Market Overview: NASDAQ Gains While S&P 500 and DOW Struggle

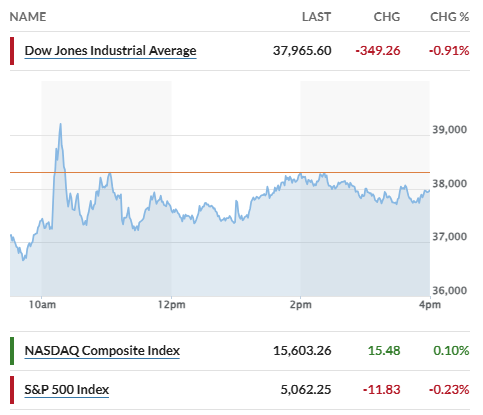

The stock market’s performance on this particular day has captured the attention of investors and analysts alike. Despite dire predictions from renowned financial commentator Jim Cramer, who warned of a potential “BLACK MONDAY” crash over the weekend, the NASDAQ managed to close in the green. In contrast, both the S&P 500 and DOW faced declines, with the S&P 500 down 0.2% and the DOW decreasing by less than 1%.

Jim Cramer’s Predictions and Market Sentiment

Jim Cramer, known for his bold market predictions, often stirs discussions among investors. His warning of a “BLACK MONDAY” created a ripple of anxiety in the financial markets leading up to the trading day. Cramer’s predictions are closely followed, and any mention of potential market crashes typically results in increased volatility. However, the market’s reaction today diverged from his forecast, highlighting the unpredictable nature of stock movements.

NASDAQ’s Performance: A Bright Spot

The NASDAQ’s positive closing can be attributed to several factors, including strong performances from technology and growth stocks. Investors showed resilience, supporting tech giants that have been the backbone of the NASDAQ index. This rally indicates that despite broader market concerns, there remains a strong appetite for innovation and technology-driven companies. The index’s ability to close positively amid predictions of downturn speaks volumes about investor confidence in these sectors.

S&P 500 and DOW: A Mixed Bag of Results

On the other hand, the S&P 500’s decline of 0.2% reflects the challenges faced by a diversified portfolio of large-cap U.S. companies. The index, which includes various sectors, may have been weighed down by losses in sectors such as energy and financials. The DOW also experienced a decrease of less than 1%, which, although not severe, indicates a cautious approach among investors regarding blue-chip stocks.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Investor Reactions and Market Analysis

The market’s mixed results suggest a complex landscape for investors. While the NASDAQ’s upward movement may offer some reassurance, the declines in the S&P 500 and DOW could signal underlying concerns about economic conditions. Investors are keenly assessing factors such as inflation rates, interest rate hikes, and geopolitical tensions that could impact market stability.

The reactions from investors today reveal a level of uncertainty. Many are likely adopting a “wait and see” approach, closely monitoring economic indicators and corporate earnings reports in the coming weeks. The divergence in performance between the NASDAQ and the other indices reflects differing investor sentiments across sectors, with technology stocks continuing to attract interest while traditional sectors face headwinds.

Looking Ahead: What Investors Should Watch

As we move forward, investors should keep a close eye on key economic indicators that could influence market trends. Reports on inflation, employment rates, and consumer sentiment will be critical in shaping market expectations. Additionally, any further commentary from financial analysts and market experts, including Jim Cramer, will be scrutinized for insights into potential future movements.

The upcoming earnings season will also play a pivotal role in guiding investor decisions. Companies that report strong earnings may bolster market confidence, while disappointing results could exacerbate existing concerns. It’s essential for investors to remain informed and adaptable, ready to pivot their strategies based on the evolving landscape.

Conclusion

In conclusion, the stock market’s performance today has been a testament to the complexities of investing. The NASDAQ closed positively, defying Jim Cramer’s “BLACK MONDAY” prediction, while the S&P 500 and DOW faced slight declines. Investors are navigating a mixed market environment, weighing the strengths of technology stocks against the challenges faced by other sectors. As we look ahead, staying informed about economic indicators and corporate earnings will be crucial for making informed investment decisions. The unpredictable nature of the market underscores the importance of a balanced approach, combining optimism and caution as we move into the next trading sessions.

JUST IN: NASDAQ closes in green, S&P500 at -0.2% and DOW down less than 1% today after Jim Cramer predicted a “BLACK MONDAY” crash over the weekend. https://t.co/zeVaFpdJdM

JUST IN: NASDAQ closes in green, S&P500 at -0.2% and DOW down less than 1% today after Jim Cramer predicted a “BLACK MONDAY” crash over the weekend.

If you tuned into the stock market news today, you might have felt a mix of excitement and anxiety. With the NASDAQ closing in the green while the S&P 500 dipped slightly and the DOW fell by less than 1%, it was a day that certainly kept investors on their toes. Adding to the drama, Jim Cramer, the well-known financial commentator, warned over the weekend of a potential “BLACK MONDAY” crash. So, what does this all mean for investors like you and me? Let’s dive in!

What Happened on Wall Street Today?

The trading day closed with the NASDAQ showing a positive finish, which is a breath of fresh air considering the overall volatility we’ve seen in recent weeks. The index rallied, indicating a level of resilience in tech stocks, which often lead the charge in market recoveries. Meanwhile, the S&P 500 saw a minor decline of 0.2%, suggesting that while some sectors are thriving, others may be feeling the pressure. On the other hand, the DOW Jones Industrial Average slipped slightly, down less than 1%. This fluctuation had many investors questioning the market’s stability.

Understanding Jim Cramer’s “BLACK MONDAY” Prediction

Jim Cramer, a figure known for his bold predictions and animated approach to market analysis, stirred the pot over the weekend with his forecast of a possible stock market crash. Cramer has a history of making headlines with his predictions, and this time was no different. His warning of a “BLACK MONDAY” had many on Wall Street bracing for impact.

Cramer’s predictions often create ripples in the investment community, and his followers tend to react strongly to his insights. While some may see his warnings as a call to action, others might view them as mere speculation. The truth is, while Cramer has made accurate calls in the past, market fluctuations can be unpredictable, and relying solely on one voice can be risky.

Why Did the NASDAQ Close in Green?

The NASDAQ’s positive close can be attributed to several key factors. First, many tech companies reported better-than-expected earnings in recent quarters, showing resilience amid economic challenges. Companies focusing on cloud computing, artificial intelligence, and e-commerce have been particularly strong performers, drawing investor interest and driving up stock prices.

Moreover, investor sentiment plays a crucial role in the stock market’s performance. As news of potential interest rate hikes looms, some investors might be seeking refuge in tech stocks, which traditionally offer higher growth potential. This shift in focus can lead to a surge in demand for specific sectors, supporting a positive close for the NASDAQ.

Understanding the S&P 500’s Minor Decline

While the NASDAQ shone brightly, the S&P 500’s minor drop of 0.2% raises questions about market breadth. The S&P 500 represents a broader range of sectors, including consumer goods, healthcare, and financials. This slight decline may indicate that while tech is thriving, other sectors are not faring as well.

For instance, rising inflation concerns and potential interest rate hikes can weigh heavily on consumer discretionary spending and financial stocks. As investors digest these factors, it’s important to stay informed and consider a diversified approach to mitigate risks in your investment portfolio.

The DOW’s Performance: What It Means

The DOW’s decline of less than 1% might sound minimal, but it signifies caution among investors. The DOW, composed of 30 significant U.S. companies, often acts as a bellwether for the overall economy. A dip here could suggest that investors are worried about broader economic conditions, even if the tech sector is thriving.

Understanding the DOW’s performance can help you gauge market sentiment. If the DOW continues to see volatility, it may indicate underlying issues that could affect your investment strategy moving forward.

Market Sentiment: A Double-Edged Sword

Market sentiment is a powerful force that can drive prices up or down. The mixed results today highlight the importance of keeping an eye on investor psychology. When news breaks, whether it’s positive or negative, the market often reacts not just based on the facts, but also on emotions.

Cramer’s “BLACK MONDAY” prediction certainly contributed to today’s market dynamics. Investors may have felt a sense of urgency or fear of missing out (FOMO), which can lead to impulsive decisions. If you’re an investor, it’s crucial to remain level-headed and avoid knee-jerk reactions based on market chatter.

How Should Investors Respond?

Given the current market conditions, you might be wondering how to navigate this complex landscape. Here are some strategies to consider:

1. **Diversify Your Portfolio**: In times of uncertainty, spreading your investments across various sectors can help reduce risk. This strategy can cushion your portfolio against downturns in specific industries.

2. **Stay Informed**: Keep an eye on market trends and expert analysis. Understanding economic indicators, earnings reports, and geopolitical events can provide valuable context for your investment decisions.

3. **Long-Term Perspective**: Short-term fluctuations can be disheartening, but maintaining a long-term investment strategy can help you weather volatility. Focus on your financial goals and avoid being swayed by daily market noise.

4. **Consult a Financial Advisor**: If you’re unsure about your investment strategy, seeking professional advice can provide clarity and guide you in making informed decisions tailored to your financial situation.

Final Thoughts on Today’s Market Movement

Today’s market movement, highlighted by the NASDAQ closing in green while the S&P 500 and DOW experienced slight declines, showcases the dynamic nature of investing. Jim Cramer’s warning of a “BLACK MONDAY” crash may have sparked concern, but it also highlights the importance of being informed and prepared.

As an investor, remember that markets are inherently volatile. Staying educated and adaptable can help you navigate the ups and downs. Whether you’re a seasoned pro or just starting, the key is to remain focused on your investment journey and not let external noise dictate your strategy.

Whether you’re looking for growth opportunities in tech, considering defensive plays in other sectors, or simply trying to make sense of the market’s mood swings, staying engaged and informed is your best bet. Keep an eye on the news, and don’t hesitate to adapt your strategy as the market evolves. Happy investing!