Death- Obituary news

Understanding Tariffs and Their Impact on the American Economy

In recent discussions surrounding economic policies, tariffs have emerged as a contentious topic. A recent tweet highlighted the complexity of tariffs, emphasizing that they are not merely tax hikes for American consumers but rather strategic import penalties aimed at holding foreign countries accountable for unfair trade practices. This article delves into the nuances of tariffs, their implications for the U.S. economy, and the ongoing debate surrounding their effectiveness.

What Are Tariffs?

Tariffs are taxes imposed by a government on imported goods. They serve several purposes, including protecting domestic industries from foreign competition, generating revenue for the government, and addressing trade imbalances. In essence, tariffs are a tool for regulating international trade, allowing countries to exert control over what enters their borders.

The Purpose of Tariffs

The primary goal of implementing tariffs is to protect local businesses and jobs. By making imported goods more expensive, tariffs encourage consumers to purchase domestic products, thereby supporting local economies. This is particularly relevant in industries where foreign competitors may have an advantage due to lower production costs.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, tariffs can be seen as a mechanism to hold foreign countries accountable for unfair trade practices. For instance, countries like China have often been criticized for their trade policies that may undermine U.S. industries. By imposing tariffs, the U.S. government aims to level the playing field, ensuring that American businesses can compete fairly.

Debunking the Myths: Tariffs as a Tax Hike

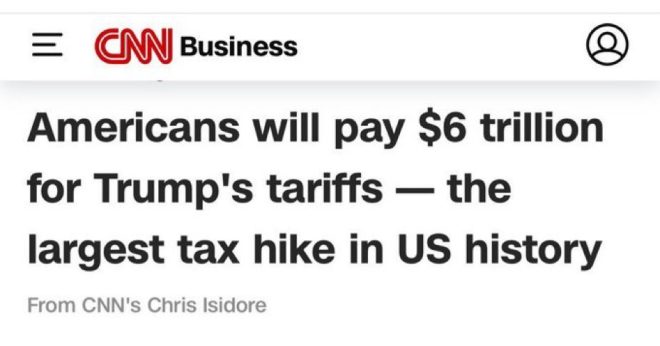

One of the common misconceptions about tariffs is that they represent a direct tax hike on American consumers. However, proponents argue that this view oversimplifies the issue. Although some costs associated with tariffs can be passed on to consumers, the assertion that tariffs result in a $6 trillion burden on American wallets is misleading.

The reality is that tariffs are designed to penalize foreign entities rather than American consumers directly. This distinction is crucial in understanding the broader economic implications of trade policies. While consumers may experience increased prices on certain imported goods, the overall impact on the economy is far more complex.

Economic Implications of Tariffs

The economic implications of tariffs are multifaceted. On one hand, they can stimulate domestic production by making imported goods less competitive. This can lead to job creation and increased investment in local industries. For example, industries such as steel and manufacturing may experience a resurgence as tariffs make foreign products less appealing.

On the other hand, tariffs can also lead to increased prices for consumers. When import costs rise, businesses may pass these expenses onto consumers, leading to higher prices for everyday goods. This creates a delicate balance that policymakers must navigate — supporting domestic industries while minimizing the financial burden on consumers.

The Debate: Are Tariffs Effective?

The effectiveness of tariffs is a subject of ongoing debate among economists, policymakers, and the public. Critics argue that tariffs may lead to trade wars, where countries retaliate by imposing their own tariffs, ultimately harming global trade relations. This could result in a cycle of escalating tariffs that negatively impacts consumers and businesses alike.

Supporters, however, contend that tariffs are necessary to address long-standing trade imbalances and unfair practices by foreign competitors. They argue that without tariffs, American industries may struggle to survive in an increasingly competitive global market.

Conclusion: A Complex Economic Tool

In conclusion, tariffs are a complex economic tool that plays a significant role in shaping international trade dynamics. While they are often portrayed as a direct tax burden on consumers, the reality is that they serve multiple purposes, including protecting domestic industries and addressing unfair trade practices.

As the debate over tariffs continues, it is essential for consumers and policymakers alike to engage in informed discussions about their implications. Understanding the nuanced impact of tariffs on the economy can lead to more effective policies that support both domestic industries and consumers. Whether viewed as a necessary measure or a misguided approach, tariffs will undoubtedly remain a prominent topic in the discourse surrounding global trade and economic policy.

Key Takeaways

- Tariffs are import penalties, not simply tax hikes on American consumers.

- They aim to protect domestic industries and hold foreign countries accountable for unfair trade practices.

- While tariffs can stimulate local production, they may also lead to higher prices for consumers.

- The effectiveness of tariffs is widely debated, with both supporters and critics presenting compelling arguments.

By exploring the complexities of tariffs and their implications, individuals can gain a clearer understanding of this essential aspect of economic policy.

This is pure propaganda.

Tariffs aren’t a ‘tax hike’ on Americans – they’re import penalties meant to hold foreign countries accountable, especially ones like China that rip us off. Some costs can be passed on, but pretending it’s a $6 trillion hit to our wallets is dishonest… pic.twitter.com/dqarCIGLYm

— Acacia (@Acacia1771) April 4, 2025

This is Pure Propaganda

When we talk about tariffs in the United States, the conversation often gets heated. You might have heard people say things like, “This is pure propaganda.” But what does that even mean? In a world where misinformation spreads like wildfire, it’s crucial to sift through the noise and understand the facts behind tariffs, especially when they are labeled as a “tax hike” on Americans.

Tariffs are not just arbitrary charges slapped on imported goods. They are strategic import penalties designed to hold foreign countries accountable for unfair trade practices. China often finds itself in the crosshairs of these discussions, primarily due to its history of trade imbalances and practices that many argue “rip us off.” So, the next time you hear someone throwing around terms like “tax hike,” take a moment to consider whether they’re actually talking about tariffs.

Understanding Tariffs and Their Purpose

Tariffs are essentially taxes imposed on goods imported into a country. They serve several purposes. The primary one is to protect domestic industries by making imported goods more expensive, thus encouraging consumers to buy locally produced items. This is where the idea of holding foreign countries accountable comes into play. By imposing tariffs on goods from countries that engage in unfair trade practices, the U.S. aims to level the playing field for American businesses.

Now, it’s important to note that these tariffs can lead to increased costs for consumers. Some of these costs may indeed be passed on, but it’s misleading to claim that they result in a staggering $6 trillion hit to American wallets. This kind of rhetoric often oversimplifies a complex issue and can lead to widespread misconceptions about the true impact of tariffs.

Are Tariffs Really a Tax Hike?

One of the biggest misconceptions about tariffs is that they represent a tax hike on Americans. While they do increase the price of imported goods, calling them a “tax hike” can be misleading. Tariffs are more like penalties for countries that engage in unfair trade practices. They are not a direct tax on citizens, but rather a measure designed to address trade imbalances.

When you hear claims that tariffs will cost Americans $6 trillion, it’s essential to look behind the numbers. Such figures can often be exaggerated to push a specific narrative. The reality is that while some costs can be passed on to consumers, attributing a multi-trillion dollar burden to tariffs oversimplifies the issue and ignores the broader context of international trade.

The Role of China in the Tariff Debate

China plays a significant role in the ongoing conversation about tariffs. Many argue that the country has a history of engaging in practices that undermine fair trade, leading to a trade deficit that negatively impacts the U.S. economy. For instance, issues like intellectual property theft and state subsidies for Chinese companies create an uneven playing field.

By imposing tariffs on Chinese goods, the U.S. government aims to address these imbalances and encourage fairer trading practices. However, critics argue that tariffs can lead to higher prices for American consumers and may not be the most effective long-term solution.

Real-World Impact of Tariffs

So, what does this all mean for you and me? The real-world impact of tariffs can be complex. On one hand, they aim to protect American jobs and industries by making it more challenging for foreign goods to compete on price. On the other hand, they can lead to increased costs for consumers, particularly when it comes to everyday items like electronics, clothing, and even groceries.

For instance, when tariffs are placed on imported steel, the cost of manufacturing products made from steel can rise. This could lead to a trickle-down effect, where companies pass on the increased costs to consumers. But again, it’s not as simple as saying tariffs are a tax hike. The dynamics of supply and demand, along with competition from other sources, often play a significant role in determining how much of these costs are actually passed on to consumers.

Addressing Misinformation

In today’s digital age, misinformation spreads quickly, especially on social media platforms. Tweets like the one from Acacia highlight the urgency of addressing misconceptions surrounding tariffs. Statements that tariffs are a “tax hike” can perpetuate misunderstandings and divert attention from the real issues at hand.

It’s essential to approach these discussions with a critical mindset, asking questions and seeking out credible sources of information. Understanding the nuances of tariffs helps us engage in more informed discussions about trade policies and their implications for our economy.

The Economic Argument for Tariffs

From an economic standpoint, there are arguments both for and against tariffs. Proponents argue that tariffs protect domestic industries and jobs, allowing American companies to compete more effectively against foreign competitors. This can lead to job growth in specific sectors, particularly manufacturing.

However, opponents argue that tariffs can lead to retaliation from other countries, resulting in a trade war that could harm American exporters. The interconnected nature of the global economy means that when one country imposes tariffs, others often respond in kind, leading to a cycle of escalating trade barriers.

Ultimately, the effectiveness of tariffs in achieving their intended goals often hinges on the broader context of international relations and economic conditions. It’s a complex dance that requires careful consideration and strategic planning.

Finding a Middle Ground

It’s clear that tariffs are a contentious issue, and finding a middle ground is essential. While they can serve as a tool for holding foreign countries accountable and protecting American jobs, it’s crucial to weigh the potential downsides, such as increased costs for consumers and the risk of retaliation from trading partners.

Engaging in open discussions about tariffs and their implications allows us to navigate this complex landscape more effectively. By fostering a better understanding of the issues at play, we can work towards policies that benefit both American industries and consumers.

The Future of Tariffs and Trade Policy

Looking ahead, the future of tariffs and trade policy will likely continue to be a hot topic. As global trade dynamics evolve and new challenges emerge, policymakers will need to adapt their strategies accordingly. Whether through negotiations, trade agreements, or the implementation of tariffs, the goal should be to promote fair trade practices while minimizing the impact on American consumers.

In the end, understanding tariffs is about more than just numbers and percentages; it’s about recognizing their role in a larger economic framework. Engaging in informed discussions and seeking out reliable information can help dispel the myths and clarify the realities of tariffs in the modern economy.

Whether you’re a consumer, a business owner, or simply someone interested in economic policy, staying informed about tariffs and their implications is essential. As discussions continue to evolve, being well-prepared and knowledgeable will help you navigate the complexities of trade in today’s world.