Exploring the Recent Surge in $zBTC and $wBTC Pool Volume Amid FDUSD Allegations

In a recent press conference, Justin Sun, the founder of TRON and BitTorrent, made waves with allegations regarding FDUSD, leading to significant shifts in the cryptocurrency market. Notably, the pool volume for $zBTC and $wBTC surged threefold on the Solana blockchain, igniting discussions about market confidence and investor behavior.

What Happened?

During the press conference, Justin Sun’s allegations prompted a notable reaction from the cryptocurrency community. Observers reported a dramatic increase in the trading volume of the $zBTC and $wBTC pools on Solana, which more than tripled in a short period. This surge raised eyebrows and led to speculation about the reasons behind this sudden spike.

As the event unfolded, many participants in the market began to unwrap their $wBTC back to native Bitcoin (BTC), a move that is still ongoing. This phenomenon has led to questions about the stability and trustworthiness of wrapped tokens, particularly $wBTC, and whether investors are losing faith in these assets.

Understanding $zBTC and $wBTC

To provide context, both $zBTC and $wBTC are wrapped versions of Bitcoin. Wrapped Bitcoin (wBTC) is an ERC-20 token that is backed 1:1 by Bitcoin, allowing it to be utilized within the Ethereum ecosystem. On the other hand, $zBTC, while also a wrapped token, is associated with the Solana blockchain, providing users with high-speed transactions and lower fees compared to Ethereum.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The rise in the volume of these wrapped tokens can indicate broader market sentiments. The sudden unwrapping of $wBTC back to native BTC suggests a shift in strategy among investors, possibly driven by the need for liquidity or a desire to hold the original asset amidst uncertainty.

The Impact of Justin Sun’s Allegations

The timing of this market activity coincides with Justin Sun’s allegations during the press conference regarding FDUSD. While the specifics of these allegations were not detailed in the brief summary, they seem to have impacted investor confidence significantly.

Sun is a prominent figure in the cryptocurrency space, and his statements often hold considerable weight. The fact that his comments led to such a drastic change in trading behavior indicates that investors are highly responsive to news and events involving influential personalities in the crypto market.

Market Reactions and Speculation

The surge in $zBTC and $wBTC pool volumes has led to various interpretations among cryptocurrency traders and analysts. Some speculate that investors are losing faith in $wBTC, possibly due to concerns about its security, transparency, or the implications of the allegations made by Sun. Others believe that traders might be reacting to insider knowledge or market signals that are not yet public, prompting them to take preemptive actions to protect their investments.

The ongoing unwrapping back to native BTC could signal a strategic pivot among investors who prefer to hold the original asset during times of uncertainty. This move might reflect a broader trend where investors seek to minimize risk by reverting to the more established and widely accepted form of Bitcoin rather than its wrapped counterparts.

Conclusion

The events surrounding Justin Sun’s allegations at the press conference have sparked significant interest and speculation within the cryptocurrency community. The threefold increase in trading volume for $zBTC and $wBTC on Solana raises important questions about market confidence and the future of wrapped tokens.

As the situation develops, it will be crucial for investors to stay informed about the implications of these allegations and to monitor changes in trading behavior. The cryptocurrency market is known for its volatility and rapid changes, and moments like these serve as reminders of the importance of due diligence and informed decision-making.

In conclusion, whether the surge in $zBTC and $wBTC volumes indicates a loss of faith in wrapped tokens or if it reflects a deeper understanding of market dynamics remains to be seen. However, the ongoing developments will surely keep traders and investors on their toes as they navigate this ever-evolving landscape.

Staying Updated

To remain informed about the latest developments and insights in the cryptocurrency market, it’s essential to follow trusted sources and engage with the community. Social media platforms, especially Twitter, have become vital for real-time updates and discussions surrounding significant events and trends in the crypto world.

By keeping a close watch on market movements and the influences of key figures like Justin Sun, investors can better position themselves to make informed decisions in this fast-paced environment.

BREAKING:

During Justin Sun’s FDUSD allegations at the press conference, something strange happened

$zBTC/ $wBTC pool volume surged 3x on Solana and some even unwrapped back to native BTC (still ongoing).

Did people lose faith in $wBTC or do they know something we don’t? pic.twitter.com/WkCWtbEyXs

— Justin | Zeus Network (@dappiokeeper) April 3, 2025

BREAKING: During Justin Sun’s FDUSD allegations at the press conference, something strange happened

In the ever-evolving world of cryptocurrency, unexpected shifts can occur in the blink of an eye. Recently, during a press conference featuring the controversial figure Justin Sun, allegations surrounding FDUSD emerged, leading to a curious spike in the trading activity of certain cryptocurrencies. Specifically, the pool volume for $zBTC and $wBTC surged threefold on the Solana blockchain. But what does this mean for the broader crypto market? Let’s dig deeper.

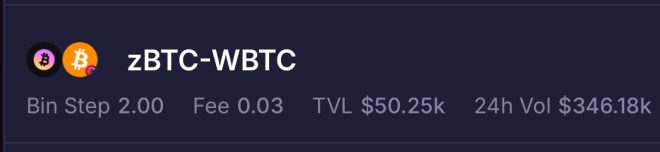

$zBTC and $wBTC Pool Volume Surged 3x on Solana

The surge in pool volume for $zBTC and $wBTC is nothing short of intriguing. For those who may not be familiar, $wBTC (Wrapped Bitcoin) is a token that represents Bitcoin on the Ethereum blockchain, allowing users to leverage Bitcoin’s value within decentralized finance (DeFi) applications. Meanwhile, $zBTC is gaining traction as a new player in the market. The triple increase in pool volume indicates that traders are actively swapping their assets, perhaps driven by concerns or insights related to the allegations made by Sun.

Some Even Unwrapped Back to Native BTC (Still Ongoing)

Interestingly, as the volume surged, some traders opted to unwrap their $wBTC back to native Bitcoin. This move raises questions: Are traders losing faith in $wBTC, or do they possess information that the rest of us are not privy to? The decision to convert back to native BTC often signifies a desire for stability during uncertain times in the crypto landscape. With the volatility that characterizes the market, it’s unsurprising that investors are looking to secure their assets.

Did People Lose Faith in $wBTC or Do They Know Something We Don’t?

This situation poses a critical question: Are the traders who are unwrapping their $wBTC losing faith in the asset, or do they have insider knowledge that suggests a downturn might be on the horizon? The dynamics of the crypto market often create a ripple effect where a few decisions can lead to mass reactions. In this case, the surge in unwrapping transactions could be interpreted as a precautionary measure by investors who are keen to protect their holdings.

The Impact of Justin Sun’s Allegations

Justin Sun is no stranger to controversy. His involvement in various crypto initiatives has often placed him in the spotlight, and this latest press conference is no exception. The allegations surrounding FDUSD, a stablecoin project, have raised eyebrows and sparked discussions across social media platforms. As the CEO of TRON, Sun’s statements can significantly impact market sentiment. Investors are likely analyzing his words and actions closely, leading to reactive trading strategies, such as those seen with $zBTC and $wBTC.

The Broader Implications for the Crypto Market

Such fluctuations in trading volume and asset conversion are not isolated incidents; they reflect broader trends within the crypto market. When significant figures like Justin Sun make headlines, it can lead to a wave of uncertainty, causing traders to reassess their positions. The surge in trading activity is a reminder of the interconnectedness of market dynamics and the influence of prominent personalities in the crypto space.

Understanding the Technology Behind $wBTC and $zBTC

To truly grasp the implications of this surge, it’s essential to understand the technology behind $wBTC and $zBTC. $wBTC is an ERC-20 token, meaning it operates on the Ethereum blockchain. It allows Bitcoin holders to utilize their assets in DeFi applications, opening doors to yield farming, lending, and other financial services. Meanwhile, $zBTC represents a newer approach, aiming to provide similar functionalities but with unique enhancements that may attract users. As these technologies evolve, the market will continue to adapt, leading to more instances of volatility.

Crypto Investor Sentiment During Controversies

The psychology of investors plays a pivotal role during times of controversy. When faced with uncertainty, many traders may choose to err on the side of caution, as seen with the recent surge in unwrapping $wBTC. This behavior is a reflection of the broader sentiment within the market, where fear and speculation can drive decision-making processes. Understanding these emotional triggers is crucial for anyone looking to navigate the crypto landscape effectively.

The Role of Social Media in Shaping Market Reactions

Social media platforms, particularly Twitter, serve as a barometer for market sentiment. The tweet from Justin Sun that highlighted the surge in pool volume quickly gained traction, with individuals speculating on the reasons behind this sudden activity. As discussions unfold online, traders often find themselves influenced by the opinions and analyses of others, leading to collective reactions that can amplify market movements. The interplay between social media and trading activity is a phenomenon that continues to evolve.

Future Outlook: What Lies Ahead for $wBTC and $zBTC?

As we look to the future, the question remains: what lies ahead for $wBTC and $zBTC? The cryptocurrency market is notoriously unpredictable, and while the recent surge might indicate a temporary reaction to Justin Sun’s allegations, it could also signify a shift in how investors perceive these assets. For $wBTC, maintaining trust will be crucial as it competes against emerging alternatives like $zBTC. The ongoing developments in the DeFi space will likely shape their trajectories.

The Importance of Staying Informed

In a market as dynamic as cryptocurrency, staying informed is essential. Whether through social media, news outlets, or community discussions, understanding the context and implications of market movements can empower investors to make informed decisions. As events unfold, keeping a finger on the pulse of developments will be crucial for navigating the complexities of the crypto landscape.

Final Thoughts on Market Reactions and Future Trends

The recent developments surrounding Justin Sun’s allegations and their impact on $zBTC and $wBTC are a testament to the volatility and unpredictability of the cryptocurrency market. As traders react to news, sentiment shifts, and new technologies emerge, the landscape continues to evolve. For anyone involved in the crypto space, understanding these dynamics will be key to navigating future challenges and opportunities. So, whether you’re a seasoned investor or just getting started, remember to stay curious and informed as you explore the fascinating world of cryptocurrencies.