Summary of the Democratic Alliance’s Legal Action Against the National Budget

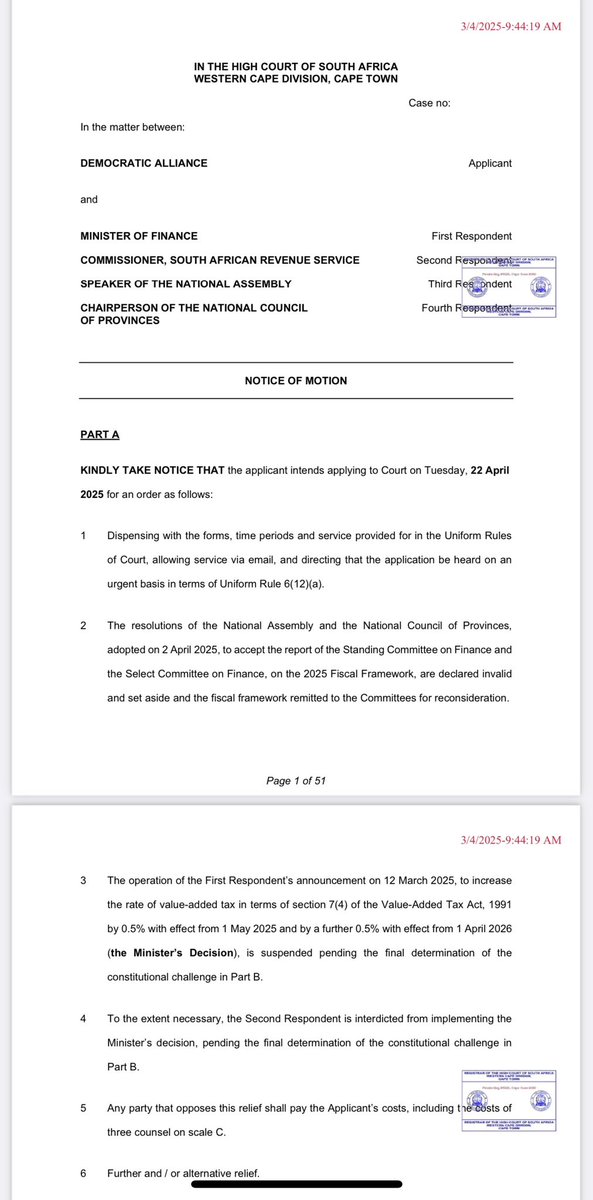

On April 3, 2025, the Democratic Alliance (DA), a major political party in South Africa, took significant legal action by filing papers in the Western Cape High Court. Their objective is to invalidate the Parliament’s approval of the 2025/26 National Budget and to suspend the proposed increase in Value Added Tax (VAT). This decision has sparked a wave of discussions and debates regarding fiscal policies and governance in South Africa.

Background on the National Budget

The National Budget is a crucial document that outlines the government’s planned expenditures and revenue collection for the upcoming fiscal year. It serves as a financial blueprint for the country’s economic policies and priorities. The 2025/26 budget, which has been the subject of contention, is particularly significant as it reflects the government’s strategy for economic recovery and growth in the post-pandemic era.

One of the central issues surrounding this budget is the proposed increase in VAT, a consumption tax that affects a wide range of goods and services. The DA’s challenge is rooted in concerns that this hike could disproportionately impact lower-income households, exacerbating existing inequalities in the country.

The Democratic Alliance’s Arguments

The Democratic Alliance has consistently positioned itself as a champion of social justice and economic fairness. In their court filing, they argue that the process leading to the budget’s approval was flawed and lacked adequate public consultation. They contend that the VAT increase is regressive and will place an additional financial burden on vulnerable populations who are already facing economic hardships.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Additionally, the DA is challenging the constitutionality of the budget approval process, asserting that it violates principles of transparency and accountability. They argue that the government’s fiscal decisions should be made with the input of citizens and should prioritize the needs of all South Africans, particularly those in disadvantaged communities.

Implications of the Legal Challenge

The DA’s legal action could have significant implications for South Africa’s governance and fiscal policy. If the court rules in favor of the DA, it could lead to a reevaluation of the budget and a reconsideration of the VAT increase. This outcome would not only affect the government’s revenue projections but also signal a shift in how fiscal policies are developed and implemented in the country.

Moreover, this legal challenge highlights the role of opposition parties in South Africa’s political landscape. The DA’s proactive stance in seeking judicial intervention underscores the importance of checks and balances within the democratic system. It reflects an active engagement in governance, prompting discussions about the responsibilities of both the government and opposition parties in representing the interests of citizens.

Public Reaction and Media Coverage

The announcement of the DA’s legal challenge has garnered considerable media attention, with various news outlets covering the story extensively. Social media platforms have also played a significant role in shaping public discourse around the issue. Many South Africans have taken to platforms like Twitter to express their opinions regarding the budget and the proposed VAT increase.

Supporters of the DA have applauded the party’s efforts to hold the government accountable, while critics argue that the legal challenge could delay essential economic reforms. Public sentiment is divided, reflecting the complexities of fiscal policy and its impact on different segments of society.

The Future of Fiscal Policy in South Africa

As the legal proceedings unfold, the implications for South Africa’s fiscal policy will be closely monitored. The outcome of this case could set a precedent for how future budgets are formulated and approved. It may also influence the broader conversation around taxation and public spending, particularly in the context of social equity and economic recovery.

The DA’s actions are a reminder of the dynamic interplay between political parties and the judicial system in South Africa. It underscores the importance of civic engagement and the role of citizens in shaping governance. As the country navigates its economic challenges, the need for inclusive policies that prioritize the well-being of all South Africans remains paramount.

Conclusion

The Democratic Alliance’s legal challenge against the 2025/26 National Budget and the proposed VAT increase is a significant development in South Africa’s political landscape. It raises important questions about governance, accountability, and the role of opposition parties in a democratic society. As the case progresses, it will be essential to watch how it influences fiscal policy and the broader economic environment in South Africa.

The legal action reflects a commitment to ensuring that government decisions are made transparently and with the input of citizens. Ultimately, this challenge is not just about a budget; it is about the values that underpin South Africa’s democracy and the importance of creating a fair and just society for all its citizens.

For ongoing updates and insights into this developing story, stay tuned to reputable news sources and follow the discussions on social media platforms where citizens are actively engaging with these critical issues.

JUST IN: The Democratic Alliance has officially filed papers in the Western Cape High Court to invalidate Parliament’s passing of the 2025/26 National Budget & to suspend the VAT Hike pending part B (the constitutional challenge) #SABCNews pic.twitter.com/etZ55JRgyt

— Canny Maphanga (@CannyMaphanga) April 3, 2025

JUST IN: The Democratic Alliance Takes Action Against the 2025/26 National Budget

In a bold move that has captured the attention of many, the Democratic Alliance (DA) has officially filed papers in the Western Cape High Court. Their goal? To invalidate Parliament’s passing of the 2025/26 National Budget and to suspend the VAT hike that accompanies it. This legal action has sparked discussions across various platforms, particularly on social media, as citizens eagerly await the outcome of this constitutional challenge.

Understanding the Context of the Legal Action

The decision to challenge the National Budget is not merely bureaucratic but strikes at the heart of fiscal policy and governance in South Africa. The DA argues that the budget process lacked transparency and accountability, which they believe are crucial for a functioning democracy. This challenge comes amidst ongoing debates about the economic direction of the country, where rising costs of living and economic stability are hot topics.

The Implications of the VAT Hike

One of the significant aspects of the budget that the DA seeks to suspend is the proposed VAT hike. Value Added Tax (VAT) is a consumption tax that affects everyone, especially the vulnerable segments of society. With South Africa grappling with high unemployment rates and increasing poverty levels, any tax hike can have a profound effect on the average citizen. The DA’s stance is that this hike would disproportionately burden those already struggling to make ends meet.

The Role of the Western Cape High Court

Filing a legal challenge in the Western Cape High Court places this issue in the hands of the judiciary, where legal precedents and constitutional interpretations will play a pivotal role. The DA’s legal team is prepared to argue that the budget process did not adhere to the required legal frameworks, thus making the passing of the budget invalid. The court’s decision could set a significant precedent for future budgetary processes in South Africa.

Public Reaction and Political Ramifications

The public reaction to the DA’s legal filing has been mixed. Many citizens are voicing their support for the DA, believing that holding the government accountable is essential. Others, however, question whether this move is politically motivated and if it will lead to any real change. Social media platforms like Twitter have been buzzing with opinions, with hashtags such as #SABCNews trending as people engage in discussions about fiscal responsibility, governance, and the role of opposition parties in South Africa.

What’s Next for the DA and the Budget Challenge?

As the case moves forward, the DA will need to present compelling arguments backed by solid evidence to convince the court of their position. The process will likely involve several stages, including hearings where both sides can present their cases. The timeline for this legal challenge remains uncertain, but it is essential for citizens to stay informed about developments as they unfold.

The Broader Economic Context

This legal challenge is set against a backdrop of broader economic challenges facing South Africa. The nation has been navigating through a complex economic landscape marked by rising inflation, fluctuating currency values, and a pressing need for sustainable growth. The DA’s actions can be seen as part of a larger effort to advocate for responsible financial stewardship and to ensure that government decisions align with the best interests of the populace.

Engaging with the Community

The DA has an opportunity to engage with communities across South Africa as they navigate this legal challenge. Town hall meetings, social media campaigns, and public discussions can help to educate citizens about the implications of the budget and the VAT hike, fostering a more informed electorate. This grassroots engagement is crucial, as it not only builds support for the DA’s position but also empowers citizens to voice their concerns about economic policies.

Conclusion: The Importance of Accountability in Governance

The Democratic Alliance’s legal challenge to the 2025/26 National Budget raises critical questions about governance, accountability, and the role of opposition parties in South Africa. As citizens, staying informed and engaged in these discussions is vital, especially when policies can significantly impact our everyday lives. The outcome of this legal challenge will undoubtedly influence the political landscape and set the tone for future fiscal policies in the country.

Stay tuned for updates on this developing story as both the DA and the government prepare to face the scrutiny of the courts and the public alike.