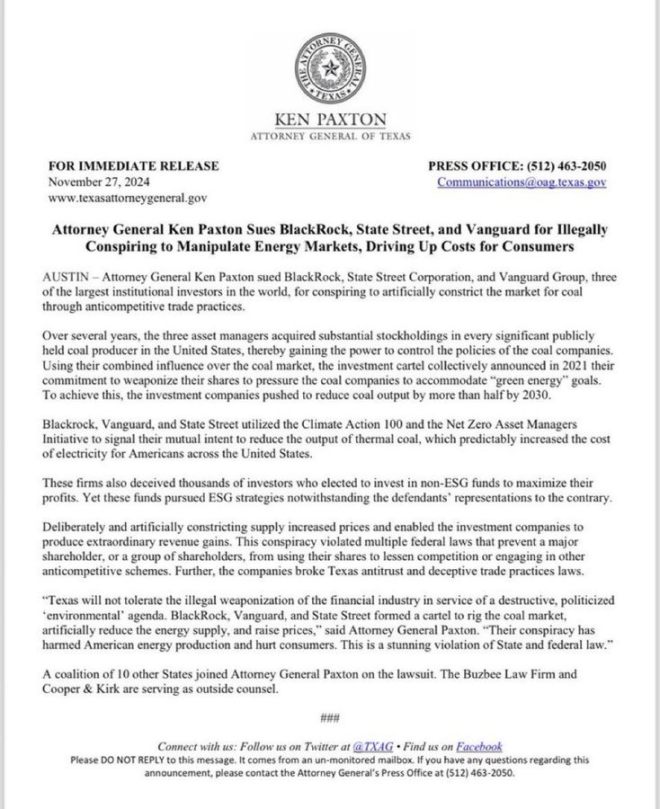

Texas Lawsuit Against Major Asset Managers: BlackRock, Vanguard, and state Street

In a significant legal development, Texas Attorney General Ken Paxton has initiated a lawsuit against three of the world’s largest asset management firms: BlackRock, Vanguard, and State Street. This lawsuit accuses these financial giants of engaging in what is described as "energy market collusion," with serious implications for the U.S. energy sector and consumers alike. This summary delves into the allegations, potential consequences, and the broader context surrounding this landmark case.

Allegations of Collusion in the Energy Market

The core of the lawsuit revolves around accusations that BlackRock, Vanguard, and State Street have been involved in rigging the U.S. coal market. These firms are accused of collaborating to manipulate energy prices, which allegedly has resulted in inflated costs for American consumers. The lawsuit claims that their actions have not only harmed the coal industry but have also contributed to rising energy expenses for households and businesses across Texas and beyond.

Impact on Energy Costs for Americans

The implications of this lawsuit are profound, touching the financial lives of millions of Americans. By allegedly driving up energy costs, the accused firms are accused of placing an undue burden on families and businesses that rely on affordable energy. The lawsuit seeks to address these grievances and hold the asset managers accountable for their actions, which are claimed to be detrimental to the economic well-being of Texas residents.

The Role of Major Asset Managers

BlackRock, Vanguard, and State Street are among the largest asset managers globally, wielding significant influence over various sectors, including energy. Their investment strategies often prioritize sustainability and environmental considerations, which can lead to conflicts when traditional energy sources like coal are at stake. This lawsuit highlights the tension between environmental goals and the economic realities faced by energy consumers.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Legal Landscape

This lawsuit marks a notable moment in the ongoing debate over energy policy and market regulation in the United States. The legal action taken by Texas may set a precedent for other states to follow, potentially leading to a wave of similar lawsuits aimed at large financial institutions perceived to be manipulating markets. The outcome of this case could reshape the regulatory environment for asset managers and the energy sector, forcing them to operate with greater transparency and accountability.

Broader Context of Energy Regulation

The allegations against BlackRock, Vanguard, and State Street come at a critical time when energy prices are a hot-button issue in American politics. As concerns about inflation and rising living costs grow, the scrutiny on major financial firms is likely to increase. This lawsuit could spark discussions about the role of institutional investors in energy markets and their responsibilities toward consumers and the economy.

Public Reaction and Implications

The lawsuit has generated significant media attention and public discourse. Advocates for consumer rights and affordable energy are likely to view this legal action as a necessary step toward justice. On the other hand, financial industry representatives may argue that the lawsuit could hinder investment in critical energy infrastructure. The outcome of this case will be closely monitored by stakeholders across the political spectrum.

Conclusion

As Texas takes a stand against major asset managers like BlackRock, Vanguard, and State Street, the lawsuit raises important questions about market fairness, consumer protection, and the responsibilities of financial institutions in a rapidly evolving energy landscape. The allegations of collusion and their potential impact on energy costs highlight the need for transparency and accountability in the financial sector. As the case unfolds, it will undoubtedly shape the future of energy regulation and investment practices in the United States.

BREAKING: TEXAS SUES BLACKROCK, VANGUARD & STATE STREET FOR “ENERGY MARKET COLLUSION”

Attorney General Ken Paxton just filed a massive lawsuit accusing the world’s top asset managers of:

Rigging the U.S. coal market

Driving up energy costs for Americans

… pic.twitter.com/wqV8wzo2d3— Jim Ferguson (@JimFergusonUK) April 9, 2025

BREAKING: TEXAS SUES BLACKROCK, VANGUARD & STATE STREET FOR “ENERGY MARKET COLLUSION”

Texas is making headlines with a groundbreaking lawsuit filed by Attorney General Ken Paxton against some of the world’s largest asset managers—BlackRock, Vanguard, and State Street. This bold legal move is raising eyebrows and sparking a nationwide conversation about the integrity of our energy markets and the financial practices of these industry giants.

What’s the Lawsuit About?

In a dramatic turn of events, Paxton is accusing these asset management behemoths of serious misconduct. The lawsuit claims that they are involved in **rigging the U.S. coal market**. This isn’t just about a few bad apples; it’s about the potential manipulation of an entire sector that plays a crucial role in America’s energy landscape. But how exactly are they alleged to be doing this?

According to the lawsuit, these firms have engaged in practices that have **driven up energy costs for Americans**. At a time when many households are already feeling the pinch from rising utility bills, this accusation could have significant repercussions for both consumers and the companies involved.

Understanding Energy Market Collusion

So, what does “energy market collusion” actually mean? In simple terms, it refers to an illegal agreement among firms to manipulate market prices or supply. When companies like BlackRock, Vanguard, and State Street—who manage trillions in assets—are accused of colluding, it raises serious concerns about fair competition and consumer welfare.

Collusion can lead to inflated prices and restricted supply, directly impacting everyday Americans. If proven, this could mean that these asset managers prioritized profits over the well-being of consumers.

The Role of BlackRock, Vanguard, and State Street

These firms are among the largest asset managers globally and have significant influence over various sectors, including energy. BlackRock, for instance, manages assets worth over $9 trillion, while Vanguard and State Street are also in the trillions. Their investment decisions impact not just markets but also the policies and practices of the companies they invest in.

The lawsuit highlights that these firms have a responsibility to act in the best interests of their investors and the public. However, if they are indeed engaging in collusion, it shows a troubling disregard for that responsibility.

Implications for Investors and Consumers

This lawsuit could have wide-reaching implications. For investors, especially those with funds managed by these firms, there’s a lot at stake. If the lawsuit proves successful, it could lead to significant financial penalties for BlackRock, Vanguard, and State Street. These penalties might affect the performance of the funds that millions of Americans rely on for retirement and other investments.

For consumers, the implications are even more direct. Rising energy costs can strain budgets, and if these asset managers are found guilty of manipulating coal prices, it could lead to a reassessment of how energy markets operate.

The Bigger Picture: Energy Policy and Regulation

This lawsuit is not just about the companies involved; it also opens the door to a broader conversation about energy policy and regulation in the United States. With climate change and energy independence at the forefront of national discussions, ensuring fair market practices in the energy sector is crucial.

Many advocates for environmental sustainability argue that such collusion can undermine efforts to transition to cleaner energy sources. If these asset managers are focused on short-term profits from fossil fuels, it could conflict with the long-term goals of reducing carbon emissions and promoting renewable energy.

What’s Next for the Lawsuit?

As this legal battle unfolds, all eyes will be on the courtroom and the arguments made by both sides. Texas is taking a firm stance, and if the lawsuit gains traction, it may inspire similar actions in other states or even lead to federal investigations into the practices of these asset managers.

The outcome could set a precedent for how large financial institutions operate within the energy sector. Will there be stricter regulations? Will consumers see changes in their energy bills? Only time will tell.

Public Reaction and Media Coverage

The response to this lawsuit has been swift, with media outlets covering the story extensively. Many are voicing their opinions on social media, discussing the potential consequences for both the asset managers and the consumers they serve. The public sentiment seems to lean toward skepticism of the practices of these large firms, and this lawsuit may serve as a rallying cry for those advocating for more accountability in the financial sector.

Conclusion: A Call for Transparency

This lawsuit against BlackRock, Vanguard, and State Street is more than just a legal matter; it’s a call for transparency and accountability in the energy markets. As the details continue to unfold, consumers, investors, and policymakers alike will be watching closely. The implications of this case could resonate far beyond Texas, potentially reshaping the landscape of energy investment and regulation in the United States.

For more updates on this developing story, stay tuned as we continue to monitor the situation and its impact on energy markets and consumers across the nation.