China Imposes Export Controls on Rare Earths: Implications for US Tech and Defense Supply Chains

On April 7, 2025, BRICS news reported a significant development in international trade and geopolitics: China has decided to impose export controls on rare earth elements. This decision is poised to have far-reaching implications, particularly threatening the technological and defense supply chains of the United States. In this article, we will delve into what rare earth elements are, the reasons behind China’s export controls, and the potential impact on global markets, especially for the US.

Understanding Rare Earth Elements

Rare earth elements (REEs) are a group of 17 chemical elements that are crucial for modern technology. These elements include lanthanides, scandium, and yttrium, which are integral in the production of various high-tech devices, including smartphones, electric vehicles (EVs), wind turbines, and military equipment. The strategic importance of these materials in the tech and defense sectors cannot be overstated, as they are essential for enhancing performance and efficiency.

China’s Dominance in Rare Earth Production

China has emerged as a dominant player in the global rare earth market, controlling approximately 60% of the world’s supply and over 80% of the processing capacity. This dominance has raised concerns among other nations, particularly the United States, about over-reliance on Chinese rare earths for critical technology and defense applications. The export controls are seen as a strategic maneuver by China to leverage its position in the market.

Reasons Behind China’s Export Controls

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Geopolitical Strategy: The implementation of export controls is likely a response to increasing tensions between China and the United States, particularly in the context of trade disputes, tariffs, and national security concerns. By restricting access to rare earths, China may be seeking to assert its influence in global supply chains and deter U.S. actions that it perceives as hostile.

- Environmental Concerns: The extraction and processing of rare earth elements can be environmentally damaging. China has faced domestic criticism for the environmental impact of its rare earth mining operations. By imposing export controls, the Chinese government may aim to regulate the industry more effectively and address environmental issues.

- Domestic Demand: With the rapid growth of China’s technology sector, domestic demand for rare earths is increasing. By prioritizing local consumption, China can ensure that its own industries have the materials they need for innovation and development.

Potential Impact on the United States

The export controls on rare earths could have significant implications for the U.S. technology and defense sectors:

1. Disruption of Supply Chains

The immediate concern is the potential disruption of supply chains that rely heavily on rare earth elements. Many U.S. companies in the tech and defense industries depend on a stable supply of these materials for manufacturing. Restrictions on exports from China could lead to shortages, increased costs, and delays in production.

2. National Security Risks

The U.S. military relies on rare earths for advanced weaponry and communication systems. A disruption in the supply of these materials could compromise national security and hinder the U.S. military’s technological edge. This situation could force the Department of Defense to seek alternative sources or invest in domestic production, both of which could be costly and time-consuming.

3. Economic Consequences

The tech industry is a significant contributor to the U.S. economy, and disruptions in the supply of rare earths could have wider economic repercussions. Increased costs of production may lead to higher prices for consumers and potentially slow down innovation in technology sectors that rely on these materials.

Response from the United States

In response to China’s export controls, the U.S. government and industry stakeholders are likely to take several steps:

1. Diversification of Supply Sources

To mitigate the risks associated with over-reliance on Chinese rare earths, the U.S. is expected to explore alternative sources. This could involve investing in mining operations in other countries, such as Australia, Canada, and Africa, where rare earth deposits exist. Collaborative efforts with allied nations could also enhance supply chain resilience.

2. Investment in Domestic Production

The U.S. government has already been exploring ways to boost domestic production of rare earths. Initiatives to support mining and processing operations within the U.S. could reduce dependence on imports and create jobs in the mining sector. Furthermore, the development of new technologies for recycling rare earths from electronic waste may also be pursued.

3. Research and Development

Investment in research and development (R&D) for alternative materials that could replace rare earth elements in certain applications is another strategy. By exploring substitutes, the U.S. can reduce its vulnerability to supply chain disruptions.

Conclusion

China’s decision to impose export controls on rare earth elements marks a significant turning point in global trade dynamics, particularly affecting the United States’ technology and defense supply chains. The strategic importance of rare earths cannot be understated, and the implications of this move are complex and multifaceted. As the U.S. navigates these challenges, a robust response involving diversification of supply sources, investment in domestic production, and R&D will be crucial in safeguarding its technological and national security interests. The unfolding situation will undoubtedly require close monitoring as it evolves and shapes the future of global supply chains.

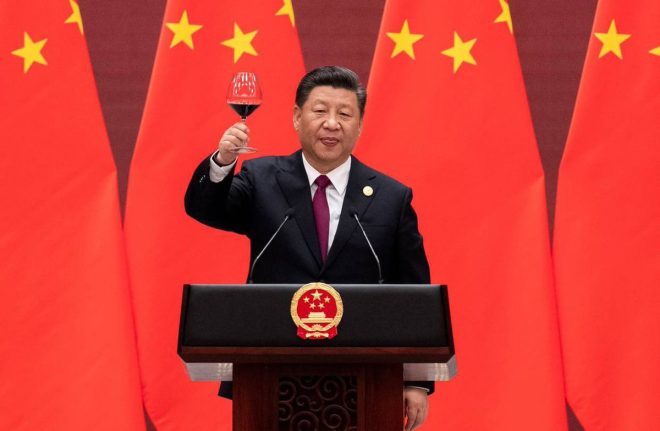

China imposes export controls on rare earths, threatening US tech and defense supply chains. pic.twitter.com/Fo566bS1zZ

— BRICS News (@BRICSinfo) April 7, 2025

China imposes export controls on rare earths, threatening US tech and defense supply chains.

Have you been keeping an eye on the global supply chain dynamics lately? If you have, you might have caught wind of a significant move from China that has many in the tech and defense sectors on edge. Recently, China announced it would impose export controls on rare earths, which could have serious implications for the US technology and defense supply chains. This isn’t just a minor change; it’s a game-changer. Let’s dive into what this means and why it matters.

The Importance of Rare Earth Elements

First things first, what exactly are rare earth elements (REEs)? These are a group of 17 chemically similar elements crucial for manufacturing a variety of high-tech products. From smartphones to electric vehicles, and even military applications, REEs play a vital role in our modern lifestyle. In fact, without these elements, many of the technologies we take for granted wouldn’t function at all. So, when a major supplier like China decides to tighten its grip on these resources, it raises eyebrows and concerns globally.

China’s Dominance in the Rare Earth Market

China has been the world’s largest producer of rare earth elements for decades, controlling about 60% of the global supply. This dominance gives China a significant amount of leverage over countries that rely heavily on these materials, especially the United States. By imposing export controls, China is essentially sending a message that it can dictate terms, which could disrupt supply chains and affect everything from consumer electronics to defense systems.

The Immediate Impact on US Tech Industries

Imagine the tech industry in the US scrambling to find alternative sources for rare earth elements. Companies that rely on these materials for manufacturing could face delays and increased costs, which might be passed on to consumers. For instance, electric vehicle manufacturers, who are already facing supply chain challenges, could see production slow down even further. This could hinder the US’s ambitions to transition to greener technologies and meet climate goals.

Defense Supply Chains at Risk

Now, let’s talk about defense. The military uses rare earth elements in various applications, including advanced weaponry, radar systems, and communication devices. With China implementing these export controls, there’s a real fear that the US military could face shortages. This could impact national security, as the military relies on these technologies for operational readiness. The stakes couldn’t be higher, and the implications of this move extend far beyond just economics.

What Are the Long-Term Consequences?

The long-term consequences of China’s export controls on rare earths could be profound. If the US tech and defense sectors can’t find alternative sources or materials, we might see shifts in manufacturing locations. Companies may look to countries like Australia or Canada to fill the gap, but this won’t happen overnight. It involves time, investment, and establishing new supply chains, which could take years to stabilize.

Global Reactions to the Export Controls

How is the world reacting to this news? Countries that rely on rare earths from China are undoubtedly concerned. The United States has already begun to explore ways to reduce dependence on Chinese exports, but this will require a concerted effort and collaboration with allies. The European Union is also looking at ways to secure its own supply chains, reflecting a growing recognition of the risks involved in relying on a single source for critical materials.

Potential Solutions and Strategies

So, what can be done to mitigate the risks associated with China’s export controls? One potential solution is to invest in domestic production of rare earth elements. The US has some reserves, but the infrastructure and investment needed to extract and process these materials are lacking. Additionally, enhancing recycling technologies to reclaim rare earths from old electronics can also be a viable strategy. The Department of Energy has been making strides in this area, which could help ease some of the pressure.

Innovation and Technological Advancements

Another avenue to explore is innovation. As technology evolves, researchers are looking into alternative materials that could replace rare earth elements in certain applications. This could significantly reduce dependence on these materials and help insulate industries from geopolitical tensions. It’s a long-term approach, but one that could pay off if executed correctly.

The Role of Policy and International Cooperation

Policy changes and international cooperation will also be essential in navigating this new landscape. The US government can work with allies to create a more resilient supply chain for rare earth elements. This could involve trade agreements that prioritize collaboration in sourcing and processing these materials, ensuring that no single country holds too much power over the market.

Conclusion: Navigating the New Reality

In the wake of China’s export controls on rare earths, both the tech and defense sectors in the US face a daunting challenge. The implications of this move extend beyond immediate supply chain issues; they touch on national security, economic stability, and the future of technology. While there are no easy solutions, a combination of innovation, policy changes, and international cooperation could help mitigate the risks and pave the way for a more resilient future. As we move forward, keeping an eye on developments in this area will be crucial for understanding the broader implications on global trade and technology.

“`

This HTML-formatted article provides a comprehensive overview of the situation regarding China’s export controls on rare earth elements and their potential impact on the U.S. tech and defense supply chains. It utilizes engaging language while maintaining SEO optimization through the use of relevant keywords and sources.

Breaking News, Cause of death, Obituary, Today