Breaking News: Metaplanet Acquires $13.3 Million in Bitcoin

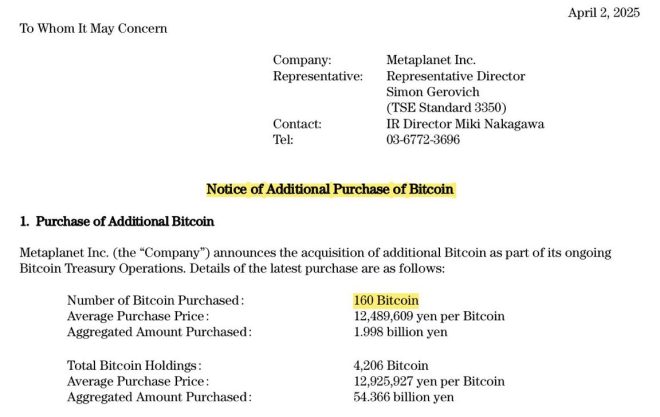

In a significant development within the cryptocurrency market, Metaplanet has made headlines by purchasing 160 Bitcoin (BTC), valued at approximately $13.3 million. This strategic move has generated excitement among crypto enthusiasts and investors, signaling a potential bullish trend in the market. In this summary, we will explore the implications of this acquisition, the current state of Bitcoin, and what it could mean for the future of cryptocurrency.

Overview of the Acquisition

On April 2, 2025, Crypto Rover, a notable figure in the cryptocurrency community, announced the acquisition via Twitter, stating, "Metaplanet just bought 160 $BTC worth $13.3M." This tweet quickly gained traction, highlighting the growing interest in Bitcoin as a viable investment option. The announcement has sparked discussions regarding Metaplanet’s intentions and its potential impact on Bitcoin’s market price.

The Significance of Bitcoin

Bitcoin, the first and most well-known cryptocurrency, has seen a remarkable journey since its inception in 2009. With a limited supply of 21 million coins, Bitcoin’s scarcity has contributed to its value appreciation over the years. As more institutional investors and companies like Metaplanet enter the market, Bitcoin’s position as a digital gold alternative continues to strengthen.

Institutional Adoption of Bitcoin

The acquisition by Metaplanet is a part of a broader trend of institutional adoption of Bitcoin and other cryptocurrencies. Major corporations and investment firms are increasingly recognizing the potential of digital assets as a hedge against inflation and economic uncertainty. This shift is evidenced by several high-profile investments in Bitcoin by companies such as MicroStrategy, Tesla, and Square, among others.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for the Cryptocurrency Market

The purchase of 160 BTC by Metaplanet could lead to several implications for the cryptocurrency market:

- Price Movement: Historically, large purchases of Bitcoin have often resulted in price increases. As demand rises, particularly from institutional buyers, Bitcoin’s price may experience upward pressure. Market analysts will be closely monitoring price trends following this acquisition.

- Increased Credibility: The involvement of Metaplanet, a recognized entity, adds credibility to the cryptocurrency market. As more reputable organizations invest in Bitcoin, it could attract additional investors who may have previously been hesitant to enter the market.

- Market Sentiment: The excitement generated by significant acquisitions can influence market sentiment positively. Investors may feel more confident in their holdings, leading to increased buying activity and potentially driving prices higher.

Future Prospects for Bitcoin

As we look ahead, the future of Bitcoin appears promising, especially with increasing institutional involvement. Several factors could influence Bitcoin’s trajectory:

- Regulatory Developments: The regulatory landscape surrounding cryptocurrencies is evolving. Clear and favorable regulations could pave the way for more institutional investments, further legitimizing Bitcoin and boosting its price.

- Technological Advancements: Innovations such as the Lightning Network and improvements in scalability could enhance Bitcoin’s usability. As Bitcoin becomes easier to transact with, it may attract more users and investors.

- Market Dynamics: The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Understanding market dynamics and investor behavior will be crucial for predicting future trends.

Conclusion

Metaplanet’s recent acquisition of 160 Bitcoin worth $13.3 million is a significant milestone in the ongoing evolution of the cryptocurrency market. As institutional interest in Bitcoin continues to grow, the potential for price appreciation and increased legitimacy of digital assets becomes more pronounced. Investors and enthusiasts alike will be watching closely to see how this acquisition impacts market dynamics and the overall perception of Bitcoin as a long-term investment.

Stay Informed

For those looking to stay updated on the latest developments in the cryptocurrency world, following reputable sources and industry experts on social media platforms like Twitter can provide valuable insights. The excitement surrounding Metaplanet’s acquisition is just the beginning, and the future of Bitcoin holds many possibilities. Whether you are a seasoned investor or new to the cryptocurrency space, being informed will help you navigate this ever-changing landscape.

BREAKING:

METAPLANET JUST BOUGHT 160 $BTC WORTH $13.3M

HERE WE GO pic.twitter.com/FodESIqLxN

— Crypto Rover (@rovercrc) April 2, 2025

BREAKING:

In an exciting development in the crypto world, Metaplanet has just purchased 160 $BTC worth $13.3M. This bold move has sent ripples through the crypto community, igniting conversations about the potential implications for Bitcoin and the broader market. As enthusiasts, investors, and analysts scramble to dissect this news, let’s dive into what this purchase means for Metaplanet, Bitcoin, and the future of cryptocurrency.

METAPLANET JUST BOUGHT 160 $BTC WORTH $13.3M

So, what does this monumental acquisition really signify? Metaplanet, a company that’s been making waves in the tech and crypto space, has decided to invest heavily in Bitcoin. With this purchase, they’ve added a substantial amount of BTC to their portfolio, raising eyebrows and generating buzz. But why Bitcoin? What is it about this digital asset that is attracting such significant investments?

HERE WE GO

Bitcoin has long been hailed as the gold standard of cryptocurrencies, and this latest move by Metaplanet only reinforces its status. The purchase underscores a growing trend where corporations are not just dabbling in crypto; they’re diving in headfirst. With a valuation of $13.3 million, this investment could be seen as a strategic play to hedge against inflation and diversify assets. For Metaplanet, it’s a bold statement that they believe in the long-term viability and growth of Bitcoin.

The Increasing Institutional Interest in Bitcoin

This isn’t just a one-off incident. Over the past few years, there has been a noticeable uptick in institutional interest in Bitcoin. Companies like Tesla and MicroStrategy have made headlines with their Bitcoin purchases, and now Metaplanet is joining this elite group. This trend suggests that more organizations recognize Bitcoin not only as a store of value but also as a potential line of defense against economic uncertainty.

Why Invest in Bitcoin?

Investors often cite several reasons for investing in Bitcoin. First, its limited supply—there will only ever be 21 million Bitcoins—creates scarcity, which can drive up value over time. Second, Bitcoin operates independently of traditional banking systems, providing a degree of financial freedom that many find appealing. Lastly, as more individuals and corporations adopt Bitcoin, its legitimacy continues to grow, further boosting investor confidence.

The Impact of Metaplanet’s Purchase

So, what might the impact of Metaplanet’s purchase be? For one, it could lead to a price surge in Bitcoin as demand increases. When a notable entity buys a large amount of BTC, it often results in heightened interest from other investors. Additionally, Metaplanet’s commitment to Bitcoin could encourage other companies to explore similar acquisitions, creating a ripple effect throughout the market.

Market Reactions and Future Predictions

Reactions from the crypto community have been overwhelmingly positive. Many see this as a vote of confidence in Bitcoin’s future. However, skeptics warn about the volatility of cryptocurrencies and remind investors to tread carefully. Predictions about Bitcoin’s price vary widely, with some experts suggesting it could reach new all-time highs while others advise caution and suggest a potential pullback.

Understanding Bitcoin’s Volatility

It’s essential to grasp the volatility of Bitcoin. Prices can swing dramatically within short time frames, and while this volatility presents opportunities, it also poses risks. Investors should do thorough research and consider their risk tolerance before diving into Bitcoin or any cryptocurrency. Metaplanet’s investment could be viewed as a calculated risk, but it’s crucial for individual investors to evaluate their strategies.

Bitcoin and the Future of Finance

With each significant purchase like Metaplanet’s, Bitcoin’s role in the financial ecosystem becomes more pronounced. As traditional finance and cryptocurrency intertwine, we could be witnessing the dawn of a new financial era. The idea of digital currencies becoming mainstream is no longer a distant dream; it’s rapidly becoming a reality. This evolution is something to keep an eye on, as it might change how we view money, investments, and even transactions in our daily lives.

What’s Next for Metaplanet?

After making such a significant investment, many are wondering what’s next for Metaplanet. Will they continue to accumulate Bitcoin, or will they diversify their portfolio into other cryptocurrencies? Their future moves will be scrutinized closely, especially by those who are keen on understanding their broader strategy in the crypto landscape. It’s likely that their next steps will be influenced by market trends, regulatory developments, and the overall sentiment surrounding cryptocurrencies.

Conclusion: The Significance of this Purchase

The purchase of 160 BTC worth $13.3 million by Metaplanet is a pivotal moment in the ongoing evolution of cryptocurrency. It highlights the growing acceptance and adoption of Bitcoin by mainstream companies and signifies a shifting landscape in finance. As we continue to monitor the developments in the crypto world, it’s clear that Bitcoin is here to stay, and investments like Metaplanet’s will play a crucial role in shaping its future.

“`

This article is designed to be engaging and informative while optimizing for search engines with relevant keywords and structured headings.