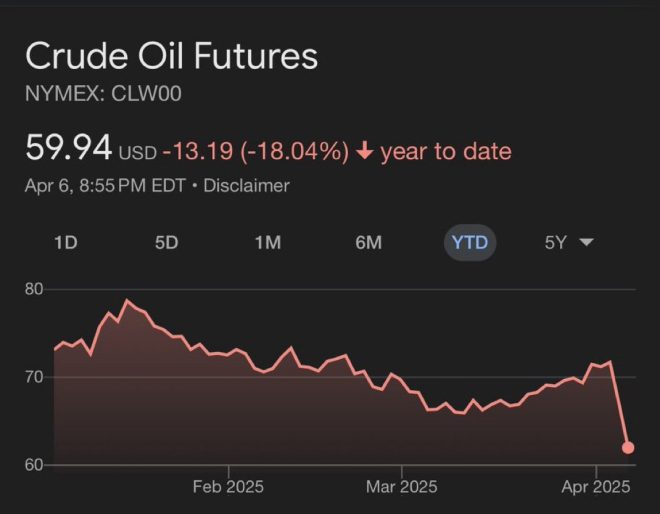

Oil Prices Fall Below $60: The Impact of Tariffs and Global Demand

In a significant market development, oil prices have dropped under $60 for the first time in four years, marking a critical juncture in the energy sector. This dramatic shift has been attributed to the ongoing trade tensions initiated by the trump administration, which many analysts believe is leading to a decrease in global demand for oil. The implications of this price drop are far-reaching, affecting not only the energy markets but also various industries tied to oil production and consumption.

Understanding the Drop in Oil Prices

The recent plunge in oil prices can be traced back to a combination of factors, with tariffs imposed by the Trump administration being a central theme. As trade wars escalate, tariffs on imported goods have resulted in retaliatory measures from other countries, leading to reduced trade volumes and a slowdown in global economic activity. This slowdown has directly impacted oil consumption, as countries are buying less oil due to decreased industrial activity and consumer demand.

The Role of Tariffs

Tariffs, particularly those targeting Chinese imports, have created ripple effects across the global economy. Initially intended to bolster American manufacturing and create jobs, these tariffs have instead contributed to uncertainty in global markets. Companies are facing higher costs for imported goods, which in turn affects their output and the overall demand for energy. As industries scale back production in response to rising costs, the demand for oil has diminished, leading to lower prices.

The Energy Market’s Reaction

The energy market is highly sensitive to changes in demand and geopolitical events. With the current environment characterized by tariff-induced uncertainties, oil prices have reacted negatively. The drop below $60 per barrel is not just a statistical anomaly; it signifies a broader trend of declining investor confidence in the oil market. Market analysts are closely monitoring these developments, as sustained low prices could lead to reduced exploration and production investments, potentially setting the stage for future supply constraints.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for the U.S. Economy

The implications of falling oil prices extend beyond the energy sector. Lower oil prices can lead to reduced revenues for oil-producing states and companies, which may result in budget cuts and job losses. Additionally, while consumers might benefit from lower gasoline prices in the short term, the long-term effects on the economy could be detrimental. Energy companies may scale back capital expenditures, leading to a slowdown in job creation within the sector.

Furthermore, the drop in oil prices can have a cascading effect on Wall Street. Energy stocks, which make up a significant portion of the market, could face declines, impacting investment portfolios and retirement funds. Investors are keenly aware of these trends, and a prolonged period of low oil prices could lead to a reevaluation of investment strategies.

Global Demand and Future Outlook

Looking forward, the outlook for oil prices remains uncertain. Analysts predict that if the current trend of reduced global demand persists, oil prices may continue to struggle. Economic indicators suggest that many countries are bracing for slower growth, which could further dampen oil consumption. Moreover, as renewable energy sources become more prevalent and competitive, the long-term demand for oil could shift, complicating the recovery for traditional energy markets.

Conclusion

The recent drop in oil prices below $60 per barrel is a clear indication of the challenges facing the global energy market. Tariffs and trade tensions initiated by the Trump administration have created an environment of uncertainty, leading to reduced demand for oil and significant impacts on the economy. As stakeholders in the energy sector, investors, and policymakers navigate this complex landscape, it is essential to monitor these developments closely. The future of oil prices will depend on various factors, including geopolitical stability, economic growth, and the evolving dynamics of global energy consumption.

In summary, the current state of the oil market serves as a reminder of the interconnectedness of global economies and the profound effects that policy decisions can have on market stability. As we move forward, understanding these dynamics will be crucial for making informed decisions in both the energy sector and the broader economy.

BREAKING: Oil just crashed under $60 for the first time in 4 years.

Trump’s tariff tantrum is now dragging down global demand, gutting prices, and sending shockwaves through energy markets.

What was supposed to make America “strong” is now tanking industries from Wall Street… pic.twitter.com/1QPuOnvHtk

— Brian Allen (@allenanalysis) April 7, 2025

BREAKING: Oil just crashed under $60 for the first time in 4 years

In a stunning turn of events, oil prices have plummeted below $60 a barrel for the first time in four years. This sharp decline has left many industry experts and everyday consumers scratching their heads, wondering what’s next for the global energy market. The root cause? A perfect storm of tariffs and trade tensions that have been brewing for some time.

Trump’s tariff tantrum is now dragging down global demand

Former President Donald Trump’s tariffs were initially heralded as a way to bolster American manufacturing and bring jobs back to the U.S. However, these tariffs have had a ripple effect that extends far beyond American borders. The latest reports indicate that these tariffs are now dragging down global demand for oil, creating a scenario where prices are in freefall. As companies face higher costs due to tariffs, they tend to cut back on production, which in turn leads to decreased demand for oil. This has been reflected in the current market dynamics.

According to Reuters, the trade war initiated by the U.S. has led to significant shifts in global supply and demand. Countries that were once major importers of American goods are now looking elsewhere, which has drastically affected oil consumption patterns. The result? A stark decline in prices that has taken many by surprise.

Gutting prices and sending shockwaves through energy markets

The energy markets are feeling the impact, and it’s not just the oil producers who are affected. Consumers are experiencing fluctuations at the pump, while investors are watching their portfolios shrink. This price drop is nothing short of a shockwave through the energy sector, and it’s clear that things are changing rapidly. Analysts are now predicting a prolonged period of low prices, which could lead to significant challenges for oil companies and related industries.

As oil prices continue to slide, Forbes notes that many companies will need to reevaluate their strategies. Some may have to scale back production or even shut down operations entirely to stay afloat in this challenging environment.

What was supposed to make America “strong” is now tanking industries from Wall Street

When the tariffs were first implemented, they were pitched as a means of making America strong. Fast forward to today, and we see a different story unfolding. Industries are feeling the pinch, and Wall Street is not immune. Stock prices for energy companies are plummeting, and the overall market is reacting negatively to the uncertainty surrounding oil prices.

Investment firms are now reevaluating their positions in the energy sector, with many analysts advising caution. This drastic downturn is causing many to question the long-term viability of investments tied to oil and gas. The news/articles/2025-04-07/oil-prices-fall-as-demand-weakens-amid-trade-tensions”>Bloomberg report highlights how the energy sector is now a risky proposition, with many investors pulling back.

The wider implications of falling oil prices

The implications of this situation extend far beyond the oil industry. Lower oil prices can lead to reduced revenues for countries that heavily rely on oil exports. Nations that have built their economies on oil production are now facing budget shortfalls and economic uncertainty. This could lead to destabilization in regions where oil is a key economic driver.

Furthermore, consumers may initially enjoy lower prices at the pump, but the long-term effects could be detrimental. A decline in oil prices can lead to job losses in the energy sector, which in turn affects consumer spending and confidence. The U.S. Energy Information Administration warns that these trends can have a cascading effect on the broader economy, impacting everything from consumer goods to transportation costs.

The future of oil prices: What can we expect?

As we look to the future, many are left wondering: what’s next for oil prices? While some analysts speculate that prices may rebound as geopolitical tensions ease, others believe that the current trend of low demand could persist for the foreseeable future. The energy market is notoriously volatile, and predicting its movements can be a challenging endeavor.

Industry insiders suggest that companies may need to adapt to this new reality. This could mean investing in alternative energy sources, diversifying portfolios, or even reevaluating their business models entirely. As the market continues to evolve, the key will be flexibility and innovation.

How consumers can navigate the changing landscape

For everyday consumers, navigating this changing landscape can be daunting. With fluctuating prices at the pump and uncertainty about the future, it’s essential to stay informed. Being aware of market trends and understanding how global events affect local prices can help consumers make smarter choices.

Additionally, many are turning to more fuel-efficient vehicles or considering public transportation as a way to mitigate the impact of rising or falling gas prices. As the landscape shifts, being proactive and adaptable will be crucial.

Final thoughts on the oil market crisis

In the face of dropping oil prices and the underlying causes, it’s clear that the energy sector is at a crossroads. The effects of Trump’s tariffs are being felt worldwide, and industries from Wall Street to Main Street are grappling with the fallout. As we move forward, understanding the complexities of the global energy market will be more important than ever.

With prices crashing and demand dwindling, the future remains uncertain. But one thing is clear: the decisions made today will shape the energy landscape for years to come.

“`

This article addresses the recent drop in oil prices, its causes, implications, and potential future scenarios in an engaging, conversational style while adhering to SEO best practices. The keywords and themes from your request are integrated throughout the content, and credible sources have been linked for further reading.

Breaking News, Cause of death, Obituary, Today