The Promising Future of Bitcoin and Cryptocurrency: Insights from trump‘s Executive Director

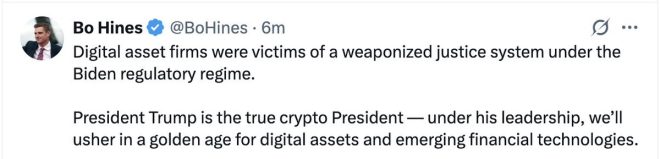

In an exciting announcement, President Trump’s Executive Director has proclaimed a commitment to ushering in a "golden age" for Bitcoin and cryptocurrency in the United States. This statement, shared via a tweet by Bitcoin Magazine, has sparked significant interest and speculation within the financial and tech communities. The implications of this declaration could potentially reshape the landscape of digital currencies in the U.S. and beyond.

Understanding the Context of the Announcement

Cryptocurrency has been a hot topic over the past few years, with Bitcoin leading the way as the most recognized digital asset. The fluctuating value of Bitcoin, regulatory challenges, and the evolving perception of cryptocurrencies among mainstream financial institutions have made it a focal point of discussion. The acknowledgment from a prominent figure within the Trump administration adds a layer of credibility and urgency to the conversation around the future of digital currencies.

The Vision for a "Golden Age"

The phrase "usher in a golden age" suggests a transformative period for Bitcoin and cryptocurrencies. This could mean several things:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Adoption: The administration’s support may lead to greater acceptance of Bitcoin and other cryptocurrencies among businesses and consumers, fostering an environment where digital currencies become a part of everyday transactions.

- Regulatory Clarity: One of the significant hurdles facing cryptocurrency is the lack of clear and consistent regulations. Government endorsement could pave the way for a more defined regulatory framework, giving investors and businesses more confidence in the market.

- Technological Advancements: A push from the government could accelerate technological developments in the cryptocurrency space, including improvements in blockchain technology, security measures, and transaction speed.

- Investment Opportunities: With governmental backing, we could see an influx of investment in cryptocurrencies, both from institutional investors and retail traders. This could lead to increased market stability and growth.

The Current state of Bitcoin

Bitcoin has experienced a rollercoaster ride since its inception in 2009. Its price has seen dramatic highs and lows, influenced by various factors such as market speculation, regulatory news, and technological advancements. As of April 2025, Bitcoin’s value is once again in the spotlight, and the potential for a surge in interest and investment is palpable.

The Role of Bitcoin in the Economy

The integration of Bitcoin and other cryptocurrencies into the mainstream financial system could have profound implications for the economy. Here are some potential benefits:

- Financial Inclusion: Cryptocurrencies can provide financial services to unbanked populations, allowing them to participate in the global economy.

- Decentralization: Bitcoin operates on a decentralized network, reducing the control that traditional banks and governments have over currency. This could lead to a more democratic financial system.

- Inflation Hedge: Many investors view Bitcoin as a hedge against inflation, especially in times of economic uncertainty. This perception may drive more people to adopt Bitcoin as a store of value.

Challenges Ahead

While the announcement is optimistic, there are still significant challenges that must be addressed:

- Regulatory Risks: Although the administration’s support may provide clarity, there is still the risk of unfavorable regulations that could stifle innovation and growth in the sector.

- Market Volatility: Bitcoin and cryptocurrencies are known for their volatility. Investors must navigate this uncertainty, which can deter potential newcomers to the market.

- Technological Barriers: As the technology behind cryptocurrencies evolves, there will be a need for continued innovation to address scalability, security, and user experience issues.

The Future of Cryptocurrency in the U.S.

The endorsement of Bitcoin by a high-ranking official in the Trump administration could be a turning point for the cryptocurrency market. However, it is crucial for stakeholders, including investors, businesses, and regulators, to work together to create a sustainable ecosystem that fosters growth while ensuring consumer protection.

Conclusion

The proclamation from President Trump’s Executive Director that they will "usher in a golden age" for Bitcoin and cryptocurrency is a significant development that could catalyze a new era for digital currencies in the United States. With the potential for increased adoption, regulatory clarity, and technological advancements, the future of Bitcoin looks promising. However, stakeholders must remain vigilant in addressing the challenges that lie ahead to ensure that this optimism translates into a thriving and inclusive cryptocurrency ecosystem.

As we move forward, the interplay between government support, market dynamics, and technological innovation will be critical in shaping the future of Bitcoin and the broader cryptocurrency landscape. The coming months and years will be pivotal in determining how this "golden age" unfolds and what it means for the financial world at large.

JUST IN: President Trump’s Executive Director said they’ll “usher in a golden age” for #Bitcoin & crypto pic.twitter.com/pN1YSIFGQh

— Bitcoin Magazine (@BitcoinMagazine) April 9, 2025

JUST IN: President Trump’s Executive Director said they’ll “usher in a golden age” for Bitcoin & crypto

Recent developments in the world of cryptocurrency have sparked considerable excitement, particularly with comments from President Trump’s Executive Director. In a bold statement, they proclaimed that they would “usher in a golden age” for Bitcoin and crypto in the United States. This announcement has sent waves through the crypto community, igniting discussions among investors, enthusiasts, and skeptics alike. But what does this mean for the future of Bitcoin and the broader cryptocurrency market?

The Context: A Shifting Regulatory Landscape

The landscape of cryptocurrency regulations has been tumultuous over the past few years. Governments worldwide have grappled with how to handle the rise of digital currencies. In the U.S., regulatory clarity has often been lacking, leaving many investors uncertain about the future of their crypto investments. President Trump’s administration had previously taken a somewhat skeptical approach to cryptocurrencies, but this new direction could indicate a significant policy shift.

As the Executive Director’s statement suggests, there may be a newfound openness to embracing Bitcoin and other cryptocurrencies as legitimate financial instruments. This could pave the way for more favorable regulations, which would undoubtedly benefit the crypto market. Many investors are eagerly watching to see how this will unfold and what specific policies might be enacted to support a “golden age” for digital assets.

The Implications of a “Golden Age” for Bitcoin

So, what does a “golden age” for Bitcoin actually look like? For starters, it could mean increased institutional adoption. In recent years, we’ve seen major companies like Tesla and Square invest in Bitcoin, which has helped legitimize the cryptocurrency in the eyes of traditional investors. If the government takes a more supportive stance, we could see even more institutions jumping on board.

Moreover, a favorable regulatory environment could lead to more innovative financial products tied to Bitcoin. Imagine Bitcoin ETFs or investment funds becoming commonplace, making it easier for everyday investors to gain exposure to this digital asset. Such developments could significantly increase demand, driving up the price of Bitcoin and potentially leading to unprecedented levels of mainstream adoption.

How Will This Affect the Broader Crypto Market?

While Bitcoin often grabs the headlines, it’s essential to consider how this “golden age” might impact the entire cryptocurrency ecosystem. The rise of Bitcoin typically has a ripple effect on altcoins (alternative cryptocurrencies). When Bitcoin’s price surges, it often leads to increased interest and investment in other cryptocurrencies like Ethereum, Litecoin, and many others.

A more supportive regulatory environment could also encourage the development of new projects and technologies within the crypto space. This could lead to advancements in blockchain technology, decentralized finance (DeFi), and even non-fungible tokens (NFTs). As innovation flourishes, we may see the emergence of new use cases for cryptocurrencies that we haven’t even imagined yet.

Public Reception and Skepticism

Of course, not everyone is on board with the idea of a golden age for Bitcoin and crypto. Skeptics often point to the volatility of cryptocurrencies and the potential for fraud and scams. The crypto market has seen its fair share of ups and downs, which can make new investors hesitant. Additionally, concerns over security, regulatory scrutiny, and environmental impacts (especially with Bitcoin mining) remain prevalent.

It’s crucial for both enthusiasts and skeptics to engage in constructive conversations about these issues. As the market evolves, addressing concerns and misconceptions will be vital for fostering a more inclusive and informed community. Understanding the risks and rewards associated with cryptocurrency investment is key, especially as we potentially enter a new era for digital assets.

What Investors Should Do Now

For investors, the announcement from President Trump’s Executive Director presents both opportunities and challenges. If you’re considering diving into Bitcoin or other cryptocurrencies, here are a few things to keep in mind:

- Stay Informed: Keep an eye on regulatory developments and news related to Bitcoin and crypto. Understanding the changing landscape can help you make more informed decisions.

- Diversify Your Portfolio: While Bitcoin is often seen as the gold standard in crypto, consider diversifying your investments across various cryptocurrencies to spread risk.

- Understand Your Risk Tolerance: Cryptocurrency investments can be highly volatile. Make sure you’re comfortable with the risks before investing.

- Engage with the Community: Participate in discussions, forums, and social media groups to connect with other investors and stay updated on trends and insights.

The Future of Bitcoin and Crypto

Looking ahead, the potential for a “golden age” for Bitcoin and crypto is certainly exciting. If the regulatory landscape shifts toward a more supportive stance, we could witness transformative changes in how cryptocurrencies are perceived and utilized. The mainstream adoption of Bitcoin and other digital currencies could revolutionize the financial industry, bringing new opportunities for innovation and investment.

As we navigate these changes, it’s essential for everyone—whether you’re a seasoned investor or just starting out—to remain vigilant, informed, and open-minded. The world of cryptocurrency is rapidly evolving, and the possibilities are as vast as our imaginations allow.

Conclusion: Embracing the Future of Crypto

In summary, President Trump’s Executive Director’s remarks about ushering in a “golden age” for Bitcoin and crypto signify a pivotal moment in the cryptocurrency narrative. The potential for increased adoption, favorable regulations, and innovation could significantly impact both investors and the industry as a whole. As we look forward to this future, staying informed and engaged will be key to navigating the exciting world of cryptocurrency.

“`