Understanding the Implications of S&P 500 Market Movements

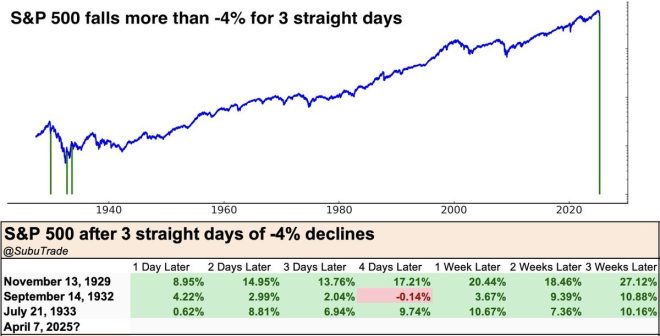

In a striking tweet from April 6, 2025, Maine (@TheMaineWonk) highlighted a significant and alarming potential occurrence in the stock market: if the S&P 500 index were to fall more than 4% for three consecutive days, it would mark the first time such a downturn has occurred since the Great Depression. This tweet raises essential questions about market stability, investor sentiment, and the broader implications of such unprecedented volatility in today’s economic landscape.

The S&P 500: A Barometer of Market Health

The S&P 500, which tracks the performance of 500 of the largest publicly traded companies in the United States, is often regarded as a reliable indicator of the overall health of the U.S. economy. Movements in this index can reflect investor confidence, economic resilience, and potential financial crises. A significant decline, such as a drop of more than 4% over three consecutive days, can signal serious underlying issues affecting the economy, such as rising inflation, geopolitical tensions, or other financial instabilities.

Historical Context: The Great Depression

The Great Depression, which began in 1929, is a pivotal moment in economic history characterized by massive stock market crashes, widespread unemployment, and prolonged economic hardship. The potential for the S&P 500 to experience a similar pattern of decline underscores the fragility of the current market. Investors and analysts are naturally concerned about what such a trend would indicate for the economy. The prospect of a downturn reminiscent of the Great Depression evokes fear among investors and can lead to a rush to sell assets, further exacerbating market volatility.

Factors Influencing Market Volatility

Several factors contribute to the volatility of the stock market, and understanding these can help investors navigate uncertain waters. Key influences include:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Interest Rates: Central banks, such as the Federal Reserve, use interest rates as a tool to control inflation. Rising interest rates can lead to higher borrowing costs for consumers and businesses, which may dampen economic growth and negatively impact corporate earnings.

- Inflation: High inflation erodes purchasing power and can lead to decreased consumer spending. If inflation remains elevated, it can prompt the Federal Reserve to implement aggressive monetary policies, which may further unsettle financial markets.

- Geopolitical Events: International conflicts, trade disputes, and political instability can create uncertainty, causing investors to react negatively. Such events often lead to market sell-offs as investors seek safer assets.

- Corporate Earnings: Earnings reports from major companies can significantly affect the S&P 500. If companies fail to meet earnings expectations, it can trigger a sell-off, leading to broader market declines.

- Market Sentiment: Investor psychology plays a crucial role in market movements. Fear and uncertainty can lead to panic selling, while optimism can drive prices higher.

The Role of Social Media in Market Perception

In today’s digital age, social media platforms like Twitter have become influential in shaping public perception of the stock market. Tweets such as the one from Maine can quickly spread information and sentiment, impacting investor behavior. The rapid dissemination of news and opinions can lead to sudden market movements, as traders react to the latest headlines and social media trends.

Preparing for Market Fluctuations

For investors, understanding the potential for significant market declines is essential for managing risk. Here are some strategies to prepare for potential downturns:

- Diversification: Spreading investments across various asset classes can help mitigate risk. A diversified portfolio is less vulnerable to the fluctuations of any single investment.

- Emergency Fund: Maintaining an emergency fund can provide a buffer during market downturns. This fund allows investors to weather short-term volatility without being forced to sell investments at a loss.

- Long-Term Perspective: Market fluctuations are a natural part of investing. Maintaining a long-term perspective can help investors avoid panic selling during downturns and focus on their overall financial goals.

- Stay Informed: Keeping abreast of economic trends, corporate earnings reports, and geopolitical developments can empower investors to make informed decisions.

- Consult Financial Advisors: Seeking guidance from financial professionals can provide valuable insights and help investors develop tailored strategies to navigate market volatility.

Conclusion: The Importance of Vigilance

The potential for the S&P 500 to experience a historically significant decline underscores the importance of vigilance and preparedness among investors. While market downturns can be unsettling, understanding the factors that drive market movements and implementing sound investment strategies can help mitigate risk and protect assets. In a rapidly changing economic environment, staying informed and adopting a proactive approach to investing is crucial for long-term financial success.

In summary, the tweet from Maine serves as a critical reminder of the potential challenges faced by investors in today’s financial landscape. By recognizing the historical context of market declines, the factors influencing volatility, and the importance of strategic planning, investors can navigate uncertain waters with greater confidence and resilience.

If tomorrow, the S&P 500 falls more than 4% for the third day in a row, it’ll be for the first time since the great depression. pic.twitter.com/7n8ql1csIR

— Maine (@TheMaineWonk) April 6, 2025

If tomorrow, the S&P 500 falls more than 4% for the third day in a row, it’ll be for the first time since the great depression.

Imagine waking up to the news that the stock market is in a tailspin. You grab your coffee, open your laptop, and see the S&P 500 has plummeted more than 4% for the third consecutive day. Not just any drop, but a historic one, the likes of which we haven’t seen since the Great Depression. It’s a scenario that sends chills down the spine of investors, analysts, and everyday folks alike.

In a recent tweet, Maine (@TheMaineWonk) highlighted this alarming possibility, effectively capturing the anxiety that many are feeling about the current economic climate. As we ponder what such a market downturn could mean, let’s dive deeper into the implications and historical context of this unsettling statement.

The S&P 500: A Brief Overview

The S&P 500, or the Standard & Poor’s 500, is more than just a collection of stocks. It’s a barometer for the overall health of the U.S. economy. Comprising 500 of the largest companies listed on stock exchanges in the United States, it offers a snapshot of what’s happening in various sectors, from technology to healthcare. When the S&P 500 falls significantly, it often indicates broader economic troubles.

The Great Depression: A Historical Perspective

To fully understand the gravity of a potential three-day drop in the S&P 500, we must consider the historical context of the Great Depression. This catastrophic economic downturn lasted from 1929 until the late 1930s, and it saw massive unemployment, bank failures, and a significant drop in consumer spending. The stock market crash of 1929 marked the beginning of this era, with the S&P 500 experiencing a staggering decline.

Fast forward to today, and the thought of repeating such a scenario is enough to make anyone uneasy. The tweet from Maine serves as a reminder that while the economic landscape has changed, the potential for drastic market shifts remains a constant concern.

What Could Cause Such a Drop?

When we consider the possibility of the S&P 500 falling more than 4% for three consecutive days, it’s essential to think about the factors that could contribute to such a decline. Here are a few key elements:

- Economic Indicators: Rising inflation and interest rates can dampen investor sentiment. If consumers are spending less, companies may report lower earnings, leading to stock price declines.

- Geopolitical Tensions: Political instability, whether domestically or internationally, can create uncertainty in the markets. Investors tend to pull back during turbulent times, leading to drops in major indices.

- Market Corrections: Sometimes, a market simply needs to correct itself. After a long bull run, a sudden downturn can be part of the natural ebb and flow of investing.

The Impact of Social Media on Market Sentiment

In today’s digital age, social media plays a crucial role in shaping market sentiment. Tweets, Instagram posts, and TikTok videos can sway public opinion, sometimes leading to significant market movements. The tweet from Maine serves as a prime example of how quickly information (or speculation) can spread, impacting investor behavior.

As the news of a potential three-day drop circulates, it can create a snowball effect, leading more investors to sell off their stocks out of fear. This reaction can exacerbate an already volatile situation, further driving down stock prices.

What Should Investors Do?

So, if tomorrow the S&P 500 falls more than 4% for the third day in a row, what should investors do? Here are a few strategies to consider:

- Stay Calm: It’s easy to panic during a downturn, but history shows that markets tend to recover over time. Taking a breath and avoiding impulsive decisions can be beneficial in the long run.

- Diversify Your Portfolio: If you haven’t already, consider diversifying your investments. A well-rounded portfolio can help mitigate losses in times of market instability.

- Consult with Financial Advisors: If you’re unsure about your investment strategy, it’s wise to seek advice from financial professionals who can provide personalized guidance based on your situation.

Learning from History

History has a way of repeating itself, and the lessons learned from past economic downturns can be invaluable. The Great Depression taught us about the risks of speculation and the importance of sound financial practices. While it’s easy to feel overwhelmed by fear during times of uncertainty, understanding the underlying factors can help demystify the situation.

The Future of the S&P 500

As we look ahead, many are left wondering what the future holds for the S&P 500. Will we see a recovery, or are we on the brink of another economic crisis? While no one can predict the future with complete certainty, staying informed and keeping an eye on market trends can help investors navigate the choppy waters ahead.

In the meantime, it’s crucial to remain vigilant and prepared for any market shifts. If tomorrow, the S&P 500 falls more than 4% for the third day in a row, it won’t just be a statistic; it will be a wake-up call for investors and a reminder of the unpredictable nature of the markets.

Final Thoughts

As we ponder the implications of a potential significant drop in the S&P 500, remember that while history can provide context, it doesn’t dictate the future. Markets can be resilient, and with informed strategies, investors can weather the storm. Keep an eye on the trends, stay informed, and don’t let fear dictate your financial decisions. After all, in the world of investing, knowledge is power.

Stay tuned to financial news and keep a close watch on the S&P 500. Whether it rises or falls, the key is to be prepared and informed. The economic landscape is ever-changing, and being adaptable is crucial for long-term success.