Understanding the Impact of President trump‘s Tariffs on the U.S. Economy

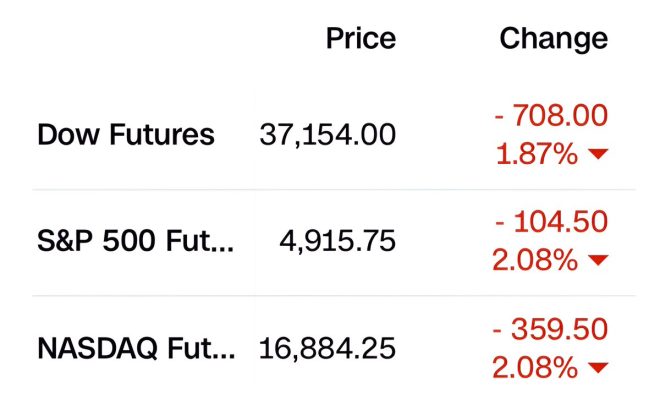

On April 9, 2025, President Trump’s tariffs officially took effect, leading to a significant reaction in the financial markets. U.S. stock futures experienced a notable decline as investors began to assess the potential repercussions of these tariffs on both domestic and international trade. This summary delves into the implications of these tariffs, their effects on the stock market, and broader economic consequences.

What Are Tariffs?

Tariffs are taxes imposed by a government on imported goods. They are typically used to protect domestic industries from foreign competition, generate revenue, or retaliate against other countries’ trade practices. In President Trump’s case, the tariffs are part of a broader trade policy aimed at reshaping international trade agreements and promoting American manufacturing.

The Immediate Market Reaction

Following the announcement of the tariffs, U.S. stock futures tumbled, indicating a bearish sentiment among investors. The stock market’s initial reaction underscores the uncertainty that tariffs can introduce into the economy. Investors often fear that higher import costs could lead to increased prices for consumers, decreased corporate profits, and potential retaliation from trading partners, all of which can negatively impact market performance.

The Broader Economic Implications

The implementation of tariffs can have several broader economic implications:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

1. Inflationary Pressure

Tariffs can lead to higher prices for imported goods, contributing to inflation. As companies face increased costs for raw materials and products, they may pass these costs onto consumers. This inflationary pressure can erode purchasing power, leading to reduced consumer spending, which is a critical component of economic growth.

2. Impact on Businesses

Businesses that rely heavily on imported materials may find their operational costs rising. This could force companies to either absorb the costs, reduce their profit margins, or increase prices for consumers. Small and medium-sized enterprises, which often operate on tighter margins, may be particularly vulnerable to these changes.

3. Global Trade Relations

Tariffs can strain relationships with trading partners. Countries affected by U.S. tariffs may respond with retaliatory measures, leading to trade wars that can disrupt global supply chains and create further economic instability. Such conflicts can have lasting effects on international relations and global economic growth.

Long-Term Effects of Tariffs

The long-term effects of tariffs depend on various factors, including the duration of the tariffs, the response from other countries, and the overall global economic environment. Some potential long-term effects include:

1. Shifts in Production

Businesses might decide to relocate production facilities to countries with favorable trade conditions, leading to a shift in global manufacturing patterns. This can result in job losses in the U.S. while potentially creating jobs abroad.

2. Investment Decisions

Investors may reconsider their investment strategies in light of tariff policies. Increased uncertainty can lead to reduced foreign direct investment in the U.S. as companies weigh the risks associated with fluctuating trade policies.

3. Consumer Behavior Changes

As prices rise due to tariffs, consumers may alter their purchasing habits, opting for domestically produced goods or lower-cost alternatives. This shift can impact the competitiveness of U.S. manufacturers and influence the overall market landscape.

Conclusion

The implementation of President Trump’s tariffs marks a significant moment in U.S. economic policy, with immediate effects on stock futures and potential long-term ramifications for the economy. While the intention behind tariffs may be to protect domestic industries, the broader consequences, including inflationary pressures and shifts in global trade relations, warrant careful consideration.

As we monitor the evolving situation, it will be crucial for policymakers, businesses, and consumers to navigate the complexities introduced by tariffs. Understanding these dynamics can help mitigate risks and capitalize on opportunities in an increasingly interconnected global economy.

Key Takeaways

- Tariffs are taxes on imported goods aimed at protecting domestic industries.

- The immediate market reaction to tariffs can include stock market declines and increased economic uncertainty.

- Tariffs can lead to inflation, increased business costs, and strained international relations.

- Long-term effects may include shifts in production, changes in investment strategies, and altered consumer behavior.

By keeping abreast of changes in trade policy and their implications, stakeholders can better position themselves for success in a fluctuating economic landscape. The effects of President Trump’s tariffs will continue to unfold, impacting various sectors and influencing the broader economic narrative in the years to come.

JUST IN: President Trump’s tariffs are officially in effect.

U.S. stock futures are tumbling. pic.twitter.com/QDGRexT1o2

— Brew Markets (@brewmarkets) April 9, 2025

JUST IN: President Trump’s tariffs are officially in effect

In a significant development that has the potential to shake up the economic landscape, President Trump’s tariffs are officially in effect. The announcement has sent waves through the financial markets, leading to a rapid decline in U.S. stock futures. Investors are bracing for what these tariffs might mean for various sectors and the economy at large.

Understanding Tariffs and Their Implications

So, what exactly are tariffs? In simple terms, tariffs are taxes imposed on imported goods. They are designed to protect domestic industries from foreign competition by making imported products more expensive. While this might sound beneficial for local businesses, tariffs can have a series of unintended consequences. For instance, they can lead to higher prices for consumers and may trigger retaliatory actions from other countries.

The impact of tariffs is not just felt in the marketplace; it extends to various aspects of the economy. According to CNBC, the immediate reaction to Trump’s tariffs has been a tumble in U.S. stock futures, which indicates investor uncertainty and concern about potential repercussions on corporate earnings and economic growth.

The Immediate Market Response

As news broke about the tariffs going into effect, U.S. stock futures took a significant hit. This reaction isn’t surprising, considering that markets often respond sharply to geopolitical and economic changes. Investors are keenly aware that tariffs can affect supply chains, production costs, and ultimately, consumer prices. The Reuters reported a notable drop in futures, reflecting the apprehension surrounding the potential fallout from these tariffs.

Economic Projections and Predictions

The implementation of tariffs usually comes with a mix of optimism and apprehension. On one hand, proponents argue that tariffs can protect American jobs and industries. On the other hand, critics warn about the risks of trade wars and inflation. Economists are now speculating about the long-term effects of Trump’s tariffs on the U.S. economy. A Forbes article outlines that while some industries may benefit, others could face significant challenges, leading to an overall mixed economic impact.

Consumer Impact: What You Need to Know

For everyday consumers, the question on everyone’s mind is: how will these tariffs affect me? The answer is complex. As businesses face higher costs due to tariffs, they may pass those costs on to consumers in the form of higher prices. This could mean spending more on everyday items, from electronics to groceries. The New York Times highlights that consumers should prepare for increased prices, especially in sectors heavily reliant on imports.

Global Reactions to U.S. Tariffs

It’s not just the U.S. that is feeling the heat from these tariffs. International markets are also reacting to the news. Countries that export goods to the U.S. are likely to respond, and this could lead to a tit-for-tat escalation of tariffs. Global trade relationships are delicate, and any moves by the U.S. can have ripple effects worldwide. According to BBC, nations are closely monitoring the situation, and many are considering their responses to protect their own economic interests.

The Future of U.S. Trade Policy

With tariffs now in effect, the future of U.S. trade policy is uncertain. Will President Trump continue to push for more tariffs, or will there be a move toward negotiation and compromise? Analysts suggest that the administration may seek to use these tariffs as leverage in broader trade discussions. The Wall Street Journal discusses how the current administration may utilize tariffs as a tool to negotiate better trade terms with other countries.

Advice for Investors

If you’re an investor, now is the time to reassess your portfolio in light of the latest tariff developments. Financial experts recommend staying informed and considering sectors that might benefit from the tariffs, as well as those that could suffer. Companies with strong domestic supply chains may be better positioned to weather the storm than those heavily reliant on imports. A Bloomberg article provides insights on how to navigate investments during this turbulent time.

Conclusion: The Road Ahead

As we move forward, the effects of President Trump’s tariffs will unfold over time. The stock market’s initial reaction is just the tip of the iceberg, and the real implications will become clearer as businesses adapt and consumers respond to changing prices. Keeping an eye on economic indicators and market trends will be crucial for anyone looking to understand the full impact of these tariffs.

In summary, with President Trump’s tariffs now officially in effect, the economic landscape is shifting. U.S. stock futures are tumbling, and everyone from investors to consumers is feeling the impact. It’s a critical moment that could define trade relations for years to come, and staying informed is key. Don’t forget to keep an eye on the news for updates, as the situation continues to evolve.