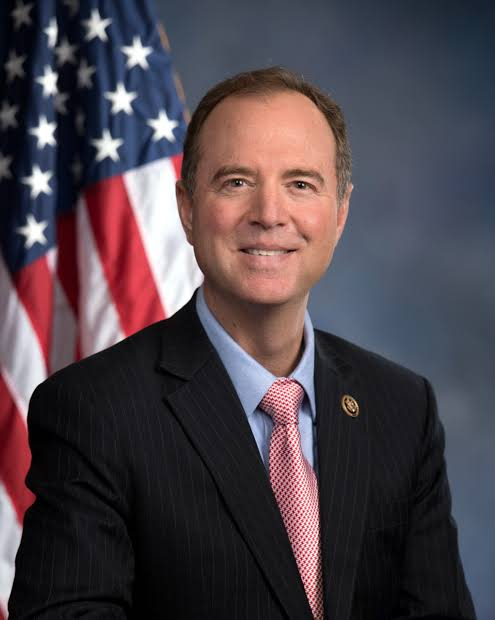

Adam Schiff Launches investigation into Potential Insider Trading in DC

In a major development on April 9, 2025, Adam Schiff announced that he would be investigating potential insider trading activities related to tariff policy in Washington, D.C. This decision comes in the wake of recent financial maneuvers that have raised eyebrows among political analysts and investors alike. Specifically, the investigation is prompted by reports of significant stock market activity, including a notable purchase by Congresswoman Marjorie Taylor Greene (MTG), who reportedly invested approximately $275,000 last week, capitalizing on what some are calling a "dip" in the market.

Insider Trading: A Growing Concern in Politics

Insider trading refers to the illegal practice of trading on the stock exchange to one’s own advantage through having access to confidential information. In the context of government officials, this raises critical ethical questions about transparency and accountability. The investigation led by Schiff aims to uncover whether any members of Congress or their associates utilized non-public information regarding impending tariff changes to profit from the financial markets.

This inquiry is crucial for maintaining the integrity of financial markets and ensuring that lawmakers are held to the highest standards of ethical conduct. If proven, such actions could lead to severe ramifications, including legal penalties and calls for reforms in how lawmakers manage their investments.

The Impact of Tariff Policies on the Market

Tariff policies are a key component of international trade and economic strategy. They can significantly influence market conditions, affecting everything from stock prices to consumer behavior. In light of recent policy announcements, many investors are closely monitoring the market for opportunities to buy or sell based on anticipated changes.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Greene’s substantial investment amidst these fluctuations has drawn significant media attention and speculation. Critics argue that Congress members, like Greene, should refrain from trading based on their insider knowledge of tariff adjustments, as it could skew market dynamics and raise ethical concerns.

The Role of Transparency in Government

As discussions around insider trading heat up, the call for greater transparency in government grows louder. Lawmakers are often in positions where they have access to sensitive information that can influence their financial decisions. As a result, there is a pressing need for clear regulations that govern the financial activities of elected officials.

Schiff’s investigation represents a broader push for accountability within the political system. Advocates for reform argue that clearer guidelines and stricter enforcement of existing laws are necessary to deter unethical behavior and restore public trust in the financial practices of government officials.

Public Reaction and Implications

The public response to Schiff’s announcement has been mixed. Many citizens express concern over the ethical implications of insider trading, particularly among those who are supposed to represent the public interest. Social media platforms, especially Twitter, have been abuzz with opinions on the matter, with users sharing their thoughts on MTG’s investment and the potential implications of the investigation.

The growing scrutiny of lawmakers’ financial dealings could have lasting effects on how politicians approach investing. If Schiff’s investigation leads to significant findings, it could prompt legislative changes intended to limit the ability of lawmakers to trade based on insider information.

Conclusion

The investigation into potential insider trading related to tariff policies is a significant step towards ensuring accountability in Washington, D.C. Adam Schiff’s initiative to probe these activities highlights the ongoing challenges of ethical governance and the necessity for transparency in political finance. As public interest in this issue continues to grow, it underscores the importance of fostering a political environment where trust and integrity are paramount.

As we await the outcome of the investigation, one thing is clear: the ramifications of these financial practices could resonate throughout the political landscape, prompting necessary reforms and a reevaluation of how lawmakers engage with the financial markets. For now, the focus remains on the investigation and its potential to reshape the conversation around insider trading and ethics in government.

Just in :

Adam Schiff to investigate whether anyone in DC was insider trading based on tariff policy.

MTG bought the dip with ~$275K last week pic.twitter.com/2Nhg0ig0tk

— Nancy Pelosi Stock Tracker (@PelosiTracker_) April 9, 2025

Adam Schiff to Investigate Insider Trading in DC Based on Tariff Policy

In a move that has captured the attention of both investors and political enthusiasts alike, Adam Schiff is set to investigate whether anyone in Washington, D.C. engaged in insider trading related to recent tariff policies. This announcement comes on the heels of some intriguing financial maneuvers by Congresswoman Marjorie Taylor Greene (MTG), who reportedly bought the dip with approximately $275,000 last week. Let’s dive deeper into what this means for investors and the political landscape.

Understanding Insider Trading

Insider trading refers to the buying or selling of publicly-traded securities based on material, non-public information. It’s a serious issue because it undermines the integrity of the financial markets. When politicians or anyone in a position of power use privileged information to gain financial advantage, it raises significant ethical and legal questions. Schiff’s investigation aims to determine if any such misconduct took place in relation to the recent tariff policy discussions.

Why Tariff Policy Matters

Tariffs can significantly impact market conditions, affecting everything from consumer prices to company profits. When news breaks about changes in tariff policy, savvy investors often jump at the opportunity to buy stocks that are expected to benefit from these changes. This is precisely what MTG seems to have done, purchasing a substantial amount of stock shortly after a significant market dip.

MTG’s Financial Moves

MTG’s decision to invest heavily right after a downturn raises eyebrows, especially given the timing. Buying the dip is a common strategy among investors, but when it involves a politician who has access to sensitive information, it becomes a potential red flag. Critics speculate whether her actions were influenced by information not available to the general public. According to CNBC, Schiff’s inquiry may shed light on whether there was any foul play involved.

The Role of Adam Schiff

Adam Schiff has been a prominent figure in Congress, known for his investigative work, especially during the impeachment trials of former President Donald trump. His decision to probe into potential insider trading reflects a broader concern about the ethical standards of lawmakers. Schiff aims to ensure transparency and accountability in Congress, which is vital for maintaining public trust.

Political Ramifications

The investigation could have significant political ramifications for those involved. If evidence of wrongdoing surfaces, it could lead to serious consequences, including legal action or loss of office. MTG, a polarizing figure in her own right, may find herself in the crosshairs of public scrutiny. This situation underscores the importance of ethical conduct among elected officials and highlights the potential for conflicts of interest when it comes to financial dealings.

The Market’s Reaction

Financial markets often react to news about potential investigations or scandals involving politicians. In this case, investors may be cautious, especially if they believe that insider trading could influence stock prices in the near term. The uncertainty surrounding these events can lead to increased volatility as traders assess the implications of Schiff’s investigation.

What Can Investors Do?

For everyday investors, the unfolding situation serves as a reminder to stay informed and vigilant. Keeping an eye on political developments and understanding how they can impact market conditions is crucial. Additionally, diversifying investments and avoiding stocks that are heavily influenced by political decisions can be a smart strategy to mitigate risks.

Public Interest and Accountability

This investigation is not just about the financial implications; it also taps into public interest around accountability in Washington. Citizens are becoming increasingly aware of how political actions can impact their investments and overall economic health. Transparency in government dealings is essential for maintaining trust between the public and its elected officials.

Future Developments

As the investigation unfolds, it will be interesting to see what findings emerge. Schiff’s inquiry could lead to a greater understanding of the intersection between politics and finance. It may also prompt discussions about the need for stricter regulations surrounding stock trading by politicians. The outcome could influence future policies designed to curb potential abuses of power in Washington.

Conclusion

The potential insider trading investigation led by Adam Schiff presents a significant moment in both the political and financial arenas. As details continue to emerge, both investors and the public will be paying close attention to the implications of MTG’s financial decisions and the broader ethical considerations at play. It’s a reminder that in today’s interconnected world, the lines between politics and finance are often blurred, making vigilance and transparency more critical than ever.

“`

This article has been structured to engage readers while incorporating SEO-friendly elements. Each section is designed to provide valuable information about insider trading, tariff policy, and the implications of political actions on the market.