President trump‘s Stance on Stock Market Volatility

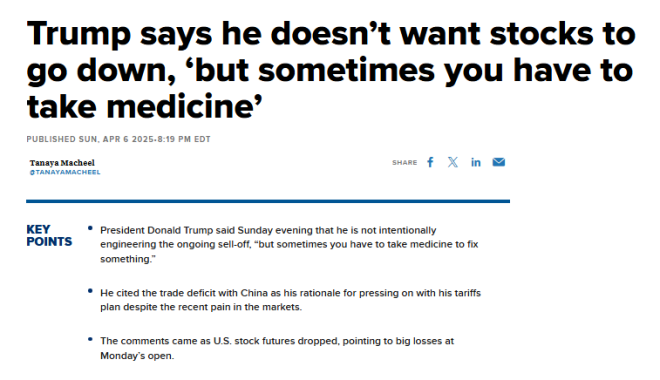

On April 7, 2025, a significant statement from former President Donald Trump highlighted his views on stock market fluctuations. In a tweet shared by Barchart, Trump expressed his concerns regarding the stock market’s performance, indicating that he does not wish for stock prices to decline. However, he acknowledged the necessity of facing tough economic realities, suggesting that "sometimes you have to take your medicine." This statement has attracted considerable attention, prompting discussions on its implications for investors, policymakers, and economic analysts.

Understanding Trump’s Position

Trump’s commentary reflects a broader sentiment often experienced during periods of economic uncertainty. His acknowledgment that the stock market may need to "take its medicine" suggests an understanding that temporary downturns can be part of a healthy economic cycle. Such statements resonate with investors who are often apprehensive about market volatility and the potential risks associated with market corrections.

The Economic Context

The stock market is an essential barometer of economic health, often influenced by various factors, including economic policies, interest rates, and global events. Trump’s comment comes at a time when many investors are grappling with uncertainty surrounding inflation, interest rate hikes, and geopolitical tensions. His acknowledgment of the need for "taking medicine" can be interpreted as a call for patience and resilience among investors, emphasizing that short-term fluctuations should not deter long-term investment strategies.

Market Reactions to Political Statements

Political figures like Trump hold significant sway over market sentiment. Statements made by such leaders can lead to immediate reactions in stock prices, often resulting in increased volatility. Investors are known to be sensitive to political rhetoric, particularly regarding economic policies that may affect corporate profits, taxation, and regulatory environments. Trump’s comments, therefore, may prompt investors to reassess their strategies and risk tolerance in light of potential market changes.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Importance of Investor Sentiment

Investor sentiment plays a crucial role in market dynamics. When influential figures like Trump convey a message of caution, it can create ripples throughout the investment community. The stock market often reacts not solely to economic data but also to the psychological factors that drive investor behavior. Trump’s expression of concern may lead to increased caution among investors, potentially affecting trading volumes and market liquidity.

The Role of Economic Indicators

Understanding the factors that influence stock market behavior is essential for investors. Economic indicators such as GDP growth, unemployment rates, and consumer spending significantly impact stock market performance. Trump’s statement highlights the complexity of these dynamics, suggesting that while he hopes for a robust market, he recognizes the reality that economic corrections may be necessary to maintain long-term stability.

Long-Term vs. Short-Term Investment Strategies

One of the critical takeaways from Trump’s statement is the distinction between short-term and long-term investment strategies. Investors often face tough decisions during periods of volatility. While some may be tempted to liquidate their holdings in response to declining stock prices, others may choose to adopt a long-term perspective, viewing downturns as opportunities to acquire undervalued assets. Trump’s acknowledgment of "taking medicine" may resonate with long-term investors who understand that market cycles are natural and that growth often follows periods of decline.

Historical Perspectives on Market Corrections

Historically, markets have undergone numerous corrections and bear markets, often leading to periods of economic recovery and growth. Notable examples include the dot-com bubble burst in the early 2000s and the financial crisis of 2008. After each of these downturns, the markets rebounded, demonstrating resilience and the potential for growth. Trump’s statement serves as a reminder of this cyclical nature of the market, encouraging investors to remain optimistic about eventual recovery.

Navigating Market Uncertainty

For investors navigating the complexities of the stock market, Trump’s comments reinforce the importance of having a well-defined investment strategy. Diversification, risk management, and a focus on fundamental analysis can help investors withstand market volatility. Understanding that corrections can serve as opportunities for growth is vital in maintaining a balanced approach to investing.

Conclusion: A Call for Resilience

Trump’s remarks about the stock market encapsulate a broader message about resilience in the face of economic challenges. While he expressed a desire for stocks to remain stable, he recognized the inevitability of economic adjustments. This perspective serves as a reminder for investors to remain vigilant, adaptable, and informed during periods of uncertainty. By understanding the broader economic context and maintaining a long-term investment strategy, investors can navigate the complexities of the stock market with confidence.

In summary, the interplay between political commentary and market dynamics is a critical aspect of the investment landscape. Trump’s statement invites further discussion on the implications of stock market volatility, urging investors to consider both the challenges and opportunities that arise in the ever-evolving economic environment.

JUST IN : President Trump says he doesn’t want stocks to go down but sometimes you have to take your medicine pic.twitter.com/TylQ6WOtzs

— Barchart (@Barchart) April 7, 2025

JUST IN : President Trump says he doesn’t want stocks to go down but sometimes you have to take your medicine

When it comes to the stock market, it can feel like you’re on a rollercoaster ride. One moment, you’re soaring high, and the next, you’re plummeting down. Recently, former President Donald Trump made headlines with his candid remarks about the state of the stock market, indicating that while he doesn’t want stocks to decline, sometimes “you have to take your medicine.” This statement resonates with many investors and market watchers who are trying to navigate the complexities of investing in today’s economic climate.

The Stock Market Rollercoaster

Let’s face it, the stock market is unpredictable. It’s influenced by a myriad of factors ranging from economic indicators to political events. Trump’s acknowledgment of the need to “take your medicine” suggests he understands that market corrections are part of the investing game. After an extended period of growth, many investors may feel anxious when they see red on their screens. It’s essential to remember that dips in the market can be healthy and necessary for long-term growth.

In the wake of Trump’s comments, investors may be pondering whether this is a signal to sell or hold their stocks. Understanding market cycles can help investors make informed decisions. Historically, after significant drops, the market often bounces back, leading to new highs. So, while the sentiment might lean towards negativity, history tells a different story.

What Does “Taking Your Medicine” Mean for Investors?

When Trump mentions “taking your medicine,” he’s touching on the reality that sometimes you have to face difficult truths. In investing, this could mean accepting losses or making tough decisions about your portfolio. For many, the fear of losing money can lead to irrational decisions, such as panic selling or holding onto underperforming stocks in the hope they will rebound.

Taking your medicine can also imply the necessity of reevaluating your investment strategies. Are you holding onto stocks that no longer align with your financial goals? Should you diversify your portfolio to mitigate risk? These are the types of questions every investor should consider, especially in uncertain times.

The Psychology of Investing

Investing is as much about psychology as it is about numbers. When the market dips, emotions can run high. Fear, anxiety, and uncertainty can cloud judgment, leading to decisions that may not be in your best interest. Trump’s statement serves as a reminder that while it’s tough to watch your investments decline, it’s crucial to maintain a clear head.

Investors should focus on their long-term goals rather than short-term fluctuations. Understanding that market downturns are often temporary can help mitigate the emotional stress associated with investing. Remember, every investor experiences losses; it’s how you respond that matters.

Market Trends and Economic Indicators

To better navigate the stock market, it’s vital to keep an eye on economic indicators. Factors such as unemployment rates, inflation, and consumer confidence can significantly impact stock performance. For instance, if unemployment rates are rising, it may indicate a slowing economy, which can lead to a decline in consumer spending and, subsequently, a drop in stock prices.

By staying informed about these trends, investors can make more educated decisions about when to buy or sell. Tools like [Barchart](https://www.barchart.com) offer insights into these economic indicators, helping investors understand market movements better.

The Importance of Diversification

One of the best ways to mitigate risk in the stock market is through diversification. By spreading your investments across various sectors, industries, and asset classes, you can protect your portfolio from significant losses. If one sector is struggling, others may be thriving, helping to balance your overall investment performance.

Trump’s remarks about taking your medicine can also be a cue to reassess how diversified your portfolio is. Are you heavily invested in tech stocks? What about healthcare or consumer goods? Ensuring a balanced approach can provide a safety net during turbulent times.

Learning from the Past: Historical Market Corrections

History has shown us that market corrections, while unsettling, are often followed by periods of recovery. For example, the market experienced significant downturns in 2000 and 2008, but subsequent recoveries led to some of the most prosperous years for investors. Understanding these historical patterns can empower investors to weather the storm during downturns.

It’s also worth noting that corrections can create opportunities. When stocks are down, savvy investors may find bargains to add to their portfolios. So, while Trump’s comments may initially seem alarming, they can also serve as a reminder to look for potential opportunities amidst adversity.

Investing Strategies for Uncertain Times

In light of Trump’s comments and the current state of the market, it may be time to revisit your investing strategy. Here are a few tips to consider:

1. **Stay Informed**: Keep up with market news and economic indicators that could impact your investments.

2. **Reassess Your Goals**: Are your financial goals still aligned with your investments? It’s always a good idea to revisit your portfolio regularly.

3. **Avoid Panic Selling**: Emotion-driven decisions can lead to regrettable actions. If possible, stick to your strategy during downturns.

4. **Consider Dollar-Cost Averaging**: This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. It can reduce the impact of volatility on your investments.

5. **Seek Professional Advice**: If you’re feeling overwhelmed, consider consulting with a financial advisor who can help guide your investment decisions.

Conclusion: Embracing Market Fluctuations

In the world of investing, fluctuations in the stock market are inevitable. President Trump’s statement that he doesn’t want stocks to go down but acknowledges the need to “take your medicine” serves as a powerful reminder for all investors. It’s essential to approach investing with a clear mind, understanding that market corrections can be part of a healthy economic cycle.

By staying informed and flexible, diversifying your portfolio, and keeping your long-term goals in sight, you can navigate the ups and downs of the market with confidence. So, embrace the journey, and remember that sometimes, taking your medicine can lead to better days ahead.