MicroStrategy and Bitcoin: A Critical Financial Update

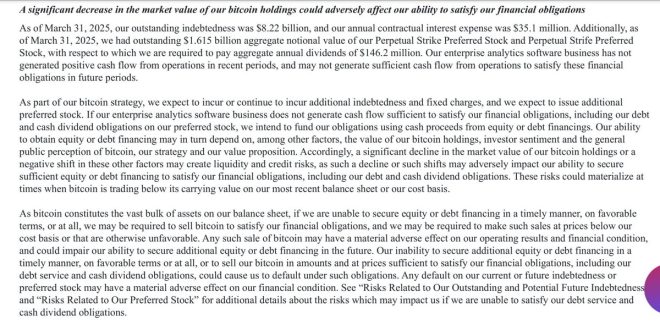

In a recent tweet from Blockchain Daily news, it was reported that MicroStrategy, the prominent business intelligence firm known for its significant investments in Bitcoin, may soon face a challenging financial situation. The company has disclosed in a filing that it might be compelled to sell its Bitcoin holdings at a loss to meet its debt obligations if the current bearish trend in the cryptocurrency market continues. This revelation raises crucial questions about the future of MicroStrategy’s Bitcoin strategy and the implications for its financial health.

Understanding MicroStrategy’s Bitcoin Holdings

MicroStrategy, led by CEO Michael Saylor, has become synonymous with corporate Bitcoin investment, having amassed a substantial amount of Bitcoin since 2020. The firm’s aggressive accumulation strategy was initially driven by the belief that Bitcoin would serve as a hedge against inflation and a store of value. However, as the cryptocurrency market has faced significant volatility, MicroStrategy’s financial strategy has come under scrutiny.

The company’s Bitcoin purchases have often been celebrated as a bold move, but they also come with inherent risks. The market downturns can severely impact the value of their holdings, which are tied to their corporate balance sheet and future financial stability.

Implications of Selling Bitcoin Below Cost Basis

The potential for MicroStrategy to sell Bitcoin below its cost basis is a significant concern. The "cost basis" refers to the original value of an asset, which in this case is significantly higher than the current market price of Bitcoin. Selling at a loss could lead to substantial financial repercussions for the company, including:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Loss of Investor Confidence: Investors may lose faith in MicroStrategy’s leadership and strategic decisions if the company is forced to liquidate its Bitcoin assets at a loss. This could result in a decline in stock prices and overall market capitalization.

- Impact on Debt Servicing: MicroStrategy has taken on considerable debt to finance its Bitcoin purchases. If the company is unable to maintain its Bitcoin holdings, it may struggle to service its debt, leading to potential financial distress or default.

- Market Sentiment: Such a move could negatively affect market sentiment towards Bitcoin and other cryptocurrencies. If a major player like MicroStrategy sells its holdings, it could instigate panic selling among other investors, exacerbating the market downturn.

Potential Market Downturn Factors

Several factors could contribute to a prolonged downturn in the cryptocurrency market:

- Regulatory Scrutiny: Increased regulatory scrutiny on cryptocurrencies can lead to market instability. As governments worldwide evaluate how to regulate digital assets, uncertainty can cause investors to withdraw from the market.

- Macroeconomic Influences: Global economic conditions, such as inflation, interest rate hikes, and geopolitical tensions, can impact investor sentiment and overall market performance. These factors can lead to decreased demand for risk assets like cryptocurrencies.

- Technological Issues: Security breaches, hacks, or issues with blockchain technology can also undermine confidence in the cryptocurrency market, leading to price declines.

MicroStrategy’s Future Strategies

As MicroStrategy navigates these challenges, several strategies may be employed to mitigate risks:

- Diversification: The company could consider diversifying its investments beyond Bitcoin to reduce reliance on a single asset class. Exploring other cryptocurrencies or even traditional assets may provide a buffer against market volatility.

- Hedging Techniques: Utilizing financial instruments such as options or futures contracts could help MicroStrategy manage its exposure to Bitcoin price fluctuations, allowing for more strategic financial planning.

- Investor Communication: Maintaining transparent communication with investors can help build trust and confidence. By outlining a clear strategy for managing its Bitcoin holdings and addressing potential risks, MicroStrategy can foster a more supportive investor base.

Conclusion

The recent filing by MicroStrategy highlights the precarious position the firm finds itself in as the cryptocurrency market continues to fluctuate. The possibility of selling Bitcoin below cost basis to meet debt obligations is a stark reminder of the risks associated with significant investment in volatile assets. As MicroStrategy navigates this turbulent landscape, its strategic decisions will be closely watched by investors and market analysts alike.

In the evolving world of cryptocurrency, companies must remain agile and prepared to adapt to changing market conditions. MicroStrategy’s journey serves as a case study for corporate investment in digital assets, showcasing the potential rewards and risks that come with such a bold financial strategy. The future will determine whether MicroStrategy can maintain its status as a leader in the corporate Bitcoin space or if it will face the consequences of a market downturn. For now, stakeholders should stay informed and vigilant as the situation develops.

JUST IN: MICROSTRATEGY FILING SAYS THEY MAY BE FORCED TO SELL BITCOIN BELOW THEIR COST BASIS TO SERVICE THEIR DEBT IN THE EVENT OF A CONTINUED MARKET DOWN TURN pic.twitter.com/fziqaqHvgN

— blockchaindaily.news (@blckchaindaily) April 9, 2025

JUST IN: MICROSTRATEGY FILING SAYS THEY MAY BE FORCED TO SELL BITCOIN BELOW THEIR COST BASIS TO SERVICE THEIR DEBT IN THE EVENT OF A CONTINUED MARKET DOWN TURN

In the ever-evolving world of cryptocurrency, news travels fast, and sometimes it’s not the kind of news you’d want to hear. Recently, MicroStrategy, a prominent player in the Bitcoin investment space, made headlines with a rather alarming filing. They indicated that they might be compelled to sell their Bitcoin holdings at a loss just to manage their mounting debt if the market continues to slide. This revelation has stirred conversations among investors, analysts, and crypto enthusiasts alike.

Understanding MicroStrategy’s Position in the Crypto Market

MicroStrategy is not your typical tech company. Founded in 1989, it has pivoted towards becoming a major Bitcoin holder under the leadership of CEO Michael Saylor. The company has accumulated a significant amount of Bitcoin over the years, viewing it as a digital gold and a hedge against inflation. However, the recent market downturn has raised questions about their strategy and sustainability.

With Bitcoin’s price fluctuating wildly, MicroStrategy’s large holdings have put them in a precarious position. The company has been vocal about its bullish stance on Bitcoin, but the realities of the market can be unforgiving. If they are forced to sell Bitcoin below their cost basis, it could signal a shift in their strategy and possibly affect their long-term viability.

The Implications of Selling Below Cost Basis

When a company sells an asset below its cost basis, it typically incurs a loss. For MicroStrategy, this would not just be a financial hit; it could also impact investor confidence. Selling Bitcoin at a loss could be perceived as a lack of faith in the asset class, which might lead to a further sell-off in their stocks and Bitcoin holdings.

Investors often look for assurances, and if a company like MicroStrategy, which has been a vocal advocate for Bitcoin, starts to liquidate its holdings, it could shake the very foundations of cryptocurrency confidence. Many would wonder if it’s a sign of a larger issue within the crypto market, especially as volatility continues to be part of the landscape.

Market Reactions and Investor Sentiments

The announcement has led to mixed reactions across the board. Some investors are understandably concerned about what this means for the broader market. If MicroStrategy sells off a significant portion of its Bitcoin, it could create downward pressure on prices, leading to a domino effect across the crypto ecosystem.

On the other hand, some analysts suggest that if MicroStrategy does sell at a loss, it could be a strategic move to stabilize their finances and focus on long-term growth. It’s a tough balancing act, and the approach they take will be closely watched by the investment community.

What Does This Mean for the Future of Bitcoin?

Bitcoin has always been a volatile asset, and this news adds another layer of complexity to its already tumultuous journey. Investors are left wondering how this will affect Bitcoin’s price and, by extension, the entire cryptocurrency market. If a major player like MicroStrategy is forced to sell, it may lead to increased skepticism among investors.

However, it’s also worth noting that Bitcoin has weathered storms before. The crypto community is resilient, and many believe that the fundamentals of Bitcoin—such as its decentralized nature and finite supply—still hold strong. The market might experience short-term fluctuations, but long-term advocates remain optimistic about Bitcoin’s future.

Understanding the Broader Economic Context

MicroStrategy’s situation isn’t happening in a vacuum. The broader economic environment plays a significant role in cryptocurrency markets. Rising interest rates, inflation, and geopolitical tensions can all impact investor sentiment and market stability. When traditional markets are unstable, investors often look for safe havens, and that’s where Bitcoin has gained traction in the past.

As MicroStrategy navigates this tricky landscape, it’s crucial to understand that their actions are influenced by external economic factors as well. The interplay between macroeconomic conditions and cryptocurrency markets is a delicate dance, and MicroStrategy’s decisions will be a reflection of how they adapt to these ongoing challenges.

The Role of Institutional Investors

Institutional investors have been increasingly influential in the cryptocurrency market. Their participation has brought legitimacy to the space, but it also means that their actions can significantly sway market dynamics. MicroStrategy is part of a larger trend where corporations are not just investing in Bitcoin but also integrating it into their balance sheets and business strategies.

As institutional investors weigh the risks and rewards of holding Bitcoin, MicroStrategy’s potential sell-off may set a precedent. Other companies might reassess their strategies based on how MicroStrategy navigates its financial obligations and the market’s reaction to their moves.

What Investors Should Consider Moving Forward

For individual investors, the situation with MicroStrategy serves as a reminder of the inherent risks associated with investing in cryptocurrencies. It’s essential to stay informed and consider the broader market context before making investment decisions. While Bitcoin has attracted many to its potential, it’s vital to remain grounded in reality.

Diversification might be a valuable strategy for those heavily invested in Bitcoin. As the market continues to shift, having a varied portfolio can help mitigate risks. Keeping an eye on institutional movements and economic indicators can also provide insights into where the market might head next.

Conclusion: The Road Ahead for MicroStrategy and Bitcoin

MicroStrategy’s recent filing raises critical questions about the future of Bitcoin and the company’s role within the cryptocurrency ecosystem. As they navigate potential sell-offs and market volatility, all eyes will be on how they manage their debt and investments moving forward. The ripple effects of their decisions may extend far beyond their balance sheet, influencing investor sentiment and the broader crypto market.

For those following the cryptocurrency landscape, it’s a time to stay informed, remain adaptable, and be prepared for whatever twists and turns may come. The world of crypto is unpredictable, but understanding the factors at play can help investors make informed decisions in this fascinating, yet volatile, market.