Texas Legislature Rejects Property Tax Relief Amendments: A Political Analysis

In a surprising turn of events, the Texas Legislature has seen a rare collaboration between Republicans (Rs) and Democrats (Ds) to defeat two proposed amendments aimed at increasing property tax relief for residents. This political maneuvering has sparked discussions about the implications of such decisions on taxpayers and property owners in Texas. This summary delves into the details of the vote, its significance, and the broader context of property tax issues in the state.

Overview of the Vote

On April 2, 2025, Texans for Fiscal Responsibility reported on Twitter that both major political parties in Texas united to vote against two amendments that would have provided much-needed relief from property taxes. The amendments were seen as a potential lifeline for homeowners struggling with escalating property tax bills. The unofficial votes indicated that a "Yea" vote corresponded to opposition against the tax relief, highlighting the complex dynamics at play in the state legislature.

The voting patterns suggest a rare moment of bipartisanship, drawing attention to the ongoing challenges faced by Texas residents regarding property taxation. The details surrounding the proposed amendments, including their specific provisions and the rationale behind their rejection, have become key topics of conversation among lawmakers and constituents alike.

The Implications of Tax Relief Rejection

The rejection of these amendments raises significant questions about the priorities of Texas legislators. Property taxes in Texas have long been a contentious issue, with many residents expressing concerns about the burden they place on homeowners, particularly those on fixed incomes or struggling to make ends meet. The failure to approve tax relief measures may further exacerbate these concerns, leading to increased dissatisfaction among constituents.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, the decision to sideline property tax relief raises potential political ramifications for lawmakers. As the 2026 elections approach, representatives may find themselves facing backlash from voters who expected action on property tax reform. The unity displayed by Rs and Ds in this instance may signal a broader consensus on certain fiscal issues, but it also highlights a potential disconnect between legislative actions and the needs of the community.

Understanding Texas Property Tax Landscape

Texas operates under a unique property tax system, unlike many other states that rely more heavily on income tax. The absence of a state income tax has led to a greater reliance on property taxes to fund essential services such as education, infrastructure, and public safety. This reliance often results in higher property tax rates, which can create financial strain for homeowners.

Historically, property taxes in Texas have been a source of controversy, with many residents advocating for reform to alleviate the financial burden. Various proposals have emerged over the years, ranging from capping tax rates to increasing exemptions for seniors and low-income families. The recent rejection of the amendments is a reminder of the complexities involved in navigating property tax legislation and the competing interests at play.

The Role of Political Parties

The collaboration between Rs and Ds on this issue showcases the often-overlooked nuances of Texas politics. While party lines typically dictate voting behavior, there are instances where broader fiscal concerns take precedence over partisan disagreements. This recent vote reflects a shared belief among legislators that certain financial measures may not align with their long-term goals or the state’s economic strategy.

However, such bipartisanship can also lead to frustration among constituents who expect their representatives to prioritize tangible benefits, such as tax relief, that directly impact their lives. Politicians may need to balance their actions with public sentiment to maintain support and trust within their districts.

Looking Forward: What’s Next for Property Tax Relief in Texas?

As Texas moves forward from this vote, the conversation surrounding property tax relief is likely to remain a hot topic. With the 2026 elections on the horizon, candidates will need to address the growing concerns of voters regarding property taxes. This situation presents an opportunity for lawmakers to engage in meaningful discussions about potential reform and explore alternative solutions that can garner bipartisan support.

Additionally, grassroots movements advocating for property tax relief may intensify their efforts, aiming to influence legislative agendas and hold elected officials accountable. The recent vote serves as a catalyst for discussions about the future of property taxes in Texas and the need for comprehensive reform that addresses the concerns of all Texans.

Conclusion

The rejection of property tax relief amendments by a coalition of Rs and Ds in the Texas Legislature underscores the complexities of fiscal policy and its impact on constituents. As residents grapple with the implications of this decision, lawmakers must navigate the balance between competing interests and the pressing need for tax reform. The upcoming elections will serve as a crucial juncture for candidates to articulate their positions on property taxes and respond to the evolving needs of the Texas populace. With heightened awareness and advocacy surrounding property tax issues, the potential for meaningful change in Texas’s tax landscape remains an ongoing conversation that will shape the future of the state.

BREAKING

Rs and Ds just now teamed up to defeat two amendments that would have increased property tax relief.

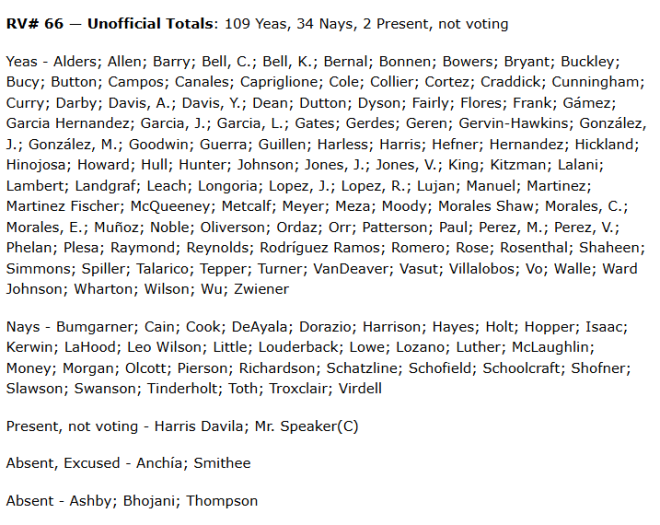

Here is are the unofficial votes

(Yea vote = against tax relief) pic.twitter.com/3fqWV86pZe— Texans for Fiscal Responsibility (@Texas_Taxpayers) April 2, 2025

BREAKING: A Surprising Political Alliance in Texas

In an unexpected twist, both Republicans (Rs) and Democrats (Ds) in Texas have come together to vote against two amendments aimed at increasing property tax relief. This decision has left many residents scratching their heads, especially those who had hoped for some financial reprieve from the ever-increasing property taxes in the state. The unofficial votes reveal that the path to tax relief remains blocked, sparking a debate about the implications of this political maneuver.

Understanding the Context of Property Tax Relief

Property taxes have been a hot topic in Texas for years, with many residents feeling the pinch as housing prices soar. With the state’s economy booming, one would expect lawmakers to prioritize tax relief for homeowners and renters alike. However, the recent vote against the amendments has raised eyebrows and questions about what truly drives legislative decisions. For more insights into the Texas property tax landscape, you can check Texas Tribune.

The Unofficial Votes: A Breakdown

The official announcement from Texans for Fiscal Responsibility provided a glimpse into the voting dynamics. The tweet stated, “Yea vote = against tax relief,” highlighting the bizarre coalition formed on the floor. This coalition raises questions about the priorities of both parties and whether they truly represent the interests of their constituents.

Why Did Rs and Ds Team Up?

It’s essential to understand why such a rare partnership occurred. One reason could be the fears of potential budget constraints that could arise from granting tax relief. Both parties may have calculated that the long-term implications of decreased revenue could outweigh the short-term benefits of offering immediate tax relief. You can explore more on the budgetary impacts of tax relief in a detailed analysis by CNBC.

The Impact on Texans

For many Texans, the defeat of these amendments means continued financial strain. Homeowners, especially those on fixed incomes, are particularly vulnerable to rising property taxes. This decision could lead to increased dissatisfaction among constituents who expected their elected officials to prioritize relief measures. As housing costs continue to rise, the pressure is on lawmakers to find a balance between funding essential services and easing the tax burden on citizens.

Public Reaction: What Are Texans Saying?

The social media response has been lively, with many expressing frustration and confusion over the vote. Some have taken to platforms like Twitter to voice their displeasure, questioning how Rs and Ds could align in such a crucial matter. The sentiment is echoed in various local news outlets, where residents are calling for more transparency and accountability from their representatives. To see some of the reactions, check out the latest tweets on the topic.

The Future of Property Tax Relief in Texas

Looking ahead, what does this mean for property tax relief in Texas? The road may be bumpy, but it’s clear that the conversation isn’t over. Lawmakers will likely face mounting pressure from constituents to revisit the issue, particularly as elections approach. Advocacy groups are expected to ramp up their efforts, pushing for more significant reforms that benefit the average Texan.

Conclusion: A Call for Action

As residents analyze the implications of this recent vote, it’s crucial for them to stay informed and engaged. Whether it’s contacting elected officials or participating in local discussions, Texans have the power to influence future decisions regarding property taxes. The hope for tax relief isn’t lost, but it requires collective action and persistent advocacy from the community. For ongoing updates and discussions, keep an eye on platforms like Texas Observer and other local news sources.