Understanding the New US Tariff Calculation Methodology

In a recent report by the New York Post, a significant update has emerged regarding how the United States is calculating tariffs on various nations. This revelation has sparked widespread interest, especially among businesses and trade analysts, as it sheds light on the ongoing complexities of international trade relations.

Overview of the Tariff Calculation

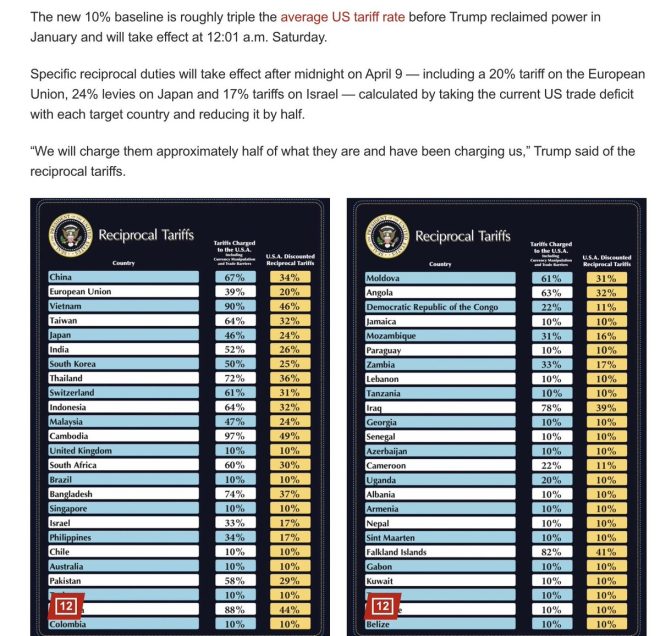

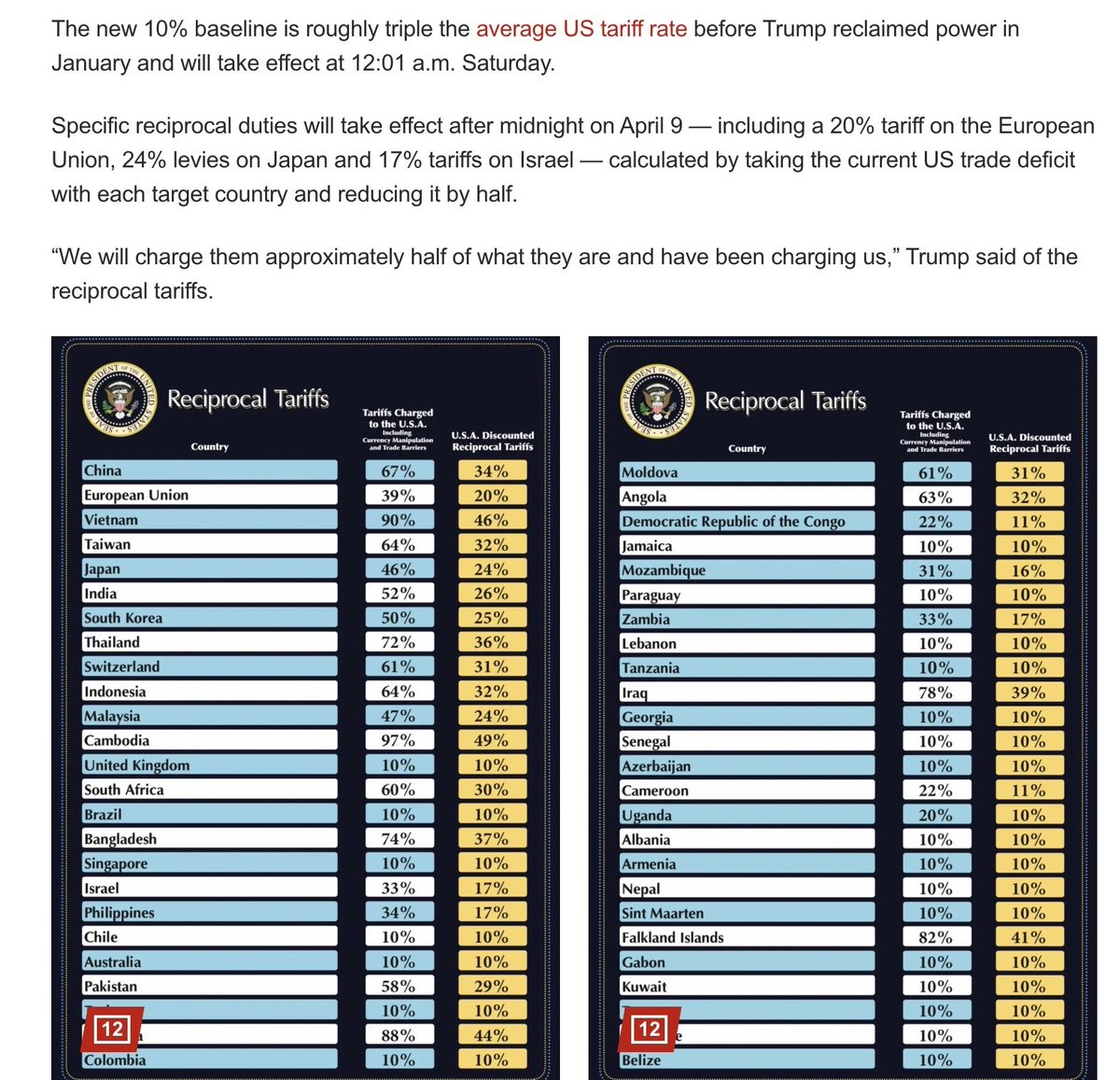

The report indicates that the US tariffs imposed on each country are now determined by a specific formula. This formula involves taking the current US trade deficit with the target country and dividing that deficit by half. The resulting figure is then utilized as the basis for the tariffs imposed on imports from those nations. This method aims to reflect the economic realities of trade deficits and is likely to impact how trade negotiations are approached in the future.

Implications of the New Tariff System

The shift in tariff calculation methodology carries several implications for international trade dynamics. Here are the key considerations:

- Impact on Trade Deficits: By directly linking tariffs to trade deficits, the US government is signaling a more aggressive stance towards nations with which it has significant trade imbalances. Countries that have been running consistent trade surpluses with the US may face increased tariffs, potentially leading to higher prices for consumers and businesses reliant on imported goods.

- Potential for Retaliation: Nations affected by these new tariffs may respond with their own tariffs or trade barriers, leading to a potential escalation in trade tensions. Diplomatic relations could be strained, particularly if countries feel that the US is unfairly targeting them based on this new formula.

- Effect on Domestic Industries: While the intent of increasing tariffs may be to protect domestic industries from foreign competition, higher tariffs can also lead to increased costs for consumers. Industries that rely on imported materials may find their operating costs rising, which could hinder their competitiveness both domestically and internationally.

- Encouragement of Domestic Production: On the other hand, the new tariff structure may encourage domestic production as companies seek to avoid the higher costs associated with imported goods. This could potentially stimulate job creation within the United States, particularly in manufacturing sectors.

- Long-Term Trade Strategy: The ongoing adjustments in tariff policies reflect a broader strategy aimed at recalibrating America’s trade relationships. As the global economy continues to evolve, the US will likely continue to refine its approach to tariffs and trade agreements, seeking to establish more balanced economic relationships.

Historical Context of US Tariffs

To fully understand the implications of this new tariff calculation method, it is essential to consider the historical context of US tariffs. Tariffs have long been a tool used by governments to regulate trade, protect local industries, and generate revenue. Over the years, the US has employed various tariff strategies, often tied to broader economic policies and political agendas.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In recent years, trade tensions between the US and several nations, particularly China, have led to the implementation of tariffs as a means of addressing perceived unfair trade practices. The introduction of this new calculation method marks a continuation of this trend, as policymakers seek to leverage tariffs as a tool for economic negotiation and reform.

The Role of Trade Deficits

Trade deficits occur when a country imports more goods and services than it exports. They can be indicative of a variety of economic factors, including consumer demand, currency valuation, and competitive advantages in certain industries. The US has experienced significant trade deficits with several countries, leading to calls for a reevaluation of how these relationships are managed.

By basing tariffs on trade deficits, the US government aims to create a more transparent and quantifiable approach to tariff implementation. This method could potentially lead to a more structured dialogue around trade practices, encouraging countries to address imbalances more proactively.

Conclusion

The recent report detailing the new US tariff calculation methodology is a significant development in the realm of international trade. As the US government implements this formula, it will be crucial for businesses, policymakers, and consumers to stay informed about the potential impacts.

Understanding how tariffs are calculated and the rationale behind these changes can help stakeholders navigate the evolving landscape of international trade. In an increasingly interconnected world, the implications of trade policies extend far beyond borders, affecting economies globally.

As the situation develops, it will be interesting to observe how countries respond to these changes and what new strategies emerge in the ongoing quest for fair and balanced trade relations. The future of global commerce hinges on the ability of nations to adapt to these shifting dynamics and work towards mutually beneficial agreements that foster economic growth and stability.

JUST IN: The NYPost has reported that the US tariffs on each nation is calculated by taking the current US trade deficit with each target country and dividing the deficit by half, to get the resulting tariff imposed. pic.twitter.com/wHXeOli9b6

— unusual_whales (@unusual_whales) April 3, 2025

JUST IN: The NYPost has reported that the US tariffs on each nation is calculated by taking the current US trade deficit with each target country and dividing the deficit by half, to get the resulting tariff imposed.

When it comes to international trade, tariffs are a significant topic of discussion, especially in the context of the United States. Recently, a report from the NYPost has shed light on how the U.S. calculates tariffs for various nations. The method is intriguing: it’s based on the current U.S. trade deficit with each target country, divided by half to determine the imposed tariff. This approach raises several questions about the implications for both the U.S. economy and its international relationships.

Understanding Tariffs and Trade Deficits

Before diving deeper into this tariff calculation method, let’s clarify what tariffs and trade deficits actually are. Tariffs are taxes imposed on imported goods, aimed at making them more expensive and thereby encouraging consumers to buy domestically produced items. On the other hand, a trade deficit occurs when a country imports more than it exports, indicating that it is spending more on foreign products than it is earning from selling its own.

The idea of connecting tariffs directly to the trade deficit is not entirely new, but it’s crucial to understand the rationale behind it. By focusing on the trade deficit, policymakers may believe they’re addressing economic imbalances. However, this method also invites scrutiny and debate over its fairness and effectiveness.

The Mechanics of Tariff Calculation

According to the NYPost’s report, the U.S. calculates tariffs by taking the existing trade deficit with a particular country and dividing that figure by two. This mathematical approach aims to create a direct link between the deficit and the tariffs imposed. For instance, if the deficit with a country stands at $100 billion, the resulting tariff would be $50 billion.

But why divide by half? The intention might be to create a balance – a way to penalize countries that are perceived to be taking advantage of the U.S. market without reciprocating. However, this raises concerns about the potential for escalated trade tensions and retaliatory measures from those countries affected by these tariffs.

The Impact on U.S. Consumers and Businesses

Let’s consider who really feels the pinch of these tariffs. Typically, it’s the consumers and businesses in the U.S. that bear the brunt of increased import costs. When tariffs go up, the price of imported goods rises, which can lead to higher prices at the checkout counter. For example, if companies face higher import costs, they often pass those costs on to consumers.

Moreover, U.S. businesses that rely on imported materials for production might find themselves in a tough spot. Increased tariffs can squeeze their profit margins, leading to potential layoffs, reduced hiring, or, in some cases, passing costs onto consumers. It’s a classic case of unintended consequences that can ripple throughout the economy.

International Relations and Trade Wars

Now, let’s talk about the broader implications of this tariff calculation method. Implementing tariffs based on the trade deficit could strain relationships with key trading partners. Countries that find themselves facing increased tariffs may retaliate by imposing their own tariffs on U.S. goods, leading to a trade war. We’ve seen this before in various instances, and it’s rarely beneficial for either party involved.

For example, during the recent trade tensions between the U.S. and China, both countries imposed tariffs on each other’s goods, which had a significant negative impact on businesses and consumers alike. The goal was to protect domestic industries, but the reality was often rising costs and limited choices for consumers.

Potential Alternatives to Tariff Calculations

Given the complexities and potential fallout from this tariff calculation method, it might be wise to consider alternatives. For instance, instead of solely relying on trade deficits to determine tariffs, a more balanced approach could involve evaluating the overall trade relationship with each country. This could include factors such as the quality of goods, labor practices, and environmental standards.

Additionally, engaging in dialogue and negotiations with trading partners could pave the way for more mutually beneficial agreements. Trade deals that promote cooperation and fair practices can create a win-win situation rather than pitting countries against each other in a tit-for-tat tariff battle.

The Future of U.S. Tariff Policy

As we look ahead, it’s essential to keep an eye on how the U.S. tariff policy evolves. The method of calculating tariffs based on trade deficits may continue to spark debate among economists, policymakers, and the public. With the global economy becoming increasingly interconnected, the stakes are high, and the need for thoughtful, strategic policies is more critical than ever.

In conclusion, while the NYPost’s reporting on U.S. tariffs provides a glimpse into how these financial tools are being utilized, the conversation must continue. There are many layers to the tariff debate, and understanding the implications for consumers, businesses, and international relations is vital. Whether through dialogue, negotiation, or alternative approaches, fostering a healthy global trade environment will be key to ensuring economic stability and growth.

Stay Informed

Keeping up with developments in U.S. trade policy is crucial for anyone interested in economics, business, or international relations. For more insights and updates, consider following trusted news sources and engaging with economic discussions online. By staying informed, you can better understand how these policies impact your daily life and the global economy.

And remember, every time you make a purchase, think about the broader implications of tariffs and trade policies. Your choices as a consumer play a role in shaping the economic landscape!