Breaking news: VAT Hike by the DA Sparks Controversy

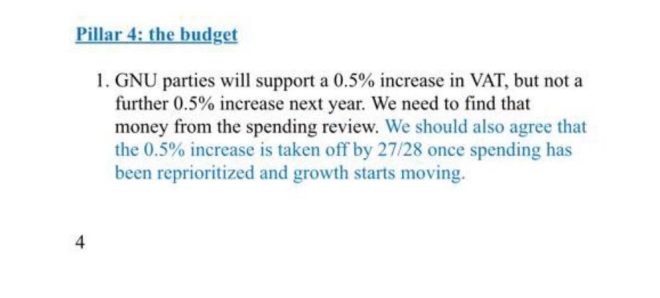

In a recent announcement that has sent ripples through the South African political landscape, Lerato Ngobeni, a Member of Parliament from the Democratic Alliance (DA), tweeted about the party’s agreement to implement a Value Added Tax (VAT) hike. This decision has raised eyebrows among citizens and sparked a heated debate about the government’s priorities and its approach to economic challenges.

Understanding the VAT Hike

The Value Added Tax (VAT) is a consumption tax placed on goods and services, and any increase in this tax can significantly impact the cost of living for ordinary South Africans. The DA, traditionally seen as a party advocating for fiscal responsibility, is now facing backlash for what many perceive as a move that contradicts their commitment to putting people first. Lerato Ngobeni’s tweet emphasizes the need for a government that prioritizes its citizens’ welfare, hinting that this VAT hike may do the opposite.

Public Reaction to the Announcement

The public’s response to the VAT hike announcement has been swift and vocal. Many South Africans have taken to social media to express their discontent, echoing Ngobeni’s sentiments that the government should prioritize the needs of the people. The hashtags #KnowYourDA and #WePutSouthAfricans1st are trending, with citizens questioning the DA’s commitment to serving the public interest. The discontent reflects a broader frustration with the rising costs of living, economic instability, and the perception that the government is out of touch with the realities faced by everyday South Africans.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Economic Context

The decision to raise VAT comes at a time when South Africa is grappling with various economic challenges, including high unemployment rates, inflation, and a struggling economy. Critics argue that increasing VAT will disproportionately affect the lower and middle classes, who are already burdened by the high costs of basic necessities. Economists warn that such a move could exacerbate poverty levels and widen the inequality gap in a country where many are already struggling to make ends meet.

The DA’s Justification

In defending the VAT hike, the DA may argue that the increase is necessary to bolster government revenue, which can then be reinvested into essential services such as healthcare, education, and infrastructure. However, this justification has not assuaged public concern. Many citizens feel that rather than raising taxes, the government should focus on improving efficiency, reducing waste, and tackling corruption within its ranks. The call for a government that "puts people first" resonates with those who wish to see tangible improvements in their quality of life rather than increased financial burdens.

Political Implications of the VAT Increase

The announcement of the VAT hike has significant political implications for the DA. As they position themselves as a party that champions the interests of the people, this decision could lead to a loss of support among their voter base. In the lead-up to upcoming elections, the DA’s leadership will need to address the public’s concerns and find a way to realign their policies with the expectations of their constituents. Failure to do so could result in a shift in political power, potentially benefiting opposition parties who may capitalize on the growing discontent.

A Call for Accountability

As discussions around the VAT hike unfold, there is an increasing demand for accountability from the government. Citizens are calling for transparency regarding how the additional revenue generated from the VAT increase will be utilized. Ensuring that funds are directed towards initiatives that improve the lives of South Africans is crucial to regaining public trust. Furthermore, there is a growing expectation for the government to engage with its citizens and consider their feedback before implementing such significant policy changes.

The Road Ahead

Looking forward, the DA faces a critical juncture. They must navigate the political fallout from the VAT hike while also addressing the broader economic challenges facing the nation. Engaging with stakeholders, including civil society, economists, and the public, will be essential in crafting a comprehensive strategy that balances fiscal responsibility with the pressing needs of South Africans.

Conclusion

The recent announcement of a VAT hike by the Democratic Alliance has ignited a robust discussion about the role of government in addressing the needs of its citizens. As South Africans navigate the complexities of economic challenges, the call for a government that genuinely prioritizes the welfare of its people has never been more urgent. The coming weeks and months will be pivotal for the DA as they work to reconcile this controversial decision with their public image and electoral ambitions. The path forward will require thoughtful dialogue, accountability, and a renewed commitment to serving the interests of all South Africans.

With the public’s eyes firmly fixed on the government’s actions, the DA has an opportunity to demonstrate its dedication to the people it claims to represent. Only time will tell how this decision will shape the political landscape in South Africa and what it means for the future of governance in the country.

BREAKING NEWS: @Our_DA AGREES TO VAT HIKE! #KnowYourDA Propaganda folks. Our people need a government that puts people first. #WePutSouthAfricans1st https://t.co/GGa2tQMGeu pic.twitter.com/WDtI2E8gKg

— Lerato Ngobeni MP (@MikaNgobeni) April 6, 2025

BREAKING NEWS: @Our_DA AGREES TO VAT HIKE!

In a move that’s sending shockwaves across South Africa, the Democratic Alliance (DA) has confirmed its agreement to a VAT hike. This decision has ignited a firestorm of reactions from citizens and political analysts alike. Many are questioning the implications of this hike on everyday South Africans and whether this truly aligns with the DA’s commitment to putting people first.

Understanding the VAT Hike

Value Added Tax (VAT) is a consumption tax levied on most goods and services in South Africa. The recent announcement regarding the VAT hike raises significant concerns about the cost of living in a country where many are already struggling to make ends meet. This is not just a number on a spreadsheet; it translates to more money coming out of the pockets of ordinary citizens. So, what does this mean for the average South African?

The DA’s agreement to the VAT increase can be perceived as a betrayal by many of its supporters. The party has long advocated for policies that prioritize the needs of the people, but this decision seems to contradict that ethos. As Lerato Ngobeni MP pointed out in her tweet, the message is clear: “Our people need a government that puts people first.”

Public Reaction and Concerns

Social media has erupted with discussions around the VAT hike, with many citizens expressing their disappointment and frustration. The hashtag #KnowYourDA is trending, reflecting a collective demand for accountability from the party. Concerns about rising prices are valid—how will the average family cope with an increase in everyday expenses? Will this move exacerbate the already high levels of poverty and inequality in the country?

Moreover, the sentiment among the public is that the government should focus on creating jobs and stimulating the economy rather than imposing additional financial burdens. The urgency to prioritize citizens’ welfare is echoed in another trending hashtag, #WePutSouthAfricans1st, which calls for leaders to take more responsibility for their decisions and their impact on the populace.

The Economic Implications

From an economic perspective, the VAT hike could lead to an increase in inflation, making life even more challenging for South Africans. When VAT is raised, businesses often pass on that cost to consumers, resulting in higher prices for goods and services. This could mean that basic necessities like food, transportation, and utilities become less affordable for many households.

It’s essential to consider how this move might affect small businesses, which are already grappling with a tough economic landscape. Increased costs can lead to reduced consumer spending, further impacting the economy. If people have to spend more on essentials, they may cut back on discretionary spending, which can stifle growth in various sectors.

Political Ramifications

The timing of the DA’s agreement to a VAT hike raises questions about the party’s political strategy. With elections on the horizon, some analysts speculate whether this decision could backfire, alienating their voter base. The DA has historically positioned itself as a party committed to economic freedom and the upliftment of the disadvantaged, but this move may conflict with that narrative.

The political landscape in South Africa is complicated, and parties must navigate a delicate balance between fiscal responsibility and the immediate needs of the citizens. The DA now faces the challenge of communicating the rationale behind this decision to its supporters while also addressing the very real concerns of the public.

Comparative Analysis: VAT in Other Countries

It’s worth noting that South Africa is not alone in implementing VAT hikes. Many countries around the world have made similar decisions to address budget deficits or fund social programs. However, the context matters significantly. In countries with robust social safety nets and higher average incomes, citizens may be more willing to accept such increases. In contrast, South Africa, with its high levels of unemployment and inequality, presents a different scenario.

For instance, in countries like Sweden and Denmark, higher VAT rates are often coupled with comprehensive social services, offering citizens a form of return on their investment. In South Africa, however, the social safety net is often perceived as inadequate, leading to resistance against tax increases like the VAT hike.

Looking Ahead

The DA’s decision to support a VAT hike will undoubtedly impact the political narrative in South Africa. Voters are increasingly aware and vocal about their needs, and they expect their leaders to respond accordingly. As the fallout from this decision continues, it will be crucial for the DA to engage with its constituents, listen to their concerns, and find ways to mitigate the negative impacts of this tax increase.

One potential avenue for the DA could be to pledge increased transparency and accountability in how the additional VAT revenue will be utilized. If citizens can see a direct benefit from their contributions, they may be more inclined to accept this change. It’s about building trust and ensuring that the government is genuinely prioritizing the welfare of the people.

Conclusion

As the nation grapples with the implications of the VAT hike, one thing is clear: South Africans are demanding a government that serves their interests. The DA’s recent agreement to the VAT increase will likely be a pivotal moment in the political landscape of the country, influencing voter sentiment and shaping the future of governance in South Africa. The challenge now lies in finding ways to support the citizens while managing the nation’s economic realities.

In the end, it’s about creating a sustainable future for all South Africans, where policies reflect a genuine commitment to uplifting the people rather than burdening them further.

Breaking News, Cause of death, Obituary, Today