Panic in the EU: Paris Halts Banking Operations Amid Stock Market Drop

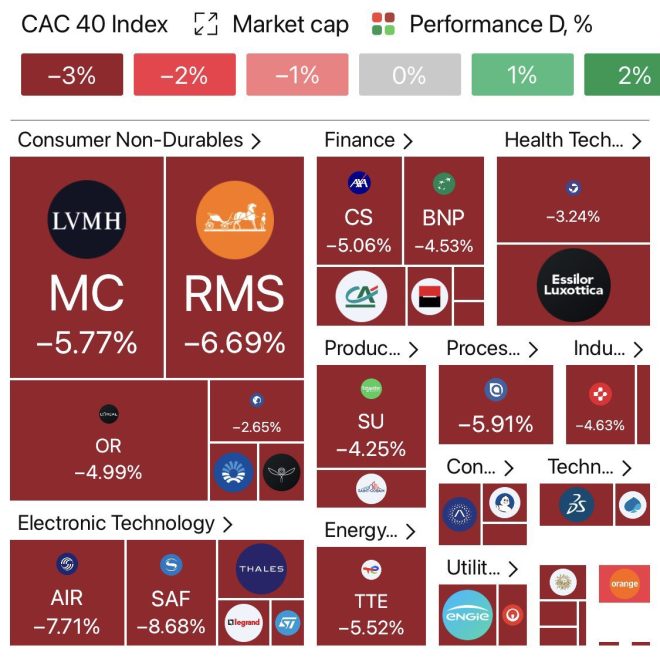

In a shocking turn of events, the European financial markets are experiencing unprecedented turmoil as Paris has decided to halt all banking operations on its stock market following a significant drop of approximately 6.5%. This dramatic decision has sent waves of panic throughout the European Union and has raised concerns about the stability of financial systems amid ongoing economic challenges.

The Current Situation

On April 7, 2025, the Paris stock market faced a critical plunge, prompting immediate action from financial authorities. The decision to suspend banking operations was made to prevent further destabilization and to allow for a thorough assessment of the situation. The abrupt market drop raises alarms about investor confidence and the overall health of the European economy.

Factors Contributing to the Market Drop

Several factors have been identified as contributing to the drastic decline in the Paris stock market. These include:

- Global Economic Uncertainty: The ongoing geopolitical tensions and economic instability in various regions are causing investors to be wary. Concerns about inflation, rising interest rates, and potential recessions are influencing market behavior.

- Sector-Specific Challenges: Key sectors within the European economy are facing unique challenges. Issues such as supply chain disruptions, labor shortages, and changing consumer behavior are impacting the performance of various industries, leading to lower stock valuations.

- Investor Sentiment: Market sentiment plays a crucial role in stock market performance. With many investors adopting a cautious approach, the fear of further losses can create a domino effect, leading to widespread sell-offs.

Implications of the Halted Banking Operations

The decision to halt banking operations in Paris has significant implications not only for the French economy but also for the broader European financial landscape:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Impact on Investor Confidence: The suspension of banking operations can lead to a lack of confidence among investors, which may exacerbate the market downturn. Investors may perceive this action as a sign of underlying weakness in the financial system.

- Ripple Effects on Other Markets: The Paris stock market is intertwined with other European markets. A significant downturn in Paris could lead to negative sentiment spilling over into neighboring countries, potentially causing a broader financial crisis.

- Government and Central Bank Response: In response to this crisis, it is expected that the French government and the European Central Bank will take swift action to stabilize the situation. This may include monetary policy adjustments, liquidity support, and measures to restore investor confidence.

Historical Context

Historically, financial markets have experienced periods of volatility and panic. However, the current situation is reminiscent of past crises where abrupt market corrections led to significant economic repercussions. Understanding this historical context is essential for assessing the potential outcomes of the current crisis.

Moving Forward: Strategies for Recovery

As the situation unfolds, it is crucial for investors, policymakers, and financial institutions to consider strategies for recovery:

- Monitoring Economic Indicators: Keeping a close eye on economic indicators such as inflation rates, employment figures, and consumer confidence will be vital for understanding the trajectory of the market.

- Implementing Support Measures: Governments and central banks must be prepared to implement support measures to stabilize the financial system. This could include interest rate adjustments, quantitative easing, or direct support to affected sectors.

- Enhancing Communication: Transparency and clear communication from financial authorities can help restore confidence among investors. Providing regular updates and outlining plans for recovery can mitigate panic and uncertainty.

- Diversifying Investment Strategies: Investors may need to reassess their portfolios and consider diversifying their investments to hedge against potential losses in volatile markets.

Conclusion: A Critical Juncture for the EU

The decision to halt banking operations in Paris amid a significant stock market drop is a critical juncture for the European Union. As the situation develops, the focus will be on how effectively financial authorities manage the crisis and restore stability. With economic uncertainty looming, it is imperative for all stakeholders to remain vigilant and proactive in their response to the unfolding events.

In summary, the panic in the EU triggered by the Paris stock market’s drastic decline highlights the interconnectedness of global economies and the fragility of financial systems. As the world watches closely, the actions taken in the coming days and weeks will play a crucial role in shaping the future of Europe’s economic landscape.

Update: Panic in EU!! Paris halts all banking operations on its stock market after ~ 6.5% drop!! pic.twitter.com/Mgz93HHkGw

— US Homeland Security news (@defense_civil25) April 7, 2025

Update: Panic in EU!! Paris halts all banking operations on its stock market after ~ 6.5% drop!!

When news broke that Paris had decided to halt all banking operations on its stock market following a significant drop of around 6.5%, it sent shockwaves throughout the European Union. Such drastic measures are typically reserved for moments of extreme financial distress, and this announcement has raised concerns about the stability of the European financial system. Let’s dive deeper into the implications of this panic in the EU and what it could mean for investors and the economy at large.

Understanding the Context of the Drop

To grasp the magnitude of this situation, it’s essential to understand what led to the ~ 6.5% drop. Market fluctuations can occur for various reasons, including economic indicators, political unrest, or international crises. In this instance, a combination of factors likely contributed to the decline. Investors often react strongly to news that could potentially destabilize markets, leading to swift sell-offs. This reaction is what we’re witnessing now in Paris, where financial uncertainty has triggered a halt in banking operations.

The Immediate Reactions

As the news spread, reactions from various sectors started pouring in. Financial analysts expressed their concerns regarding the long-term implications of such a significant drop. Social media platforms, especially Twitter, became hotbeds for discussions surrounding the crisis. As noted in a tweet from US Homeland Security News, the situation has escalated to a point where panic is palpable among investors and citizens alike.

The Role of Social Media in Financial News

In today’s world, news travels faster than ever. Social media platforms play a crucial role in disseminating information and shaping public perception. Within minutes of the announcement, hashtags and discussions emerged, reflecting a mixture of fear and speculation. The tweet shared from US Homeland Security News not only provided updates but also underscored the importance of staying informed during such turbulent times. The immediacy of social media means that reactions can influence market behavior, creating a cycle of panic and uncertainty.

Impact on the European Economy

The decision to halt banking operations in Paris is more than just a reaction to a stock market drop; it has broader implications for the European economy. When a major financial hub like Paris takes such drastic measures, it can lead to a ripple effect across the continent. Other countries might experience increased volatility as investors reassess their positions and strategies. This could potentially lead to a domino effect, where fear spreads, and other markets suffer as a result.

What This Means for Investors

For investors, this situation presents both challenges and opportunities. While panic selling can lead to significant losses, it can also create buying opportunities for those who are willing to take risks. Experienced investors often look for undervalued stocks during such downturns, banking on the eventual recovery of the markets. However, it’s crucial to exercise caution and conduct thorough research before making any decisions.

The Need for Stabilization Measures

The halt in banking operations signals a desperate need for stabilization measures. Governments and financial institutions may need to step in to restore confidence in the markets. This could involve implementing economic policies aimed at stabilizing the financial system, such as lowering interest rates or providing liquidity to banks. The response from European leaders will be closely monitored, as their actions will play a pivotal role in determining how quickly markets can recover.

Global Repercussions

While the immediate focus is on the European markets, the global financial landscape cannot be ignored. A significant drop in one major economy can have far-reaching effects on others. Investors worldwide are likely to react to news from Paris, leading to potential declines in their own markets. The interconnectedness of today’s economies means that no country operates in isolation, and a crisis in the EU can influence markets in Asia, North America, and beyond.

Future Outlook

The outlook following this incident remains uncertain. Analysts will be closely watching for indicators of recovery, such as how quickly the markets stabilize and whether investors regain confidence. The next few days will be critical in determining whether this drop is a temporary setback or a sign of deeper issues within the European financial system.

Staying Informed

In times of financial uncertainty, staying informed is crucial. Regularly checking reliable news sources and financial updates can help investors make informed decisions. As we navigate this turbulent period, it’s essential to remain vigilant and not let panic dictate our actions. Remember, informed decisions are often the best decisions, especially during market downturns.

The Importance of Financial Literacy

This incident underscores the importance of financial literacy. Understanding how markets function, recognizing the signs of volatility, and knowing how to react can empower individuals and businesses alike. Educational resources are available for those looking to improve their financial knowledge, which can prove invaluable in times of crisis. Investing time in understanding the markets can lead to better long-term outcomes.

Lessons Learned

Every financial crisis presents an opportunity to learn and adapt. The events unfolding in Paris may serve as a wake-up call for investors and policymakers alike. It’s a reminder of the fragility of financial systems and the importance of being prepared for unexpected downturns. Whether you’re a seasoned investor or new to the market, the key takeaway here is to remain adaptable and responsive to changing circumstances.

Conclusion

The situation in Paris, with the halt of banking operations due to a significant stock market drop, illustrates the volatility of financial markets and the far-reaching implications it can have. As we continue to monitor the developments, staying informed and prepared will be crucial for navigating the uncertain waters ahead. Let’s keep an eye on how the European Union responds and how this situation unfolds in the coming days.

Breaking News, Cause of death, Obituary, Today