World Tariffs Now Live: Implications for the US Economy and Wall Street

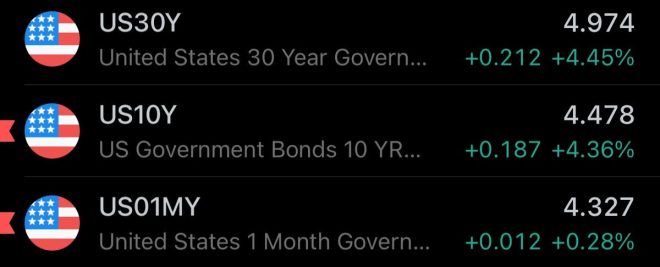

On April 9, 2025, a significant economic development unfolded as world tariffs went live, prompting a wave of reactions from financial analysts and market participants alike. The announcement, made by Joshua Jake via Twitter, highlighted a pressing concern: the US 10-Year Treasury yield reached 4.478%. This development has raised questions about the stability of Wall Street and the potential necessity of Federal Reserve intervention in the markets. This article will explore the implications of the newly implemented world tariffs, the current state of US Treasury yields, and the role of the Federal Reserve in stabilizing the economy.

Understanding World Tariffs

World tariffs are taxes imposed on imported goods, aimed at protecting domestic industries from foreign competition. The implementation of these tariffs can significantly impact international trade, consumer prices, and economic growth. Tariffs can lead to increased production costs for businesses that rely on imported materials, which may, in turn, affect pricing strategies and profit margins.

The introduction of world tariffs is often a reflection of broader economic policies aimed at promoting domestic production and reducing reliance on foreign imports. However, tariffs can also provoke retaliatory measures from other countries, leading to trade wars that further complicate the global economic landscape.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Significance of US Treasury Yields

The US 10-Year Treasury yield is a critical indicator of economic health, representing the return investors receive for lending money to the government for a decade. A rise in yields often signals increased borrowing costs and can impact various sectors, including housing, consumer spending, and corporate investments. The current rate of 4.478% suggests that investors are demanding higher returns, possibly due to inflation expectations, economic uncertainty, or changes in monetary policy.

Higher Treasury yields can lead to increased mortgage rates, which may dampen housing market activity. Additionally, businesses may face higher costs of capital, potentially stalling expansion plans and hiring efforts. As such, the implications of rising yields are far-reaching, affecting both the broader economy and individual consumers.

The Role of the Federal Reserve

In light of the rising Treasury yields and the implementation of world tariffs, the question arises: Will the Federal Reserve intervene to stabilize Wall Street and the broader economy? The Federal Reserve, the central bank of the United States, plays a crucial role in managing monetary policy and ensuring economic stability. Its actions can significantly influence interest rates, inflation, and overall economic growth.

If the economic conditions worsen due to the impact of world tariffs and rising yields, the Federal Reserve may consider several intervention strategies. These could include lowering interest rates, implementing quantitative easing measures, or providing forward guidance to reassure markets. Such actions aim to stimulate economic activity and restore investor confidence.

Market Reactions and Investor Sentiment

The announcement of world tariffs and the rise in Treasury yields have already begun to influence investor sentiment. Market participants are likely to react cautiously, weighing the potential risks and rewards of their investments. Heightened uncertainty may lead to increased volatility in the stock market, as traders adjust their positions in response to changing economic conditions.

Investors may also seek to diversify their portfolios, moving away from sectors most vulnerable to the impacts of tariffs and rising yields. For example, industries reliant on imports or those with thin profit margins may face increased scrutiny as investors reassess their risk exposure. Conversely, sectors that benefit from domestic production and less reliance on international supply chains may see increased interest.

Long-term Implications for the US Economy

The implementation of world tariffs and the corresponding rise in Treasury yields could have long-term implications for the US economy. If tariffs lead to increased production costs and consumer prices, inflation may rise, prompting further actions from the Federal Reserve. This could create a cycle of rising rates and economic uncertainty, impacting consumer confidence and spending.

Moreover, the potential for trade wars could disrupt global supply chains, affecting multinational corporations and their operations. Companies may need to re-evaluate their sourcing strategies and consider relocating production to manage costs effectively. Such adjustments could reshape the landscape of global trade and impact economic relations between the US and its trading partners.

Conclusion

The recent announcement of world tariffs and the subsequent rise in US Treasury yields highlights significant challenges for the US economy and Wall Street. As investors react to these developments, the role of the Federal Reserve becomes increasingly critical in managing economic stability. Understanding the implications of these changes is essential for investors, policymakers, and consumers alike.

As the situation evolves, monitoring the response from both the Federal Reserve and market participants will be key in assessing the long-term impact on the economy. With uncertainties looming, the need for strategic planning and informed decision-making has never been more important. Whether through Federal intervention or market adjustments, the path forward will require careful navigation to ensure sustained economic growth and stability.

BREAKING: World Tariffs are Now Live.

US10Y – 4.478%

Starting to look like the only way Wall Street can be saved is by Fed Intervention. pic.twitter.com/50nURlt3h0

— Joshua Jake (@itzjoshuajake) April 9, 2025

BREAKING: World Tariffs are Now Live

If you’ve been keeping an eye on the financial markets, you might have noticed the buzz around tariffs recently. “BREAKING: World Tariffs are Now Live” has been making waves, and for good reason. This move is expected to have profound implications for global trade, economies, and yes, Wall Street, too. So, what does this really mean for everyday folks as well as investors? Let’s dive into the nitty-gritty.

Understanding World Tariffs

Tariffs are essentially taxes imposed by a government on imported goods. By making foreign products more expensive, the government aims to protect local businesses from international competition. The recent announcement of world tariffs means that countries around the globe have started implementing these taxes, which can lead to various economic ripples.

While tariffs can sometimes be beneficial in protecting domestic industries, they can also lead to higher prices for consumers. You might find yourself paying more for imported goods, and businesses that rely on foreign materials could face increased costs, leading to higher prices on their end too.

The Immediate Impact: US10Y – 4.478%

One of the first points of interest following the announcement was the spike in the US10Y yield, which hit 4.478%. This figure is significant because it reflects the return on investment for a 10-year U.S. Treasury bond. When yields rise, it often indicates that investors are anticipating higher inflation or even a tightening of monetary policy.

Higher yields can impact various sectors, from real estate to equities. If you’ve been thinking about buying a house or investing in stocks, brace yourself. Rising rates could make borrowing more expensive, which might cool off the housing market and lead to fluctuations in stock prices.

Wall Street’s Response

With the announcement that world tariffs are now live and the US10Y yield rising, Wall Street is feeling the pressure. Investors are on edge, and many are looking to the Federal Reserve for guidance. As Joshua Jake pointed out in a recent tweet, it’s starting to look like the only way Wall Street can be saved is by Fed intervention.

But what does Fed intervention look like? Often, it involves the Federal Reserve adjusting interest rates or implementing other monetary policies to stabilize the economy. If they decide to step in, it could mean cutting rates to encourage borrowing and spending, which could, in turn, boost the economy and the stock market.

The Ripple Effect on Global Markets

When large economies like the U.S. implement tariffs, it doesn’t just affect their own markets; it creates a domino effect worldwide. Countries that export goods to the U.S. may see their economies impacted as their products become more expensive for American consumers. This could lead to retaliation in the form of tariffs from those countries, escalating into a trade war.

Trade wars can be damaging not just to the countries involved, but to the global economy as a whole. Supply chains get disrupted, businesses face uncertainty, and consumers end up paying more for goods. According to a report from the [World Bank](https://www.worldbank.org/en/news/feature/2021/01/27/how-the-global-economy-recovered-from-the-pandemic), global trade can slow down significantly in times of high tariffs, leading to a downturn.

What This Means for the Average Consumer

As a consumer, you might be wondering, “How does this impact me?” Well, if you’re in the market for electronics, clothing, or even food items that are imported, you may soon find yourself shelling out more money. Companies will likely pass on the costs of tariffs to consumers, which means higher prices at the checkout line.

Additionally, if you’re a small business owner who relies on imported goods, you may have to rethink your pricing strategy. With tariffs in place, your profit margins could shrink, forcing you to make tough decisions about your business model.

The Long-Term Outlook: Navigating Uncertainty

In times of economic uncertainty, it’s essential to stay informed and adaptable. The implementation of world tariffs and the potential for Fed intervention signals a changing landscape. For investors, this means keeping a close watch on market trends and being prepared for volatility.

If you’re considering investing during this period, diversify your portfolio. By spreading your investments across different sectors and asset classes, you can mitigate risks associated with economic changes.

Conclusion: Stay Informed and Prepared

The announcement of world tariffs and the subsequent rise in the US10Y yield are significant events that will shape the economic landscape for the foreseeable future. With Wall Street looking to the Fed for intervention, we’re in a period of heightened uncertainty.

Make sure to keep an eye on news and updates related to tariffs, interest rates, and market trends. Understanding these dynamics can help you make informed decisions, whether you’re an investor or a consumer. As we navigate through these changes, staying informed is your best strategy for managing your finances effectively.

For more detailed insights, check out the latest updates on platforms like [CNBC](https://www.cnbc.com/) or [Bloomberg](https://www.bloomberg.com/).

Breaking News, Cause of death, Obituary, Today