economic uncertainty. With erratic policy shifts and chaotic justifications, it can be challenging to stay grounded. However, by staying informed, building resilience, and focusing on what we can control, we can navigate these turbulent times. Remember, chaos may be the constant, but so is the potential for change and stability. Let’s embrace the journey ahead, armed with knowledge and a willingness to adapt.

Breaking News, Cause of death, Obituary, Today