China’s Record Oil Purchases from Iran: An Overview

In April 2025, it was reported that China has been purchasing record-high amounts of Iranian oil, with figures reaching an astonishing 1.91 million barrels per day in March. This significant development in the global oil market has drawn considerable attention from analysts, policymakers, and industry experts, as it highlights the evolving dynamics between China and Iran in the context of international energy trade.

The Context of China-Iran Oil Trade

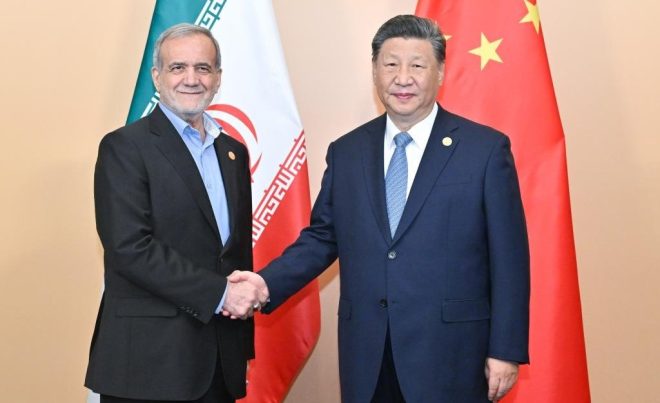

The growing oil trade between China and Iran is a pivotal aspect of both countries’ economic strategies. Over the past few years, China has emerged as one of the largest consumers of oil globally, driven by its rapid industrialization and urbanization. Meanwhile, Iran, facing economic sanctions and restrictions from Western countries, has increasingly turned to China as a primary market for its oil exports.

Factors Driving the Increase in Oil Purchases

Several factors contribute to the record-high oil purchases by China from Iran:

- Sanctions on Iran: The U.S. sanctions on Iranian oil have forced Tehran to seek alternative markets. China, being a non-Western nation, has been more willing to engage in trade with Iran, thereby facilitating the latter’s economic survival amid restrictions.

- China’s Energy Security Strategy: As the world’s second-largest economy, China aims to secure stable energy supplies to sustain its growth. By importing Iranian oil, China diversifies its sources of crude oil, reducing its dependency on more traditional suppliers in the Middle East and beyond.

- Economic Cooperation Agreements: The deepening bilateral relations between China and Iran are underscored by various economic cooperation agreements, including infrastructure investments and trade deals that support oil transactions.

- Discounted Oil Prices: Iranian oil has often been available at discounted prices, making it an attractive option for Chinese importers. This price advantage is particularly appealing in a competitive global market.

Implications for Global Oil Markets

The rise in Iranian oil exports to China has significant implications for global oil markets:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Influence on Oil Prices: The increase in supply from Iran could potentially influence global oil prices, especially if it leads to higher overall output levels in an already saturated market.

- Geopolitical Dynamics: The strengthening of ties between China and Iran could shift geopolitical dynamics in the Middle East. It may lead to increased tensions with countries aligned with U.S. interests, particularly those in the Gulf region.

- Market Adjustments: Other oil-exporting nations may need to adjust their strategies in response to the increased competition from Iranian oil, particularly if China continues to prioritize Iranian imports.

The Future of China-Iran Oil Relations

Looking ahead, the trajectory of the China-Iran oil relationship will likely be shaped by several factors:

- International Relations: Changes in U.S. foreign policy or shifts in the global geopolitical landscape could impact the trade dynamics between China and Iran.

- Energy Transition: As the world moves towards renewable energy sources and seeks to reduce reliance on fossil fuels, the future of oil trade, including that between China and Iran, may face uncertainties.

- Domestic Developments: Iran’s internal political and economic stability will also play a crucial role in its ability to export oil to China and other markets.

Conclusion

The record-high oil purchases by China from Iran underscore a significant shift in the global energy landscape. With China importing 1.91 million barrels per day in March 2025, this trend reflects broader economic and geopolitical dynamics that will likely continue to evolve. As both nations navigate their respective challenges and opportunities in the energy sector, the implications of their relationship will resonate beyond their borders, influencing global oil markets and international relations for years to come.

This development not only highlights the resilience of Iran in the face of sanctions but also underscores China’s strategic approach to securing energy resources. As we move forward, observers of the global oil market will be keenly watching how this relationship unfolds and what it means for the future of energy trade and geopolitical alliances.

BREAKING

China continues to purchase record-high amounts of Iranian oil, reaching 1.91 million barrels per day in March. pic.twitter.com/AtZ13UnDJs

— Globe Eye news (@GlobeEyeNews) April 9, 2025

BREAKING

In recent news, China continues to purchase record-high amounts of Iranian oil, reaching an impressive 1.91 million barrels per day in March. This surge in oil imports has significant implications for both the global oil market and the geopolitical landscape. Let’s dive into this development, exploring its impacts and the reasons behind it.

China’s Oil Demand and Iranian Supply

China’s insatiable appetite for energy has been a driving force in its economic growth. As the world’s second-largest economy, the demand for oil is continuously on the rise. The fact that China is significantly increasing its imports of Iranian oil indicates a strategic pivot in its energy procurement methods. With a staggering 1.91 million barrels per day flowing in from Iran, it’s clear that Beijing is not just looking for any oil—it seeks reliable sources that can help fuel its industries and transportation networks.

The Geopolitical Landscape

This surge in Iranian oil imports comes at a time when the geopolitical landscape is shifting. The relationship between China and Iran has historically been complex, influenced by various factors including economic ties, sanctions imposed by Western countries, and regional stability. China’s increasing reliance on Iranian oil showcases its willingness to engage with nations that are often sidelined in global diplomacy.

Why the Increase in Iranian Oil Imports?

There are several reasons behind China’s record-high purchases of Iranian oil. One of the primary factors is the United States’ sanctions against Iran, which have made it challenging for Iran to sell its oil to traditional markets. Consequently, China has stepped in as a key buyer, offering Iran a much-needed lifeline. This mutually beneficial relationship allows China to secure energy supplies while providing Iran with the economic support it desperately needs.

The Economic Impacts

In the world of oil trading, numbers matter. The 1.91 million barrels per day mark is not just a statistic; it represents billions of dollars flowing into the Iranian economy. This influx can help stabilize Iran’s economy, which has been battered by sanctions and economic mismanagement. For China, it means a steady supply of oil at competitive prices, aiding its energy security strategies.

Global Oil Prices and Market Reactions

When major players like China shift their oil purchasing strategies, the repercussions are felt across global markets. Analysts are closely monitoring how this increase in Iranian oil imports will affect international oil prices. With Iran’s ability to supply oil at discounted rates due to sanctions, it puts pressure on other oil-exporting countries to remain competitive, potentially leading to fluctuations in oil prices worldwide.

Environmental Considerations

While the economic and geopolitical aspects are crucial, we also need to consider the environmental implications of increasing oil consumption. China’s growing reliance on fossil fuels, including Iranian oil, raises questions about its commitment to reducing carbon emissions. As climate change becomes an even more pressing issue, the balance between energy needs and environmental sustainability will be a challenging tightrope for China to walk.

The Future of China-Iran Relations

This unprecedented level of oil trade between China and Iran could lay the groundwork for deeper economic cooperation. The two countries have already signed various agreements aimed at bolstering their economic ties, and the oil trade is likely just the beginning. As both countries navigate their respective challenges, we may witness a strengthening of their partnership, with potential implications for the broader Middle East and beyond.

The Role of Technology in Oil Trade

In the age of digitalization, technology plays a pivotal role in the oil trade. From sophisticated tracking systems to blockchain technology that enhances transparency, both China and Iran are leveraging advanced solutions to optimize their oil transactions. This technological integration can lead to greater efficiency and security in oil trading, further solidifying their economic relationship.

Conclusion

The significant increase in China’s purchases of Iranian oil, now reaching 1.91 million barrels per day, showcases a complex interplay of economic necessity, geopolitical strategy, and market dynamics. As we move forward, it will be fascinating to see how this relationship evolves and what it means for the global oil landscape, environmental policies, and the future of international relations.

Breaking News, Cause of death, Obituary, Today