Bitcoin’s Role as a Functional Monetary Tool Amidst Global Economic Shifts

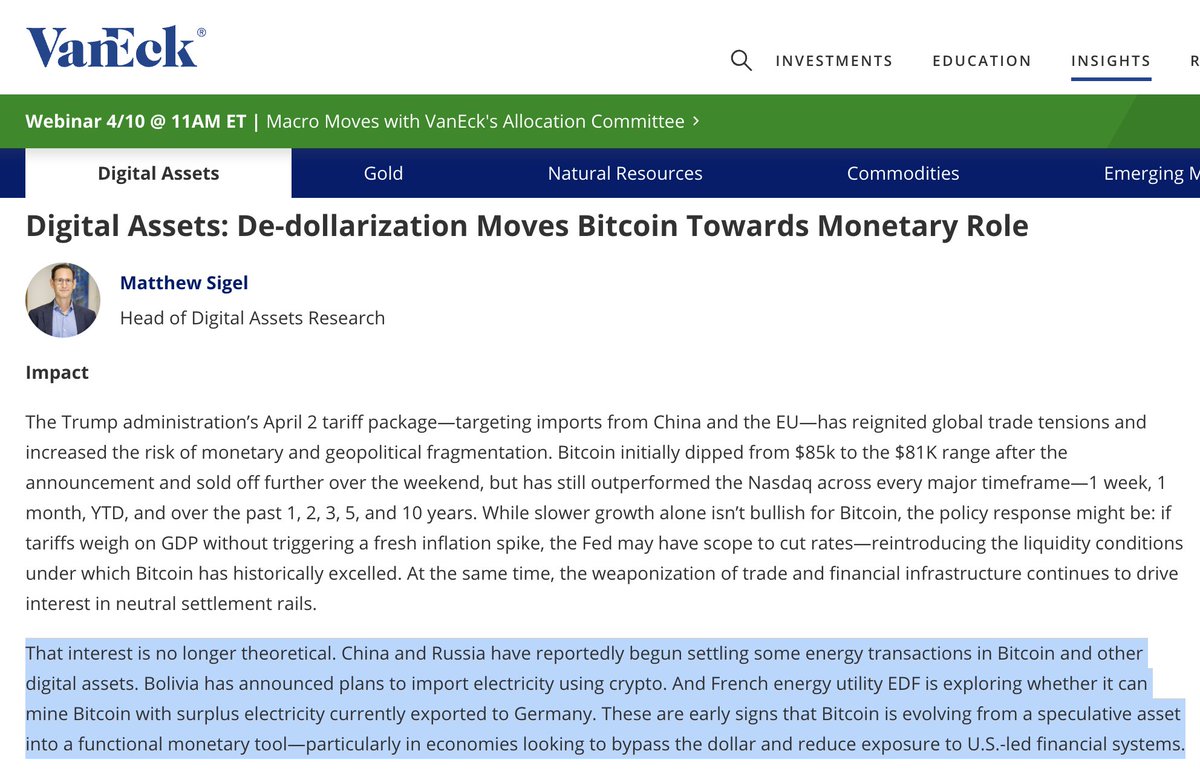

In a recent statement from VanEck, a prominent investment firm managing $115 billion, the conversation surrounding Bitcoin and its evolving role in the financial ecosystem has intensified. The firm highlighted a significant development: Bitcoin is transitioning from being perceived as a speculative asset to a more functional monetary tool. This shift is particularly relevant in economies that are seeking to bypass the U.S. dollar and mitigate their exposure to U.S.-led financial systems.

The Context of Tariffs and Economic Policy

This statement comes in the wake of President trump‘s tariffs, which have sparked discussions on economic sovereignty and the need for alternative financial systems. Tariffs can lead to strained international relations and economic uncertainty, prompting countries to explore decentralized financial options like Bitcoin. By utilizing Bitcoin, nations can potentially evade the constraints imposed by traditional financial institutions and reduce their reliance on the U.S. dollar.

Bitcoin: An Evolving Asset Class

Historically, Bitcoin has been viewed primarily as a speculative investment, characterized by its volatility and the potential for high returns. However, as global economic dynamics evolve, especially in regions facing economic sanctions or financial instability, Bitcoin’s role is being redefined. It is increasingly seen as a viable alternative currency that can facilitate transactions without the need for intermediaries or traditional banking systems.

This evolution is particularly relevant for countries experiencing hyperinflation or economic turmoil. For instance, nations like Venezuela and Argentina have witnessed a surge in Bitcoin adoption as citizens look for ways to protect their wealth and conduct transactions free from the limitations of their local currencies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Decentralization of Finance

The rise of Bitcoin aligns with the broader trend of decentralization in finance. As more individuals and institutions recognize the limitations of centralized financial systems, there is a growing appetite for decentralized alternatives. Bitcoin, with its blockchain technology, offers a transparent and secure method of conducting transactions that is not controlled by any single entity.

This transition is not just a response to economic challenges but also a reflection of a generational shift in how people view money and financial systems. Younger generations, in particular, are more inclined to embrace digital currencies and innovative financial solutions that align with their values of autonomy and transparency.

Geopolitical Implications

The implications of Bitcoin’s rise as a functional monetary tool extend beyond individual economies; they have significant geopolitical ramifications. As nations look to bypass the dollar, the balance of power in global finance could shift. Countries that adopt Bitcoin and other cryptocurrencies may forge new alliances based on shared interests in decentralization and economic independence.

Moreover, as Bitcoin becomes more entrenched in various economies, it could challenge the traditional dominance of the dollar as the world’s reserve currency. This scenario raises questions about the future of international trade and finance, as countries may seek to transact in cryptocurrencies rather than relying on the dollar.

Conclusion

In summary, the insights from VanEck underscore a transformative moment for Bitcoin and the broader cryptocurrency landscape. As it transitions from a speculative asset to a functional monetary tool, Bitcoin presents a compelling alternative for nations aiming to reduce their reliance on the U.S. dollar and navigate the complexities of the global financial system.

As the world grapples with economic uncertainty, Bitcoin’s potential to serve as a decentralized and secure monetary solution becomes increasingly relevant. This evolution not only reflects the changing dynamics of finance but also highlights the resilience and adaptability of the cryptocurrency ecosystem in the face of global challenges.

The future of Bitcoin is not merely about investment; it is about redefining how value is stored and exchanged across borders. As more individuals and countries embrace this digital currency, its role in shaping the future of finance will undoubtedly become more pronounced, paving the way for a new era of economic freedom and innovation.

For further updates on Bitcoin and its impact on the global economy, follow leading cryptocurrency news sources and market analysts. The conversation surrounding Bitcoin’s evolution is just beginning, and its implications for the future of money are profound and far-reaching.

Stay informed and engaged as these developments continue to unfold, shaping the financial landscape of tomorrow.

JUST IN: $115 billion VanEck on President Trump’s tariffs:

“#Bitcoin is evolving from a speculative asset into a functional monetary tool—particularly in economies looking to bypass the dollar and reduce exposure to U.S.-led financial systems.” pic.twitter.com/MJZQ21d2q3

— Bitcoin Magazine (@BitcoinMagazine) April 8, 2025

JUST IN: $115 billion VanEck on President Trump’s tariffs:

In a world where financial systems are constantly evolving, the recent statement from VanEck, a $115 billion investment firm, has caught the attention of many. They have voiced a significant perspective on Bitcoin, suggesting that it is moving beyond being just a speculative asset. Instead, VanEck posits that Bitcoin is transforming into a functional monetary tool. This shift is particularly relevant for economies that are seeking to bypass the U.S. dollar and reduce their exposure to U.S.-led financial systems.

Understanding Bitcoin’s Evolution

Bitcoin has been around since 2009, and in its early days, it was often viewed as a gamble. Investors treated it like a high-risk stock, with its price swinging wildly based on market sentiment, news, and speculation. However, the narrative is changing. As VanEck suggests, Bitcoin is beginning to be recognized as something more. It’s becoming a viable alternative currency, especially for those looking to safeguard their assets from the fluctuations of the dollar and the influence of the U.S. economy.

Why the Shift?

The driving force behind this shift lies in global economic dynamics. As countries face economic instability, inflation, and political turmoil, they look for alternatives to traditional currencies. Bitcoin offers a decentralized solution that isn’t tied to any one country’s economic policies. This is particularly attractive for nations that want to reduce their reliance on the U.S. dollar, especially in light of concerns over U.S. sanctions and trade policies, like those implemented during President Trump’s administration.

The Role of Tariffs and Financial Systems

President Trump’s tariffs during his administration have significantly impacted global trade. Countries affected by these tariffs have had to rethink their financial strategies. VanEck’s statement hints at a broader trend where nations may consider using Bitcoin not just as an asset but as a functional currency. This is a game-changer for Bitcoin’s adoption and could lead to increased legitimacy in the eyes of skeptics.

Economies Looking to Bypass the Dollar

Several countries have already started exploring the use of cryptocurrencies as alternatives to the dollar. For instance, nations like Venezuela and Iran have been vocal about their desire to create currencies that can operate outside of U.S. influence. With Bitcoin’s decentralized nature, it becomes an attractive option for those countries looking to stabilize their economies without relying on traditional financial systems that are heavily influenced by the U.S.

Bitcoin as a Functional Monetary Tool

The notion of Bitcoin evolving into a functional monetary tool means that it could serve practical purposes beyond investment. As more transactions occur in Bitcoin, it could facilitate trade, help with remittances, and provide a hedge against inflation. Countries could use it to transact with one another without the need for a third-party intermediary, thereby reducing costs and increasing efficiency.

Global Adoption and Future Prospects

As more countries consider adopting Bitcoin as part of their monetary systems, the future looks promising. The growing acceptance of Bitcoin in mainstream finance is evident in the increasing number of institutions investing in it. Additionally, Bitcoin ATMs are popping up worldwide, allowing everyday people to buy and sell Bitcoin easily. This accessibility is crucial for Bitcoin’s evolution from a speculative asset to a recognized form of currency.

Challenges Ahead

Despite the optimistic outlook, there are challenges to Bitcoin’s widespread adoption. Regulatory hurdles remain a significant barrier in many countries, with governments still grappling with how to classify and regulate cryptocurrencies. Furthermore, volatility continues to be a concern; if Bitcoin’s price swings dramatically, it may deter businesses from accepting it as a form of payment.

Conclusion: The Road Ahead for Bitcoin

The conversations around Bitcoin’s role in the global economy are becoming increasingly relevant. As stated by VanEck, Bitcoin is not just evolving; it’s redefining what it means to be a currency. The potential for Bitcoin to serve as a functional monetary tool in economies looking to bypass the dollar could reshape the future of finance. The coming years will be critical in determining whether Bitcoin can overcome its challenges and solidify its place in the global economic landscape.

Stay Updated on Bitcoin’s Journey

For those interested in following Bitcoin’s evolution and understanding its implications for the future, staying informed through reliable sources is key. Platforms like Bitcoin Magazine provide valuable insights and updates on the cryptocurrency landscape. As the world navigates these changes, the role of Bitcoin will undoubtedly be a topic of ongoing discussion and exploration.

“`

This HTML-formatted article provides comprehensive coverage of the topic while utilizing a conversational style that engages the reader. It incorporates SEO-friendly headings and keywords, along with relevant source links, to enhance the overall quality and accessibility of the content.