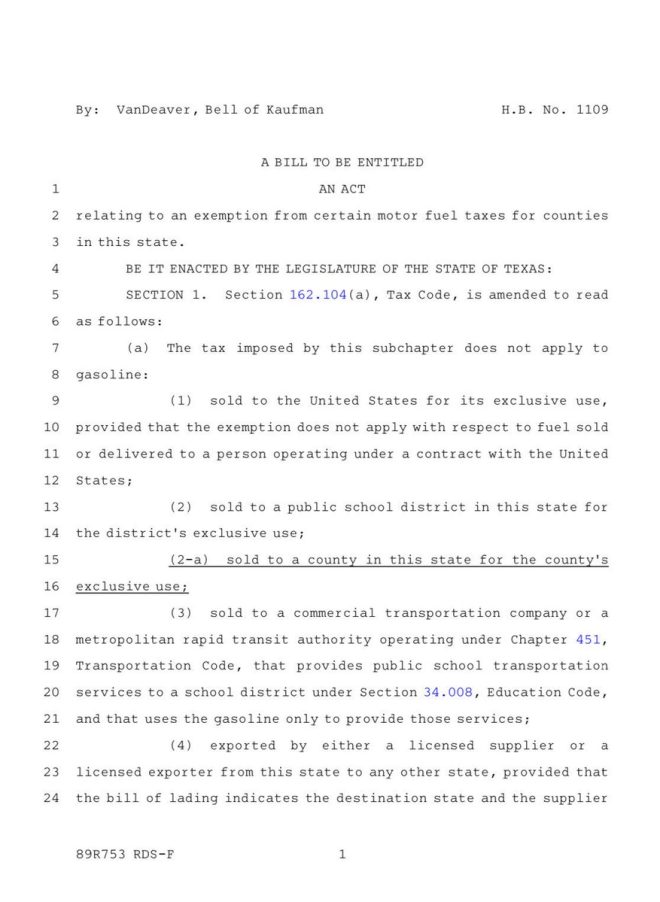

Texas house Passes Bill Exempting Government Entities from Gas Taxes

In a recent legislative move that has sparked widespread outrage among Texans, the Texas House has passed a controversial bill that exempts government entities from paying gas taxes. This decision has raised eyebrows and ignited discussions about the priorities of lawmakers, especially considering that individual taxpayers do not receive any corresponding tax breaks.

The Implications of the Bill

The new bill essentially allows government agencies to bypass gas taxes, which are crucial for funding infrastructure and public services. While proponents argue that this measure will help government entities save on operational costs, critics argue that it undermines the financial burden faced by everyday Texans.

Gas taxes are a significant source of revenue for the state, funding essential services like road maintenance and public transportation. By exempting government entities, the bill not only shifts the tax burden but also highlights a discrepancy in how tax policies are applied to individuals versus government bodies.

Taxpayers vs. Government Entities

One of the main points of contention is the disparity between how taxpayers are treated compared to government entities. Citizens who rely on their personal finances to manage daily expenses are left without any tax relief, while government organizations benefit from this exemption. This raises questions about the priorities of the Texas House and whether they truly have the interests of taxpayers in mind.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Lawmakers are expected to prioritize the needs of their constituents, and this bill appears to do the opposite. Many believe that taxpayer money should be allocated towards financial relief for the citizens of Texas, rather than providing breaks for government agencies.

Public Response and Backlash

The backlash against the bill has been swift and vocal. Many Texans, including lawmakers who opposed the bill, have taken to social media to express their discontent. Critics argue that this exemption sends the wrong message about government accountability and fiscal responsibility.

One prominent voice against the bill is the Texas lawmaker who voted “NO” on the measure, emphasizing the need to put taxpayers first. This sentiment resonates with many residents who feel ignored by their representatives. The decision to prioritize government savings over taxpayer relief has fueled discussions about the need for reform and greater transparency in government spending.

What Does This Mean for Texas Residents?

For the average Texan, the passage of this bill could mean continued financial strain without any relief in sight. With rising gas prices and inflation impacting household budgets, the lack of tax breaks for individuals could exacerbate economic challenges. The decision to exempt government entities from gas taxes may ultimately lead to a further disconnect between the government and the citizens it serves.

Moreover, as gas prices fluctuate, the burden on Texans is likely to increase. Without any tax relief, residents may find themselves struggling to keep up with costs, all while seeing government entities benefit from a tax exemption. This scenario raises critical questions about equity and fairness in tax policy.

Looking Ahead: The Future of Tax Policy in Texas

As the dust settles on this controversial decision, many are left wondering what the future holds for tax policy in Texas. Will lawmakers take into account the voices of their constituents, or will they continue to prioritize government interests over those of the taxpayers?

The backlash against the bill highlights a growing demand for changes in how tax policies are crafted and implemented. Many Texans are calling for more transparency and accountability in government spending, as well as a greater focus on providing relief to individuals who are struggling financially.

In the wake of this bill’s passage, it is likely that discussions surrounding tax reform will continue to gain momentum. Citizens are increasingly vocal about their expectations for elected officials and their desire for policies that prioritize the needs of taxpayers.

Conclusion: A Call for Change

The Texas House’s decision to exempt government entities from gas taxes while ignoring the financial struggles of everyday Texans has sparked outrage and calls for change. As citizens demand accountability and fairness in tax policy, it is essential for lawmakers to listen and respond to the needs of their constituents.

The passage of this bill serves as a reminder that tax policies profoundly impact the lives of individuals and families. It is crucial for legislators to prioritize the interests of taxpayers and ensure that any measures taken reflect the realities faced by everyday Texans. The conversation around tax reform is far from over, and it is up to the citizens of Texas to hold their representatives accountable and advocate for a fair and equitable tax system.

Outrageous: The Texas House just passed a bill to EXEMPT GOVERNMENT ENTITIES FROM GAS TAXES… but does not give individual Texans any tax break at all.

We should be putting TAXPAYERS first… not the GOVERNMENT.

I voted NO. https://t.co/4GR2Xm4GOu

Outrageous: The Texas House just passed a bill to EXEMPT GOVERNMENT ENTITIES FROM GAS TAXES… but does not give individual Texans any tax break at all.

The recent move by the Texas House to pass a bill that exempts government entities from gas taxes has left many Texans feeling frustrated and bewildered. Why is it that the government gets a break while everyday citizens are left to shoulder the burden? This decision seems to prioritize government interests over those of taxpayers, and that’s simply not right. As a Texan, it’s disheartening to see our elected officials making choices that don’t reflect the needs of the people they represent.

We should be putting TAXPAYERS first… not the GOVERNMENT.

This sentiment resonates with countless individuals across the state. The idea that taxpayers should always be the priority is fundamental to a functioning democracy. When lawmakers make decisions that benefit government entities at the expense of the average citizen, it raises serious questions about their priorities. Shouldn’t the focus be on reducing the tax burden for individuals and families instead of providing perks to government agencies? It’s a tough pill to swallow when it feels like the government is getting a free ride while taxpayers continue to struggle with rising costs.

I voted NO.

As a representative who truly cares about the citizens I serve, I found it necessary to vote against this bill. My decision was driven by a commitment to advocate for the people, not the government. Taxpayers deserve better than to be sidelined in favor of government entities. This legislation undermines the basic principle of accountability that should guide public service. When you put taxpayers first, you ensure that resources are allocated efficiently and equitably. The notion that we should prioritize government interests over individual taxpayers is not only misguided but also detrimental to the community as a whole.

The Implications of the Bill

Passing a bill that exempts government entities from gas taxes has several implications. For one, it could lead to increased costs for individual Texans. When government entities save money on taxes, the funding for essential services—like roads, schools, and public safety—doesn’t necessarily increase. Instead, taxpayers end up paying the price through higher fees or reduced services. It’s a classic case of shifting the financial burden without providing any relief to the people who actually fund these services through their taxes.

The Importance of Transparency

Transparency should be at the forefront of government operations. When decisions are made behind closed doors, it breeds distrust among constituents. This recent bill is a prime example of why transparency matters. Texans deserve to know how their tax dollars are being spent and why certain decisions are made. Keeping taxpayers informed fosters a sense of community and encourages civic engagement, which is essential for a thriving democracy. Without transparency, decisions like this one feel arbitrary and self-serving.

Taxpayer Advocacy Groups Weigh In

Taxpayer advocacy groups have expressed their concerns regarding the bill, emphasizing the need for a balanced approach that considers the needs of all citizens. Organizations like the Texas Taxpayers and Research Association advocate for fair taxation policies that benefit individuals rather than government entities. Their message is clear: the focus should be on providing relief to taxpayers, not on creating loopholes for government agencies. It’s a call to action for all Texans to voice their concerns and demand accountability from their representatives.

The Bigger Picture: Gas Taxes and Their Impact

Gas taxes play a crucial role in funding infrastructure projects that benefit everyone. They help maintain and build roads, bridges, and public transportation systems—essential components of a functioning society. When government entities are exempt from these taxes, the overall funding pool shrinks, potentially leading to delayed projects and subpar infrastructure. This can have a cascading effect on the economy, impacting everything from job growth to public safety. It’s vital to consider how such tax exemptions can ripple through the community, ultimately affecting everyone.

What Can Texans Do?

As concerned citizens, it’s essential to stay informed and engage with our representatives. Attend town hall meetings, voice your opinions through social media, and reach out to your elected officials. Let them know how you feel about the recent bill and its implications. Grassroots movements have the power to influence policy decisions and hold lawmakers accountable. By standing up for your rights as a taxpayer, you can make a difference in your community and beyond.

Moving Forward: The Need for Reform

The passage of this bill highlights a pressing need for reform in how our government approaches taxation. It’s time to reevaluate the priorities that guide these decisions. A tax system should be fair and equitable, ensuring that all citizens contribute their fair share while receiving the benefits of public services. Moving forward, we must advocate for policies that prioritize taxpayers and create a more balanced approach to taxation. This includes rethinking exemptions and ensuring that government entities are held to the same standards as the citizens they serve.

Engaging in the Political Process

Engagement in the political process is crucial for driving change. Whether through voting, attending community forums, or participating in discussions, every action counts. As Texans, we have the power to influence the direction of our state. Staying engaged not only helps hold elected officials accountable but also fosters a sense of community among citizens. When we come together to advocate for our rights, we can push for policies that truly reflect the needs of the people.

A Call for Accountability

Accountability is key in government. Elected officials must be held responsible for their decisions, especially when those decisions significantly impact taxpayers. This recent bill is a reminder that we need to remain vigilant in our pursuit of fair and just policies. By demanding accountability from our representatives, we can help ensure that decisions made in the halls of power reflect the values and needs of the community.

Conclusion

As Texans, we deserve better than legislation that prioritizes government entities over individual taxpayers. The passage of this bill is an opportunity for us to reflect on our values and hold our leaders accountable. Moving forward, let’s continue to advocate for policies that put taxpayers first, ensuring that our voices are heard loud and clear. Together, we can work towards a fairer and more equitable taxation system that benefits everyone.

“`

This HTML-formatted article covers the main topics of the Texas House bill, emphasizing the need to prioritize taxpayers over government entities. The conversational tone aims to engage readers while maintaining a clear focus on the issues at hand.