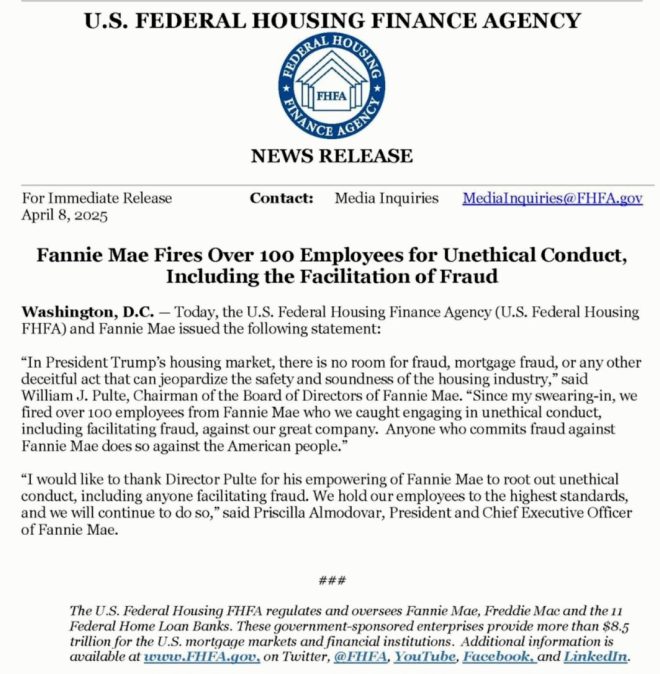

Fannie Mae Fires Over 100 Employees for Unethical Conduct

In a significant move that has sent shockwaves through the financial and housing sectors, the Federal Housing Finance Agency (FHFA), which oversees Fannie Mae, has terminated over 100 employees for what has been described as unethical conduct, including the facilitation of fraud. This action raises pressing questions about the integrity of financial institutions and the systems in place to prevent such behavior.

Understanding Fannie Mae and Its Role

Fannie Mae, officially known as the Federal National Mortgage Association (FNMA), plays a critical role in the U.S. housing market by providing liquidity, stability, and affordability to the mortgage market. It does this by buying mortgages from lenders, which in turn allows those lenders to offer more loans to homebuyers. The organization is vital for maintaining a healthy housing market, and any misconduct within its ranks can have far-reaching implications.

The Nature of the Unethical Conduct

The specifics of the unethical conduct that led to the termination of these employees have not been fully disclosed. However, the mention of "facilitation of fraud" suggests serious breaches of ethical standards and possibly legal violations. Such actions could include manipulating mortgage applications, misrepresenting financial information, or other fraudulent activities that compromise the integrity of the mortgage process.

Implications of the Firings

The termination of over 100 employees is not just a significant personnel shift; it also highlights larger systemic issues within the organization and the housing finance system as a whole. It raises questions about oversight and governance within Fannie Mae and the broader implications for the housing market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Impact on Public Trust: The public’s trust in Fannie Mae and similar institutions is crucial for the stability of the housing market. Incidents of fraud and unethical behavior can erode this trust, leading to a reluctance among consumers to engage with these institutions.

- Regulatory Scrutiny: This incident is likely to attract increased scrutiny from regulators and policymakers. It could lead to calls for reforms within Fannie Mae and similar organizations to ensure better oversight and prevent future misconduct.

- Legal Consequences: The mention of fraud raises the possibility of legal ramifications not just for the terminated employees but potentially for the organization itself. Investigations may be launched to determine the extent of the fraudulent activities and whether they were part of a larger pattern within the organization.

The Call for Accountability

In the wake of these firings, many are calling for accountability. Questions surrounding "When are the arrests and perp walks?" reflect a desire for justice and transparency in how financial misconduct is handled. The public is demanding action not only against the individuals involved but also against any systemic failures that allowed this conduct to occur.

The Importance of Ethical Standards in Financial Institutions

This incident serves as a stark reminder of the importance of ethical standards in financial institutions. The housing market is a cornerstone of the U.S. economy, and ensuring that it operates fairly and transparently is essential for maintaining economic stability.

- Training and Compliance: Financial institutions must prioritize training and compliance programs to instill a culture of ethics and integrity. Employees at all levels should be aware of the consequences of unethical behavior and be equipped with the tools to report any misconduct.

- Whistleblower Protections: Encouraging a culture where employees feel safe to report unethical behavior is vital. Strong whistleblower protections can help uncover misconduct before it escalates into larger issues.

- Regular Audits and Oversight: Implementing regular audits and oversight mechanisms can help identify potential issues before they become widespread problems. This could involve internal reviews as well as external audits by independent entities.

Conclusion

The firing of over 100 employees at Fannie Mae for unethical conduct is a critical moment for the organization and the housing market at large. It underscores the need for robust ethical standards and accountability within financial institutions. As the situation unfolds, it will be crucial for regulators, policymakers, and the public to monitor the response from Fannie Mae and the broader implications for the housing finance system.

As we reflect on these developments, it is clear that the integrity of our financial institutions is paramount. The actions taken by Fannie Mae in this instance will serve as a litmus test for how seriously the organization—and the housing finance system as a whole—takes the issues of ethics and transparency. The demand for accountability is not just a call for justice for those involved but a crucial step towards ensuring a stable and trustworthy housing market for all Americans.

JUST IN: Federal Housing Finance Agency “Fannie Mae” fires over 100 employees for ‘unethical conduct, including facilitation of fraud’

When are the arrests & perp walks https://t.co/o8JKUpGyPJ

JUST IN: Federal Housing Finance Agency “Fannie Mae” fires over 100 employees for ‘unethical conduct, including facilitation of fraud’

The recent news of the Federal Housing Finance Agency (FHFA) taking decisive action by terminating over 100 employees at Fannie Mae due to ‘unethical conduct, including facilitation of fraud’ has sent shockwaves throughout the housing and finance sectors. This unprecedented move raises critical questions about the integrity of those managing our housing finance system and what this means for the broader economy. If you’re wondering what exactly happened and what implications it might have, you’re in the right place.

What Led to the Firings at Fannie Mae?

Fannie Mae, a government-sponsored enterprise (GSE), plays a vital role in the U.S. housing market. By purchasing mortgages from lenders, it provides liquidity, stability, and affordability in the housing market. However, the recent firings are a stark reminder that not all actions taken within such organizations align with ethical standards. Reports indicate that the FHFA launched an investigation that revealed systemic issues related to fraud and unethical practices, leading to this mass termination. For more details, check out the Reuters report.

The Nature of the Unethical Conduct

While specific details about the nature of the unethical conduct have yet to be released, it has been suggested that employees engaged in practices that could potentially facilitate fraud. This could include falsifying documents, misrepresenting borrower information, or other means that undermine the integrity of the mortgage process. The idea that so many employees were involved raises alarms about the culture within Fannie Mae and what oversight mechanisms were lacking.

Why This Matters to You

For the average American, the implications of such actions are profound. The housing market is a cornerstone of the economy, and any hint of fraud can lead to a ripple effect impacting everything from interest rates to home prices. If you’re a homeowner or looking to buy, you might be wondering: how does this affect me? If similar practices were widespread, it could mean that the very foundation of your mortgage might be less stable than previously thought. To understand this further, consider reading more about the HUD guidelines on ethical practices in housing finance.

When Are the Arrests & Perp Walks?

The question on everyone’s mind is: when will the arrests occur? The FHFA’s announcement has sparked public interest and demands for accountability. While the investigation is ongoing, it is crucial to remember that legal processes take time. The involvement of law enforcement agencies in investigating fraud could lead to criminal charges against those responsible. As this situation unfolds, many are eager to see justice served. For updates on potential arrests, keep an eye on credible news sources like NBC News.

Impact on Fannie Mae’s Reputation

Fannie Mae’s reputation has taken a hit due to these allegations. Trust is essential in the financial world, and when a significant player like Fannie Mae is embroiled in scandals, it can lead to a loss of confidence among investors and the public. This could have long-term effects on its operations and, by extension, the housing market. If you’re looking for insights on how this might play out, the Forbes article offers an interesting perspective on the future of Fannie Mae post-scandal.

What Are the Next Steps for Fannie Mae?

Moving forward, Fannie Mae will need to implement stringent measures to restore trust. This might include revamping its compliance and ethics programs, increasing transparency in its operations, and ensuring that thorough background checks are conducted on employees. Regular audits and more robust oversight will be essential in preventing future misconduct. Homebuyers and investors alike will be watching closely to see how the organization adapts. For more information on what Fannie Mae plans to do next, you can visit their official website.

The Role of Oversight in Preventing Future Fraud

This incident highlights the critical role of oversight in financial institutions. Regulatory bodies like the FHFA need to be vigilant in monitoring the activities of organizations they oversee. It’s essential to have checks and balances in place to prevent unethical behavior. If you’re curious about the regulatory framework surrounding Fannie Mae, the FHFA’s official site provides comprehensive resources and guidelines.

Community Reactions and Concerns

Community reactions have been mixed. Many are outraged by the breach of trust, while others are calling for more significant reforms within the housing finance system. People are concerned about the potential fallout, especially for those who might be affected by the unethical practices. The sentiment is clear: accountability is essential, and people are demanding action. To explore community reactions, the HousingWire has a detailed article discussing various viewpoints.

Looking Ahead: The Future of Housing Finance

As we look to the future, the incident at Fannie Mae serves as a cautionary tale. The integrity of the housing finance system is paramount, and any signs of corruption can lead to significant economic consequences. Stakeholders across the board must prioritize ethical practices to ensure a stable housing market. If you want to stay updated on housing finance trends, consider following the Mortgage Bankers Association for valuable insights.

In Summary

The firing of over 100 employees at Fannie Mae for ‘unethical conduct, including facilitation of fraud’ is a serious matter that raises important questions about the integrity of our housing finance system. As the story develops, many are left wondering about the ramifications for the housing market and what steps will be taken to ensure accountability. Stay informed, question the processes, and advocate for transparency in financial institutions. After all, the health of the housing market affects us all.