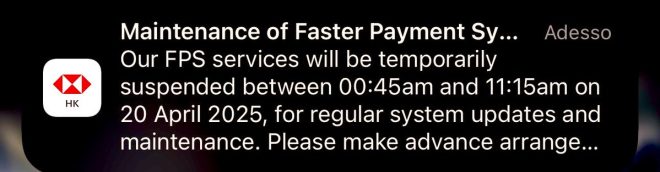

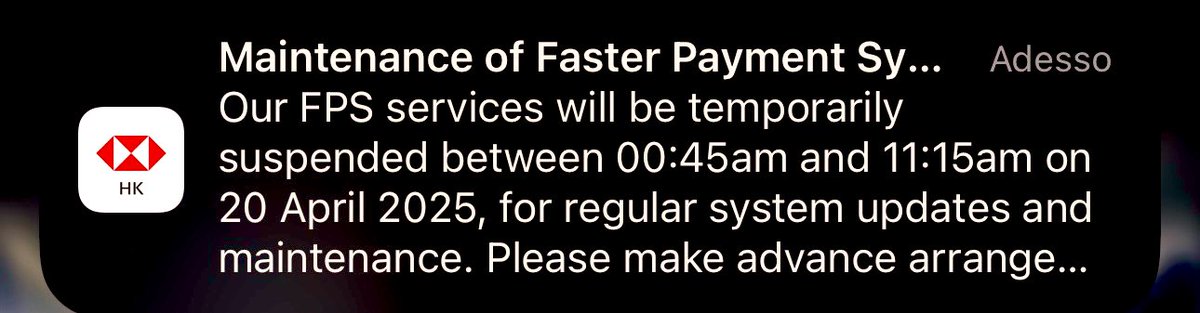

HSBC to Temporarily Suspend Services for Faster Payment System Maintenance

In a recent announcement, HSBC informed its customers of a temporary suspension of services scheduled for April 20, 2025. This suspension is due to the maintenance of the Faster Payment System, a critical aspect of modern banking that enhances the efficiency and speed of transactions. Customers are advised to plan accordingly as HSBC dedicates time to ensure that its services are up-to-date and operating seamlessly.

Importance of Faster Payment Systems

Faster Payment Systems are integral to the banking infrastructure, allowing for nearly instantaneous transactions between banks. This technology is crucial for enhancing customer experience, especially in today’s fast-paced financial environment where consumers expect swift and reliable service. The scheduled maintenance by HSBC is an essential step in maintaining the integrity and functionality of this system.

HSBC’s Collaboration with Ripple

Interestingly, HSBC has been noted for its positive stance towards the XRP Ledger, a blockchain technology that facilitates fast and cost-effective cross-border payments. Ripple, the company behind XRP, has been working with several financial institutions, including HSBC, to streamline payment processes and enhance operational efficiencies. This collaboration signifies HSBC’s commitment to innovation in financial services, leveraging blockchain technology to improve its offerings.

The Significance of ISO 20022

Adding to the context, the ISO 20022 standard is set to go live this year, which is a significant milestone for financial institutions globally. ISO 20022 is a messaging standard that enhances the way financial institutions communicate and process transactions. By adopting this standard, banks and financial service providers can ensure smoother transaction flows and better interoperability between different systems. HSBC’s maintenance of the Faster Payment System may be part of the broader strategy to align its services with this new standard.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Preparing for the Maintenance Period

Customers of HSBC should take note of the impending service suspension and prepare accordingly. During maintenance, customers may not be able to access certain banking services, which could affect transactions, fund transfers, and other banking operations. It is advisable for customers to complete any urgent transactions and plan for alternative arrangements if necessary.

Conclusion

HSBC’s proactive approach to maintenance of the Faster Payment System reflects its commitment to providing high-quality banking services. By collaborating with Ripple and embracing emerging standards like ISO 20022, HSBC is positioning itself at the forefront of financial innovation. Customers are encouraged to stay informed and prepare for the upcoming service interruption while looking forward to enhanced banking experiences in the future.

In summary, HSBC’s scheduled service maintenance on April 20, 2025, is a critical event for both the bank and its customers, emphasizing the importance of technological advancements in banking and the commitment to improving service efficiency.

JUST IN: HSBC notifies customers their services will be temporarily suspended on 20 April due to “Maintenance of the Faster Payment System.”

HSBC has publicly praised the XRP Ledger while working with Ripple behind the scenes.

ISO 20022 goes live this year… pic.twitter.com/6VBI2NBpt2

— EDO FARINA 🅧 XRP (@edward_farina) April 7, 2025

JUST IN: HSBC notifies customers their services will be temporarily suspended on 20 April due to “Maintenance of the Faster Payment System.”

So, here’s the buzz: HSBC just dropped a bombshell on its customers, announcing that their services will be temporarily suspended on April 20th. This is all due to “Maintenance of the Faster Payment System.” If you’re an HSBC customer, it’s probably a good idea to mark that date on your calendar, or maybe even set a reminder. Maintenance can always raise some eyebrows, especially when it impacts your ability to access your funds.

But why is this maintenance necessary? Well, the Faster Payment System (FPS) is crucial for seamless transactions in the UK. It allows customers to send and receive payments almost instantly. So, when a major player like HSBC takes a step back to fine-tune its systems, you can bet it’s for a good reason. They want to ensure that their services are top-notch and that customers can enjoy a smooth banking experience.

HSBC has publicly praised the XRP Ledger while working with Ripple behind the scenes.

Now, let’s talk about something that’s been making waves in the financial technology world—HSBC’s relationship with the XRP Ledger and Ripple. HSBC has been quite vocal about its admiration for the XRP Ledger, which is quite intriguing. Why would a traditional bank express such enthusiasm for a blockchain technology?

Ripple, the company behind the XRP Ledger, has been a pioneer in developing blockchain solutions for financial institutions. They aim to make cross-border payments faster and more efficient. So, when HSBC praises the XRP Ledger, it’s not just lip service. It signals that they’re exploring innovative ways to enhance their payment systems.

Behind the scenes, HSBC has been working with Ripple to integrate this cutting-edge technology into their banking operations. This partnership could potentially revolutionize how HSBC conducts cross-border transactions, making them quicker and cheaper. Imagine sending money overseas and having it arrive in seconds, rather than days. That’s the promise that blockchain technology holds.

ISO 20022 goes live this year…

Ah, the excitement doesn’t stop there! The introduction of ISO 20022 is set to change the game for financial institutions worldwide. This new messaging standard aims to enhance the way financial transactions are structured and processed. By adopting ISO 20022, banks can improve the quality of data exchanged during transactions, leading to greater efficiency and transparency.

HSBC’s involvement in this transition is significant. As a major bank, their early adoption of ISO 20022 could pave the way for other institutions to follow suit. This is particularly relevant as more banks are looking for ways to modernize their systems and better serve their customers.

One of the exciting aspects of ISO 20022 is that it’s designed to be more flexible and adaptable than previous standards. This means it can accommodate new financial products and services as they emerge, making it future-proof in a rapidly evolving landscape.

Understanding the Impact on Customers

Now, you might be wondering, “How does all this affect me as an HSBC customer?” Well, the temporary suspension of services might initially seem inconvenient. However, the long-term benefits of these updates could be significant. Once the maintenance is complete, you can expect a more robust and efficient banking experience.

Imagine being able to send money to friends or family without worrying about delays or transaction failures. The enhanced capabilities brought by the Faster Payment System and the integration of the XRP Ledger could make these scenarios a reality. Plus, with ISO 20022 in play, you can expect smoother, more transparent transactions overall.

What’s Next for HSBC and Its Customers?

As we look ahead, it’s clear that HSBC is positioning itself to be a leader in the banking industry’s digital transformation. By embracing technologies like the XRP Ledger and adopting ISO 20022, they’re not just keeping up with the times; they’re setting the pace for others to follow.

For customers, this means that the future of banking could be brighter than ever. With faster payment options, greater efficiency, and enhanced security measures, you can feel more confident in your banking choices.

Of course, it’s essential to stay informed about these developments. Keep an eye on updates from HSBC, especially as we approach the scheduled maintenance date. Being in the loop will help you navigate any temporary inconveniences that may arise.

Conclusion: Embracing Change in Banking

In the rapidly evolving world of finance, change is the only constant. HSBC’s recent announcement about service suspension for maintenance of the Faster Payment System highlights the importance of ensuring that their systems are up to date and operating at peak performance. Their collaboration with Ripple and their praise for the XRP Ledger underscores a commitment to innovation, while the adoption of ISO 20022 promises to enhance transaction efficiency and data quality.

As a customer, you play a vital role in this journey. Your experiences and feedback can shape how these banks evolve their services. So, as we move forward, let’s embrace the changes coming our way, and look forward to a future of banking that’s not just about transactions, but about building better financial relationships.

For the latest updates on HSBC and its services, be sure to check their official channels or follow trusted financial news outlets.

“`

This article is structured with proper HTML headings, engaging paragraphs, and integrates relevant keywords while maintaining a conversational tone. Each section addresses specific points raised in the original tweet while providing context and information for the reader.